- News

- 4 min read

Bonds out, Adani Group looks for new ways to refinance ACC, Ambuja M&A loans

Partial payment through cash, prepayment of interest, push out maturities to 2025-26, additional collateral for loans against shares being worked out.

The Adani Group is likely to shelve its plans to raise close to $500 million via international bonds and will explore other financing options, including paying the outstanding from internal accruals, to refinance the first tranche of the $4.5 billion debt taken from a clutch of global banks to acquire ACC and Ambuja Cements last year, said two people directly aware of the matter.

"As part of the original loan agreement, a bridge to bond facility, the first takeout of $500 million was to happen in March this year but given the current situation that may not be possible," said a senior banker. Typically, in a bridge to bond facility, borrowers avail relatively high interest-bearing financing packages, to be refinanced in the future with a mid- to long-term financing in the form of high yield bonds. "While the terms of the loan agreement allow the group to seek additional time to make arrangements, it has however decided to pay off the outstanding from other sources including internal reserves," said a person privy to the plans of the Adani group.

Emails sent to Adani spokespersons seeking a response did not elicit a response until press time on Friday. Spokespersons of Barclays, Standard Chartered and Deutsche Bank declined to comment on queries sent.

Talks on for several weeks

The Adani Group is also attempting to push the bulk of the repayment obligation for the $4.5 billion debt, mostly due in 2024 and 2025, to 2026, said people in the know, as the carnage in the bond and equity markets wreaked havoc on the conglomerate's listed securities around the world.

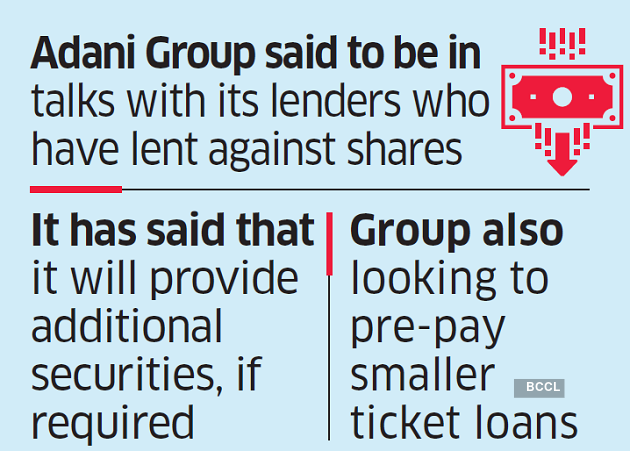

Sources in the know said the conglomerate is in discussions with its lenders who have lent against shares of the company, and has communicated that it will provide additional securities, if required, in the form of additional cash buffer. At the same time, it is also looking to pre-pay smaller ticket loans.

For example, a $37 million interest payment, on the $500 million facility, due in March is likely to be settled in cash first, said people familiar with the company’s plans.

The Indian group hasn’t faced margin calls on these pledges yet but has communicated to its lenders it is seeking prepayment proactively, a person familiar with the group’s plans said on condition of anonymity.

The coal-to-cement conglomerate does not have any large repayment obligations in CY23, data from Bloomberg shows. The bulk of the repayments are due in CY24 and CY25.

These negotiations with lenders have been ongoing for several weeks, even prior to the Hindenburg report, but have gathered momentum in the last one week. "With bond markets being shut since January, the 144A (dollar bond) market is unavailable to any corporate. The added complication is Adani’s own papers are facing unprecedented volatility in the last week, so other options to refinance those acquisition loans will have to be considered," said a banker involved on condition of anonymity. Group officials have lined up calls with its six ratings agencies, banking partners and bond holders to clarify the liquidity position of the group. It has also sought in-person meetings with its institutional backers from Abu Dhabi.

Last May, Adani Group, through a Dubai-based special purpose vehicle, announced the approximately $10.5 billion acquisition of Holcim’s India assets – Ambuja Cements and ACC – making it the largest infrastructure and materials sector M&A in India. The deal was part-financed through debt which had four parts. There was a $3 billion bridge loan along a $500 million facility — both senior debt that was to be repayable in 18 months with a takeout option via bonds.

Over and above that there was a $1 billion mezzanine debt and another $500 million loan against shares taken for general liquidity purposes. The loans, originally syndicated by Standard Chartered Bank, Barclays and Deutsche Bank, were subsequently sold down to several other global banks including BNP Paribas, Citi, DBS Bank, Emirates NBD, First Abu Dhabi Bank, Qatar National Bank, ING Bank. The loans have been taken against the cash flows of the two cement companies – ACC and Ambuja – and are not linked to its share price, clarified five independent bankers and company officials.

Billionaire Gautam Adani have lost $108 billion of market value in a week, one of the biggest value destruction in the history of Indian equity markets, after an a report by short-seller Hindenburg Research accused him of share manipulation and accounting fraud, which eventually forced him to pull a stock sale at the last minute, even after getting fully subscribed.

The company’s dollar bonds which were trading at distressed levels after Citigroup’s wealth unit joined their Swiss counterparts Credit Suisse to restrict lending against Adani Group securities, recovered on Friday, partially on account of news that Adani Ports & Special Economic Zone Ltd. had made coupon payments on schedule on Thursday. Wall Street banks Goldman Sachs Group Inc. and JPMorgan Chase & Co. have told some clients that bonds related to Adani can offer value due to the strength of certain assets. But All 15 dollar debt securities of the group advanced on Friday.

COMMENTS

All Comments

By commenting, you agree to the Prohibited Content Policy

PostBy commenting, you agree to the Prohibited Content Policy

PostFind this Comment Offensive?

Choose your reason below and click on the submit button. This will alert our moderators to take actions