- Strategy & Operations

- 2 min read

Audit alarm rings for Oppo, Realme as Indian units struggle with missing records, negative net worth

Oppo and Realme, the Chinese smartphone giants, are facing scrutiny in India. Auditors have raised concerns about their financial records. Oppo's negative net worth and ongoing litigation raise doubts about its future. Realme faces issues with procedures and record maintenance. These issues emerge amid intense regulatory pressure on Chinese brands in India. Investigations into alleged financial irregularities are underway.Highlights

- Auditors of the Indian units of Chinese smartphone manufacturers Oppo and Realme have raised multiple concerns regarding their financial bookkeeping, processes, and incomplete records, as noted in recent Registrar of Companies filings.

- Oppo Mobiles India reported a negative net worth of ₹3,551 crore as of FY24, with significant accumulated business losses, raising concerns about its financial stability and ongoing regulatory inquiries.

- Realme Mobile Telecommunications India faced auditor concerns over lapses in procedures and the accuracy of its financial accounts for FY24, indicating potential issues in record maintenance.

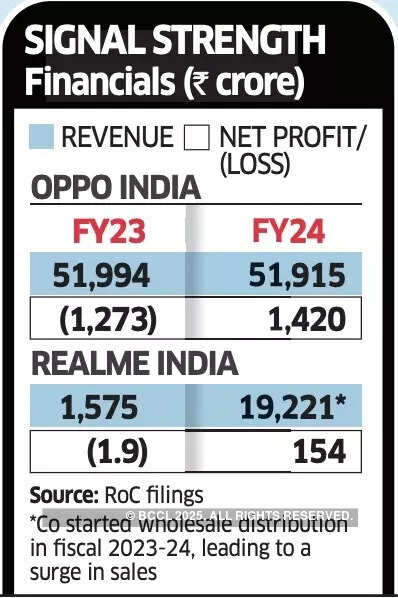

Turned a Profit in FY24

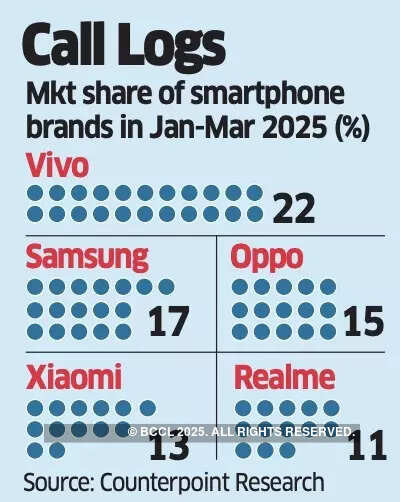

Investigations and court cases are ongoing. Oppo Mobiles India and Realme Mobile Telecommunications India, wholly owned by their Chinese parents through entities based in Hong Kong, didn’t respond to queries.The auditor of the Oppo unit, India’s third-largest smartphone brand, said in the RoC report that the company incurred substantial accumulated business losses in earlier years, resulting in negative net worth. It said the debt-equity ratio is adverse, raising significant concerns about financial stability and the ability to meet obligations. Oppo India’s net worth is a negative ₹3,551 crore as of FY24, according to the filing.

“The company is involved in material litigations and is subject to ongoing regulatory inquiries, outcomes of which are uncertain and could have a material impact on its financial position and operations,” the auditor said in the filing. “These events and conditions indicate the existence of material uncertainties that may cast significant doubt on the company’s ability to continue as a going concern.”

Oppo India’s non-current borrowings stood at ₹2,082 crore in FY24, including external commercial borrowings from its parent of ₹1,668 crore and working capital loans from HSBC Bank of ₹414 crore, according to the RoC data. Current borrowings were at ₹2,085 crore.

In the case of the Realme unit, India’s fifth-largest mobile phone brand, the auditor flagged lapses in procedures and record maintenance. The auditor was also not sure about the accuracy of accounts under certain heads and the completeness of the company’s FY24 profit and loss accounts.

Comments

All Comments

By commenting, you agree to the Prohibited Content Policy

PostBy commenting, you agree to the Prohibited Content Policy

PostFind this Comment Offensive?

Choose your reason below and click on the submit button. This will alert our moderators to take actions