Historical evidence clearly shows non-seasonal inflation lags from October to December, picks up from January to March.

By David Enna, Tipswatch.com

The one really big thing I have learned while writing about inflation and inflation protection over the last 12 years is this: You can’t assume anything about inflation. Years ago, I was perfectly willing to make predictions. Now, after getting spanked by inflation again and again, I just say: “Let’s wait and see.”

Take last year for example: When the June 2022 inflation report was released, the third in the six-month string for setting the I Bond’s variable rate, inflation was running at 3.03%. In just three months! That seemed to indicate — if this trend continued — the new variable rate could rise to 12% at the November reset. Several news reports touted 10% to 12% figures. I cringed.

The trend didn’t continue, and we hit three months of low inflation from July to September, resulting in a perfectly reasonable variable rate of 6.48%.

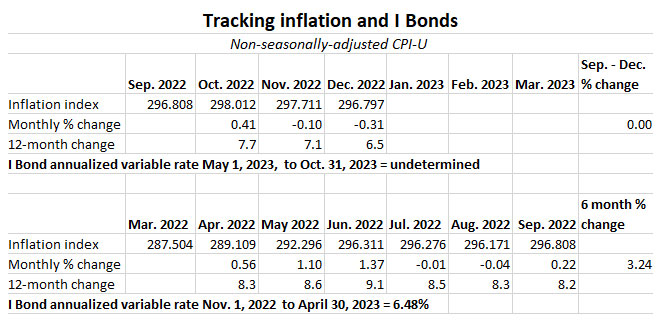

Now we are three months into a new six-month span that will reset the I Bond’s variable rate on May 1. The trend of seemingly low inflation is continuing and right now we are looking at a variable rate of 0.0%. Could that happen? Yes. Will it happen? Let’s wait and see.

Today, I decided to look at the last 10 years of October to March rate-setting periods for I Bonds, focusing on the ones where inflation started off slowly. And then ask: What was end result after the full six months? Let’s take a look.

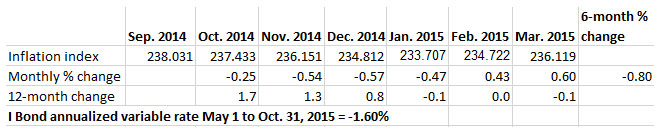

2020

From October to December 2020, non-seasonally adjusted inflation ran at just 0.07%, indicating a “trend” toward a variable rate of 0.28%. But then inflation picked up from January to March 2021, and the resulting variable rate was quite a bit higher: 3.54%, annualized.

We saw a similar pattern in the April to September 2020 period, when inflation ran at -0.12% in the first three months, projecting a trend toward a variable rate of -0.48%. But then inflation popped higher, and the annualized variable rate ended up at 1.68%.

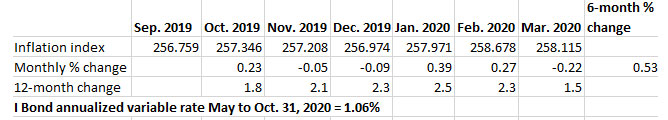

2019

From October to December 2019, inflation ran at 0.08%, projecting a trend toward an annualized variable rate of 0.32%. Inflation picked up (a bit) from January to March 2020, resulting in a variable rate of 1.06%.

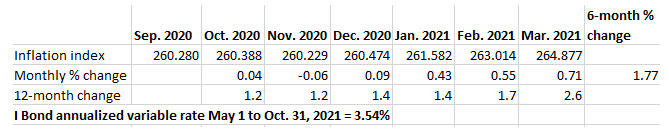

2018

From October to December 2018, non-seasonally adjusted inflation ran at -0.48%, projecting a trend toward an annualized variable rate of -1.92%. At the time, I wrote this:

This is a fairly disastrous trend for holders of I Bonds, because even though an I Bond’s composite interest rate can’t go below zero, a negative variable rate will wipe out a matching amount of the I Bond’s fixed rate. … Still, this negative trend could reverse, at least partially, in the next three inflation reports.

And yes, the trend did reverse, with the annualized variable rate ending up at 1.4%.

