By David Enna, Tipswatch.com

Back in early July, I wrote an article suggesting a strategy of staggering purchases of short-term Treasurys to boost your gains on cash holdings. I raised this idea because yields on Treasury bills (often called T-bills) were already higher and rising faster than yields you could find at a bank or money market fund.

Why stagger the purchases, laddering them a few weeks apart? This allows you to gain from rising interest rates, while also giving you easier access to your cash if you need it.

That strategy certainly has worked. Here are the typical cash-equivalent yields I listed in that article on July 4, compared to current returns after several months of Federal Reserve rate hikes:

- 1-year Treasury bills, yielding 2.79% then. Now: 4.03%

- 26-week Treasury bills, yielding 2.62% then. Now: 3.86%

- 1 year bank CDs, yielding 2% then. Now: 3.1%

- 13-week Treasury bills,yielding 1.73% then. Now: 3.35%

- 4-week Treasury bills, yielding 1.27% then. Now: 2.57%

- Vanguard Treasury Money Market, yielding 1.11% then. Now: 2.34%

- Online bank savings accounts, typically yielding 1% to 1.2%. Now: 1.9%

- 6-month bank CDs, yielding 1% then. Now: 2.5%

- Fidelity Treasury Money Market, yielding 0.98% then. Now: 1.86%

- 3-month bank CDs, about 0.35% then. Now: 1.5%.

As I noted in that July article — and it is still true today — the sweet spot in the T-bill yields seems to be in the 13-week and 26-week maturities. The 26-week is now just 10 basis points lower than the 2-year Treasury, which closed yesterday at 3.86%. The 13-week is desirable because the shorter term allows you to get access faster to future rate increases.

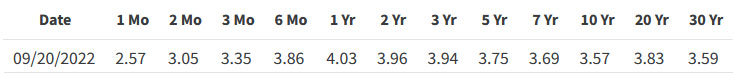

Here is the current nominal yield curve for all Treasury issues, based on the Treasury’s Yield Curve estimates, which are updated daily after the market’s close:

The short-end of the curve still looks the most attractive, but I would be highly tempted to dive into a 5-year Treasury note if the yield surpasses 4.0%, which definitely looks possible. Who knows what will happen to yields over the next 5 years? But it seems to make sense to lock in a rate that is historically attractive. The last time the 5-year yield exceeded 4% was October 2007, just before the Great Financial Crisis cut yields in half.

Obviously these short-term rates will be rising in the next week, in the aftermath of the Federal Reserve’s increase in its federal funds rate, to be announced today. The 4-week T-bill should be rising to around 3.25% if the Fed raises the rate 75 basis points. The 13-week and 26-week probably have already built some of the increase in, but still should move higher.

How to stagger your purchases

Here is the example I used in the July article, supposing that you are looking to put $60,000 in cash to work, using TreasuryDirect. New 13- and 26-week T-bills are auctioned every Monday. (This strategy would also work using a brokerage firm that allows auction purchases without any fees or commissions.):

13-week Treasurys. You could make three purchases of $20,000 each, four weeks apart. Then you can roll these purchases over on TreasuryDirect, meaning you will always have access to $20,000 within about 4 weeks. This strategy will quickly adapt to rising interest rates. Staggering 13-week Treasury bills is a good strategy for someone who might need the cash back in a short time.

26-week Treasurys. You could make three purchases of $20,000 each, eight weeks apart. Again you could roll these purchases over, riding interest rates higher, and always have access to $20,000 within eight weeks. Staggering 26-week Treasurys is a good strategy for someone who feels comfortable with a little longer delay in re-accessing the cash.

A combination. Put $30,000 in staggered 13-week Treasury bills, and $30,000 in staggered 26-week Treasury bills. You’d ride interest rates higher, get a slight yield boost for the 26-week term, and still have access to $10,000 within four weeks.

The July article lays out a step-by-step guide for using TreasuryDirect to make and schedule the purchases. I have used this technique, and it works well. I haven’t used a brokerage to make short-term Treasury purchases, so I can’t say how smooth that process is. But it should be fine.

