By David Enna, Tipswatch.com

The Treasury’s auction of $21 billion in a new 5-year Treasury Inflation-Protected Security — CUSIP 91282CGW5 — resulted in a real yield to maturity of 1.320%, a bit higher than looked likely through the morning.

Demand appears to have been fairly weak for this 5-year TIPS. The bid-to-cover ratio was 2.34, the lowest for any TIPS auction of this term for as long as I’ve been recording this data (back to June 2019). A similar TIPS was trading on the secondary market all morning with a real yield around 1.29%. So … 1.32% looks good.

Definition: A TIPS is an investment that pays a coupon rate well below that of other Treasury investments of the same term. But with a TIPS, the principal balance adjusts each month (usually up, but sometimes down) to match the current U.S. inflation rate. So, the “real yield to maturity” of a TIPS indicates how much an investor will earn above (or below) inflation.

Pricing: The coupon rate for this TIPS was set at 1.25%. Because the real yield was higher, investors paid an unadjusted priced of about 99.664 for $100 of par value. The inflation index will be 1.00241 on the settlement date of April 28, and that means investors will pay an adjusted price of about 99.91 for about $100.24 in principal. (Plus about 4 cents for accrued interest.)

It’s a small thing, but a lot of TIPS investors tell me they relish the idea of buying a TIPS below par value, because par value is guaranteed to be returned at maturity, even if we hit a period of extended deflation. This TIPS delivered.

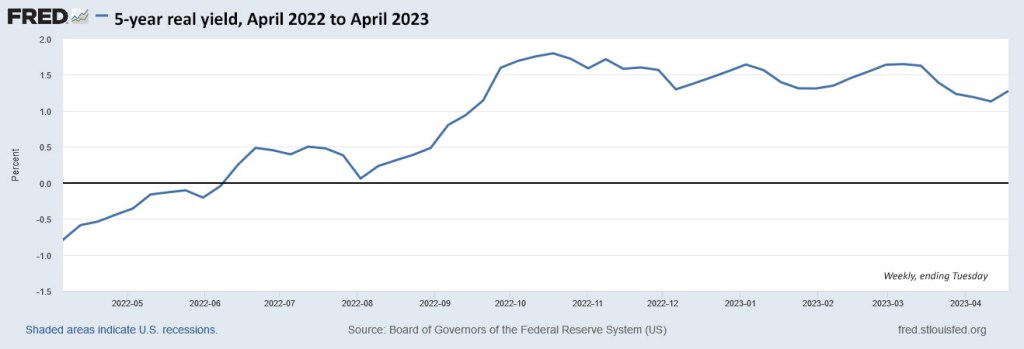

The yield. Real yields for all TIPS have risen sharply over the last year, but peaked in fall 2022 and have slid a bit lower since then. Here is the one year trend in the 5-year real yield:

The auction’s result of 1.320% looks in line with the trading range we’ve seen over the last several months. As recently as March 8, the 5-year real yield hit 1.87% but began falling in reaction to the U.S. banking turmoil. It dipped as low as 1.06% on April 6.

Inflation breakeven rate

At the auction’s close, a 5-year nominal Treasury note was yielding 3.63%, giving this TIPS an inflation breakeven rate of 2.31%, which is historically high but looks attractive with U.S. inflation currently running at 5.0%. I’m a bit surprised we didn’t see higher demand for this auction, because the nominal 5-year at 3.63% isn’t very attractive. At least the TIPS protects against unexpected inflation.

Here is the one-year trend in the 5-year inflation breakeven rate, showing that 2.31% is on the low end of recent rates:

Reaction to the auction

How did the market react to the auction results? With a yawn. The TIP ETF, which holds the full range of maturities, barely budged after the auction’s close at 1 p.m. EDT. So it looks like things went as expected, even though demand was weak.

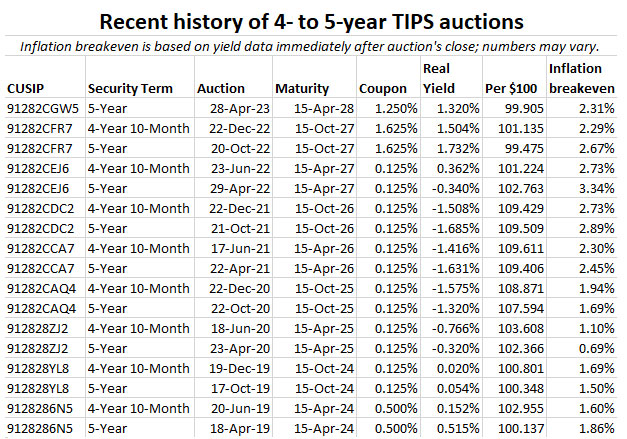

For investors, getting 1.32% above inflation for the next five years is attractive. Just one year ago, on April 29, 2022, a new 5-year TIPS auctioned with a real yield of -0.340%. Times have changed, huh?