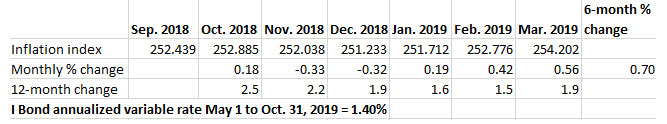

2017

From October to December 2017, inflation ran at -0.12%, projecting the potential for a new variable rate of -0.48%. But then inflation rebounded in January to March 2018, resulting in a variable rate of 2.22%.

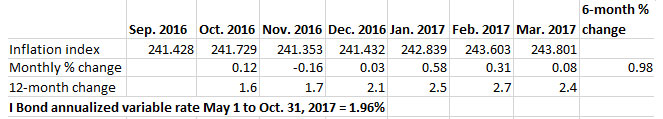

2016

Inflation from October to December 2016 ran at 0.0%, just like we are seeing in the last three months of 2022, projecting the potential for a 0.0% variable rate. But inflation rebounded from January to March 2017, resulting in an annualized variable rate of 1.96%.

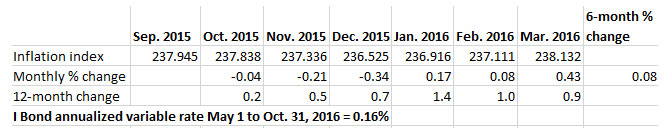

2015

Non-seasonally adjusted inflation from October to December 2015 ran at -0.60%, projecting a possible trend toward a variable rate of -2.4%. Pretty disastrous, right? But it didn’t happen. Inflation rose enough in January to March 2016 to bring the variable rate up to 0.16%.

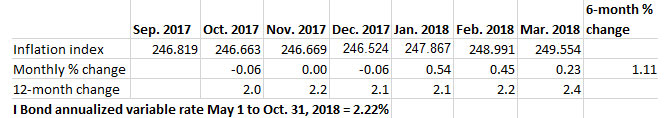

2014

Inflation from October to December 2014 ran at -1.35%, projecting a possible trend toward a variable rate of -5.4%. Deflation was bad, but not that bad. Inflation from February and March 2015 rebounded enough to get the variable rate to -1.60%, still a very ugly number.

Since I Bonds were first launched in 1998, there have been only two rate-setting periods resulting in a negative variable rate: This one in 2014, and the October 2008 to March 2009 period, which got a spectacularly low rate of -5.56%.

One oddity of I Bonds is that if you are going to have a negative variable rate, it’s better for it to be deeply negative. That’s because the composite interest rate can’t go below 0.0%, so you won’t lose a cent of principal, and you will be out-performing inflation for those six months. When inflation rebounds higher, you get the full benefit without suffering any penalty for deflation.

Historical perspective: A lesson learned

I could have continued this listing. In 2013, the October to December period ran at -0.47%, but the resulting annualized variable rate was 1.84%. In 2012, the October to December period ran at -0.78%, but the resulting variable rate was 1.18%. That is far back as my compiled data go.

Even if you look at 2021, when inflation was surging, the October to December period ran at 1.63%, projecting a trend toward a possible variable rate of 6.52%. But inflation surged even higher in January to March 2022, resulting in the epic variable rate of 9.62%.

Clearly, since this trend has continued for 10 straight years, non-seasonally adjusted inflation tends to under-report in the October to December period, and then rebound in the January to March period. This was easily seen in the November inflation report, with seasonally-adjusted inflation coming in at 0.1%, but non-seasonal at -0.1%. And then for December, seasonally-adjusted was -0.1%, while non-seasonal was -0.31%. Seasonal and non-seasonal balance out over 12 months, so we should see some gains in non-seasonal inflation in the months ahead.

So back to the question: Will the I Bond’s variable rate go to zero at the May 1 reset? Based on this historical evidence, I don’t think it will. It will be higher that 0.0%. But anything can happen. Let’s wait and see.

• I Bonds: A not-so-simple buying guide for 2023

• Confused by I Bonds? Read my Q&A on I Bonds

• Let’s ‘try’ to clarify how an I Bond’s interest is calculated

• Inflation and I Bonds: Track the variable rate changes

• I Bond Manifesto: How this investment can work as an emergency fund

* * *

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear.Please stay on topic and avoid political tirades.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. The investments he discusses can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

Pingback: January inflation came in higher than expected, rising 0.5% to an annual rate of 6.4% | Treasury Inflation-Protected Securities

Doesn’t the fixed rate of 0.4 percent apply to the accrued principle on an I-bond even if the inflation rate (variable rate) goes negative (below 0 percent) for 6-months or longer?