When to quit this strategy?

I’d be OK with continuing these rollover investments if the Fed announces a “stall” on raising future interest rates (that could happen in 2023, certainly). But at that point, bank CDs might begin catching up with the Treasury rates — or could be offering attractive promo rates. During this time it might be wise to begin paring down the T-bill holdings and looking for longer-term issues.

If you believe the Fed is about to begin cutting interest rates (it will give signals) it will be time to unwind this strategy. In 2019, the 13-week T-bill rate fell from 2.47% on April 29 to 1.55% on Dec. 31. So, in normal circumstances, you will have time.

Video: Another viewpoint

Jennifer Lammer of Diamond NestEgg posted a video Sept. 26 on this same topic from a slightly different approach. As usual, it’s clear and well organized (and she mentioned my site!). Here is the video:

* * *

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. The investments he discusses can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

I don’t understand if you re-invest a 4 week bill don’t you make more yearly? Than a 13 week yearly?

It’s possible, but only when short-term rates are rising very quickly.

What about the 17 week bills?

There was a 17-week T-bill auction on Oct. 19, but I don’t see any others scheduled. I believe these are “cash management” offerings, and don’t know how they are scheduled.

Good morning David. Are there any advantages or disadvantages of buying Tbills in a brokerage account vs traditional IRA vs Roth? Thanks. New to all of this.

I buy them at TreasuryDirect, so for me that is a cash account and rollovers are automated. This is for money I will need in the next year or two, so I personally wouldn’t do them in an IRA, which I use for longer-term holdings. Some people have noted that Schwab (maybe others) will hold your rollover until the next weekly auction, meaning you lose a week of interest. That’s a negative. But otherwise, T-bills would work in all the possible accounts.

Re the issue with Schwab holding rollovers, I’ve been buying T-bills at Fidelity and electing not to have rollovers done automatically. But on the maturity date, the cash is available for reinvesting—in another T-bill or anything else—that same day, which seems ideal (a withdrawal, though, would have to wait a day). Vanguard, where I’ve also bought T-bills, is a day slower to make the money available for reinvesting.

David, thanks for this and other excellent posts on your blog. I have learned a lot about TIPS and treasuries as a result.

When you buy T-Bills at Treasury Direct and use auto roll, is it possible to turn or or off auto roll online if one chooses to?

Yes, you can cancel any reinvestment, I believe up to four days before the reinvestment auction.

Pingback: With Bond Funds Battered, Investors Might Want to Climb a Treasury Ladder

Wow, Thats sounds like a good price for your money. Im going to be stocking up on some 1 year bonds. Cant beat 4% anywhere. Ladder those bonds fellas.

Coincidentally, I have been putting relatively small amounts ($30,000 or so) into 3 month T-bills once a week for the last month. I buy at auction (every Monday) and settle on Thursday, using Schwab online. No problems. I would prefer the 6 month T-bills because the yield is quite a bit higher, but do not want to lock up my money for six months (although I could sell anytime but at a loss if rates keep rising). I do not use auto-rollover.

As soon as rates peak or start heading down, I will buy 5 year Treasury bonds. I am tempted to do so now since I can get 4% now, but I have learned to be patient. I am happy with 4%, but happier with 5%. The Fed seems to suggest their terminal rate will be around 4.5%, but that goes up with every Fed meeting the last six months. I watch the core CPI monthly change.

Schwab’s money market fund, SWVXX, pays 2.2% now, which is as much or more than almost any bank high yield savings account. So I am gradually moving money out of my bank accounts and into SWVXX. SWVXX is not FDIC insured so I only keep maybe $100,000 in it. (I know Vanguard has a federal money market fund that pays about the same, but I prefer to use Schwab, as I have had problems with Vanguard in the past). It only takes a day to move money from bank to brokerage using ACH. I told my banker if he does not raise his savings rate to 3 percent, I am moving my money out (as if he really cared). Banks have the annoying habit of raising rates relatively slowly when the Fed is raising rates, and lowering them relatively quickly when the Fed is lowering rates.