I was a buyer at this auction, fulfilling my wish to bolster the 2028 rung of my TIPS ladder. This TIPS will get a reopening auction on June 22 and then a new 5-year TIPS will be auctioned in October and reopened in December.

Here is the recent history of TIPS auctions of this term:

• Confused by TIPS? Read my Q&A on TIPS

• TIPS in depth: Understand the language

• TIPS on the secondary market: Things to consider

• Upcoming schedule of TIPS auctions

* * *

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear.Please stay on topic and avoid political tirades.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. I Bonds and TIPS are not “get rich” investments; they are best used for capital preservation and inflation protection. They can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

David, have a question. On Treasury Direct I put in order for 5 year TIPS well in advance and will see the security show up on 4/28/23, the settlement day, with the money coming out of my checking account. So how come, I bought the exact same security (initial offering) in Fidelity account and it showed up in the account on 4/21/23???

Similar thing happens at Vanguard, with the TIPS being “posted” on April 20, but payment not completed until April 28.

Does that mean if there are intermittent occasions of deflation the cumulative inflation adjustment of the I bond over it’s lifetime will exceed that of the thirty year time due the zero floor?

It’s true. Although six-month deflationary periods are rare, I Bonds actually benefit from that temporary setback, because the accrued balance is unaffected while composite rate might drop to 0.0% for six months. When inflation rises from the dip, the I Bond holder gets the benefit of the full increase. A TIPS investor sees principal first decline and then rise, which isn’t as attractive.

Tax implications aside, if you are interested in a 5-10 year inflation protected investment, which is a better option, a 5 or 10 year TIPS or an I bond? I recognize that with TIPS there is potentially more risk from deflation but with a real yield currently of 1.28% for a 10 year TIPS and 1.35% for a 5 year TIPS it seems to me TIPS might be the better investment for this time horizon even if the I bond fixed rate increases slightly. I would appreciate any thoughts.

Even though real yields have fallen, TIPS have an advantage over I Bonds. But an I Bond offers advantages of simplicity, much better deflation protection and tax deferral. TIPS are more complicated, but have no purchase limit. For me, TIPS are more attractive right now, but I will still purchase I Bonds in 2023.

Bought 9128283R9 today, for the same YTM so let’s hope I don’t suffer the deflationary risk. My cash did not settle til today, to be able to invest.

What happens to Tbills if debt limit isn’t raised?

I am planning to write about this over the weekend, but the answer is: We don’t know. Most likely Treasury issues will continue to be redeemed and interest will be paid.

Whew, thanks for your reply.

David, I’m not sure if you’ve seen this piece, a pretty scary review of possible outcomes by Mark Zandi at Moody’s that was mentioned by Paul Krugman in a recent column:

Click to access going-down-the-debt-limit-rabbit-hole.pdf

It inspired me to call Schwab to talk about how to invest in foreign-currency denominated bonds issued by “safe” countries (Switzerland, Germany, Britain, Australia, …). I didn’t come up with anything that seemed do-able, so I somewhat reluctantly bought the 5-year at auction yesterday.

Per the 14th Amendment, the US Government has to pay debt. They can’t default.

Social security, welfare, Federal salaries- those aren’t debt. You could call them obligations- which is what the Moody’s article calls them.

Treasury bonds, bills, etc. are more than obligations. They are legal debt. The US Government has to pay them before they pay social security, welfare, Federal salaries, etc.

As David says, this would be uncharted waters

The very last thing to be skipped (after failing to pay SS etc) would be Tbills and other Treasury securities. Tbills remain the safest investment in the world. If their value comes into doubt, it’s Katy bar the door.

Just getting as close as we did to a default in 2011 caused a downgrade in US debt. And the loose cannons in Congress are “looser” now than they were in 2011, IMO

“On August 5, 2011, Standard & Poor’s (S&P) lowered the credit rating of long-term U.S. government debt from AAA (the highest possible rating) to AA+. The downgrade reflects S&P’s judgment that (1) the recent Budget Control Act (P.L. 112-25) falls short of what is needed to stabilize the government’s fiscal situation and (2) the capacity of Congress and the Administration to deal with the debt has become less stable, effective, and predictable.”

https://sgp.fas.org/crs/misc/R41955.pdf#:~:text=On%20August%205%2C%202011%2C%20Standard%20%26%20Poor%E2%80%99s%20%28S%26P%29,debt%20has%20become%20less%20stable%2C%20effective%2C%20and%20predictable.

