By David Enna, Tipswatch.com

Even before I Bond investors crashed the TreasuryDirect website in late October, many financial journalists were pondering this question: “How fast can you get out of I Bonds?” For example, this from MarketWatch in early October:

“You can hold on to Series I bonds for 30 years, but if you jumped in when the interest rate skyrocketed to 9.62%, you might be looking for an off-ramp well before then. If you were attracted primarily by the high yield, you may want to sell sometime in 2023.”

The reason, at least in theory, was that the I Bond’s inflation-adjusted variable rate was about to fall from the super-enticing 9.62% (for six months, annualized) to a lower rate, which ended up being 6.48%, not quite as “super,” but still enticing. Many new investors have bought into I Bonds as a short-term investment, which is totally logical. You can’t find returns like this on any other very safe investment.

A couple of things complicate an I Bond exit strategy: 1) You must hold the I Bond for 12 months before you redeem it, and 2) if you redeem before 5 years you will lose the last three months of interest. Because of that interest penalty, savvy investors will want to exit at a time when the last three months of interest are below current market rates. And that may mean waiting well beyond the required 12-month holding period.

The conventional approach. My advice on exiting I Bonds remains: “Redeem when you need the money.” I Bonds held for 5 years become an easily accessed pot of inflation-protected savings. So … my conventional thinking is: Buy I Bonds every year. After 5 years, consider selling when you need the money. And target the I Bonds with a 0.0% fixed rate for the first sales.

The short-term approach. OK … you need the money very soon, and you used I Bonds as a short-term savings investment. If you really need the money, just redeem after 12 months and take the 3-month interest penalty. You will still do OK. But the wiser approach, if you can afford it, is to hold off on redemptions until the 3-month penalty is applied to a lower interest rate and therefore less painful.

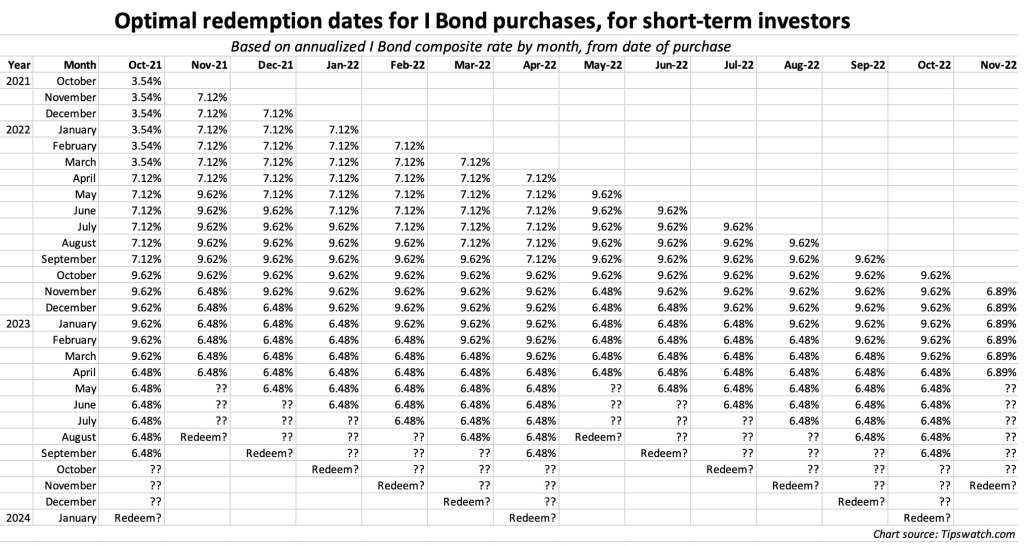

In this chart I have laid out the optimal exit month for all I Bonds purchased from October 2021 to November 2022. This is all subject to change, of course, because we don’t know what the I Bond’s next variable rate will be at the reset on May 1, based on October 2022 to March 2023 inflation.

The key to understanding this chart is that I Bonds earn the then-current composite rate for a full six months after the initial month of purchase. This is very important in planning your exit strategy.

