Why? The Medicare system is making amends for an ill-advised increase of 14.6% in 2022.

By David Enna, Tipswatch.com

One year after Medicare costs jumped 14.6% because of uncertainty over an Alzheimer’s drug, the Centers for Medicare & Medicaid Services has announced Medicare costs will be falling in 2023 for the Part B premiums and deductible, along with declines in potential IRMAA surcharges for people with higher incomes.

The reductions are welcome news, and come at a time when U.S. inflation is running at close to a 40-year high. The CMS announcement came a month earlier than usual, which was a surprise. In about a month, if you are on Medicare, you will get a letter from CMS informing you of these new premium and deductible costs for 2023.

If you planned poorly, you may be meeting up with the Income-Related Monthly Adjusted Amount, also known as IRMAA. And you really don’t want to meet IRMAA. Even though the surcharges are going down, they can be lofty, so it’s smart to plan ahead to limit these costs.

Let’s dive into the key Medicare changes for 2023.

Part A: Hospital insurance

Most people who reach age 65 go on Medicare Part A, even if they are still working. Medicare Part A covers inpatient hospital, skilled nursing facility and some home health care services. About 99% of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment.

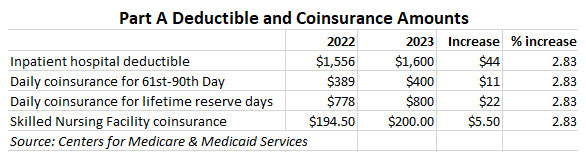

Although coverage is generally free, Part A has some sizable deductibles and coinsurance costs, and those will be rising 2.8% in 2023, making this area an exception to Medicare’s price reductions:

Keep in mind that most people on Medicare have a Medigap or Medicare Advantage plan that will cover all or most of the Part A deductible and coinsurance amounts. For example, all standardized Medicare Supplement (Medigap) plans, A through N, provide coverage for Part A coinsurance, and most also cover all or most of the Part A deductible costs.

Part B: Medical insurance

Medicare Part B can be described as covering “outpatient services,” things like doctor visits, some lab tests, an annual wellness exam, flu shots, diabetes screenings, etc. Medicare Part B generally pays 80% of approved costs of covered services, and you pay the other 20%. Some services, like flu shots and a wellness visit, may cost you nothing.

Part B deductible. Before Medicare pays anything, you have to meet your Part B deductible each year. For 2023, that deductible is falling to $226, a decrease of $7 (3%) from the annual deductible of $233 in 2022. All currently-offered Medigap plans do not cover this deductible. But once the deductible is met, Medicare and Medigap plans will cover some or all of your Part B costs.

Part B premium. The Part B monthly premium, paid by all people on Medicare, will be $164.90 for 2023, a decrease of $5.20 (3%) from $170.10 in 2022. CMS provided this explanation for the cost reduction for the Part B deductible and premium:

The 2022 premium included a contingency margin to cover projected Part B spending for a new drug, Aduhelm. Lower-than-projected spending on both Aduhelm and other Part B items and services resulted in much larger reserves in the Part B account of the Supplementary Medical Insurance (SMI) Trust Fund, which can be used to limit future Part B premium increases.

In addition, CMS announced a change in Medicare policy for people who are immunosuppressive and no longer eligible for full Medicare coverage:

Beginning in 2023, certain Medicare enrollees who are 36 months post kidney transplant, and therefore are no longer eligible for full Medicare coverage, can elect to continue Part B coverage of immunosuppressive drugs by paying a premium. For 2023, the immunosuppressive drug premium is $97.10.

Summary. For most people in 2023, Medicare Part B is going to cost $164.90 a month for the premium, plus the cost of the $226 deductible. That’s a total cost of $2,205 a year, down from $2,274 for 2022, a reduction of about 3%.

But beware … IRMAA is lurking

Since 2007, a beneficiary’s Part B monthly premium is based on reported income, known as MAGI, or modified adjusted gross income. According to the Social Security Administration handbook, for Medicare’s purposes MAGI is adjusted gross income (line 11 of the 2021 federal income tax form) plus tax-exempt interest.

