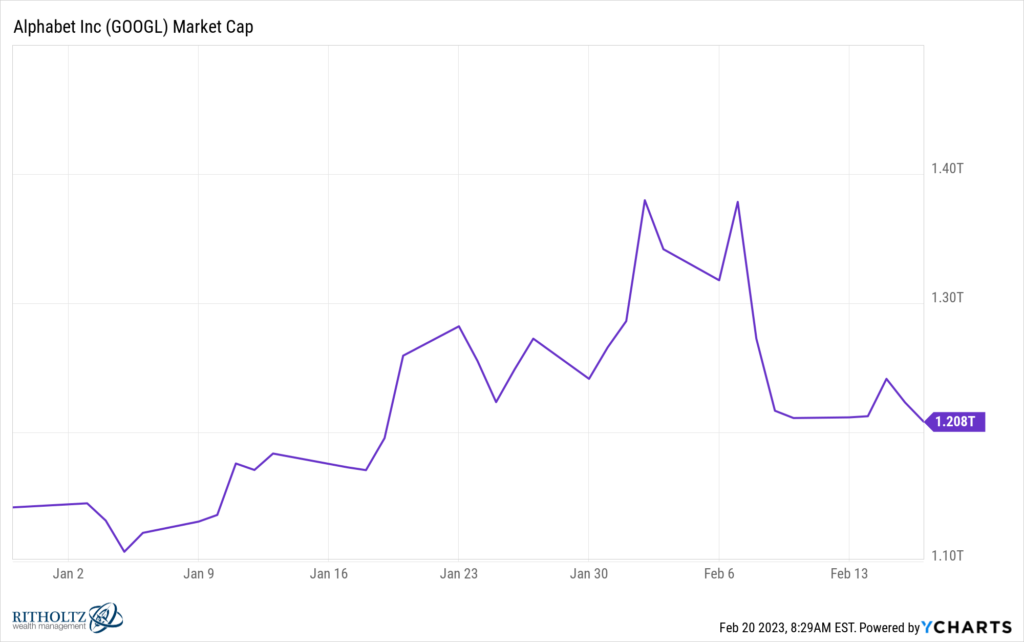

One of the biggest stories in the markets so far this year is the $100 billion in lost market cap ripped out of Alphabet’s stock when it became apparent that the search giant was going to be under siege by Microsoft’s push into AI. How did such a successful, innovative business like this suddenly find itself in this position? Maybe it wasn’t so sudden. Perhaps what ails Alphabet was a long time coming and the ChatGPT vs Google Search headlines were just the catalyst to unleash all this doubt among the investing public.

The stock market is closed today so I am directing your attention to this long but worthwhile post by an ex-employee of the company who sheds some light on what’s wrong internally and how things got that way.

I joined Google just before the pandemic when the company I had co-founded, AppSheet, was acquired by Google Cloud. The acquiring team and executives welcomed us and treated us well. We joined with great enthusiasm and commitment to integrate AppSheet into Google and make it a success. Yet, now at the expiry of my three year mandatory retention period, I have left Google understanding how a once-great company has slowly ceased to function.

Keep reading: