TreasuryDirect’s information often confuses investors. There is another way.

By David Enna, Tipswatch.com

Almost every week, I get questions about the way TreasuryDirect shows the current value of I Bonds purchased within the last five years. Here are recent examples:

“I-Bond was purchased last April. So far … the actual annual earning rate is not 7.12% as we saw last April but low. Is it because the current holding has not included the last 3 month interest? Can you explain it? Thank you.”

… “I invested $10,000 on 6/13/22 and I only gained $156 in value on 11/1/22. That seems low given that the interest rate was 9.62%. Help!”

The usual advice. You can check the total value of your Series I Savings Bonds after logging into TreasuryDirect’s account pages and then clicking through to the totals for the individual bonds. Or you can use the Treasury’s Savings Bond Calculator, which TreasuryDirect claims is only for paper I Bonds (maximum amount of $5,000 each) and isn’t accurate for electronic I Bonds. But it is accurate for electronic bonds, you just have to double the $5,000 amounts for purchases of $10,000 in that form.

I wrote a step-by-step guide to using the Savings Bond Calculator back in June 2018, and I think the basics remain just about the same. One of the advantages of using the calculator is that it creates a browser-based file you store on your computer. It can be updated without actually logging in to TreasuryDirect, and then saved again.

Confusion arises when investors check account balances at TreasuryDirect — or use the Savings Bond Calculator — because they will not see the last three months of interest for I Bonds that have not been held five years. I’ve written about this several times, including this August 2022 article: “Don’t go ballistic over the way TreasuryDirect reports I Bond interest.”

But there is actually a very easy way to track the current value of your I Bonds, including those three months of interest that TreasuryDirect hides for recent purchases.

Eyebonds.info: A valuable resource

If you want to track the current value of your I Bond investment, Eyebonds.info is an excellent and reliable site. It’s a creation of Bob Hinkley, a retired corporate financial analyst and computer programmer (and famed Boglehead contributor). It’s very simple to use:

- Go to the homepage.

- Click on I Bonds.

- Find the month you purchased the I Bond in the table and click on it.

- Click on the investment amount listed below that matches your original investment.

The page that then displays the earned-interest history of your I Bond, all the way to the end of the your current composite rate (the end month depends on the month you purchased the I Bond). The numbers presented do not subtract the last three months of interest, so remember if you redeem early, you will lose those three months of interest.

