Real yield to maturity could be the highest in 12 years.

By David Enna, Tipswatch.com

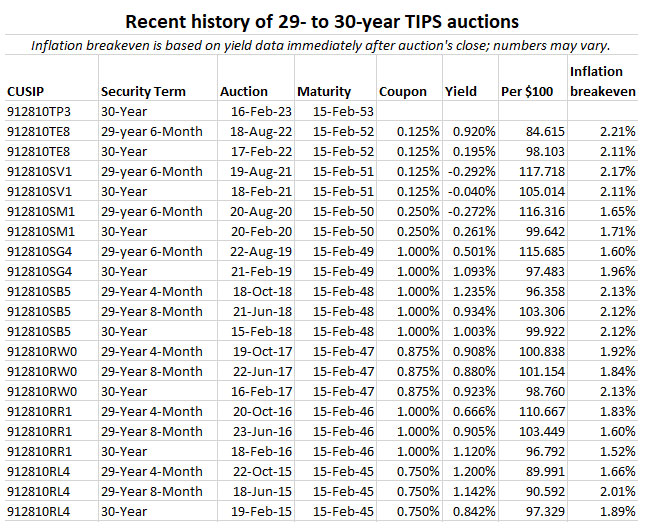

The Treasury on Thursday will offer $9 billion at auction for a new 30-year TIPS, CUSIP 912810TP3. The real yield to maturity and coupon rate will be determined by the auction results, but it’s looking like this TIPS will get the highest real yield at auction for this term since at least 2014, possibly back to 2011.

The U.S. Treasury on Friday was estimating the real yield of a 30-year TIPS at 1.53%, up 20 basis points since the beginning of February. If that real yield holds through the auction on Thursday, this new TIPS would get a coupon rate of 1.5%, the highest since an originating auction in February 2011.

Oh no, nostalgia!

Ah, 2011 … that was the year I created Tipswatch.com, with the first post on April 10, 2011. A couple months later I weighed in on a 30-year TIPS reopening auction, for CUSIP 912810QP6. My preview was fairly negative. In the last few months, a few readers have quoted that article back to me to demonstrate how unpredictable the Treasury market can be. (Oh yes, I am fully aware of that.)

That 30-year TIPS auction on April 10,2011, ended up getting a real yield to maturity of 1.744%, which looks outstanding today, but was rather disappointing at the time. Hard to believe, isn’t it? Here is what I said in my preview article:

The auction yield should be around 1.8%, probably a bit higher. This is 110 basis points higher than the going rate on a 10-year TIPS, and a whopping 230 basis points higher than a 5-year TIPS. You will get that yield for 30 years, on a principal base that is constantly increasing with inflation. …

That yield is not great. In fact, this TIPS was first issued four months ago with a base rate of 2.19%. It is likely that the TIPS rates will begin – eventually – moving more toward ‘normal’ levels, and for a 30-year that would be nearly 3%. However, I have been saying that for quite awhile, and I have been wrong.

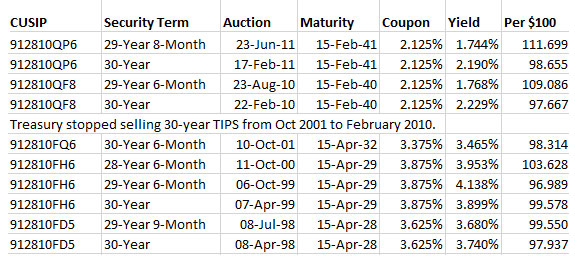

Why did I say a real yield of 3% was “more normal”? That was based on data available in 2011. The Treasury had stopped issuing 30-year TIPS from October 2001 to February 2010. So this was the total history of 30-year TIPS auctions at the time:

Still, I did invest in CUSIP 912810QP6, which ended up getting a real yield to maturity of 1.744% (a record-low for this term at the time). In 2011, I was disappointed. Today, I am quite happy and I am still holding that TIPS, which has a solid coupon rate of 2.125% and an inflation index of 1.357.