Although I believe Bitcoin is eventually going to be worthless, gold and Bitcoin would go to the moon in the event of a default on the debt

I bought the 5-year auction and am considering buying the 10-year auction.

A question I have is:

William Bernstein, in his book Four Pillars of Investing, recommends keeping your bond holdings to a maturity of 5 years or less. He argues that adding further length to the maturity only marginally improves the yield but adds significantly to the volatility. The historically data supports his point in my opinion. And that risk is not worth taking in the safe (fixed income) portion of your portfolio.

I mostly follow his rule of keeping the duration less than 5 years.

But I’m starting to think that this might not apply to TIPS. If I’m able to lock in a real yield of 1.2-1.3% for 10 years, that sounds like a good deal to me. I’m pretty much guaranteed to increase by purchasing power by 1.2 to 1.3% every year for 10 years. Not bad for the fixed portion of my portfolio where I’m not aiming for a home run, just aiming to maintain my purchasing power. And it’s essentially risk-free.

David, do you have any preference in regard to duration, maturity length?

This one is easy to answer because Bernstein just wrote about buying a 30-year TIPS, and explaining why: https://www.advisorperspectives.com/articles/2023/03/20/riskless-at-age-104 (This advice only works if you can hold the bond to maturity.) He says: “A TIPS is risky in the short term and riskless in the long run.”

My TIPS ladder stretches out to 2043, but there are no TIPS to buy from 2034 to 2039, so the ladder is backed up by I Bonds that have a flexible maturity date.

Why is TIPS risky in the short term? Is it because of deflation?

From what I have gathered, deflation is not a risk if you bought at action, it cannot go below par value. But even if purchased in the secondary market, the point isn’t the reported nominal value of the TIPS that you see in your spreadsheet from month to month…it’s the fact that your PURCHASING POWER has been substantially preserved; if there is deflation, the dollar is worth more and buys more, so the perceived decline in value is not the focus. (It took me a long time to get my head around this after focusing on the bottom line for decades.) If I am incorrect, please let me know.

Bernstein’s other book (TIAA) said the main reason to buy short-duration bonds is that they have less correlation to stocks than long bonds. This is especially important if doing periodic rebalancing, which I doubt you will be doing with TIPS (especially the 30-year ones) — so the argument doesn’t apply so much. I would still want a large share of my fixed income in shorter duration bonds (bond funds), and to include them when rebalancing. It does beg the question of how correlated 30-year TIPS are with other asset classes, and also of how much we should care, given that some inflation protection seems important in any case.

DB, a TIPS is risky in the short term because it has a maturity of at least 5 years (or 10 or 30) and if you need to cash out early — in the short term — you could lose principal because of interest-rate risk, causing the market value to decline.

Right, but if holding to maturity, that risk is moot. Other than deflation (if one pays more than the face value), what other risks are there with TIPS?

On Today’s 5 year TIPS auction, as David said, it did not look good this morning, especially, at least for me, after the 8:30am jobs report. As I placed the order, Fidelity & Vanguard were expecting around 1.125%, I am glad I bought, though I cut it down to half. I am goging to wait for the June 5 year TIPS auction for the rest of the cash in our IRA accounts. In the meantime, In the meantime, checking if 4 week US bills offer better yield than a money market fund. If the economy keeps slowing then the June Auction may go under 1% real yield. But then, I agree, one never knows how the TIPS may react.

A couple of reactions: 1) That 1.125% was probably a prediction of the coupon rate, not the real yield. Anything below 1.25% would have created a coupon rate of 1.125%. But I personally was expecting something closer to 1.29%. 2) Watch out for 4-week T-bills right now. Investors are flooding into them, causing their yields to drop dramatically. Today’s 4-week auction got an investment rate of 3.251%, compared with 4.968% for the 8-week. That is crazy. It is an indication of fear caused by the looming debt crisis.

Yes, 1.125% was a prediction. I am not going to walk away from MMF giving 4.6%+ for 3.4 on a 4 week Bill. I recently bought 17 week US Bills, 5%+ looks a lot better. Yes, this fear about debt crisis is indeed crazy, like in the past, it will go to the last minute when all gets settled. May represent an opportuity for an active trader, not me.

David:

I continue to enjoy your site. Maybe it is late in the day, but I am struggling to recall how the Unadjusted Price is determined. Perhaps you can refresh my recollection?