If the variable rate goes negative, it will wipe out any fixed rate up to the amount of the negative variable rate. But the composite rate can’t go below zero.

Apparently the I-bond “fixed rate” does not exactly follow the traditional concept of a fixed rate on a bond, if the fixed rate can go down to 0 percent during any extended deflationary period.

True! It’s been my pet peeve for a while. The Fixed Rate is a bit of a misnomer but it’s not the Fixed Rate that goes to 0%, it’s the Composite Rate. And it’s not the Fixed Rate that you get, its the Composite Rate.

“Deflation can bring the combined rate down below the fixed rate (as long as the fixed rate itself is not zero). However, if the inflation rate is so negative that it would pull the combined rate below zero, we don’t let that happen. We stop at zero.”

https://www.treasurydirect.gov/savings-bonds/i-bonds/i-bonds-interest-rates/

Thanks for this! Now I’m clearly understanding.

Will there be any more known about the fixed rate for the May reset in the coming months?

I am a long term investor. If there’s a chance it could rise should I wait until May or go ahead and buy now to lock in the .4% fixed and 6.48% variable?

Not sure it it matters but also have 10k for spouse and me in our gift boxes.

I was thinking I should deliver these for this years allotment. And then buy us each another for the git

No way to know on the fixed rate until we get close to the May 1 reset, and even then we can only speculate.

The January m/m CPI-U will likely be 0.5-0.7%. I’m predicting that the May 2023 reset will be 3-3.5% including fixed portion

Could be. The Cleveland Fed is nowcasting 0.5% inflation for January, but their predictions have been consistently high in recent months. National average gas prices have increased about 6% so far in January, that could be a big factor.

David, thank you for this article. If history is any guide, we may not be heading towards a 0% inflation rate on May 1 as many of us who follow this closely were starting to believe. Thank you for researching the historical data.

It seems to me the wise move now for those of us employing the Gift I Bond strategy would be:

1) For long-term investors, buy two $10K Gift I Bonds between spouses before May 1 to lock in the 0.4% Fixed Rate.

2) In lieu of buying, deliver two $10K Gift I Bonds with the 0% Fixed Rate between spouses which reaches the $10K quota for 2023.

3) For short-term investors, redeem the $10K Gift I Bond with the 0% Fixed Rate by each spouse three months after the May 1 rate kicks in for those I Bonds to minimize the early withdrawal penalty and invest those conservative dollars where you can get a higher return elsewhere (T-Bill, T-Note, etc.)

I have been purchasing I-bonds since 2014 and have a collection of eight purchases to-date. I ran a print-out of these holdings on 12/31/22 and again on 1/13/23 for the same holdings. I was surprised/puzzled to see interest rate changes displayed for bonds purchased in January 2022, 2021, 2017 & 2015 that went from 9.62% on 12/31/22 to 6.48% on 1/13/23 (all with a fixed rate of 0.00%). Whereas, interest rates for bonds purchased in March 2020 and April 2019 are displayed as 9.83% and 10.14%, respectively, on both 12/31/22 and 1/13/23. Did something occur between 12/31/22 and 1/13/23 that would account for these changes/anomalies? Thanks.

If you purchase I Bonds in January, as many people do, your variable rate changes every January 1 and July 1. So on January 1, your holdings transitioned from the 9.62% variable rate, which started in July for you, to the new variable rate of 6.48%. The March I Bonds transition in March and September, and the April I Bonds transition in April and October. The March 2020 I Bonds have a fixed rate of 0.20% and the April 2019 I Bonds have a fixed rate of 0.5%. See this: https://tipswatch.com/qa-on-i-bonds/

Just chiming in with the likely explanation. No, nothing changed between 12/31/22 and 1/13/23, but something was different about those bonds when you purchased them.

The I Bond you purchased in March 2020 had (and still has) a fixed rate component of 0.20% that is part of the overall composite rate that was applied to this bond from the November 1, 2019 rate change.

The I Bond you purchased in April 2019 has (and still has) a fixed rate component of 0.50% that is part of the overall composite rate that was applied to this bond from the November 1, 2018 rate change.

The other bonds you have must have a 0% fixed rate component since they are reflecting the current rates.