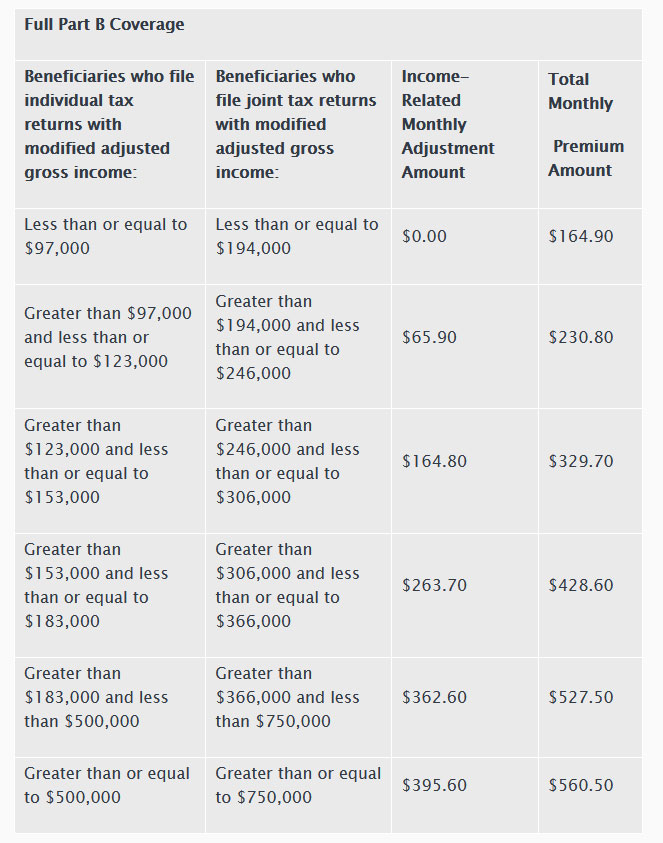

Here are the 2023 Part B total premiums for high-income beneficiaries, which apply to income reported on your 2021 tax return:

These income-related monthly adjustment amounts affect about 7% of people with Medicare Part B. And it’s important to note that people on Medicare Advantage plans continue to pay the Part B premium, and are also subject to the IRMAA surcharges.

CMS just recently announced these 2023 IRMAA levels, but they are triggered by income you reported on your 2021 federal tax return. These charges are universally misunderstood. They are called 2023 IRMAA levels, but apply to the 2021 tax return. In other words, when you filed your 2021 return earlier this year, you could not know the income levels that would trigger the surcharges. And a tiny mistake can be very expensive.

When you file your 2022 return next year, realize that you won’t know the relevant IRMAA levels until October or November 2023, many months after you have filed. It’s a crazy system.

Part D: Drug coverage

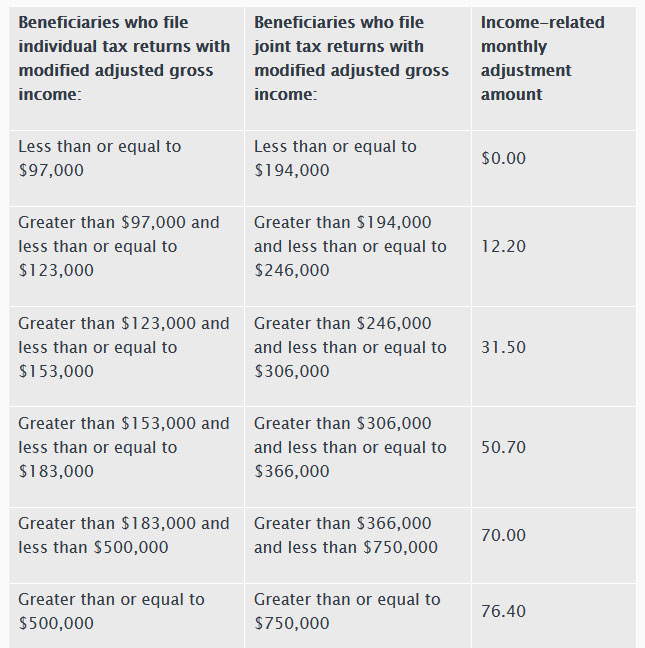

IRMAA surcharges also apply to Medicare’s Part D premiums for drug coverage. There is no “standard” Part D premium — the cost you pay depends on the Part D insurer and plan you choose. The IRMAA cost, if any, is added on top of your base premium. People in Medicare Advantage plans don’t pay a separate Part D premium, since those plans include Medicare Advantage Prescription Drug (MAPD) coverage. But Part D is built into Medicare Advantage, and the IRMAA surcharge still applies.

Here are the Part D IRMAA levels for 2023, based on reported income for 2021:

IRMAA can pack a wallop

The IRMAA penalty isn’t a “progressive tax” that ramps up as you go over an income level. Instead, going $1 over the limit is the same as going thousands of dollars over the limit, and incurs the same surcharge. For 2023, the IRMAA surcharges are falling about 3.1% across the board, while the income triggers are increasing about 7.7% (except for the two highest levels, which stayed the same). That’s good news, but you still need to watch out for IRMAA.