I was looking at Schwab:

US Treasury VAR Auction 09/28/2022 , maturity 1 year, 10 months, 9 days from today.

Schwabs pricing model estimates this well come out at 100.005887. Seems like taking a haircut right off the bat with FRN for the convince of not having to roll over and tying money up for a longer time? Any comments?

TD says “Issued for a term of two years, FRNs pay varying amounts of interest quarterly until maturity. Interest payments rise and fall based on discount rates in auctions of 13-week Treasury bills.” You will be subject to the usual bond price fluctuations when buying on the secondary market. If rates are going up you will lose a little money, if going down you will make a little money. I think tying up ones money in a 13 week T-bill is perhaps a better alternative (for me). Having said that, you can sell any bill or bond whenever you want, just realize you might make or lose money, so your money is never really “tied up”. I like to know exactly what I am getting, especially when rates are rising, so I hold 13 week T-bills to maturity. I buy at auction. Strategies can be different and some investors of course can have a different opinion.

Will buy at the auction too, 13 week but there is also some secondary listed with a few basis points better yield, same maturity. Im gonna buy both. Guess got to get auction order in tomorrow?

As for buying 13 week T-Bills at auction on Monday, you can wait until the day before, Sunday. You must have the order in by Monday before 10 am EST (I am pretty sure of this time, but call Schwab to check if you are going to wait until Monday). I always put the order in on Sunday as I am on the West Coast and don’t do anything before 7 am. This works with Schwab, I haven’t tried with other brokerages.

At Schwab, order entry cutoff on the day of the auction is 9:30 AM ET for US T-Bills and 10:30 AM ET for US T-Notes.

Fidelity 2 year T notes 4.20% (Auction)9/26/22, check it out.

I use to be hesitant to exceed the insurance limits overall. But it seems Schwab has a reinsurance going on for anything above the limits. So it seems safe. I m with you less accounts are better. Moved our of AMX High Yield savings back to Schwab.

This is really a good strategy to lock in at higher rates.

How about buying a 13 week, 26 week and 52 week treasury bills at auction and roll the shorter one into the 52 week one. Money will be available every 3 months. This can be repeat every month so to catch higher yields as the Fed raises rate – the terminal rate is projected to 4.5%. Go longer duration in order to lock in higher yield.

When the Fed tells you what they gonna go believe them! Stay short term 3 month, until inflation is under the Fed rate. We waited a long time for this, do not get inpatient! It will take Fed longer reduce rates then raise! Plenty of time to lock in higher rates! Dry powder will be reward!

The Treasury Floating Rate Notes adjust weekly.

Yes, based on the 13-week Treasury auction, which is every Monday. This makes an FRN an attractive investment while interest rates are rising, because it adjusts higher every week, faster than even a 4-week T-bill. But it is a 2-year commitment. If rates begin falling, the FRN yield will also fall.

Anything to watch out for if one is buying at the reopening rather then the reg auction? Or in the end its a non event!

This is what TD sez The U.S. Treasury began issuing Floating Rate Notes (FRNs) in January 2014. Issued for a term of two years, FRNs pay varying amounts of interest quarterly until maturity. Interest payments rise and fall based on discount rates in auctions of 13-week Treasury bills.

Yes and the treasury offers 13 week bills each week so the rate of the FRN would change every week with the latest rate.

Great article. Does T-Direct redeem right into your Savings account? Or can you can bills in T-Direct once they mature? The 6M Bill auction on 9/26 looks very interesting

Yes, generally TD redeems into the linked bank account. But you can opt to have the money held at TD in a non-interest-paying holding area.

If 4% is your trigger for the 5 year, secondary market non-callable CDs at Fidelity are being offered at 4.2% today (including the $1 markup per

$1,000). These are for buy-and-holders only. You’ll get crushed if you have to sell it prior to maturity.

How about just buying VGSH (Vanguard Short-Term Treasury ETF) as it keeps going down (yield goes up).

I own it. Its total return is -4.13% year to date. I can live with that. I consider it a core bond holding, but not as a cash holding.

