My back-to-work morning train WFH reads:

• The ‘Fidelity Mafia’ Behind Big Crypto: The mutual-fund powerhouse was a bitcoin pioneer and built a deep talent pipeline for the industry. (Wall Street Journal)

• Small Multifamily Homes Were Disappearing. Now States Are Scrambling to Revive Them: Construction of low-density housing like duplexes hovers near record lows, as states pass zoning reform to tackle the affordable housing crisis. (CityLab) see also Solar Boom Spreads to Timberlands and Self-Storage Rooftops: Last year’s climate bill sparked a solar bonanza for big property owners. (Wall Street Journal)

• The Manufacturing Boom’s Hidden Costs: The U.S. has embarked on its most aggressive industrial policy since the Cold War as it grapples with the twin threats of a rising China and climate change. The pivot has accelerated a manufacturing revival and spurred investment that will reshape key parts of the economy. But it comes at a cost, threatening to keep inflation higher as the nation makes more goods and imports less. (Barron’s)

• Here’s What a $5 Million Retirement Looks Like in America: Retirees open up about their financial lives and how they spend their time and money. (Wall Street Journal)

• First Ride: Damon Motors HyperSport. This 200-horsepower beast is Damon’s bid to bring safe, electric motorcycles to the masses. WIRED put the HyperSport to the test. (Wired)

• Consumers Are Spending Like It’s 2019 : Pandemic-driven binges recede as expenses mount and customers value experiences over goods. (Wall Street Journal)

• The curious ways your skin shapes your health: Weathered or unhealthy skin is emerging as a major risk factor for almost every single age-related disease, from Parkinson’s to type 2 diabetes. (BBC)

• Lockdowns and face masks ‘unequivocally’ cut spread of Covid, report finds: Royal Society review looks at non-pharmaceutical interventions when applied in packages of several measures. (The Guardian)

• What makes Vivek so annoying? An investigation. Section Guy Runs For President Harvard graduate Vivek Ramaswamy is a grimly recognizable figure to anyone else who went there, even if we never knew him personally. (Very Serious)

• One win, 17,000 defeats – life as a Washington General. In contrast to the universal adulation enjoyed by the Globetrotters, those wearing the Generals’ infamously unsuccessful green jerseys are booed, ridiculed, and dunked on during defeat, after defeat, after defeat. (BBC)

Be sure to check out our Masters in Business interview this weekend with Greg Davis, Chief Investment Officer of the Vanguard Group. Davis is responsible for the oversight of approximately $7 trillion managed by Vanguard fixed income, equity index, and quantitative equity groups. He also serves as a member of the Treasury Borrowing Advisory Committee of the US Treasury Department.

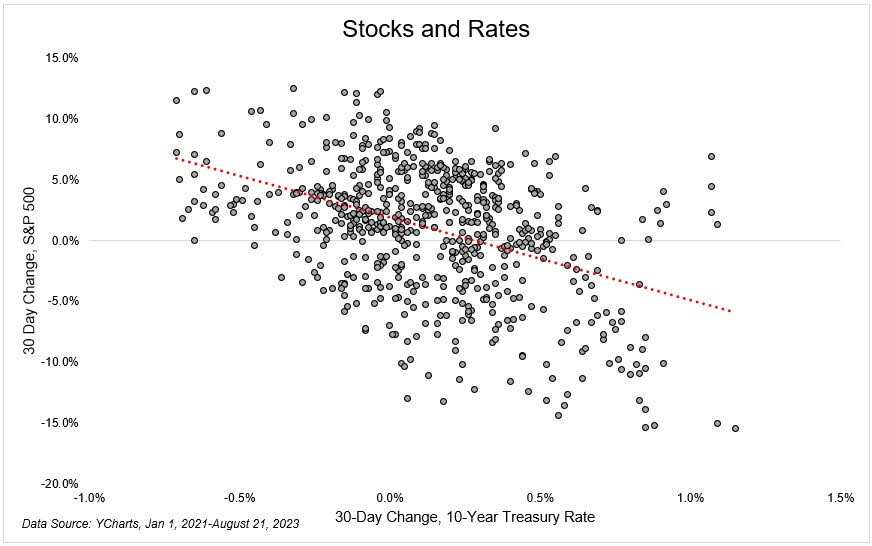

f the 10-year treasury rate was up, which it was 64% of the time, stocks fell 0.15% on average over the same time. If 10-year rates were down over a 30-day period, the S&P 500 gained 3.1% over the same time

Source: Irrelevant Investor

Sign up for our reads-only mailing list here.