New investors are baffled by Treasury Inflation-Protected Securities. Can’t blame them.

By David Enna, Tipswatch.com

A year ago, while real yields for Treasury Inflation-Protected Securities were still deeply below zero, I worked with a Wall Street Journal reporter on a detailed story about investing in TIPS. Things got difficult when we got to the subject of “real yield to maturity.”

Financial reporter: “This doesn’t make sense. What is my actual return? If inflation is 7.0%, why isn’t my real yield to maturity 7.0%? I don’t get it. I’m going to leave real yield to maturity out of the article.”

Me: “You can’t do that! It’s too important. It’s the key to understanding TIPS and investing in TIPS. Your editor will never approve it.”

Wrong. The article on investing in TIPS was written, approved and published, without ever mentioning real yield to maturity.

A year later, TIPS are a rising star of the investment world, with … er … real yields to maturity at their highest levels in 12 to 15 years, much higher than the future yield of highly popular U.S. Series I Savings Bonds. Now I am getting a lot of questions about TIPS. I have a Q&A on TIPS that answers many of those questions, but I thought it would be helpful to discuss, in detail, the complex language of TIPS. If you understand the language, you will better understand TIPS.

Par value

Par value is the bedrock of a TIPS investment. At some point, when you buy a TIPS at auction or on the secondary market, you will enter a dollar amount in a box. The dollar amount you enter is the par value of the TIPS you are purchasing.

Par value, almost always, is not what you will actually pay for that TIPS. The actual cost will be determined by a combination of factors, but par value is 1) the amount the Treasury guarantees will be returned to you at maturity, no matter what happens with inflation, and 2) the base amount you will use to determine the current accrued value of your TIPS.

Coupon rate

After the initial auction of a TIPS, the Treasury sets its coupon rate at the 1/8th-percentage-point increment below the auctioned real yield. (All coupon rates are set at 1/8th percentage points … 0.125%, 0.250%, 0.375%, etc. If the TIPS auctions with a negative real yield, it gets a coupon rate of 0.125%, the lowest the Treasury will go for a TIPS.)

For example, at the July 21, 2022, auction of a new 10-year TIPS, the auctioned real yield was 0.630% and the coupon rate was set at 0.625%.

The coupon rate remains the same until that TIPS matures, even if the real yield to maturity rises or falls in the future. For example, that July TIPS later reopened in November with a a real yield of 1.485%, but its coupon rate remained at 0.625%.

The coupon interest on a TIPS is biannual, paid out every six months. It is not reinvested. But while the coupon rate remains the same, the amount actually paid will rise (or possibly fall) to match the accrued principal of the TIPS.

Real yield to maturity

What is it? It is the total return your TIPS investment will earn above (or below) official U.S. inflation for the term of the TIPS. The term “real yield” means “yield above inflation.” Other Treasury issues and bank CDs have a defined “nominal” yield, but investors can’t know the future real yield. TIPS have a defined real yield, but investors can’t know the future nominal yield. It all depends on future inflation.

The real yield of any TIPS is constantly changing, based on market sentiment. But the important factor is: When you buy a TIPS you plan to hold to maturity, you have set in stone your real yield to maturity. The market may reprice that TIPS, but your real yield doesn’t change, unless you sell before maturity.

A key thing to remember about the real yield: After you purchase a TIPS, and pay a premium or discount to par value to create the real yield to maturity, this is what you will earn going forward:

Inflation accruals + coupon rate

In other words, your real yield was set by the price you paid. After that, you earn the rate of inflation + future coupon payments.

Pricing of a TIPS

How is the price of a TIPS determined? At the original auction, investors bid based on the desired real yield to maturity, because at that point there is no set coupon rate. At a reopening auction or on the secondary market, investors know the coupon rate, so bidding is based on how much the real yield will vary from that coupon rate.