When you own a fund such as that, if rates continue a slow, steady march upwards, wouldn’t it take quite a while to ever get your principal losses back?

Generally, lower price means you are earning more interest and you will eventually catch up when rates stabilize. But if rates continued to climb to eternity … not good.

I guess you could avoid that by purchasing TFLO the Floating Rate Treasury ETF.

What about 2 year FRNs? Is the spread attractive? Where can one check the spread?

You can check the spread on TreasuryDirect’s auction results page: https://www.treasurydirect.gov/instit/annceresult/press/press_secannpr.htm …. Look for FRN in the list below and click on the plus sign to see results from the latest auction. The most recent spread was 0.090%.

I’ve also been buying short term treasuries on the secondary market. The fees are folded so looking apples to apples, they seemed a little better-at least as shown on the Fidelity site. Have to factor in some of the yield is short term gain and some tax free interest but my purchases are not so large that it’s relevant.

Nobody needs another account or password for a few basis points to cause estate issues. That is why I try to consolidate everything at one broker. Now if we could get those IBONDs over, but will never happen.

Yes, I read on TreasuryDirect that if the last owner has greater than $100k in savings bonds, a court has to be involved to release the funds to the estate.

Yep TD always an estate nightmare. Oh well we have a small estate deal in Florida.

I just looked that up but not sure what it means. If you have electronic bonds or paper that’s been converted to electronic, you designate beneficiaries. If the total account is over 100K, does that mean the executor has to go to some court to cash in? Any further info would be helpful.

Yet more annoying things to deal with. The mattress is looking better and better. Thanks to all you smart people for furthering my education.

https://www.treasurydirect.gov/indiv/research/indepth/ebonds/res_e_bonds_eedeath.htm#court

yep! Oh well. Maybe they will upgrade their system some day. 100k us to be big money!

Well, that’s a good reason not to use TD to buy treasuries. No choice if you buy savings bonds. I buy treasuries online with Schwab. No problem, no commission, I buy at auction. Also TD does not allow you to sell treasuries.

Why buy short-term Treasurys, like 13-week and 26-week, on the secondary market, since these get a new auction every week? Are you seeing favorable yields in the secondary market?

It is my definition of short term-under 2 years. I am seeing 9 month paying 4%, 1 yr 4.11% treasuries-all state tax free. I know part of your point in the article is to ride the curve up but a ladder under 1.5 years feels pretty short term. With today’s increase interest rate increase I wished I’d waited a little longer to implement but something will be coming due soon enough.

“It is my definition of short term-under 2 years” At my age that is long term. General investment info is never age/goals appropriate adjusted. Do not be fooled where many invest 30yr term at 70 years of age but fail to tell you its for the kids.

I don’t do it, but that apparently is the only way to buy them at Merrill Edge. They don’t allow you to buy at auction.

I know Schwab makes it easy with a ladder tool but only has the secondary issues. They hide their auction page. Gonna put in an order for Monday buy some Tbills auction the 26th. I’ll compare to a similar maturity date.

I buy T-bills *at auction* via Schwab every Monday. Click Trade > Bonds > Treasury Auctions (link is right below the table). Buy any T-Bill that has been announced.

So you can answer the question, are the auction better prices then the secondary market?

I buy 26-week a few times a year and often find the off-the-run issues to have better yields. So last time I bought a 5-month rather than 6. Throws things off if you have to have clockwork regularity, but it has become a hobby to eke out an extra 10-15 basis points so I don’t mind.

The big key is you have to have an opinion on the Fed hikes. If one thinks the Fed has just started, stay short term like a 3 month ladder, with mmarket maybe the first rung. I m using the mm since you cannot get the maturities exactly near the rate hike dates. When the Fed does not raise, Ill think longer term is my plan. Using broker tbill/cds makes this a piece of cake! I have waited 4 yrs for this to happen! Lock in good rates for cash and the market rallys back, priceless!

That’s my thinking too! I’m in my early 60s with family longevity.

I plan to lock in a more secure retirement and income stream with long term treasuries, when it appears interest rates are about to reverse course.

