Non-seasonally adjusted inflation rose 0.8%, giving a boost to investors in TIPS and I Bonds.

By David Enna, Tipswatch.com

The January inflation report, just released by the Bureau of Labor Statistics, showed a return to higher-than-expected U.S. price increases, after several months of mild inflation.

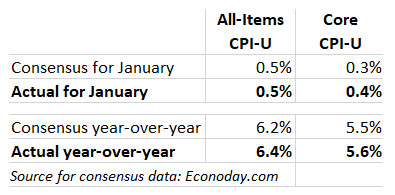

The Consumer Price Index for All Urban Consumers rose 0.5% in January on a seasonally adjusted basis, the BLS said. Over the last 12 months, the all-items index increased 6.4%. January’s monthly number equaled economist expectations, but the year-over-year rate was above expectations of 6.2%. Core inflation, which removes food and energy, increased 0.4% for the month and 5.6% for the year. Both of those numbers were higher than expectations.

Looking for a positive spin? The all-items annual increase of 6.4% was the smallest 12-month increase since the period ending October 2021, the BLS said.

Both all-items and core inflation were heavily influenced by the cost of shelter, which accounted for nearly half of the all-items increase in January. Shelter costs were up 0.7% for the month and 7.9% year-over-year. Shelter costs tend to be controversial, at least to CNBC talking heads, because they are considered a lagging indicator. More from the report:

- Costs for food at home increased 0.4% in January and were up 11.3% year over year. The index for eggs rose 8.5% for the month. In contrast, the fruits and vegetables index fell 0.5%.

- Gasoline prices increased 2.4% for the month after falling 9.3% over the previous two months. Gas prices are now up just 1.5% year-over-year.

- Costs for utility gas service increased 6.7% for the month and are up 26.7% for the year.

- The medical care services index fell 0.7% in January, to an annual rate of 3.0%.

- Costs for used cars and trucks fell 1.9% for the month, the 7th straight month of decreases. These costs are now down 11.6% from the elevated level of 2022.

- Costs for new vehicles rose 0.2% for the month and are up 5.8% for the year.

The January report incorporates reweightings of the sector indexes to reflect consumer survey information from 2021. For more on this, see the BLS fact sheets. Based on BLS estimates, this reweighting could have slightly increased the all-items number versus the old weightings, since costs of shelter got a higher weighting and used vehicles got a lower weighting.

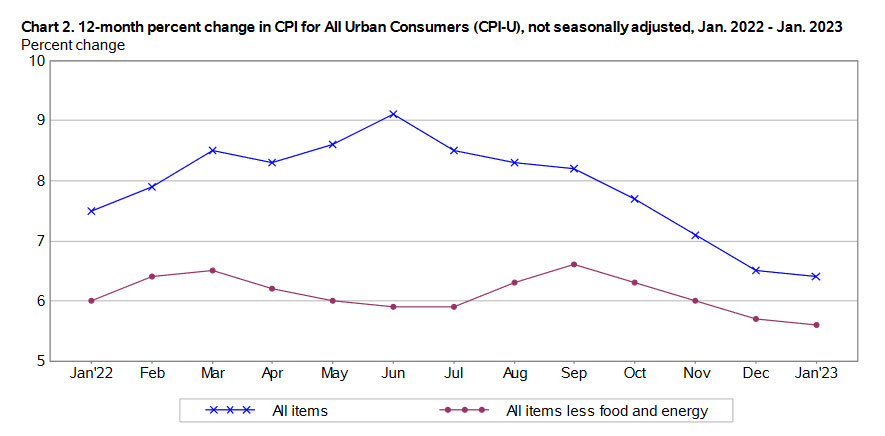

Here is the one-year trend for annual all-items and core inflation, showing how the two rates are aligning as shelter prices rise and gasoline prices moderate. Both all-items and core inflation, while remaining high, have been trending lower since September:

What this means for TIPS and I Bonds

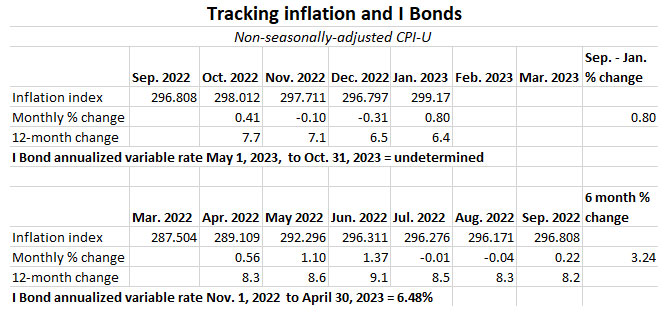

Investors in Treasury Inflation-Protected Securities and U.S. Series I Savings Bonds are also interested in non-seasonally adjusted inflation, which is used to adjust principal balances on TIPS and set future interest rates for I Bonds. For January, the BLS set the CPI index at 299.170, an increase of 0.80% over the December number.

For TIPS. The January inflation report means that principal balances for all TIPS will increase 0.8% in March, after falling 0.1% in January and 0.31% in February. As I noted in a recent article, non-seasonal inflation tends to track lower in the last six months of the year and higher in the first six months. Here are the new March Inflation Indexes for all TIPS.

For I Bonds. January’s inflation report is the fourth in a six-month string that will determine the I Bond’s new variable rate, which will be reset on May 1 based on inflation from October 2022 to March 2023. For the first three months of that period, inflation ran at 0.0%, but January’s number boosts the total to 0.8%. That would translate to a variable rate of 1.6%, down from the current 6.48%. But two months remain, and those months are likely to record positive inflation.

I had been saying I thought the May variable rate reset would be at least 2%,but now it looks like it could be a bit higher, possibly above 3%. Of course, with inflation, nothing is certain.

Here are the data I am tracking, so far:

What this means for future interest rates

Because January inflation came in higher than already-elevated expectations, I’d say there is nothing here that would change the Federal Reserve’s stated course toward at least one more (and probably two) 25-basis-point increases in its federal funds rate.

In pre-market trading, stocks across the board are down this morning, but the NASDAQ is taking the bigger hit because of its interest rate sensitivity. Bloomberg’s headline this morning is: “US Inflation Stays Elevated, Adding Pressure for More Fed Hikes.” From the article:

“It could’ve been worse,” said Stephen Stanley, chief US economist at Santander US Capital Markets LLC, noting declines in used-car prices and airfares. However, “as long as shelter costs are going up as rapidly as they have been, it’s going to be tough to get inflation down anywhere close to where the Fed would like to see it.”

The figures, when paired with January’s blowout jobs report and signs of enduring consumer resilience, underscore the durability of the economy — and price pressures — despite aggressive Fed policy.

Richmond Fed President Thomas Barkin was just interviewed on Bloomberg TV, giving his thoughts on the January inflation report. “I just think there is going to be a lot more inertia, a lot more persistence to inflation than maybe we all want,” he said. Watch the interview:

• I Bonds: A not-so-simple buying guide for 2023

• Confused by I Bonds? Read my Q&A on I Bonds

• Let’s ‘try’ to clarify how an I Bond’s interest is calculated

• Inflation and I Bonds: Track the variable rate changes

• I Bond Manifesto: How this investment can work as an emergency fund

• Confused by TIPS? Read my Q&A on TIPS

• TIPS in depth: Understand the language

• TIPS on the secondary market: Things to consider

• Upcoming schedule of TIPS auctions

* * *

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear.Please stay on topic and avoid political tirades.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. I Bonds and TIPS are not “get rich” investments; they are best used for capital preservation and inflation protection. They can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

Hi, thank you for writing this blog, it is very instructive. Now, since you follow inflation trends for such a long time, do you have an opinion on the inflation outlook for the next 12 to 18 months?

I do foresee inflation drifting into the 4% range by the end of this year. But I know that no one can predict inflation out more that a month or two.