Best regards.

I can’t give you a formula or equation, but the unadjusted price is determined by the auctioned real yield. Once that high yield is set, the coupon rate is set 1/8th-percentage-point lower, and that creates an unadjusted price for par value. After the inflation accrual is added in (because the settlement date is 8 days later) you get the adjusted price, which reflects the amount of principal you will receive at the settlement day.

Yes. Thanks.

Does purchasing with funds from the certificate of indebtedness prevent the possibility of an insufficient funds charge? For instance if I use my savings account to fund a treasury purchase if the final price overextends my savings account balance, the I will be charged by my bank. Does Treasury Direct just not complete the order if the CofI balance is unsufficient to cover the order, or is there an additional charge?

At least for a savings bond, if you have insufficient funds TreasuryDirect will take the bond back and then try again the next day, and then one more time the next day. It doesn’t appear that TD has a penalty fee, but your bank or brokerage may hit you with a fee.

Curious how you feel a lower than expected first quarter GDP report at the end of the month will affect inflation and interest rates?

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2023 is 2.5 percent on April 18, unchanged from April 14 after rounding.

GDP is probably slowing, but I don’t think it is negative. And inflation is slowing, but we aren’t anywhere near deflation. I do think we are approaching the top in interest rate hikes by the Fed, which will cap off the short-term end of the market. Longer-term bond rates really aren’t that high; they could go higher if the economy stays afloat.

Assume the low auction coverage ratio is largely due to increased data and talk of an imminent recession.

It appears that one would be significantly better off buying 10 x $1000 5year TIPS than 1 x $10000 TIPS. I think there is a mistake.

Yes, total cost under $1000 TIPS column should be $999.489

The adjusted interest didn’t add in correctly, for some reason. This is fixed and thanks for the heads up.

The total cost for the $1,000 should be $999.489. On another note, I got $4.49 of accrued interest, slightly off from David’s of $4.39. This is based on the coupon rate of 1.25% and the accrued days of 13 using 360 days per year in my calculation. Can someone reflect on my statement? Thanks.

Max, I have updated the accrued interest after finding another problem in my calculation. I haven’t used this template since December 2022 and apparently I have forgotten how it works. Anyway, the official adjusted accrued interest is $0.44506 per $1,000.

I also bought (only 1 K) The numbers I got back from Fidelity is total cost $999.50 which seems in line with what you say.

I have decided to opt out for the time being on purchasing new ibonds. (I am on a limited budget for investments an I try to keep all options available.) if on the other hand ibonds get a variable rate of 70 basis points or better I will buy some in May.

David, Thanks so much for all the valuable information you post on this Web site. I began purchasing TIPS back in Dec 2022 after reading some of your posts, and my purchase today was the final one to complete a 10 year TIPS ladder. I noticed that on the secondary market CUSIP 9128283R9 which matures on 01/15/2028 was selling on Fidelity today (ask price) with a yield to maturity of 1.355 and 1 bond minimum. Would that have been a better deal than the auction, or is it pretty much of a toss up? Just trying to get a sense of how much advantage there really is to waiting for the auctions.

CUSIP 9128283R9 has an inflation factor of 1.43… all that is guaranteed by Treasury is par value – so there is much more deflation risk than today’s auctioned TIPS bond.

Oops – 9128283R9’s inflation factor is 1.22 (vs 912810PV4, which is 1.43). Point remains the same.

Sal, Craig is right. It’s important to take a look at the accrued inflation you will be purchasing, which is 21.7% above par value. That’s not necessarily a bad thing, but it will mean your investment cost will be higher to cover the additional principal. That TIPS was issued 5 years ago, so it has 5 years of accumulated inflation adjustments.

So, how does that work when the adjusted price on the secondary market is below par value but the inflation factor is above 1? For example, CUSIP 912810SV1 has an ask price of 68.527, an adjusted price 79.037671, and of an inflation factor of 1.516. If I hold to maturity, no matter how much deflation occurs, am I guarantted a profit on the principle (100 – 79.037671) in addition to the semi-annual coupon I earn? Isn’t that a better deal than buying at auction where I am not guaranteed a profit on the principle?

Thanks.

Sal, you can do a quick calculation to estimate your costs, using a $10,000 par purchase. For the Feb 15 2051 TIPS, the inflation index is 1.153, so you’d be purchasing $11,530 of principal. The price would be about 68.50, so 11,530 x .6850 = $7,898.05. So you’d be buying under par and guaranteed to get back at least $10,000 in 2051, plus the coupon rate of 0.125%.