Traveling again? Of course.

By David Enna, Tipswatch.com

For most of last week, I was stressing out about today, when I will be leaving for South America for a tw0-week-plus trip. It wasn’t the travel that had me stressed. It was the fact that on May 1 the Treasury would announce the I Bond’s new fixed/composite rate and I’d be away from internet for hours.

Well, that worked out. The Treasury — for the first time ever — announced the new rates early, on Friday, since all purchases from Friday through October will be receiving the new fixed rate of 0.9% and composite rate of 4.3%. Thank you, Treasury, for the early announcement.

I am expecting to have very little internet access for much of this trip — which includes high mountains, Amazon jungle and remote islands. And that means I will be late posting news, approving comments and answering questions. There will be some news that needs covering before I get back, and I hope to get to it when the internet gods allow it.

What’s ahead

May 2. TreasuryDirect is going down for maintenance from about 6:30 to 8:30 am EDT. Don’t be surprised if it lasts longer. This shouldn’t be a big deal; there are no Treasury auctions scheduled for Tuesday.

May 3. At about 2:15 pm EDT, the Federal Reserve will announce its latest interest rate decision. Everyone expects a 25-basis-point increase in the federal funds rate, putting the rate in the range of 5.00% to 5.25%, slightly above the current U.S. inflation rate of 5.0%.

The key thing will be the message the Fed sends about rates going forward. I don’t usually write about these Fed announcements, which are covered by 1,000 media outlets. But it will be an important bit of news to watch.

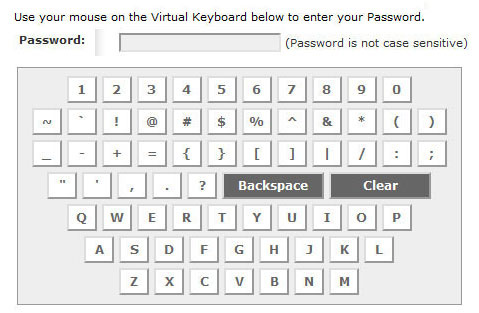

May 7. TreasuryDirect is going to remove its notorious “virtual keyboard” sometime this week to “improve the customer experience.” I actually like that keyboard, but it has very few fans. One problem is that it discourages users from creating complex passwords using a password manager. So it actually lessens security, somewhat.

I have no idea what will replace it. Usually, I would write a guide about the changeover, but that probably won’t be possible, because I will be in an the Amazon jungle about that time.

May 10. The Bureau of Labor Statistics will release its April CPI report. All CPI reports are crucial, but this one is a little less so since the March report set the I Bond’s current variable rate of 3.38%. I will try to post an analysis when I can get connected.

The Cleveland Fed’s inflation nowcasting is predicting all-items inflation of 0.6% for April and 5.2% year over year, putting U.S. inflation back on an upward path. That would be bad news for the markets, but these Cleveland Fed predictions often miss the mark.

May 11. Treasury will announce the May 18 reopening auction of CUSIP 91282CGK1, creating a 9-year, 8-month TIPS. I would normally post a preview article on Sunday morning, May 14. That might (or might not) happen.

May 18. If all goes as planned, I will be home on the day of the 10-year TIPS auction, which closes at 1 p.m. EDT, and things will be returning to normal. I will posting the results and an analysis after the auction.

* * *

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear.Please stay on topic and avoid political tirades.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. I Bonds and TIPS are not “get rich” investments; they are best used for capital preservation and inflation protection. They can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

I decided to stop buy Treasuries and invest in brokered CDs instead, until the Debt Ceiling Debacle is past us.

Wow, have a great time! Those blue-footed boobies are fantastic birds!

Hello David: What is your experience with .25 interest hikes by the FED. Do they reflect in the next Treasury auction immediately after or they are already priced-in a few days ahead of the announcement?

Happy Travels. Seems you wont be having too much time in Lima, my hometown, but if you do there are many good places to go.

The Fed hikes are usually priced in the weeks before, but the looming debt crisis has skewed the T-bill rates. Friend we are traveling with were just in Lima, but we start in Quito.

Wow! What is up with today’s auction? I bought 8-week bills since the 4-week ones haven’t been so great. Today however, the 4-week bill went for 5.964% with the 8-week coming in at 5.537%. Do you think this is from the debt limit announcement? (I know you’re travelling, so I won’t expect an answer right away.)

Yes, I’ve been predicting the 4-week would have the highest yield very soon, because of the now-looming debt limit.

Have a great time in South America! Just wondering if you organized your own independent trip, or if you booked with a cruise or tour company (and if so, which one.) I’ve done lots of travel in North America, Asia, and Europe, but have never been to South America.

This is Overseas Adventure Travel, small group

Thanks! I never traveled with them but got their catalog every year back in the 1990s. Enjoy.

Have a great trip Mr. Enna. It sounds exotic and adventurous. Enjoy the moments.

Happy and safe travels David. Thanks for keeping us ‘posted’. Ugh. (pun intended and instantly regretted). I’m sure you’ll enjoy your vacation all the more knowing the .9% fixed Ibond rate is locked in. For what it’s worth, I kinda like the TD keyboard too but hopefully the new changes will continue to expand to cover some much-needed modernization of the entire website.

You’re living my dream. I hope to be healthy and wealthy in my retirement years to do the same. Have a great trip!

Thank you for letting us know your schedule and upcoming important dates. Safe travels.

Please make sure to come back.

Have a great trip. If you can, please put your itinerary somewhere. Some of us, while vicariously living through you, would want to follow your travels on our own. Any good tips (pun intended) on your travels would also be good (especially of the savings kind – again, pun definitely intended). 🙂

The best part of TD was the keyboard. Simple to use. Sounds like a new pw fiasco coming. 42,Upper, lower, character, no leters from the alphabet!

When I created a separate account several years ago, the password requirement was more complex, but not out of the norm. I think TD realizes that a lot of people are trying to use their phones to view the site and the virtual keyboard is not mobile friendly.

Treasury Direct used to send us little cards, about the size of a credit card. Very amusing along with their online keyboard. They will probably go to two-factor authentication, along with a more complex password.

It’s not screen reader friendly either. Their suggested solution when contacting them was to disable JavaScript in my browser. Which caused it to not load at all, ha.

I for one am glad they’re removing it. My normal method of access is to edit the page’s HTML to remove the “readonly” attribute on the password field, at which point my password manager can paste into the field. Stupid piece of junk. Hopefully this means they’ll let us create case sensitive passwords going forward, but I won’t hold my breath on that.

Yes, it’s definitely not ADA-compliant. I suspect it was designed that way to get around password-stealing key-logger malware. Back in the day, that was a bigger concern. I liked it better than the keycard (mentioned by Patrick) they had before, but I guess it’s time for it to go.

Hope you have an interesting and enjoyable trip David.

My plan is $9562 in new I bonds @ .9% and $438 in VTI. Then wait 5 years. Cheers!

What’s VTI and your ratio logic?

VTI is Vanguard’s total market ETF. A great ETF by the way, where I keep the majority of my after tax investment. And I’m a Fidelity guy but VTI is hard to beat.

I’m not Len but maybe he’s doing some kind of experiment to see how they compare?

You are limited to multiples of 25$ $9550, $9575, $9600 etc. when you buy iBonds

Have a great time, David! I’ve been to the Amazon, and its incredible. Safe travels.