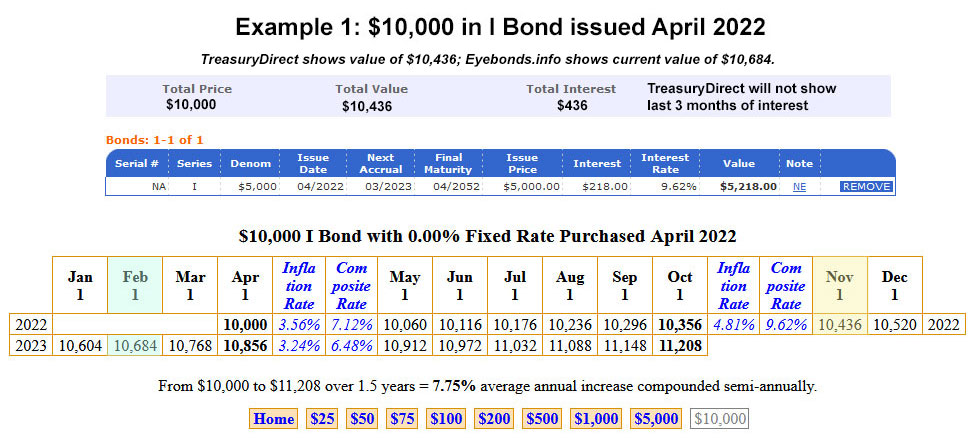

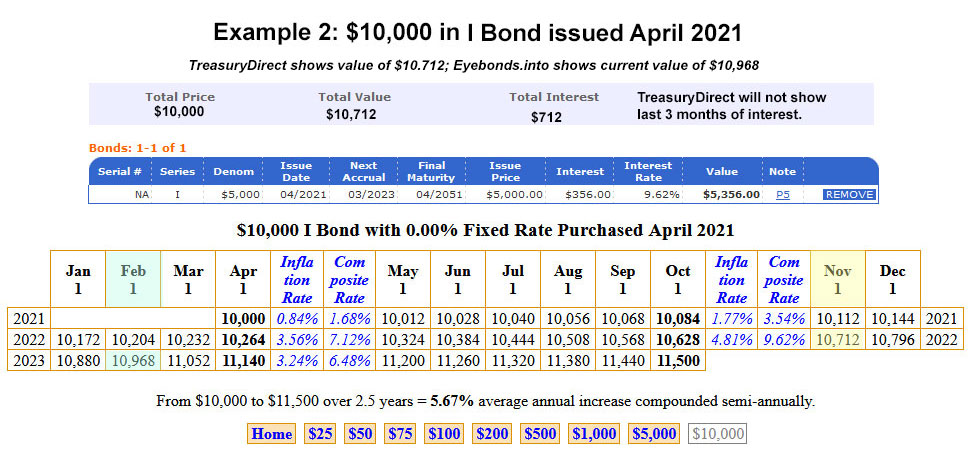

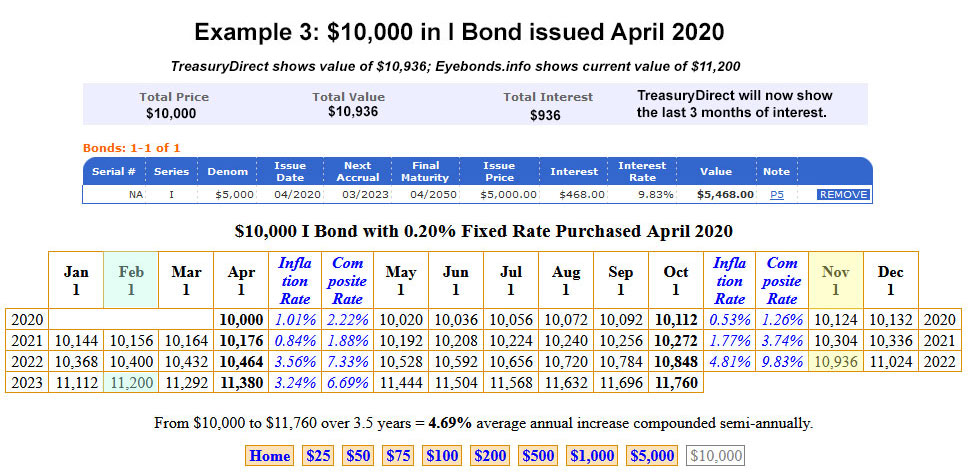

Now, let’s run through some examples. In these examples, I am presenting results for a $10,000 investment in April of various years. The top section of each chart shows the Savings Bond Calculator’s presentation (doubled to match the $10,000 investment). The bottom section of each example comes from Eyebonds.info.

Example 1 is for a $10,000 I Bond purchased in April 2022. TreasuryDirect shows a value of $10,436, but that does not include the last three months of interest. The Eyebonds.info presentation shows a current value (as of Feb. 1, 2023) of $10,684 and continues with interest calculations through October 1. Note that the Eyebonds.info information for Nov. 1, 2022, matches TreasuryDirect’s calcuation, because it does not include interest for November, December and January.

Also, note that I Bonds earn interest for the previous month on the first day of each month. Don’t get confused by that. You don’t earn interest until the month is completed.

Example 2 is for a $10,000 I Bond purchased in April 2021. TreasuryDirect shows a value of $10,712, minus the three months interest. Eyebonds.info shows a current value of $10,968, which includes the last three months of interest through the end of January.

Example 3 is for a $10,000 I Bond purchased in April 2020. TreasuryDirect shows a value of $10,936, which excludes the last three months of interest. Eyebonds.info shows a Feb. 1 value of $11,200, which includes those three months of interest.