You will see TIPS prices based on $100 increments, and that is how much you will pay for $100 of the TIPS’ current value (par value + inflation accruals). If the coupon rate is below the market real yield, then the price of the TIPS will be lower than $100. If the coupon rate is higher than the market, the price of the TIPS will be higher than $100. Here’s an example of how that worked for the 10-year TIPS issued in July 2022:

Originating auction. Even at an original auction, the TIPS price is unlikely to be exactly $100. That’s because: 1) the coupon rate will be slightly below the auctioned real yield (when the real yield is above 0.125%), and that will slightly lower the price you pay, and 2) even a new TIPS will have some inflation and interest accruals. A new TIPS is issued on the 15th of the month, but the settlement date is on the last business day of the month. So an investor is getting about 15 days of accrued inflation and interest.

Take the July 2022 10-year TIPS as an example:

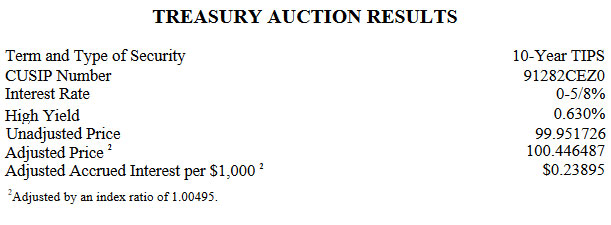

The auctioned real yield, called “high yield” in this chart, was 0.630%, so the Treasury set the coupon rate at 0.625%. That set the unadjusted price for par value at about $99.951. But then you have to calculate in the fact that this TIPS would have an inflation index of 1.00495 on the settlement date of July 29, plus it would earn a few cents of interest in those 14 days.

- $100 par value x .99951 unadjusted price = $99.952

- $99.952 x inflation index of 1.00495 = $100.446 adjusted price

- Plus the investor would prepay for about 2 cents of accrued interest.

Reopening auction. Now let’s quickly look at the result of the 10-year TIPS reopening auction on Nov. 17 for this same TIPS, CUSIP 91282CEZ0. Over the four months from the originating auction, real yields soared higher, so the pricing was quite different.

Note that the coupon rate remained at 0.625%, set by the original auction. But the auction resulted in a much higher real yield to maturity, 1.485%. And because of that, the price paid by investors was deeply discounted.

- $100 par value x .92312 unadjusted price = $92.3126

- $92.3126 x inflation index of 1.02147 = $94.2946 adjusted price

- Plus the investor prepaid for about 23 cents of accrued interest

The key factor here is that the real yield to maturity was created by market demand, and because the real yield was higher than the coupon rate, the price of the TIPS was lower. When you buy a TIPS, whether at an opening or reopening auction or on the secondary market, the real yield to maturity is the key factor to consider. If you hold to maturity, it sets your future return over U.S. inflation.

Non-competitive bidders — that’s all of us — at both new and reopened TIPS automatically get the high yield. Big-money investors make competitive bids, which could be rejected. All winning competitive bids also get the high yield.

Accrued interest. As a side note, you pay for the accrued interest after the sale closes, but this money is not added to the principal of the TIPS. You will get that money back at the next coupon payment; in the case of this July 2022 TIPS, on January 15, 2023.

Inflation accruals

Inflation accruals for TIPS are based on non-seasonally adjusted inflation from two months earlier. The Treasury takes that inflation number and creates an inflation index that changes every day, up or down depending on if inflation was positive or negative two months earlier. For example, non-seasonally adjusted inflation rose 0.41% in October 2022, so TIPS inflation accruals in December are rising 0.41.%. In November, non-seasonal inflation dropped 0.10%, so inflation accruals will decline 0.1% in January.

Each month, on the day the U.S. inflation report is released, the Treasury issues new inflation index ratios for all TIPS for the month two months ahead of the report. Here is the full list of January inflation indexes, based on November inflation. And here is how those numbers look for the TIPS issued in July, CUSIP 91282CEZ0:

In that chart, note that the index ratio for Jan. 1 is 1.02569 and through the month will decline to 1.02469 on Jan. 31 because November was a slightly deflationary month. These inflation indexes are crucial because they set the base principal amount for all TIPS, every single day. That means if you sell a TIPS on the secondary market, you will get the full value of your earned inflation.