Point of this history lesson: We can’t accurately predict where interest rates are headed. What looked disappointing in 2011 ended up being a prize investment in my TIPS portfolio.

Back to this week’s auction!

For two kinds of investors, a 30-year TIPS with a real yield of 1.50% could be attractive: 1) a buy-and-hold-to-maturity investor who is young enough to survive 30 years, and 2) a TIPS trader who believes that real yields are likely to fall in the relatively near future, which would bring capital gains on a trade.

I am neither 1 nor 2, so I am no longer interested in investing in 30-year TIPS. These TIPS are highly volatile investments and require discipline to hold through wild swings higher or lower in market value.

Although real yields on the secondary market for this term were higher in October 2022, 1.53% remains attractive. Just a year ago, in February 2022, a new 30-year TIPS auctioned with a real yield of 0.195%.

Definition: The “real yield” of a TIPS is its yield above official future U.S. inflation, over the term of the TIPS. So a real yield of 1.53% means an investment in this TIPS will exceed U.S. inflation by 1.53% for 30 years. If inflation averages 2.3%, you’d get a nominal return of 3.83%, on par with a nominal 30-year U.S. Treasury. But if inflation averages 4.5%, you’d get a nominal return of 6.03%.

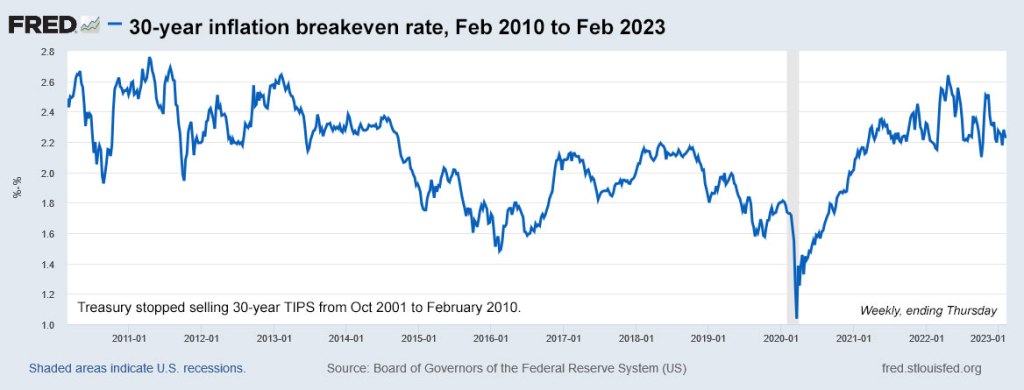

This chart shows the history of 30-year real yields since the Treasury reinstated the 30-year TIPS in February 2010:

For much of this 13-year period, the 30-year real yield lingered in a range around 1.0%, but keep in mind that real yields were suppressed by the Federal Reserve’s quantitative easing. Now we are in a period of quantitative tightening, and there is no way to predict how long that will last or the eventual result on real yields.

For an investor of the right age looking to build a buy-and-hold TIPS ladder, this 30-year TIPS looks like a reasonable investment. As long as that investor can ignore market volatility, which could be extreme in either direction.

Inflation breakeven rate

With the 30-year nominal Treasury bond closing Friday with a real yield of 3.83%, a new 30-year TIPS with a real yield of 1.53% would have an inflation breakeven rate of 2.3%, a bit higher than recent auctions of this term. But 2.3% looks reasonable. Over the last 30 years, inflation has averaged 2.5% a year. For all 30-year periods beginning in 1971, only one period has had inflation lower than 2.3% — 1990 to 2020 at 2.2%.

Here is the trend in the 30-year inflation breakeven rate from 2010 to 2023:

Final thoughts

I won’t be a buyer, but that is based on my age and ability to hold to maturity. My current TIPS ladder stretches out to February 2043, when I will be approaching 90. I still have some spots to fill, but I will be focusing on TIPS maturing in 5 to 19 years. For example, next month on March 23 we will have a 10-year TIPS reopening auction, and then on April 20 a new 5-year TIPS will be issued.