I pulled out of bond funds over a year ago, and have been sitting in cash waiting for rising yields. I’m considering half of my “bond” money ((now in cash and 3-6 month treasuries) to pour into 20 year treasuries in different denominations should I need to sell prior to maturity, and the other half, a ladder between 2-10 years rungs.

Has anyone done this sort of thing years back when yields were high, and later sold prior to maturity? Did you make money? Lose?

I am researching my risks.

Based on current conditions, it appears sometime in 2023 will be the time to lock in long term rates.

Here is a link to a chart of the 20-year Treasury yields going back to 1993: https://tipswatch.files.wordpress.com/2022/09/t20.jpg

So where is the optimum rate in this chart, and where do you start to buy in? I have no idea. But it does appear that 5% was a stable point through much of the 2003 to 2007 era, and that could be what you are looking for. But you may never see it. The current 20-year is sitting at 3.73%. It will probably go higher, but at the high point of the last Fed tightening cycle it only reached 3.3%, lower than where it is today.

“Ladder” is often used casually to mean a bunch of bonds with sequential maturities. In the retirement decumulation world, however, it has the specific connotation of matching bonds to future liabilities. In this latter sense, one would not sell bonds prior to maturity. They are allowed to mature at the time they are needed for the intended liability.

I have rarely traded individual bonds. All situations had to do with the credit side, not interest rates. For example, the cruise line junk bonds bought after 9/11 and the BP bonds in the wake of Deepwater Horizon were sold at a profit when those situations returned to normal. On the other hand, a loss was taken at tax-loss harvesting time on a muni bond which had defaulted.

I’m interested in the idea of creating your own total return bond fund since it may have less expenses than a marketed fund. But the performance will then be determined by the manager’s ability to forecast economic conditions.

There may be some academic literature available on the efficacy of forecasting in general and interest rates in particular if you care to search for it.

I think I would look at the track record of similar funds that do what you mentioned and see how the pros did with probably a team!

I bought a Fixed Income Annunity with income rider about 60 yrs old. Will pay me 7% plus inflation for life. 30% of my bond money at the time. The less money I have to manage the better, specially when the brain turns to mush! My long term trigger is when inflation is below the interest rate.

FYI, earlier this morning (9/21) I was looking over the 1-year CDs offered on Fidelity’s brokerage platform. There were several offering 4.0% yield, and they were call-protected. A day or two ago when I looked, there was only one CD (from J. P. Morgan) with at 4.0% interest rate, and that was NOT call-protected. So that picture changed quickly, and it certainly does seem that those rates will bump up a bit more very soon.

Im sure the brokers have figured out a way not to lose money on these. Maybe they are betting on the maturity net and not take a hair cut on the principle. So they take those off the market. Im only guessing!

If you buy at an auction through a brokerage, it’s a simple pass-through. The broker doesn’t make any money, BUT … the broker would prefer for that asset to remain in their realm. When it matures, you will probably reinvest it elsewhere inside of Fidelity, Schwab or Vanguard.

“The Firm and the broker-dealer arranging for the CD to be offered will receive a placement fee from the Issuer in connection with your purchase of a CD.”

From Fidelity’s 12-page CD Disclosures document. Just a clarification that the broker does make money on the new issues. The issuing bank pays them for access to their large pool of investors instead of waiting for individual depositors to walk through the bank doors.

I’ve never done it but Fidelity has an option to roll over the treasury or CD for the same maturity when it matures. HAve to call to cancil autoroll and so never did it.

Schwab has an easy way to cancel online, its looks like a reinvest dividend option. Have to leave it on one time to see how it does. No lasting damage can be done if you are really short term.

Note that if you use auto-rollover at Schwab, your funds sit *UNinvested* for a week between each rollover (repurchase). (That is not the case at Fidelity where the *same day* that a T-bill matures, the next T-bill is purchased.)