For example, investors who bought I Bonds in October 2021 earned 3.54% for six months, then 7.12% for six months, then began collecting 9.62% just last month — in October 2022. They will launch into the 6.48% rate in April 2023. The next variable rate will begin in October 2023. Add three months to that and the optimal redemption date for I Bonds purchased in October 2021 is January 2024. (This assumes that the next variable rate reset will be below market rates. That may not be true.)

Investors who bought in November 2021 collected 7.12% for six months and then 9.62% for six months and this month began collecting 6.48% for six months. Add three months to that, and you get an optimal redemption month of August 2023.

Like a lot of people, I bought my full allocation of I Bonds in January 2022. My optimal month for redemption for those bonds doesn’t come until October 2023. That could be a factor if I wanted to sell those 0.0% fixed rate I Bonds and buy I Bonds with a higher fixed rate. (Mostly likely, I won’t be doing this.)

And so on through the chart. A lot of people bought I Bonds in October 2022, crashing the TreasuryDirect system. Those people will collect 9.62% for six months, then 6.48% for six months. Add 3 months and you get to an optimal redemption month of January 2024.

The holding period is potentially shortest for people who purchase I Bonds this month, in November 2022. They will collect 6.89% for six months (higher because the fixed rate rose to 0.40% for these purchases) and then an unknown rate for six months. If that rate is low enough, the optimal redemption rate could be November 2023, because the 3-month interest penalty could potentially fit into the first year.

Beware of assumptions! This chart lays out a potential optimal redemption dates for people looking to maximize earnings on a short-term I Bond investment. But if the next variable rate comes in very high — and it could — that would push out the holding period another six months for people who can afford to wait.

But my main point is: Don’t be too quick to hit the “exit” button on your I Bond investment. Take full advantage of the attractive rates you are now earning.

• Confused by I Bonds? Read my Q&A on I Bonds

• Let’s ‘try’ to clarify how an I Bond’s interest is calculated

• Inflation and I Bonds: Track the variable rate changes

• I Bond Manifesto: How this investment can work as an emergency fund

* * *

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear. Please stay on topic and avoid political tirades.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. The investments he discusses can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

Pingback: The I Bond exit ramp is now open; proceed with caution | Treasury Inflation-Protected Securities

David–do you plan on writing a post discussing how to best ladder CDs in a fast rising interest rate scenario such as now?

Or if not, can you or someone point me to a resource?

At the beginning of next year, I was thinking of buying a 6 month CD for starters, then perhaps waiting a couple months and buying another 6 month, then maybe if the Fed seems like they’re holding off on more hikes, start buying 1-3 yr CDs. (I don’t want to lock my money up with 5 yr CDs).

Is there a sweet spot for choosing when to capture the best mid to longer term (1 -3 year) rates? i.e. Will it be right after the first Fed announcement that indicates they are pausing on any more rate hikes?

I’m not much of an expert on CDs or CD ladders. You could look around http://www.depositaccounts.com for great information and current rates, including this guide to ladders: https://www.depositaccounts.com/blog/how-to-build-a-cd-ladder.html …. Plus, bogleheads.org has a helpful guide: https://www.bogleheads.org/wiki/Laddering_bonds_or_CDs

Very sage advice, as usual. As someone with relatively little IRA space, I would add that the tax deferral feature of I Bonds is also very attractive. That plus the put at par make I Bonds an excellent choice for inflation proofing long-term expenses, especially when you’re unsure of the timing of the expenses. I’m definitely keeping mine.

Quick question: Is the 0.4% coupon on new I Bonds also tax deferred until redemption?

Yes, the entire composite rate is tax deferred.

It’s worth pointing out (because it accentuates the usefulness of the article):

At the TD Website, it indicates the interest rate each of your holdings is currently receiving. BUT it doesn’t incorporate the 3 month penalty window so the rate you see is NOT necessarily the rate you will loose to penalty. e.g. when the rate shown for a particular holding at TD changes from 9.62% to 6.48% you need to wait 3 more months before your penalty rate is 6.48%. Otherwise you’re going to lose out on months of the 9.62% rate.

Bottom line is the TD website doesn’t make it obvious what rate you will miss out on for your penalty. You need to count the months and this table in this article is helpful for that.