Example 4 is for an I Bond issued in April 2017, which has now passed the five-year holding period and is no longer subject to the three-month interest penalty. TreasuryDirect shows a February 2023 value of $11,892, exactly matching the information on Eyebonds.info because the interest penalty is no longer in effect.

TreasuryDirect’s reasoning

By eliminating (hiding, actually) the last three months of interest for I Bonds held less than 5 years, TreasuryDirect is attempting to cause less confusion, not more confusion. If it showed the full total, and investors redeemed early, they would swamp TreasuryDirect with complaints they were cheated. So TreasuryDirect focuses on presenting an accurate current redemption value, not current total value.

I’ve suggested that TreasuryDirect simply create two columns, one for redemption value and one for current value. That would really lessen investor confusion. But … that’s not happening.

Anyway, Eyebonds.info is a tremendous resource for tracking and understanding the current and near-future value of your I Bonds. It also has historical information on TIPS, and a treasure-chest of information on U.S. inflation dating back to 1971.

The site also has an Excel-based I Bond Calculator you can download. I haven’t used it, but a lot of my readers seem passionate enough (and nerdy enough?) to give it a try. Let me know how it works. For me, the Savings Bond Calculator and Eyebonds.info are all I really need.

• I Bonds: A not-so-simple buying guide for 2023

• Confused by I Bonds? Read my Q&A on I Bonds

• Let’s ‘try’ to clarify how an I Bond’s interest is calculated

• Inflation and I Bonds: Track the variable rate changes

• I Bond Manifesto: How this investment can work as an emergency fund

* * *

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear.Please stay on topic and avoid political tirades.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. I Bonds and TIPS are not “get rich” investments; they are best used for capital preservation and inflation protection. They can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

WOW! eyebonds.info. GREAT HELP!! ssa.tools is another incredible free site for calculating social security benefits. The people that put these kind of helpful sites together need to get a GOLD MEDAL!!!

Thanks for the reference to Eyebonds.info, I’ll be checking it out, but for now I’m a long time user of the Savings Bond Calculator (even the one that existed before the web page version). I’ve got my own spreadsheet that I update by copying the results from my updated inventory page from the Savings Bond Calculator into every 6 months or whenever I’ve made a new purchase. On that spreadsheet I group and subtotal my holdings by maturity year just so I can see the building tax liability I’ve got. I also add a column that shows the fixed rate of each I bond I hold since that information isn’t otherwise on the calculator. Treasury Direct has a pdf that they update every six months with that historic information: https://treasurydirect.gov/files/savings-bonds/i-bond-rate-chart.pdf

Also, you said regarding the Savings Bond Calculator: “But it is accurate for electronic bonds, you just have to double the $5,000 amounts for purchases of $10,000 in that form.” Since I have many small I bond purchases from 2000-2002 (yes, I wish they were larger, but I was a newbie at this back then and didn’t realize what a great deal they would be later on when the fixed rates plunged) along with $10k purchases in more recent years, I find it easier to just make two $5k entries in my Savings Bond Calculator inventory for each $10k purchase instead of having to remember which entries to double and which to track as is. Most years I actually have four identical entries, two for my $10k purchase, and two for my husband’s.

I’m a novice starting with $500 when I started buying I bonds in January 2021 and I set up auto-purchases of $50/week and let it grow. Is it more advantageous to have more selective timing of purchases or does it matter? I’m saving for the long term unless an emergency arises. I can see that tracking my investment will be more complex and I look forward to trying out your site/calculator spreadsheet method. I also set up EEbond purchases and look forward to learning more about those. Thank you, I am glad I “found” this article. SML

I think the monthly purchase plan is fine. Remember with EE Bonds that the initial purchase automatically doubles in value after 20 years, creating a 3.53% compounded return. So you want to hold those for 20 years, and then redeem.

Hi David! I’ve got the may 2022 ibonds and want to cash out without losing any of the 6+% interest. Would that be August 1st to cash in? Thanks! –Mary Fran

That’s correct. Wait until Aug. 1.