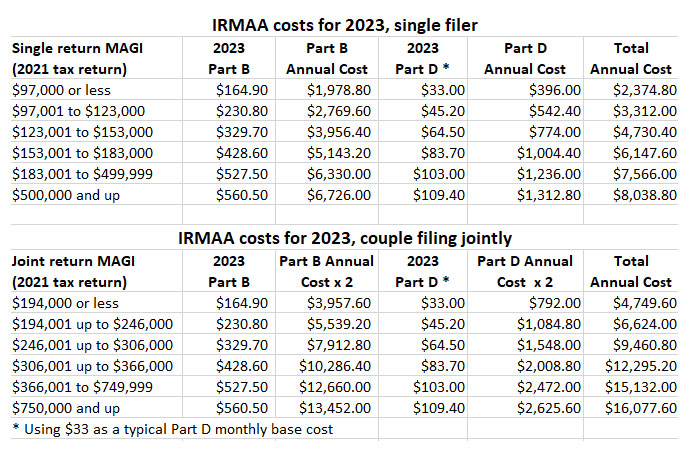

Here is a look at the annual costs of Parts B and D, plus IRMAA, for 2023, based on income reported for 2021:

In all cases, the IRMAA cost levels will be a bit lower in 2023 — assuming the income level stayed the same — because of the Part B premium reductions. Part D surcharges remained about the same. For example:

- A single filer with income of $122,000 would pay about $3,321 annually, versus $3,402 last year. That’s a reduction of about 2.4%.

- Joint filers with income of $245,000 would pay $6,624 for two people on Medicare, versus $6,804 last year. That’s a reduction of about 2.7%.

- Even a couple with income of $800,000 would pay a bit less — $16,078 for two people on Medicare, versus $16,541 last year, a reduction of of about 2.8%.

My advice: Recognize IRMAA and plan for it

It’s worth noting that the first IRMAA tier for both singles and couples is not too daunting. It adds just $937 to the annual costs for a single filer, and $1,874 to the annual costs for a couple. But the next tier up starts to get pricey, increasing annual costs by $2,356 for a single filer and $4,711 for joint filers.

So I think people looking to take capital gains, buy a boat, make Roth conversions, etc., could feel comfortable in hitting that first IRMAA tier. In fact, anyone planning on doing major Roth conversions over a period of time should probably shoot for that level, but not higher, if possible.

Anyone reaching age 63 this year, and everyone already on Medicare, should be paying careful attention to income levels each year. That means tracking capital gains distributions, dividends, pension payments, annuity income, Roth conversions, IRA withdrawals, Social Security income, etc. It’s a lot of work, but can avoid financial pain.

Another key consideration is that Required Minimum Distributions are required from traditional tax-deferred accounts beginning at age 72. If you have sizable holdings in these accounts, you could be facing years of higher Medicare premiums triggered by RMDs. And if one spouse dies, and the surviving spouse inherits tax-deferred holdings, the problem magnifies. The surviving spouse now will file a single tax return, pushing IRMAA costs much higher.

So making some Roth conversions, within reason, before reaching age 72 makes good financial sense. Plus, it’s wise to use tax-deferred accounts for charitable giving, beginning at age 70 1/2, when qualified charitable distributions are allowed.

You can appeal an IRMAA ruling

The Social Security Administration has very specific rules that will allow you to get a waiver of the IRMAA surcharge, if you meet certain criteria for a “life-changing event,” which include:

- Work stoppage

- Work reduction

- Employer settlement payment

- Death of spouse

- Divorce

- Loss of pension income

You’ll need to fill out IRS Form SSA-44 to request the waiver.

Conclusion

The decline in Part B costs was anticipated because of last year’s aggressive increase based on an Alzheimer’s drug that ended up costing less, and being used less, than expected. The result: A typical person on Medicare will be paying about $63 a year less for Part B coverage. Overall costs could end up rising, however, if premiums for Part D and Medigap plans increase in the coming year.

* * *

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. The investments he discusses can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

I have a friend who, for her whole life worked (resort town) just enough to be eligible to claim state unemployment insurance as allowed by law. Other than that, she worked off the books or “under the table”at seasonal jobs. When she turned 62, I doubt that she qualified for much in the way of Social Security benefits (She said she “didn’t need it anyway”). When she turned 65 she expressed surprise at what she considered the extreme cost of Medicare premiums. She did not elaborate, but given that she paid so little into Social Security, how did she qualifiy for Medicare part A, and does the Agency raise the part B premiums in cases like this?