Unexpected inflation is why one might buy TIPS. Probably nobody including the Fed has a great inflation model. We are all data dependent.

I think predicting inflations directions is not fruitful. Buying TIPS at decent historical real rates is my bet.

I am unsure how to manage a current TIPS holding expiring soon in April 2023. At age 75 I’d like to maybe extend this TIPS batch out to about 5 years and the current rate at 1.5% looks attractive. Well up from the start of the month.

But I’m unclear how the sale now would work out versus waiting until my April 15 TIPS mature. Of course, no way of knowing what the 5yr TIPS would be at on April 15. The current bid shows 100.156 and yield to worst of -0.371. Any thoughts on how to view this? Do I loose out by selling about 2 months early?

I also own the TIPS maturing on April 15, in a taxable account. I plan on letting it mature and then use the proceeds to buy I Bonds, but I will probably also be buying the new 5-year TIPS to be auctioned on April 20. Why not just let the TIPS mature on April 15 and then buy the new TIPS a few days later?

I could let the April 15 TIPS mature, but might miss a fairly high 5yr TIPS at 1.5%. Of course, the 5yr TIPS might be even better 2 months from now.

If I pull the trigger now I can lock in a decent rate for 5 years. But I don’t know how to calculate what I miss by not holding to April 15. Hence the question.

Les, let’s assume you have $10,000 par in this TIPS, which has a coupon rate of 0.625%.

1) You let it mature April 15. You will get $10,000 x inflation index plus one more coupon payment. The latest inflation index so far is for March 31 which is 1.20412. As of that date your accrued principal is $12,041 (with 15 days remaining) and your last coupon payment would be around $37. So you get $12,078 (and probably a bit more).

2) You sell it now. The inflation index is 1.196, so you have $11,960 in accrued principal. The bid price is around 100.22 so you would get about $11,986 today, plus a bit of accrued interest. All of this depends on the bid/ask swing and current pricing.

So there is the difference, roughly: $12,078 if you wait and $11,986 if you sell now. Remember, this TIPS is about to get a 0.8% inflation accrual in March and that’s pretty much the difference.

OK, thanks for that analysis. I see that if I am willing to throw the dice on the TIPS rates on April 15 then I should stick it out until maturity. Hmmm…. 🙂

BTW, I have a logon to WordPress but seem to still have to put in the email and name details on each reply. Is there a logon for this sight on another way to do it?

Thanks again for your help.

You can try going to WordPress.com and logging in before you comment. That might work. Even I get stuck in this trap on my own site, at times.

Not directly related to the subject of the article, but, thank you, David the writer, for remembering (as in “Here are the data . . .”) that the word “data” is plural. I am in your camp. These days it’s probably a losing battle to against “the data is” or “the mass media is” (usages which can be seen almost any day in assorted journalism outlets), but I appreciate a kindred spirit.

The word data IS plural. So … data ARE plural. I worked as a copy editor for a few years, a skill I have just about totally lost. But some things stick. Want to weigh in on the Oxford comma? (I am in camp “yes.”)

“Data is” vs. “data are” are useful to distinguish the uneducated from the educated.

Thank you for doing this blog David, its very informative and educational!

I feel inflation is going to remain higher than many people believe, because I believe Q1 (Feb/March left) is the time frame normally when companies hand out annual pay increases and yearly bonuses. This is why companies have higher expenses in Q1 too.

Maybe this is somewhat baked into the predictions, but I would think we can expect consumer spending to continue to increase.

Companies also will raise prices in goods/services to cover these costs of extra wage expenses.

I think this would be somewhat positive for Ibonds/Tips, but of course nobody wins with higher inflation.

Core CPI monthly change came in at .41 percent. The Fed won’t like that, especially with strong job growth. The Fed has to be much more aggressive for much longer to get CPI down to 2 percent. For I-bonds, as David says, the .80 percent monthly change in the non-seasonally adjusted CPI is all that matters.