Accrued principal value

TIPS have a “market value” — set by the market based on constantly changing real yields to maturity, but also a “current principal value,” which ignores the market shifts and simply measures the current total of par value + inflation accruals. If you are holding to maturity, you can simple track the current accrued principal value with this equation:

Par value x inflation index = Accrued principal

If you bought $10,000 par value of a TIPS and it currently has an inflation index of 1.05672, that TIPS now has $10,567.20 of accrued principal. That number is important because it is the base for the next coupon payment. As it rises, the coupon payment also rises.

At maturity, any TIPS will pay par value x inflation index, along with one final coupon payment. It’s not complicated if you hold to maturity.

Current market value

The accrued principal value is one factor used to determine the current market value of a TIPS on the secondary market. As market real yields rise and fall, the price of the TIPS rises and falls. So the price could be $90 for $100 of value, or $110 for $100 of value, depending on how much the coupon rate varies from the market-set real yield.

Secondary market purchase. When you purchase a secondary-market TIPS at a brokerage, you will be putting a dollar amount in a box, just like at TreasuryDirect. But that is not what you will pay. It is the par value you are purchasing. Your actual purchase would look something like this for a TIPS with a price of $95 and an inflation accrual of 1.15:

- You place an order for $10,000 par value

- Principal you are purchasing: $10,0000 x 1.15 = $11,500 accrued value

- Your cost: $11,500 x .95 = $10,925

- Plus some small amount of accrued interest.

- And in some cases, a brokerage commission.

So, in this simplified example, you’d be paying $10,925 for $11,500 of principal. From that moment on, until maturity, you’d be earning inflation + coupon payments. You accepted a below-market coupon rate, but were rewarded with a price discount. It all balances out. Par value is $10,000, so even if severe deflation strikes, you are guaranteed to receive at least $10,000 at maturity, along with coupon payments along the way.

As you go through the brokerage purchase process, you may see “yield to worst” listed as the yield. That is the real yield to maturity. This “worst” terminology refers to callable bonds, but TIPS aren’t callable and the worst yield is the actual real yield to maturity.

Inflation breakeven rate

This is a measure of market sentiment toward future inflation. It is calculated by subtracting the real yield of a TIPS from the nominal yield of a Treasury of the same term. For example, at the Dec. 20 market close, the 10-year inflation breakeven rate was 2.24%, based on Treasury estimates.

- 10-year Treasury note was yielding 3.69%

- 10-year TIPS had a real yield of 1.45%

- 3.69% – 1.45% = 2.24%

Keep in mind that the inflation breakeven rate isn’t a great predictor of future inflation. It just measures market sentiment. Here is the trend in the 10-year inflation breakeven rate from 2003 to 2022. Look at the 2012 to 2108 era. Do you see any prediction or even hint of our current surge to 40-year-high inflation, topping 7% a year over the last two years?

The inflation breakeven rate is a useful tool, however, because it shows how “expensive” TIPS are versus a nominal Treasury. The lower the inflation breakeven rate, the cheaper the relative cost of a TIPS. Right now, with the 10-year at 2.24%, we are at the border of expensive, but the inflation trend has dramatically changed in the last two years. TIPS look attractive, in my opinion.

Final thoughts

I know that TIPS are an esoteric and confusing investment. I was at a party the other night and a friend told me, “I have TIPS in my portfolio but I have no idea how they work.” Yeah, I hear you. Things get less complicated if you invest in individual TIPS and hold to maturity, ignoring market swings. Then you can track current value with a simple Excel spreadsheet: Par value x inflation index.

I am sure I didn’t get close to answering all the possible questions or solving all the mysteries. I’ve been writing about TIPS for more than a decade and I still come across new concepts. It’s a learning process and I hope this article helps. If you did find this article helpful, please share it with friends who are new to investing in TIPS.

* * *

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear.Please stay on topic and avoid political tirades.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. The investments he discusses can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

Excellent post! Very helpful and well done!

There’s a SeekingAlpha article that has been circulating for about a month from a writer names “The Fortune Teller” which, in my opinion, shows a severe lack of understanding of how TIPs work, and is giving bad advice.