Discussion:

https://www.bogleheads.org/forum/viewtopic.php?p=6859184#p6859184

Good info for those starting out, but changing brokerage for a few pennies is pound foolish for me. I once closed an account at Fidelity 35 yrs ago, had one stock that went worthless, but they still send me statements cuz they could not price the stock . Could never get them to stop or really close the account. Ever 10 yrs I try to get it closed!

The point is not to change brokers, but rather, to not use auto-invest. *Manually* reinvest at each rollover point to remain fully invested. With Schwab, as long as the settlement dates are the same (the maturity date of the old t-bill and settlement date of the newly purchased t-bill), no cash is needed to fund the purchase and you remain fully invested.

I cannot believe you actually lose any interest. That is not good business. Just it takes a bit to post for clearing. You bought it at the actual auction, since that was your order, discount price and matures at par. So the interest you receive is the same, no matter when it showed up in your account. The auction price is the auction price.

Not true, Don. Read the Bogleheads discussion, linked above. It has been confirmed that you are uninvested and lose a week of interest with every auto-rollover through Schwab.

Read it, nobody actually mentions price and compared to auction! Think its just bookkeeping. Even if true a few basis points one might lose just is not noticeable unless you are rolling a couple mil! I do not believe everything on the web. But txs for the headsup!

This is also on B!

“At Schwab, the T-bill matured on 9/13/22, sat for a few days, and was reinvested in the T-bill that auctioned on 9/15/22 with a settlement date of 9/20/22.

At Treasury Direct, the T-bill matured on 9/13/22 and was reinvested in the T-bill that settled that same day, resulting in zero days out of the market.”

Looks like Schwab does exactly what you would do if you were manually rolling from auction to auction, so no misrepresentation! There are always a few days between maturity and new auction.

These other guys roll are doing something different!

Seems like on manually rolling at Schwab auction to auction accomplishes nothing better then their autoroll!

At the risk of beating a dead horse (too late!), in your example, Schwab’s auto-roll doesn’t reinvest a T-Bill that matures on 9/13 until 9/20 – leaving a full week, uninvested – which is exactly what happens.

When you manually reinvest, you schedule your reinvestment to occur on the same day as maturity.

You purchase at the last auction price with the same maturity, it makes no difference when it is posted. Schwab has no control over when the auction happens or when the maturity of the security happens! These other brokers are doing something with your money between maturity and the next auction. Good for them. Schwab is do what it says nothing more or less.

Actually, you shouldn’t need to call. On the Fidelity order page for both CDs and T-bills there’s an area where you answer Yes/No to the Auto Roll question. I have always selected No since I’m not sure I’ll want to reinvest at maturity. Note: I use the Fidelity website to order. The Fidelity app, so far as I can see, does not have that same Yes/No area.

Your are quite correct. What I meant to say is that if you elect to autoroll, you have to call to stop it. They say they might automate this but not so far.

BTW, you can cancel the Auto Roll option under the “Activity and Orders” tab on Fidelity.com without having to call in.

First you will get an email on the morning before the auction saying Fidelity has placed a pending order on your behalf. Then:

Go to the “Activity and Orders” tab

Then the “Orders” sub-tab

Next, you will see an “Open” order for the next T-Bill

Just click the “Cancel” button to stop the order and thus the Auto Roll

For example, I got an email from them this morning (Wednesday) at 8AM saying they have placed an order for an Auto Rolled 4 Week T-Bill for tomorrow’s (Thursday) auction.

My order shows “Buy XXX of 912796YF0 at Market (Good ’til Canceled)” where XXX is the amount to be purchased. I took my purchase value out for privacy and security reasons but you should get the picture.

Hope this helps.

Bob S.

Any opinion on Treasury Bill ETFs that are less than a year? For example SGOV? You can reinvest the dividends so that might be a plus.

It’s a good fund, with an expense ratio of 0.12% and a current yield of 2.24%, so it is time-lagging the 4-week Treasury. The Vanguard Treasury Money Market is a similar option.

Love this article. I literally just did this yesterday & am putting the finishing touches on that video. It’ll be coming out this weekend hopefully – will link your article to it as some of our community would be interested in the 26-week strategy.

Looking forward to that!