If she didn’t pay Medicare taxes for 10 years, then Part A would indeed be expensive, as the SSA says: “the premium is either $278 or $506 a month in 2023, depending on how long you or your spouse worked and paid Medicare taxes.” But that doesn’t apply to Part B, from healthline.com: “There is no work history requirement to enroll in Medicare Part B. You can enroll as long as you’re at least 65 years old.”

Pingback: September inflation report sets I Bond variable rate at 6.48%; Social Security COLA rises to 8.7% | Treasury Inflation-Protected Securities

Excellent article! You are right on target re: need to plan for IRMAA. In my own projections, I’ve discovered that because IRMAA is a cliff tax, holding I or EE Savings Bonds and deferring taxes on their interest until redemption many years down the road can push me into IRMAA territory and/or more expensive IRMAA tiers. This realization encourages me to think extra carefully before considering purchasing tax-deferred savings bonds as well as other tax-deferred vehicles such as multi-year guaranteed annuities, deferred single premium annuities, QLACs, etc. I’ve found that the much of IRMAA hit can be minimized or avoided by aiming for fairly smooth taxable income levels in retirement rather than allowing large jumps in certain years.

Planning for the IRMAA hit is a must, even when you are willing to go into level one. My personal method is to set an income goal for the year, determined by incoming money, interest, dividends, withdrawals and Roth conversions. Since no I Bonds have ever matured, I haven’t had to plan around that, but I had EE Bonds mature this year, and I adjusted the other levels to compensate to stay under the target.

There’s also the NIIT (Net Investment Income Tax) to plan around and possibly avoid, with similar strategies available as for managing IRMAA, except that the NIIT threshold is not indexed for inflation.

The current 3.8% NIIT threshold is $125,000 for a single filer, $250,000 for joint filers. That is getting dangerously close to the current tier one IRMAA limit ($123,00 for single, $246,000 for joint). Next year the IRMAA tier one limit will probably exceed the NIIT threshold. Bummer. And you are required to pay estimated taxes on this! However, it looks like the tax is only applied on the amount you go over the threshold, which could be a small amount if you are barely over. Is that right?

The threshold for married filing separately is $125K; for a single or head of household filer, it’s $200K. The 3.8% NIIT applies to the lesser of the amount of MAGI over the threshold or the amount of net investment income once MAGI exceeds the threshold.

Your articles are very informative! Unsure if there may be an error in the Part D IRMAA levels in the 2023 table? I noticed that all the single and joint modified adjusted gross income levels in Part D are lower than the same levels in Part B (i.e. Part B single is equal to or less than $97K vs.n$91K for Part D). Shouldn’t they be the same?

Also, I read your 2018 article and was wondering with all the price increases that have occurred on the various Part B plans, if you still believe Part G may be the most appropriate?

Bob, thanks for catching that. I guess I had the tables for 2022 and 2023 open at the same time, and I copied the wrong one. This is now fixed. The numbers in the cost summary later in the story were correct. I haven’t done extensive research comparing the Medigap plans, but I am personally very happy with Part G. I did it through AARP United Healthcare.

Excellent article as usual, David. You wrote an article on SeekingAlpha a few years ago (2018?) that was also excellent, regarding Medicare and which Medigap plan to choose, and it helped me a lot since I was turning 65 that year. Perhaps do an update to that article in the future for new Medicare applicants when you get a chance. It’s very helpful.

One slight typo above. In the final paragraph of IRMAA section (just before Part D section), you wrote, “When you file your 2023 return next year…”. I think you meant it to say “2022 return”.

BTW, the fact IRMAA brackets are not progressive is not generally understood well, and I’m glad you pointed that out. It is very important to keep even $1 below the next bracket threshold (but since we don’t know the actual dollar brackets in advance, it’s not easy!). I consider IRMAA to be a form of means-testing and a tax, even if it’s called a “surcharge”.

Thanks for the alert on the typo. This article had a lot of 2021s, 2022s and 2023s in it and I knew I was going to mess one up. This is fixed. And thank for remembering that 2018 article (the year I went on Medicare) https://seekingalpha.com/article/4185050-nearing-65-dont-get-caught-medicares-money-traps … That article took a tremendous amount of research and actual fighting for information from the companies (some of which refused to give me their age-by-age costs). Now I just write this annual summary of the Medicare cost changes.

The thing is that the IRMAA brackets almost always go up. (I don’t think they’ve ever gone down, although theoretically they could due to deflation.) So just shoot for the previous year’s target, which will provide a buffer.

Yes. I set an income target each year and then fill out the rest with Roth conversions after I see the latest IRMAA levels.