Hi David, thanks for your prompt and timely post. The exchnage above is also helpful. What are your, or anyone else, thoughts on May fixed rate for I bonds. Is it expected to be higher or lower than 0.4%?…thanks!!

It’s impossible to say, but right now I would predict something around 0.4%, not lower but not hugely higher. I haven’t given this much thought yet.

I bought the allocated half in January. The other half is in short term T-Bills maturing in mid April. I plan to decide in late April whether to buy the remaining in April or May and that decision will be purely based on expected May fixed rate

Ditto.

David, would you remind us again what you will be looking at in late April to make an educated guess about the new fixed rate that will be set in May?

There is no “magic formula” so everything I say is actually a guess. I watch the 10-year real yield, which right now is sitting at 1.46%. The I Bond’s fixed rate is usually 40 to 75 basis points below that 10-year yield, so that could indicate a new fixed rate of around 0.7% to 1.0%, up from the current 0.4%. But back on November 1 the 10-year real yield was higher (1.58%) than it is now and the Treasury went with 0.4%, possibly because the surge in real yields was only a few months old. Now real yields have sustained at a higher level, so I think fixed rate above 0.4% is easily justified. But things can change, and the Treasury doesn’t listen to me.

With you magic cap on….is there any chance the fixed rate in May could drop below the current .4%? What would need to happen with the current economic environment for it to be lowered? If you had to guess do you think it will at least remain .4% if not higher?

Why the mystery around the Treasury and fixed rate? Could it be there is no formula at all? Nothing would surprise me.

Thanks!

There is no known formula and it is set by the decision of the Treasury. Everything I say, or anyone else says, is a guess. So: right now I’d say it won’t fall below 0.4%.

Thanks David. In my opinion, anything higher than the current 0.4% fixed rate makes it worthwhile to wait until May. (In the long run, the fixed rate is much more important that the 6-month variable rates because the fixed rate persists for the life of the bond.)

Thanks David & Anurav for your take. Unlike previous years, this year I bought half of our I Bonds for myself in January and decided to wait to buy the rest for my wife in late April. I guess once we get to late April, we will know more. In the meantime, not just T-Bills but, the shortend of, the T-Notes are also getting more interesting. Adding duration/maturity is worth considering because these yields are not going to last for long. If the March employment report or the next months CPI come higher and lower, respectively, yields will fall fast. In Today’s WSJ Opinion, based on quantity theory of money (M2), by two Johns Hopkin University believe that Fedral Reserve will push the economy into a recession with their current resolve. The WSJ editorial board does not agree with their opinion and thinks that it will be premature to signal a pause. Time will tell how it plays out.

David, I did a little number crunching and assuming the May variable rate is 3%, the May fixed rate would have to be 0.8% for a May purchase to break even with an April purchase after five years (May 2028).

Hah, great minds think alike. I posted the same thing you did but as a suggestion for David to do after the April 12 CPI report. Our posts crossed.

A five year break even is worse than the 4 year break from the 9.62% with 0% Fixed rate vs. the current 6.89% with a 0.4% Fixed rate, if I remember correctly.

My conclusion: Buy in April AND buy in May through spousal gifting if you can, and redeem any past I Bonds with a 0% Fixed rate after 5 years or beforehand if rates tumble.

Marc, I chose five years because that’s when the 3-month interest penalties end.

Gotcha. You started with a five year timeframe and worked backwards to the rates, compounding the interest every six months, and eliminating the penalty. Thanks for taking the time to do that. Would you be willing to post the spreadsheet so we could all do some hypotheticals?

David is correct about the May variable rate, which will be known after the CPI numbers come out in early April. It should dictate purchasing decisions in late April. If the May variable rate is low, say 3%, then the fixed rate (which we can only guesstimate in late April based on the 10-year real yield) must be high, at least 0.7%. If the May variable rate is higher than that then the fixed rate can be lower. In any case it will be a crap shoot.