I mistakenly bought two tranches of $10K each in May2022. I got an email saying that over purchase of $10K will be refunded to me in 8 to 10 weeks. No refund yet. Since then I sent several secure messages through my account and I get the “template” reply saying we are too busy. I once dared calling and the wait time was 4+ hours!!!

One of the questions I asked was what interest will my over purchase amount of $10K will earn when the amount is ultimately refunded some day. Still same “template” answer.

What can I do? What should I do? Do I not earn ANY interest if the treasury doesn’t refund my $10K for a year? Thank You.

Eventually, I predict, you will get back $10,000, nothing more.

I thank you for your prompt response.

No redress — legal or otherwise — for treasury holding my $10K for a long period with no interest??? Even IRS pays interest for overpayments!!!

Once again, I need an education.

The article mentions in many different areas ‘selling’ of I-bonds. Unless there is a secret society doing this, is it not redeem only & when redeemed tax is paid? So many newbies, I would think words matter.

Selling = redeeming. There is no other alternative. I usually say redeeming but sometimes say selling. It is the same process, completed at TreasuryDirect or at a bank for a paper I Bond.

I Bonds cannot be sold. To cash them out requires redemption through Treasury Direct.

Income tax is generally payable for the year of redemption on all interest that has accumulated, but if the bond owner previously elected to be taxed on the interest on an annual basis, the only interest taxed for the year of redemption will be the interest earned from January 1 of that year through the redemption.

In those few cases where the bond owner used all or some of the redemption proceeds to pay for qualifying education, the applicable accumulated interest (based on the prorated portion of the total proceeds used for that purpose) will not be taxed at all.

I have a 5.99% HELOC whose rate will continue to rise as the Fed raises interest rates, and am considering liquidating I Bonds bought more than five years ago once the interest rate on the HELOC exceeds that of the I Bonds. I will probably be purchasing more I Bonds in April 2023 but am not going to rush out and purchase them in January (I bought my 2022 allocation in January). Instead my available wages will be used to extinguish the HELOC to the greatest extent possible.

I do wonder if I should give up those I Bonds so quickly, but if rates shoot up another 2 or 3% and that does the trick to arrest inflation then selling the bonds seems like a good idea. (I treat the HELOC as investment interest since I purchased stocks and bonds with the HELOC funds. Available I Bonds + savings accounts > HELOC balance so this is an arbitrage.)

It partly depends on the dollar amount of accumulated interest on your I Bonds in the year you would redeem them. If high enough, that accumulated interest, together with the loss of your deduction for investment interest expense by paying off the HELOC, may put you into a higher tax bracket. You may want to project your tax situation (or have a tax pro do it for you if you use one).

I’m not 100% sure but I think you are forgetting something. If you redeem an I bond that you have owned for 2, 3 or 4 years, and if you bought the max of $10,000, that I bond is now worth $12,000, $13, 000 etc. That higher amount will continue to compound tax free into the future. If you redeem it and start with a new I bond with the fixed rate you will begin again at the $10,000 because that is the limit for purchase. So there is the compounding effect of higher amounts you are neglecting.

At that point, you would need to look at what you would want to do with the excess money. Is there a good way to reinvest it, or possibly to spend it? The rollover strategy is especially good for people who don’t have available money to make the I Bond purchase when the fixed rate is high.

Hi David,

In a case where the goal is to sell/flip older lots of 10k zero fixed rate I-bonds and reinvesting them into the new fixed rate .04% I-bond.

I believe someone could just sell the exact 10k amount, keeping any interest in the older i-bonds.

So a partial redemption maybe useful in this case.

Selecting the right time is the key for this move.

Good point. It’s true you can do a partial redemption, but it could be tricky since when you redeem you are automatically paid interest on that partial redemption. So I think you’d have to figure out the redemption amount + interest that would hit near the $10,000 goal.

Technically, they’d need to sell more than the exact 10k amount to account for the federal tax they’ll own on the interest portion of the redemption. So yes, partial redemption is possible, but it’ll take a bit of math to get the exact right amount to hit the exact target.