I paid taxes on the current balance of my deferred Treasury bond interest about 7 yrs ago and have been declaring current year interest and paying taxes annually since then. Most matured this year but I have seven years to go on a few I bonds and have started buying I bonds again in the last couple of years. This is the first year to declare interest oñ these newer bonds. #1 Should I be declaring the amt showing on SB calculator (which was blank last year because hidden accruals) OR the excel amount? Presumably the hidden amt will magically appear at the appropriate time and I would catch up then, yes? I’m dreading and haven’t started the process of final reckoning for this year’s taxes. I have (matured) converted EE bonds, one matured paper EE bond that I cashed in Dec, remaining converted I Bonds, new electronic I Bonds, and paper tax refund I bonds.

#2 Is there any simple logical format to do this? I was under the impression I couldn’t use the Calculator for electronic bonds, but you show examples with N/A or blanks in serial bond field, so I assume that is possible for me to do, not just your format for sake of examples, right?

It was a moment of GREAT RELIEF when I found your site!

Thank you for sharing your information.

I have just started using I Bonds as part of the Fixed Income portion of my retirement portfolio. I wish to report interest to the IRS annually. I am extremely relieved to hear that I can use the Treasury Savings Bond Calculator. BUT you point out:

Also, note that I Bonds earn interest for the previous month on the first day of each month. Don’t get confused by that. You don’t earn interest until the month is completed.

So would you say that using the Treasury Calculator I would have to enter January 1st next year as my “value as of” date to include December 31st of the previous year for IRS interest earned reporting?

Thanks in advance

Bruce

Just guessing, but I’d say interest earned in January would count in the new year. The key to this will be to keep very accurate records of tax on interest paid each year. You’ll need that at maturity.

Nice tool @DL! I put together something similar at https://yourtreasurydirect.com/

For folks who want the full download, redemption data can be pulled directly from the treasury at https://fiscaldata.treasury.gov/datasets/savings-bond-value-files/savings-bonds-value-files

I have yet to find a similar source for “Accrual Value”, so we’re left with calculating our own (with rounding and implementation assumptions). Probably all in the realm of “close enough”, but let me know if I missed something.

BTW: feedback or suggestions for improvements very welcome! contact@yourtreasurydirect.com

With the passage of time and the benefit of recent inflation data, has your assessment of whether it pays to buy I bonds now or wait until April befote purchasing changed?

I am sticking with April, since there is no penalty for waiting. Most likely I will buy in April. If the fixed rate rises dramatically on May 1 I would then use the gift-box strategy to buy a pair of I Bonds in our two accounts — my wife’s and mine. Things can change, of course.

Hi,

I purchased a 10k iBond on 10/1/2021.

If I use treasury direct’s calculator using a 5k input and doubling the result, I come up with a value of $10,624 as of 02/2023.

If I use the EyeBond web page, I come up with a value of $10,876 as of 2/1/23.

Shouldn’t these values be the same?

Also…your step by step instructions on Seeking Alpha are now behind a paywall…

Muddling along…sigh…

TreasuryDirect will not show you the last three months interest until you hold the I Bond for five years. So what you see in that calculator is the value as of Nov. 1 2022, which was $10,624. This article explicitly explains this.

Thank you. I guess I thought that clicking through TD to see the accrued value would give interest less the last 3 months accrual but that the calculator would give the actual value. So…now I understand. I’ll use the Eyebond web page. Take care.

I created a repurposed and scaled-down version of my Savings Bond Calculator guide that you can read: https://tipswatch.com/2022/12/31/heres-a-step-by-step-guide-to-using-the-treasurys-savings-bond-calculator/

The key thing is you create your inventory in the calculator (using a web browers) then you SAVE the end result as an *.html file (Web page, HTML only) and store that on your computer. Then when you want to update it, you click on the file on your computer. It opens the list in a Web browser. Then click “return to Savings Bond Calculator,” where you can update your holdings. Then SAVE your list again as an html file.