Investors looking at this new 30-year TIPS should focus on buying it in a tax-deferred account, but because the coupon rate will be around 1.5%, that should be adequate to cover “phantom income taxes” in a taxable account. Investors in a taxable account have to pay taxes on TIPS inflation accruals in the current year.

You can track the Treasury’s daily Yield Curve updates here. Yields are likely to continue to be volatile into next week. This auction closes at noon Thursday for non-competitive orders at TreasuryDirect. If you are putting an order in through a brokerage, make sure to place your order Wednesday or very early Thursday, because brokers cut off auction orders before the noon deadline. I’ll be posting results soon after the auction closes at 1 p.m. ET Thursday.

Here is a history of all 29- to 30-year TIPS auctions over the last eight years:

• Confused by TIPS? Read my Q&A on TIPS

• TIPS in depth: Understand the language

• TIPS on the secondary market: Things to consider

• Upcoming schedule of TIPS auctions

* * *

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear.Please stay on topic and avoid political tirades.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. I Bonds and TIPS are not “get rich” investments; they are best used for capital preservation and inflation protection. They can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

Tuesday update, after market close: Treasury’s estimate of the 30-year real yield is holding at 1.53%.

If the plan is to hold for 30 years, it would seem that buying the upcoming 30-year TIPS in a retirement account is strictly better than buying an Ibond right now.

– A TIPS in a traditional IRA would receive (roughly) similar tax treatment to the Ibond, while a TIPS in a Roth IRA would receive superior tax treatment.

– Expected real rate on 30-year TIPS = roughly 1.5%; real rate on an Ibond right now = 0.4%.

Do Ibonds have ANY advantage over TIPS right now for a 30-year buy-and-hold scenario?

I agree, if the investor is truly committed to holding for 30 years and ignoring market swings. A real yield of 1.50% obviously beats 0.40%. One negative is that the TIPS in a traditional IRA loses its state income tax exemption, since all assets in a traditional IRA are taxable when withdrawn. The advantages of an I Bond are: 1) flexible maturity, 2) much better deflation protection, and 3) ability to use assets tax-free for educational expenses, under certain criteria. I view I Bonds more as an investment that transforms in 5 years into a tax-deferred, inflation-protected savings account. I Bonds also offer the chance to redeem and re-purchase at a higher fixed rate, with no danger of losing market value. (But of course … that triggers taxes.)

I am seriously considering the long term TIPS but the flexibility of I Bonds for use in a scenario where I need to make a large down payment on a new home, need to replace a car immediately, etc. leans toward I Bonds for me. The $25,000 annual limit (with myself, my sole proprietorship, and tax refund) seems adequate for the investments I plan to make as well. If I had a large amount to invest beyond this, I might think different.

Any idea why Vanguard has recently marked all its TIPS bonds as $100k minimum purchases?

On the weekend, Vanguard seems to grey out the “buy” button on secondary-market TIPS and you can’t really see the pricing. I looked just now and all the purchase alternatives are showing, as normal. When you get all the way to the purchase screen you should be able to enter lesser amounts.

I tried and the 10 years TIPS mature in Jan 2033 was still with min purchase of $100K.

I’m an RIA and have been buying TIPS from VG for over a decade. Their new website in transition is a slow-no train wreck. After hours tonight I see 20 if 37 listed CUSIPS with 100 or 150 as min orders (those are x 1000), which is better than Fri when all were at 100k. We’ll see how it looks in the morning.

Thanks for this very sad info. I split my accounts between Vanguard and Fidelity, but my TIPS-buying IRA account is at Vanguard. The Treasury auctions were still working last month, I can report.

It could be because this TIPS is so new there is very little trading in it. Fidelity’s ordering system is more sophisticated, but I couldn’t tell there what the minimum purchase level was.