There is an auto type in the paragraph. If not wrong it should read October 2024.

“ he holding period is potentially shortest for people who purchase I Bonds this month, in November 2023. They will collect 6.89% for six months (higher because the fixed rate rose to 0.40% for these purchases) and then an unknown rate for six months. If that rate is low enough, the optimal redemption rate could be

October 2023,

because the 3-month interest penalty could potentially fit into the first year.”

You are correct. The correct purchase month is November 2022 and the correct potential sales date is November 2023. And this is fixed. Thanks for the alert HP.

I’ll probably keep holding my 0.0% and 0.20% fixed rate bonds at least until they stop earning the 6.48% which will be at the end of next year. I’ll likely hold my 0.50% bonds at least through the end of the five year period.

I’ve been purchasing I Bonds both as a short term savings/emergency fund and as long term inflation-adjusted funds. However, this year has seen nominal and real rates rise significantly.

For the short term, I may sell because I can get nominally higher rates in 2024.

For the long term, I may sell since real TIPS yields are currently significantly higher.

Since I usually purchase my I Bonds near the end of each six month period, I know the return several months in advance. If nominal or real rates fall, I may continue to hold or purchase them.

Depending on CPI-U values through March 2023, and nominal rates, I may purchase the 0.40% fixed rate bonds before the next reset and hold for 15 months.

Thank you for the interest rate chart. However, for making redemption timing decisions, one also needs to consider that interest does not begin to accrue to your bond balance until the beginning of the fourth month. In effect, no interest is paid in the first three months to reflect the early redemption penalty. Consequently, for example, in your table above, an I-bond bought in May ’22 will accrue interest at a 9.62% rate from August ’22-January ’23, then at 6.48% from February ’23 through July ’23. Thus, in the table above, when considering when to redeem, there doesn’t need to be any question marks in the last three months. There is no uncertainty during these months for short term investors whose focus is on the account accrual rate rather than the underlying interest rate.

Robert, the interest penalty applies to the LAST three months of interest, not the first three months. So after the fourth month is earned, TreasuryDirect will show you the first month of interest as earned.

Another important consideration– the best day of the month to redeem is the 1st. This gives you the full interest of the prior month and minimizes the “interest penalty” in the month of redemption. If you redeem on the last day of the month, you get no interest payment for that month.

Are there any rules about redeeming an I Bond and then having to wait a certain time period before purchasing another? Or can one do both in the same calendar year, if need be?

Also, once redeemed, how long does it take to actually get the I Bond cash transferred back into my bank account?

– No restrictions on selling. You can still buy up to the annual limit.

– It should appear within a few days. I’ve sold Series EE Bonds early on the first of the month, and it appeared in my brokerage account in the evening of the second.

Redemption and purchasing activities are not linked. The one is not a limitation on the other.

Excellent advice as ALWAYS. Thank you so much, David!

-With gratitude + utmost respect

100% agreement with Mo.

It would be interesting to also discuss the optimal buying strategy.

For instance, is it better to buy in May and November because you can liquidate sooner, or would it be best to layer-in the purchase three or four times per year (e.g. $2,500 each) to catch the highest variable yield without knowing the fixed rate, but leave some room for extra purchases after the announcement?

I had purchased $40k of I bonds in April this year. Using the gift box idea where I bought 10k and gifted my wife 10k and she the same to me. I was tempted to add more to the gift box in November but didn’t like the idea of getting those funds “stuck” for 2 years before I could gift them. It was a hard call but I let it go.

You bring up good points in your post, thank you. I also wanted to mention the obvious – dollars are fungible, they are mutually interchangeable. If you need $10,000 for something & have several choices for where to source it, consider that money raised for one purpose can easily be used for another. This fungibility could allow you to hand on to iBonds for longer periods, which could mean avoiding the 3 month interest penalty. Also, with the $10k per year per person cap, there’s not many shortcuts to build a six figure portfolio of iBonds without buying them yearly and also holding to accumulate.

Set up LLCS. They are cheap, easy to set up, and you can have as many as you want.

Besides being a bookkeeping and tax nightmare, depending on the state that you live in, those LLC’s may not be that cheap.