Just wanted to caution others here who read it to not take it seriously. David, did you see this one and would you agree that the article should be ignored?

https://seekingalpha.com/article/4561510-tip-stip-vtip-tip-not-included-in-portfolio?v=1672250893#comment-94108717

Reminds me of all the articles being written last year trying to shoot down I Bonds as a sensible investment. The problem has been with TIPS funds and ETFs, plus the fact that the Federal Reserve pushed real yields deeply negative. So real yields rose 300+ basis points in 12 months. Any bond fund would take a wallop from that kind of increase in yield. Right now, individual TIPS are attractive if held to maturity. Not going to get rich on these; it is just a safe, inflation-protected investment.

For those who enjoy making the effort to understand the multiple complicating details of purchasing a TIP bond at auction, there is no downside to the difficult learning curve. But to others who may hesitate to buy because they don’t understand these details, I say that there is no need to understand them. It is sufficient, I think, to know that you are purchasing an inflation-adjusting Treasury bond for a term of X years that will, if held to maturity, return whatever you end up paying for the bond plus an annual interest rate based on the combining of two percentages: 1) whatever the official inflation rate is over the term of the bond, and 2) the fixed percentage (called the “real yield”) offered on that bond at the time of purchase. That’s it! You may end up paying a little more or a little less than the face amount of the bond based on those hard to understand complicating factors, but just know that this variance will wash out by the time the bond matures.

I will also add that I have chosen to buy most of my TIPS through Vanguard’s short-term TIPs ETF – VTIP – with an average maturity of about 2.5 years. My view is that for an investor like me who does not plan to routinely spend maturing TIP bonds, but rather roll them over into new bonds, a fund or ETF offers greater simplicity of ownership, including automatic reinvestment of interest payments and the reinvestment of maturing bonds, as well as the maintenance of a constant maturity. Also, if one intends to hold TIPS in a taxable account, a TIPS fund greatly eases the tax reporting issues.

For me, these benefits outweigh the one uncertainty that any periodic withdrawal from a fund will return a principal amount either a bit higher or a bit lower than my initial purchase price depending on prevailing interest rates. But I note that this uncertainty is as likely to be to my benefit as my harm, and because I am buying the short term ETF, this uncertainty will have relatively little impact on the fund’s total return.

As I see it, a strong case in favor of individual TIPS exists only if you expect to be spending the proceeds of maturing bonds. If, like me, you expect to roll the proceeds of maturing bonds into new bonds, you are essentially creating your own labor-intensive mutual fund.

Thanks Barry. I prefer to own individual TIPS and hold them to maturity, but I continue to have a holding in VTIP in my traditional IRA account.

Very basic question…Current inflation rate is ~7%. If inflation a year from now is 5%, will the value of the TIPS drop 2%?

Which on one level makes sense (inflation dropped 2%), on the other hand inflation is still running 5% year to year.

As long as inflation is increasing, the principal of a TIPS will be increasing. A decline in the rate of inflation would simply lower the rate of increase in principal, but it would increase 5% in your scenario.

How does Vanguard display the value of the TIPs on a daily basis? Are they displaying the current value as PAR x inflation index? Just trying to figure out how to best identify the gain/loss associated with the amount I paid for the TIPs. I plan to hold to maturity so no issue on daily price swings but wanted to be sure I was looking at their #s correctly.

It’s a good question. Vanguard shows the par value as the “quantity” in your list of holdings, and also shows “current balance,” which is the market value of your investment. When you click on the holding it presents the price (current price of the TIPS, such as $99.56), the “bond factor rate” (inflation index) and the current balance, which takes the inflation index into account. So, in short, Vanguard shows the market value, not just the accrued principal.

David:

Thanks for this post and all of your other posts about TIPS; they’re tremendously useful. It seems like a real challenge to try to simplify a very complicated subject. I’m still unclear about the circumstances under which a TIPS produce a negative real return if they are bought at (a) New Issue auction, (b) Reissue auction, or (c) on the secondary market?

It seems that the only way that can happen is if the buyer pays too much for the TIPS, but because of the way the index ratio affects the amount of coupon and principal received, it’s not clear to how exactly to determine whether the price being asked is too much.