Sorry, our responses overlapped but same basic explanation.

No problem. I always appreciate when readers contribute helpful information.

Hi David,

Very interesting observation. As you said, let’s wait and see. As someone mentioned earlier, pay raises and COLAs would contribute some I’m sure. However, I also wonder about the holidays.

Companies start holiday shopping ASAP because they want your money first. So instead of “Black Friday” now we have “Black Fall.” Christmas decorations come out before Halloween now. Point being, prices go down and stay down until the new year comes around. Then come the new, higher prices for the latest stuff. By no means am I saying it’s that cut and dry. Just another possible contributor.

I saw a post here how to move bonds from the converted account to the main account. Anyone got a link? Txs

I think you might mean this: https://tipswatch.com/2022/05/08/ready-to-convert-paper-i-bonds-into-electronic-form-heres-a-step-by-step-guide/

Not sure if Dave has written about it, but Harry Sit’s website, The Financial Buff, is chock full of step by step explanations of such things as your question. It’s a great resource. The link below first explains how to transfer paper bonds to a conversion account, and then how to transfer those converted bonds to your main account.

https://thefinancebuff.com/how-to-deposit-paper-i-bonds-to-online-account.html#htoc-transfer-to-main-account-optional

Oops. I was writing my reply while Dave was posting his. So two ways to find your answer.

Hi. Did you mean to say May 1 (Now we are three months into a new six-month span that will reset the I Bond’s variable rate on November 1.)?

Also, a question. I was inclined to buy 2023 iBonds now to get the 6.89% rate for 6 months, knowing the next 6 months will likely be much lower. It seems likely the annual return will be more like 3.5-4%. But CDs are available for 5%. For a short-term buyer, wouldn’t that make more sense? I know the CD doesn’t have the .4% inflation adjustment, but that doesn’t seem like much….? Thanks for any input.

Thanks for noticing that, and it is fixed. I had to rush this one a bit because my wife wanted to take a walk. It’s a beautiful January day in Charlotte. …. On the short-term investment, if you really want to exit after 12 months, then a 1-year CD looks like a very good alternative, especially if you can lock down 5%. If the I Bond variable rate goes to 2.0% then you’d get 1.2% actual interest for the second six months (with the fixed rate) and that means just 0.6% after the 3-month penalty. The total 12-month return would be about 4.1% if you redeem after 12 months. If inflation is higher you would do better. The nice thing about an I Bond is that you still have the flexibility to hold it for a longer period.

Although depending on where Nancy lives, she may have to pay state income tax on the interest earned on that CD which would narrow the difference in the rate comparison, whereas there is no state income tax due when redeeming an I Bond.

I just encouraged my daughter to perhaps increase her purchase of I bonds while the fixed rate of .04 does exist ….

Having ibonds that have a fixed rate is so nice to see in the savings bond calculator- I’d hate for her to be stuck with 0 fixed rate bonds if she can avoid it. I think that mid April will be a very consequential newsletter!

Thank you for maintaining this blog, I always enjoy reading.

Hi,

How much does the annual Social Security Cola increase contribute to the January – March overall wage inflation? Could it be a significant factor?

Thanks

PS I enjoy your articles.

I am guessing that yes, it probably contributes a small amount, along with overall wage inflation.

Variable rate is likely to be low. The greater unknown is what will happen to the fixed rate, since that will be a capricious decision by Treasury. Will it remain 0.4%? Will it go higher? Will the fixed rate go back to zero?

This fixed-rate issue is going to be complicated. Real yields are heading lower, the 10-year TIPS real yield is down to 1.22%, 36 basis points lower than where it was on Oct. 31, just before the last reset. So at this point I see 0.4% continuing, but a whole lot can change.

Still the best investment in town in my opinion. The chance of going to zero is a slim chance. Inflation is still in a unfavorable position at this time.

Three months on the books as of this week = I savings bond inflation interest rate of zero.

Alan, not sure if you were asking a question, but if you are tracking your I Bond at TreasuryDirect, remember that the site will not show you the last three months of interest until you have held the I Bond for five years. So what you are seeing is normal.

Thank you. I was referring to the non seasonally adjusted measures for oct 2022 of 0.4 /nov -.1/dec -.3 adding up to zero so far for the upcoming may 1 2023 inflation interest rate.