For example, in California there’s an annual miniumum tax of $800. Besides that every state seems to different regulatory costs.

Unless the LLC’s actually are a legitimate business, I sure hope that the IRS and the Treasury never get together and do an audit.

Before I retired, I had a legitimate business. That was complicated enough without throwing iBonds into the mix.

California is a bit of an outlier. There are many states where the cost is $50 or less (tax-deductible). From the IRS standpoint, the LLCs are disregarded entities, they don’t exist. The Treasury Department reviewed my LLCs and quickly concluded they are fine.

Only single member LLCs are disregarded entities. Also, even if the LLC has only one member, in situations where the LLC has elected to be taxed as a corporation, the entity is not disregarded.

The LLCs are single member and have not elected to be taxed as a corporation.

I don’t believe that loophole works. Per:

https://www.treasurydirect.gov/savings-bonds/how-much-can-i-spend-own/#id-i-give-as-gifts–615502

“The gift counts for that person’s limit in the year in which they get the bond.”

In other words, the amount you purchased for yourself plus the amount gifted to you cannot exceed $10K electronic I-bonds per calendar year.

This is correct. Receiving $10,000 in gift i Bonds puts you at the limit under current rules.

True, gift counts towards your annual limit. The “loophole” with the gift is that it only counts toward your limit in the year you receive the gift but it still accumulates interest sitting in the giftbox based on when it was purchased.

So, for example suppose you and your spouse bought your limit when rates where over 9% and bought 10k worth of gift ibond to give each other. You couldn’t gift those gifts this year (you are already at your limit) but could next year (or even several years later) when rates drop too low for you to want to purchase (and thus won’t be hitting your limit otherwise).

Yes, not only accumulates interest in the gift box but also ages while in the gift box, reducing the time until they can be sold or sold without the 3-month interest penalty.

The chart is an interesting way to track each tranche of bonds bought. Great idea. As for picking an “optimal” exit point it seems to me that unless something radical happens to force the FED to cut rates sooner than anyone is predicting, that inflation is likely to persist at 5% or more through most of 2023. We could even be in a late 70’s early 80’s inflationary period. For me, My plan is to build a 60k nest egg (5×12=60) that could be called upon to supplement my retirement income, say $1000/mo, if needed and if the rate being paid both currently and ON AVERAGE, is substantially below what I can buy CDs or short-term treasuries to yield. The reality is for short-term savings, if the I-Bond current yield falls, so will rates on ST CDs and Treasuries. This isn’t rocket science and we should take advantage of these higher rates until something better comes along. One question. Since we have the choice of when to pay taxes on interest paid (either annually or when a bond is redeemed), does TreasuryDirect send a 1099 or some other statement annually that reports that “income” to the IRS? How does one elect to defer taxes on this accrued but not yet received interest? Standing ready to buy my next tranche on January 1, 2023.

Treasury Direct will not issue forms 1099-INT annually unless you elect (in writing, on your tax return) to be taxed on each year’s earned interest. The election applies to all I Bonds you own, so you cannot cherry-pick, and once you elect, it will be very difficult to revoke your election as it requires IRS approval. Otherwise, you will be taxed only when your bonds mature or, if sooner, when you redeem bonds.

I plan on doing as you suggested and not touch them until I absolutely need them. I’m excited to buy in January since the fixed rate went up. Snatch that while it’s there. Add the 6.48% and the money quickly comes in.

I plan to wait until Mid-April instead of January to know the likely May 1 2023 I Bond rate in order to decide whether it makes more sense to:

A. Buy before the rate change.

B. Buy after the rate change; or

C. To receive delivery of a Gift I Bond my spouse has pending in her Gift Box.

I’ll hold a short-term T-bill in the intervening period to partially offset the interest rate difference since I don’t plan on redeeming any I Bonds in mid-2023 and I’ll use the maturing T-Bill for that next I Bond.