I’m trying to understand how TIPS work. You write, “So a real yield of 1.53% means an investment in this TIPS will exceed U.S. inflation by 1.53% for 30 years. If inflation averages 2.3%, you’d get a nominal return of 3.83%, on par with a nominal 30-year U.S. Treasury. But if inflation averages 4.5%, you’d get a nominal return of 6.03%.” Does this mean that the TIPS owner will get some kind of an average factor applied to the accrued principal at maturity?

No. I have an explanation of this on my TIPS In-Depth page: https://tipswatch.com/tips-in-depth/ …. The real yield to maturity is based on the price you pay in relation to the coupon rate. Once you purchase a TIPS, from that point on you get inflation accruals + coupon rate all the way to maturity. The TIPS gets a daily inflation accrual adjustment, based on inflation two months earlier. Those accruals compound every six months. At maturity you get par value x inflation index plus one last coupon payment.

Also, regarding TIPS held at the Treasury and not in a tax deferred account, for paying the taxes for interest I believe they are just treated as interest and reported on the schedule B, but where are the increase (or loss) in value of the bond due to inflation taxes reported? thank you

TreasuryDirect issues an 1099-INT (for coupon payments) and a 1099-OID (for inflation accruals). At maturity these 1099s will reflect only the final year accruals and interest, since you’ve already reported and paid the taxes.

Thank you but where are these reported in the tax filing?

1. 1099-INT (for coupon payments) – In Schedule B-Part 1 for Interest?

2. 1099-OID (for inflation accruals) – Schedule ??

thank you

There is also a section in the 1099 called “Bond Premium on Treasury Obligations” which I think is actually a credit. Is that true? Where does that get reported, possibly in the Schedule B-Part 1 for interest also? thank you!

Could be, but I have never had an amount reported in this Bond Premium section.

I do my taxes in Quicken and it asks if I had a 1099-INT and/or OID and I fill in the needed information. But yes, it looks like both 1099-INT and 1099-OID end up getting reported on Schedule B, part 1 for interest.

OK, thank you, my last question is regarding State taxes. Is it correct that any interest from TIPS or IBonds, either coupon payments or inflation accruals, is exempt from reporting on State taxes?

Yes, it is exempt from state taxes. (I am no tax expert, however.)

Regarding the taxes on a TIPS bought from the treasury and not held in a tax deferred account, my understanding is there will taxes on the interest plus taxes on the increase in value of the bond due to inflation (unless there is no inflation). Is it correct to say that when the bond reaches maturity, the only remaining taxes would be on the interest and value increase for just that year before maturity because the amount of interest and value increase for previous years has already been paid in those previous years?

This is correct. I still have several TIPS held in a taxable account and I pay the yearly tax on the inflation accruals. At maturity, there is just that last year of inflation accruals and the last coupon payment, so the tax burden is minimal. This is an advantage of holding TIPS in a taxable account, but it works better while you are still working and have income to pay the taxes.

“tax-deferred account” you mention. Must be a Roth? Else how would you manage RMDs?

It could be a Roth but wouldn’t need to be. I am assuming the traditional IRA would have other investments than this one TIPS, so RMDs could be paid out of those investments. For example, a total bond fund or S&P 500 fund.

If necessary, you could also do an in-kind transfer from your Traditional IRA to taxable in 1-bond increments to satisfy RMDs, right? You don’t have to cash out the bonds.

Even if the TIRA held only TIPS, one could take RMDs via moving individual bonds to one’s taxable account, yes? Of course this would almost certainly require taking a larger taxable distribution than the RMD but the excess would likely be fairly modest.

Why are tips auctions so infrequent? I assume because they’re largely a retail product. Why not increase the amount at auction so as to make them more frequent or if necessary, reduce the amount available at each auction and increase the frequency

This should be easy going forward since expanded budget deficits means more issuance going forward

There is a TIPS auction every month, which includes a 10-year new issue or reopening every other month. This has been the pattern for as long as there have been TIPS.