Eyebonds.info is a very nice website. I like the way it calculates the average annual increase compounded semi-annually. This is something new for me. For an I-bond purchased in August 2001, this number is 5.55%. Not bad for a return that is federal tax deferred, state tax free, and risk free. The composite rate range in this case is 0% to a crazy 12.76%. As we know, it can never go below zero.

However, I will continue to update my I-bonds using the Treasury Direct Savings Bond Calculator every six months since that is what I always do and it is also accurate.

Another quirk of viewing I Bonds within your TreasuryDirect account is that it shows you only the composite rate in effect for each bond in the current month. The account does not show you the fixed rate component of each bond. This is important information to have, when you want to redeem some of your I Bonds.

Generally, it is preferable to redeem a bond that has a lower fixed rate, and hold onto a bond that has a higher fixed rate. However, due to the way that I Bonds earn interest (six months of composite interest, offset from the month of purchase), it can be misleading to assume that a bond with a lower composite rate has a lower fixed rate. On the contrary, depending on the month an I bond was purchased, a bond with a lower composite rate may actually have a higher fixed rate.

Very good point. Anyone looking to roll over a 0.0% fixed-rate I Bond for one with a higher fixed rate needs to be very careful in selecting the I Bond to redeem. It is not immediately obvious, as you note. If the I Bond is currently paying 9.62% or 6.48%, you can be sure that one has a 0.0% fixed rate (and you really don’t want to redeem those yet).

I don’t understand the investors who say they are going to redeem an I Bond and reinvest in a new I Bond or Treasury. Cannot one just keep the I Bond and use other funds to invest in a new I Bond or other instrument?

Rob, since I Bonds can’t be purchased in a tax-deferred account, investors have to raise taxable money to invest. After retirement, that can be more difficult, so rolling over an I Bond makes sense for some people.

Indeed. Further to that, when you redeem you get your principal and all the accrued interest, when you (re)invest you only invest the principal, so redeeming and reinvesting can also be a way of harvesting the interest at a time of your choosing (low tax year) while continuing to be invested in ibonds.

Wow — both great resources! Played with them this morning. Nice to see that they tracked to each other and showed the slightly increased value of the bond. Also liked to see how the rate changed over the years. The graphics were concise and the description for the line of code in the FAQ allowed me to create a simple tracker of my own. Thanks again !

Is there a way to know the value of ibonds as of December 2022? I wanted to file my child’s taxes to declare the ibond interest yearly so that way I didn’t have to pay all the taxes in the year the bond is redeemed and get credit for the kiddie tax thresholds. However there’s no 1099 available since the bonds haven’t been redeemed. Any ideas?

You can use Eyebonds.info to find the December 2022 amount. Just find the month you originally purchased the I Bond and examine the resulting chart.

I suggested to the Treasury that EE bonds should show not just the current yield but also a yield to maturity. YTM can be significantly larger due to the doubling at initial maturity.

I was informed that it was not only difficult, but very confusing. I just wrote a spread sheet to calculate. I didn’t think it was too difficult.

This is the Eyebonds worksheet I use, which shows accrued value and redemption values in one place, side by side, after you enter the date you purchased the I-Bond and the amount. https://eworkpaper.com/ibond.php Kudos to Mr. Hinkley for such an amazing resource, and to you for sharing it with your readers!

DL, that is a fantastic piece of work. TreasuryDirect needs to adopt that IMMEDIATELY.

Nice. After 5 years your “Accrued Value” = “Redemption Value”.

Parenthetically, that 3 month interest penalty when cashing out within the first five years is ridiculous. It isn’t really going to deter most people from cashing out because it is too small. It just complicates an already complicated process, and leads to a lot of confusion (I understand that is often the goal of bureaucracies). One can only buy $10,000 a year generally. So say the composite rate averages 6%, and you cash out in one year , so that after the penalty you get essentially 4.5%. Well $600-$450 is only a $150 penalty. Now if we could buy $100,000 annually, then it might mean something.