Is it the case that any time a buyer pays a premium, they are exposed to the risk of ultimately getting a negative real yield? Is the risk heightened if they buy when the index ratio is above 1.0? Does the risk increase the higher the index ratio is above 1.0? (My thinking here is that if TIPS are bought when the index ratio (and inflation) are particularly high, and inflation decreases (particularly at the time the bond matures), the buyer could receive back less principal than they “paid for.”) Can you explain how to determine if the price being paid exposes the buyer to the risk of a negative real return?

Thanks in advance and thanks for your blog!

Bob

If you pay near par value for a TIPS (such as at an originating auction with a positive real yield) the risk is extremely small that you won’t get back your original investment. But … let’s say you bought a TIPS last year with a negative real yield and paid maybe $110 for $100 of value. Then you have to have enough inflation over the term of the TIPS to make up that 10% extra cost. (Fortunately, inflation has been quite high over the last year.) Or … if you buy a TIPS on the secondary market with a very high coupon rate and very high inflation index, you get the double whammy of paying a premium price for that extra principal. So the risk there is higher.

The higher the cost above par value, the higher the risk. But generally, the risk of loss isn’t huge. And people who have held TIPS for many years (as I have) have lots of built-up accrued principal. All of that could decline if prolonged deflation strikes. I really don’t lose sleep over this.

Seems like the only time I can realize a gain, I have to sell my Tips or hold to maturity? The rest just seems like a mechanism to adjust your principal based an inflation while you hold it. Is this the nutshell view?

Well, you do get the coupon rate paid out as current interest, twice a year. The coupon interest will rise (or possibly fall) with the level of the underlying principal.

Isnt that the low low coupon, and the real money is made when you sell principal value? The real killing is when you sell not the coupon today? Its hard to get excited about a 1% return after taxes!

You forget inflation.

The principal is adjusted for inflation. So, no “winning” there. Your excess return ABOVE inflation is the coupon rate. Same holds true for many other types of investments.

For example, if your index fund returns 7%, but inflation was 6%, you excess return above inflation is 1%.

People always tend to stare at the big number, instead of taking into account the “hidden tax of inflation”.

Regarding: track current value with a simple Excel spreadsheet: Par value x inflation index.

How does one actually do this in excel? example would be nice.

Column one = par value (set at purchase)

Column two = inflation index (updates daily)

Column three = column one x column two = current value.

Example:

$10,000 x 1.00576 = $10,057.60

You can find the current day’s inflation index at the Wall Street Journal: https://www.wsj.com/market-data/bonds/tips

I am sorry for lack of understanding but I don’t see column named inflation index

Is it equivalent to Yield?

It’s called accrued principal in that Wall Street Journal chart. When it shows a number like 1199, then the inflation index is 1.199. That chart shows a rounded off inflation index, but it’s accurate enough to track your investments.

Thank you David for continuing to try to explain things to this particularly dense member of your readership! It took me awhile to learn couples dancing…I kicked a few folks in the shins and stepped on a fair number of feet…but I am now a pretty good dancer! I hope I may one day become proficient at handling TIPS…

“The auctioned real yield, called “high yield” in this chart, was 0.630%, so the Treasury set the coupon rate at 0.625%. That set the unadjusted price for par value at about $99.951.”

QUESTION: What is the formula for calculating the “unadjusted price?” How is it derived from the “high yield” and the “coupon rate?”

“But then you have to calculate in the fact that this TIPS would have an inflation index of 1.00495 on the settlement date of July 29”

QUESTION: Where do I go to get the inflation index?

QUESTION: What is the formula for computing accrued interest between the purchase and issue date? Is it “Unadjusted Price” x “Coupon Rate” X (“Purchase Date” – “Issue Date”)/365.25?

Oh no … formulas! Not my super power. I am sure some of my brainy readers actually know or can guess at the formula used to set the unadjusted price. In an originating auction, investors bid for the real yield they desire and the resulting high yield creates the coupon rate. The relationship of the coupon rate to the high yield sets the unadjusted price.