Hoya, one thing to consider is that on a $10,000 investment, a boost of 0.1% in the fixed rate only amounts to $10 a year. So if the variable rate is going to fall greatly in May, then buying in April might still make sense because of the higher variable rate for six months.

Perhaps we can coax David into running a projection of the two options after the April 12th CPI Report to determine what the break even point would be if the May 1 Fixed rate comes in at different levels.

Marc, I posted instructions for creating a spreadsheet in another thread. Unfortunately, it did not include fixed rates so I modified it for myself after November, which included the 0.4% fixed rate. I can’t post spreadsheets here but I can create one that I can e-mail to David so he can post it.

One legitimate option (but we still need to wait to see the upcoming variable rate) would be to go ahead and buy to the limit in April, ensuring the 6.89% rate for six months. Then, if the fixed rate rises to a much higher level in May, use the “gift box” strategy (if you have dual accounts for spouses) to buy $10,000 more in May for each spouse. I’m not a huge fan of the gift box, but in this case I would probably use it.

Fos the last 10+ years, I have been buying the max for my wife and me without much consideration to the fixed rate because it has been mostly zero and also it’s about the inflation/variable rate that matters the most. However, I am learning a lot about the inflation products such as TIPS, I Bonds, etc. from David’s blog. Ignorance was a bliss for me and I was happy and satisfied. Suddenly, I even care for .1% more in the fixed rate without calculating its added value. Now it’s about winning, so, in a convoluted way, it’s David’s fault for making me smarter. Well, no good deed should go without some criticism 🙂

It is really hard not to pull the triger, and be done with, in buying this year’s I Bonds for my wife. However, I am going to wait, really?, until April for potentially the most precious, plus or minus, $10 from the fixed rate. Everyone’s participation is helping learn new things and most appreciated.

Do what I and others here doing. Buy half now (at the current variable rate plus the current fixed rate) and wait until April to buy the rest, so you can decide then whether to buy in April (at the current variable and fixed rates) or wait until May (at a lower variable but possibly higher fixed rate.)

Are we having fun yet?

I bought my I bonds in January, representing the first half, the second half (for my better half) needs buying. Hence my posts.

Understood. I bought half of mine and half of my better half’s in January, and will buy the other half for both of us in late April or May, based on the May variable rate and my guesstimate of the May fixed rate, which will be based on the 10-year TIPS real rate at the time, per David’s perspicacious and oracular insight into the inner mind of the otherwise unfathomable Treasury Department.

Inflation rose 0.5% in January but the CPI-U rose 0.8%. Is it historically the case that the CPI-U exceeds the CPI, and if so, does that mean I Bonds exceed overall inflation even if the fixed rate is 0%?

Although we can’t predict the future, it’s fun to try. Feel free to check my math:

– If we extrapolate the next two months at the same 0.8%, that would put the May 1 annualized inflation rate for I Bonds at 4.8% (2.4%x2). That probably the high end of the range.

– If it’s half that at 0.4% each, it would be 3.2% (1.6%x2).

– if it’s one quarter of that, it would be 2.4% (1.2%x2).

Using the middle of those three scenarios, the one year annualized rate for buying an I Bond before May 1 would be 5.045% ((6.89%+3.2%)/2).

The most recent 52-week T-Bill came in at around 4.7% but could inch up from here by April so the two investments could end up being quite comparable this time around.

CPI and CPI-U are the same thing. The “headline” CPI-U you see reported is the seasonally adjusted index. But non-seasonal numbers are used to adjust TIPS balances and set I Bond interest rates. It’s all the same CPI. Seasonal and non-seasonal balance out after one year. So, no I Bond’s won’t outperform inflation if the fixed rate is 0.0%. After a year, it’s all equal.

Sure, the next two months could come in at 0.8% for non-seasonal, but I’d guess a number around 0.4% or 0.5% is more likely. Last year, non-seasonal inflation increased strongly in February (up 0.91%) and March (up 1.34%) so it’s likely the annual number is going to start slipping lower. Your math on the possibility of a 5.04% annualized return looks good, but if you subtract a 3-month interest penalty it drops down to about 4.3%. So for a short-termer, the T-bill looks like a better bet.

