Prioritizing AR innovation can help CFOs weather recession: study

CFO Dive

SEPTEMBER 29, 2022

With inflation top of mind for CFO’s, upgrading AR processes could help financial executives buffer against persistent economic pressures.

CFO Dive

SEPTEMBER 29, 2022

With inflation top of mind for CFO’s, upgrading AR processes could help financial executives buffer against persistent economic pressures.

Corporate Finance

SEPTEMBER 29, 2022

Amid high inflation, rising interest rates, and a faltering stock market, one bright spot has been the performance of the U.S dollar. Since the beginning of the year, the dollar has risen 17 percent against the British pound, 25 percent against the Swedish krona and Japanese yen, and an astounding 40 percent against the Argentinean peso. Two currencies that have strengthened compared to the dollar are the Mexican peso and Brazilian real.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CFO Dive

SEPTEMBER 29, 2022

The share of CFOs who view financing conditions as unfavorable doubled compared with results in a second-quarter survey, the Richmond Fed said.

Nerd's Eye View

SEPTEMBER 29, 2022

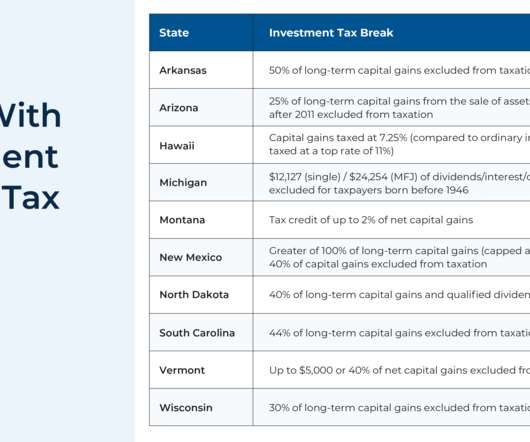

As an individual begins planning for retirement, one of the factors often considered is whether (and where) they might relocate to enjoy their retirement. When evaluating their potential options across the U.S., a state’s income tax rules can have a significant impact on where they might choose to live. The perception of a state as having high or low taxes could make it more or less attractive for someone choosing where to relocate, and those perceptions are often skewed by the state’

Advertiser: Paycor

HR doesn’t exist in a vacuum. This work impacts everyone: from the C-Suite to your newest hire. It also drives results. Learn how to make it all happen in Paycor’s latest guide.

CFO Dive

SEPTEMBER 29, 2022

John R. Tyson, son of Chairman John H. Tyson, was promoted to CFO as the company navigates economic headwinds including higher supply costs.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

Essentials of Corporate Finance

SEPTEMBER 29, 2022

Amid high inflation, rising interest rates, and a faltering stock market, one bright spot has been the performance of the U.S dollar. Since the beginning of the year, the dollar has risen 17 percent against the British pound, 25 percent against the Swedish krona and Japanese yen, and an astounding 40 percent against the Argentinean peso. Two currencies that have strengthened compared to the dollar are the Mexican peso and Brazilian real.

Future CFO

SEPTEMBER 29, 2022

Finance and sustainability are much more connected than previously thought. ACCA recently urged Malaysian firms to ensure that qualified finance professionals are placed at the helm of their sustainability agendas. Addressing senior representatives of some of the country’s most significant employers during a visit to Malaysia earlier this month, Helen Brand set out the vital role of the finance function in delivering climate change targets and building the prosperous, sustainable economies of th

The Reformed Broker

SEPTEMBER 29, 2022

Apple is actually a detractor from the market today, says Ritholtz’s Josh Brown from CNBC. The post Clips From Today’s Closing Bell appeared first on The Reformed Broker.

Barry Ritholtz

SEPTEMBER 29, 2022

For years, we have heard that “there is no alternative” – TINA – to equities, and that thanks to the Fed, “Cash is trash.”. No longer. The Federal Reserve, in its belated attempt to fight inflation, has cranked up rates to the point where today, there is an alternative to stocks: Bonds. It’s been over two decades since the Fed first began panic cutting interest rates in response to such events as the 1998 Long Term Capital Management implosion, the 2000 dotcom crash (2001-03), the Septembe

Speaker: James Kahler, COO of Full Course

Ever wondered where to splurge and where to safely conserve when it comes to operating and growing your restaurant? 🤔 Join James Kahler, COO of Full Course and industry visionary, in this new webinar where he'll talk all about best practices to invest in your restaurant's success! Whether you're a new business or an established restaurant, a seasoned pro or a rookie, you'll learn the keys to sustainable success in this competitive industry.

Barry Ritholtz

SEPTEMBER 29, 2022

My mid-week morning train WFH reads: • Treasury 10-Year Yield Rises Above 4% to Highest Since 2008 : Treasury 10-year yields climbed above 4% to the highest level since October 2008, as investors were rattled by Federal Reserve hawkishness and concern over potential Japanese sales of US government debt. An index of US sovereign securities extended its worst year since at least the 1970s after St.

Let's personalize your content