The inflation index is updated daily by the Treasury and is listed each month for all TIPS based on inflation two months earlier: https://www.treasurydirect.gov/instit/annceresult/tipscpi/2022/CPI_20221213.pdf. You can find an update each day on this Wall Street Journal page: https://www.wsj.com/market-data/bonds/tips

The accrued interest also has a unique formula applied, based on the number of days before the settlement date. But like I said, formulas aren’t my specialty. The formula calculates the interest that would be earned in that number of days.

to get the unadjusted accrued interest, the formula appears to be:

(Days between issue date and dated date)/364) X Coupon Rate X Face Value

for calculating unadjusted price at auction, i’d suggest using the PRICE function in a spreadsheet

It could be Treasury uses a half-year formula, so it would be days/182 x 1/2 coupon rate x face value. Not sure about that, though. I guess the result would be the same?

Thank you DW!!

Would you be able to post an example of use of the Excel PRICE function with inputs based on purchase of $10,000 of the recent 5 year reopening.

Take care!

Question: on the basis of what value are the inflation accruals of a TIPs calculated by the Treasury?

Suppose a TIPs did not move at all and the value is still at par, i.e. $100. Next up comes 5% inflation and the inflation accrual is $5 giving $105 TIPs book value.

But what if the TIPs trades at a discount or premium? Is the Treasury still going to assume $100 x 0.05 = $5 inflation accrual, or do the use the current value to discount/premium? Say, the TIPs trades at $80, so now the inflation accrual is 0.05 x $80 = $4??

The inflation accruals are completely independent of the market’s decisions on real yields. On the secondary market, investors set the real yield based on yield trends. The inflation accrual simply matches inflation two months earlier, with an inflation index determined for each day of the month. It is not affected by the real yield.

But in the end, the market price of a TIPs should trade closer and closer to $100 when it reaches its maturity date?

If so, then maybe it is a good idea to buy TIPs at a discount on the market to fill in holes in a TIPs ladder. After all, you are guaranteed to get $100….

As someone who “wants” to purchase a TIPS but is “confused” about how they work, I found this article helpful but still overly complicated. There are just too many moving parts to keep straight. Perhaps that is my limitation or simply an unavoidable byproduct of the investment type. It makes me wonder how TD came up with this convoluted option to begin with. Has anyone written a history of how TIPS came into being? I can only imagine the thought process of the person who came up with this option.

I purchase all kinds of investment from T-Bills to I Bonds to Munis to stocks and mutual finds, but always hesitate before buying a TIPS. Do you have an article that explains how a 5 year TIPS purchased at TD and held to maturity works, because that is the only way I would consider getting into this investment? When I say how it works, I mean, using a recent TIPS, what my gross profit be at the end of five years when my principal is returned to me, the net profit after taxes paid in given tax bracket, and how taxes are declared (does TD provide a 1099)? I’m sure this seems like a simplistic request but that kind of explanation seems like the most straightforward one to offer TIPS wannabe newbies like me.

You are looking for an assurance of a nominal return, and you can’t get that with a TIPS. You can only know the real return. If a TIPS has a real yield of 1.5% for 5 years, your nominal return is going to depend on the future rate of inflation.

If inflation averages 2%, you get a nominal return of 3.5%. At 2.5% inflation, it is is 4%. At 5% inflation, it is 6.5%.

David, my take on this is that the real yield is not annualized but rather the total yield to maturity on top of whatever the inflation to maturity amounts to. So in the examples you gave above for nominal return you are referring to inflation averaging 2%, 2.5%, and 5% TOTAL to Maturity, respectively, rather than year over year. Is that correct?

It would be 1.5% on top of average annual inflation, whatever that is. If average annual inflation is 3% over the term, then 4.5%.

Okay, where I’m getting screwed up in the math is – well take for example the initial auction of 91282CFR7 with a reported high yield of 1.732% and a coupon of 1.625%. Assume a flat inflation index of 1.00 (no inflation or deflation.) I can’t seem to be able to make the math work to turn an annual coupon payment of $1.625 per $100 par value into a real return of 1.732% unless I paid only $93.82 for $100 par value. I paid quite a bit more than that. Where am I messing this up??? Thank you for your patience with me.