For IBonds, let’s say the May variable rate resets to 3%. This would be meaningfully below Treasury rates of 4-5% across the yield curve. What would be some reasons to stay with the IBonds versus selling them and buying Treasuries instead?

If you are looking at an I Bond as a short-term investment, you probably should look elsewhere, because of the 3-month interest penalty for a redemption within 5 years. But I Bonds as a long-term investment still make sense because with a fixed rate of 0.4% they will always out-perform inflation by 0.4%. After 5 years they become an inflation-protected savings account. Remember, those Treasury rates could fall dramatically in the next Fed easing cycle.

But if you had to choose between I-bonds and TIPs, you would pick the latter?

I’m still buying both this year. But for people who can handle the complexity, TIPS are a better investment on yield alone.

During your recent humble interview with Barrons you mentioned buying in the year 2000 – which translates to a recent six month combined rate of ~13%. You have accumulated a pile of inflation-increase protection.

Ten year Note/20-30 year Bond all with current yields near ~4%. At what yield percentage would you buy the 20 year Treasury bond, for example, in case of dramatic interest rate fall. And, thank you for your excellent work.

I did buy those I Bonds in 2000 and they are currently yielding 13.18%. But I didn’t buy up to the limit. I have a another set yielding 12.76% right now. After October 2001, I lost interest in I Bonds and didn’t begin purchasing again until 2011. …. On the nominal Treasurys, if I see 5% yield on anything between 5 and 15 years, maybe even 20, I would be a buyer.

I have been weighing the chances of being able to purchase a 5 or 7 year treasury even at 4.6%. I have looked at the effect of deferred taxes and compounding when comparing ibond or EE bond vs treasuries and on the 5 to 7 year time horizon I think locking in 4.6% may be a safer bet than believing that there will be sufficient consistent inflation for the ibond to beat, and I am also uncertain that the EE will get high enough to beat. When I read your sentence it makes me think that you feel treasuries are going to achieve a 5% soon. Please let us hear your thoughts.

Thank you Mr. Enna and congratulations for resuming in 2011.

I “lost interest” too. But actual interest. That NEGATIVE 2.78% variable inflation rate set May 1, 2009 wiped out all of the fixed rates since November 1, 2001. As you know, that meant a total composite return of 0.00% for six months (but at least it stopped at zero).

The I Bonds that I bought in 2006 will probably be doubling in value in a year or two therefore outperforming the 20 year EE Bond. I am not dissatisfied with these purchases.

Alan, we had annualized deflation of 2.78% for six months, and you earned 0.0%, so you out-performed inflation by 2.78%. The next variable rate was 3.06%. But nominals are definitely superior investments at times of deep deflation.

DC, I don’t know if we will see 5% yields in the range of 10 to 20 years. Seems like this should have happened already in the 5 year, but yields are now lower than they were in the fall. But in my case I would still mix nominal and inflation-protected investments.

While gas prices are a major component of the CPI, very little attention seems to be paid to auto insurance premiums, which rose significantly in the last 12 months. My personal annual gas costs are now less than my premiums, which carry a good driver discount and a reduction for multiple policies with the same carrier. Have other readers had that experience?

Costs for motor vehicle insurance increased 1.4% in January and are up 14.7% for the year. Yes, that is a hefty increase.

Insurance in general. My home owners insurance went up about 30%, ouch!

Working with my agent on reducing limits and increasing deductible. Loose, loose for me.

Isn’t that one of the age old critiques of the CPI? That unavoidable, yet essential expenses such as insurance, utilities, taxes, personal services, tuition, expenses that tend to exceed inflation are excluded from the CPI?

It’s true that taxes aren’t tracked, but insurance costs are, so are utilities, tuition and most personal services. See this: https://www.bls.gov/news.release/cpi.t02.htm