I left accrued interest between issue date and settlement out of that calculation, but that only amounts to about $0.07/$100 or so, right?

Paul, on that October auction: The coupon rate was 1.625% and the real yield was 1.732%. That’s a difference of only 0.108%. Just roughly, over 5 years that’s 0.54%. The unadjusted price was $99.49, which is .051% less than $100. So pretty close for a napkin calculation.

Again, thanks for your patience with one who sometimes struggles with the math. Still taking the inflation factor completely out of the picture to simplify, where I seem to be going wrong is forgetting that Treasury promises that the lesser amount I pay up front will be upped to the par value in a lump sum at maturity. $1.625 annual coupon on $99.49 is an actual annual yield of about 1.634%. But at the end of the 5 years I am rewarded for sticking out the full term with a repayment of $100 for my $99.49, or an added 0.51%. That does put my actual net yield closer to the stated High Yield when averaged over the term of the bond. Thank you.

“… Treasury promises that the lesser amount I pay up front will be upped to the par value in a lump sum at maturity. ”

Keep in mind that the unadjusted price is for $100 of par value and you are immediately earning interest on $100, not $99.49. You are buying $100 at a discount.

“Keep in mind that the unadjusted price is for $100 of par value and you are immediately earning interest on $100, not $99.49.”

Stated that way, I am immediately earning an “interest” of 1.625% on that $100 and not an interest of 1.732%. The make-up amount doesn’t come until the very end – just like any other bond sold at a discount. My actual purchase was for a par value of $4000, for which I was actually debited by TD Ameritrade a total of $3981.88.

So, unless I am still off base, I believe my payment/repayment schedule will look something like this:

10/2022 ($3,981.88)

04/2023 $6.50

10/2023 $6.50

04/2024 $6.50

10/2024 $6.50

04/2025 $6.50

10/2025 $6.50

04/2026 $6.50

10/2026 $6.50

04/2027 $6.50

10/2027 $4,006.50

Wow! Too early for math apparently. LOL Let me try that table again:

10/2022 ($3,981.88)

4/2023 $32.50

10/2023 $32.50

4/2024 $32.50

10/2024 $32.50

4/2025 $32.50

10/2025 $32.50

4/2026 $32.50

10/2026 $32.50

4/2027 $32.50

10/2027 $4,032.50

Correct, in theory, except remember that the coupon payment will rise as accrued principal rises, keeping it aligned with future inflation.

This is all a big help to me, for which I am very grateful! Not belaboring the point but simply trying to understand a little better: I think you are referring to accrual of principle due to the inflation that I was attempting to simplify out of the equation for my better understanding? (In which case it would not apply to my given example of no inflation or deflation.) Or are you stating that, contrary to my understanding thus far, the amount discounted from the face value is repaid evenly over the life of the bond rather than all at once at the end?

Happy holidays, David! Thanks for ending the year with another enlightening article. The only comment I have is regarding your definition of real yield:

“Real yield to maturity

What is it? It is the interest rate your TIPS investment will earn above (or below) official U.S. inflation for the term of the TIPS.”

The way I think of real yield to maturity isn’t in terms of “interest rate”. Rather, I think of it as the average annual “total return” versus inflation that I will receive at maturity, assuming I hold my purchases TIP to maturity. It’s a guaranteed total return in excess of inflation IF the real yield is positive. Or it’s a guaranteed total return below inflation if the real yield is negative when purchased. It does indeed show as “Yield to Worst” on my secondary market purchases through TD Ameritrade.

Am I describing this accurately? Total return above (or below) inflation is all I care about, not “interest rate”. BTW, I plan to hold every individual TIP I purchase to maturity. For that reason, I keep my durations short!

Excellent point! I actually cringed when I first typed “interest rate” in that sentence. I have changed this to total return. It is a more accurate description.

I would only caveat that the real yield that will be realized is not set in stone except in the case of a zero-coupon bond. The yield to maturity calculation assumes that coupons can be reinvested at that yield. If the real yields at which coupons are actually reinvested are higher/lower, the overall real yield realized at maturity is also slightly higher/lower. The lower the coupon rate, the less of an impact.

You could be right. Honestly, I don’t have the expertise to say yes or no. I have seen this idea before. However, here is a scholarly paper that refutes it, at least for nominal investments: https://www.economics-finance.org/jefe/econ/ForbesHatemPaulpaper.pdf

I glanced at the article. It supports my point. To use the authors’ example, if an investor does not reinvest the bond coupons at 5% they will not realize a 5% return. For example, if they earn nothing on their coupons they will have $1,250 at the end of 5 years. On an investment of $1,000 that is a 4.56% return. If they reinvest coupons at 10% they will earn a 5.46% return. Yield to maturity is not an investment return – that is their point, and it was mine.

However, the underlying principal of a TIPS increases with inflation until maturity. And so the coupon interest also increases as the principal increases. With a nominal Treasury, that isn’t the case because the principal remains stable.

As the Forbes et al. article makes abundantly clear, the Yield to Maturity (YTM) calculation can be computed EXACTLY at the time of bond purchase and does NOT make any assumptions about return on coupon payments that may or may not be reinvested. If a bond pays out all its coupons on schedule and returns the principal at the maturity date as promised, it has achieved its yield to maturity. So it is incorrect to state that “The yield to maturity calculation assumes that coupons can be reinvested at that yield.” The overall yield realized at maturity with coupons reinvested (also known as realized compounded yield, or RCM) cannot be known at the time of bond purchase; this is a conceptually different than Yield to Maturity. As a practical matter, YTM = RCM only for zero coupon bonds. While zero coupon TIPS are unavailable, one can purchase ones with a minuscule 0.125% coupon and achieve a RCM that will be very close to the YTM at purchase.

In the above, I meant to abbreviate realized compounded yield as RCY, not RCM. 🙂

Thanks David, this was very helpful. Especially for me as a new TIPS investor.

Hi David….A question about the value of a TIPs bond at maturity and ignoring interest payments. Say for example I purchase a TIP on the secondary market with an inflation index of 1.5000 (paying $150) and I hold that bond until maturity. At maturity I discover that the inflation index has actually fallen to 1.4000 due to a terrible deflationary economy. The treasury returns $140 and I experience a $10 loss? I recognize that the treasury will never return less than $100 but I paid $150 for the bond and received $140 back. While deflation is unlikely, is that the only risk I have and is my example possible?

This example is correct. You are guaranteed to receive $100 at maturity, but you will get $140 because of the inflation index of 1.4. So you do have a net loss. Maybe you could claim a capital loss, but I am no tax expert. This is why some secondary-market investors shy away from buying a large amount of accrued principal, especially at a premium cost. For TIPS you buy at originating and secondary auctions (in other words at or near full term), this risk is extremely low.

Helpful?

I have been investing in TIPS for over 20 years and this is the best explanation you find anywhere. The Treasury should have handle their explanations.

Happy New Year David!

@Tipswatch, uh-oh, my inner obsessive-compulsive editor is being triggered.

The Coupon Rate section is confusing to me. “[T]he Treasury sets its coupon rate 1/8th-percentage-point below the auctioned real yield to maturity.” This suggests to me that if the auctioned real yield was 0.630%, the coupon rate would be (0.630 – 0.125 =) 0.505%, rather than 0.625%. I think you should say that the auctioned real yield to maturity is rounded down to the next even 1/8th-percentage-point.

And “But if the TIPS auctions with a negative real yield, it gets a coupon rate of 0.125%, the lowest the Treasury will go for a TIPS” should probably be “But if the TIPS auctions with a negative real yield or a real yield below 0.125%, it gets a coupon rate of 0.125%, the lowest the Treasury will go for a TIPS.”

And I’m only partway through what’s promising to be a very useful article!

Well … of course it is the 1/8th-percentage-point increment below the real yield. I will add that word to avoid confusion.

Thank you for this wonderful and helpful explanation. I look forward to

these articles and they have helped me a great deal!!!

Best regards,

Brian