Why would you delay starting the 1 year holding period and getting the 6.89% rate for a couple of months unless the funds you will be investing are earning that rate or better? Not a criticism, I’m trying to understand your thinking. Seems to me if you earn 6.89 for 6 months and 0.4 for the second six months (assuming the inflation part of the rate goes to zero) you still earn 4.26% over 12 months. (10k grows to $10,426.19 if my math is correct). True, I can buy a CD that matures in February of 2024 that pays 4.8% today (and that is likely to go up by January) but I give up the inflation protection and tax deferment. Good luck to us all!

The reason would be if you think the fixed rate will rise substantially, so you could opt to hold out until May.

David, what do you think the chances are that the fixed rate rises?

I’ve been thinking of using the gift box method to have more than one purchase with the 0.4% (to hold till needed) as I’m thinking of ibonds as a safe place retirement option and I’m really liking that fixed rate added in over 30 years. I know that each of those up front purchases freezes the money harder than a normal ibond because each has to wait to transfer for a year my limit hasn’t been maxed. I have trustworthy family, so I could do several. (and because I have cash – couldn’t bear to put much in the stock market with it being 3 standard deviations over the norm)

It’s impossible to predict the future of the fixed rate, but I’d say at this point (with the 10-year real yield at 1.69%) a higher rate fixed rate is justified. What will happen in May will depend on rate trends in coming months.

I realize there is no info on how or why concerning the fixed rate. I just know you have a far better finger on it than I do, so even your feeling that a higher rate is (at the moment) justified, is helpful. I think I will be a little more cautious and save a few options so I can see how things look to you at the end of April. Thank you!

Butopia1502,

No problem at all and it’s helpful to think it through and discuss it further.

Once we clear the 2022 calendar year and the I Bond purchase limit is restored to $10K for those of us who maxed out the limit in 2022, we are talking about the choice between a purchase, roughly in Mid-January and waiting approximately 3 months until Mid-April.

If your getting in the upper 4% range on a Treasury, which is doable today, vs. 6.89% on an I Bond, the roughly 2% difference for 3 months on $10K is $50.

To me, it’s worth $50 to have as much information as possible to make the purchase decision which I can only get in Mid-April. I won’t know the new fixed rate but I will know the inflation rate portion of the composite rate, and I will know the alternative TIPS rate and Treasury rates. The three choices I outlined are very different options. For example, if I choose to accept I Bond gift delivery, I can always buy a treasury or a 5 year TIPS with the $10K if advantageous to do so.

That said, the 6.89% I Bond rate is indeed attractive especially with the 0.4% fixed rate, and I lean towards buying it in April as we sit here today. The thing is, as inflation decreases, the 5 month gap in rate that I will get in April-September as compared to what is likely to be a lower rate after May (my best guess) allows me to extend that gap longer as long as I fill the gap beforehand from January- April when interest rates are rising.

for an investor who is considering an IBond as an intermediate or long-term investment, it could be worthwhile to wait on a 2023 purchase until after the May 2023 rate reset. if the fixed rate component of the IBond moves substantially higher, say from 0.4% to 0.8% in May, then over a long holding period, a May ’23 bond purchase should come out ahead of a January ’23 purchase. over a short holding period, that potential fixed rate benefit would have much less impact.

Your chart is very helpful but missing the month of December in 2023 which would pull some exit dates in by a month. Also, even long term investors that bought with a 0% fixed rate may want to sell and reinvest to get the 0.4% fixed rate. For example, if the new rate in May of 2023 is 4% losing three months of interest at that rate would cost you 1%. Selling and reinvesting would pay back in two and a half years.

How did I miss a month? Who knows? But this is fixed and thank you very much for spotting that. Rolling over 0.0% fixed rate I Bonds is a smart move, as long as you are comfortable with your total amount of your long-term holdings. (You can only replace the I Bonds you sold, not add any more that year.) I am sure I will be doing this if the fixed rate stays above 0.0% into the future.

You can add plenty that year if you are using LLCs as the registrant for your I bonds.

Interesting. Why they count a rollover the same as a new purchase is ridiculous.

The concept of a rollover really doesn’t exist with an I Bond. You can’t rollover an EE savings bond either. The bond matures, you collect the interest, and it’s a federal taxable event. The end.

As Marc said, there is no such thing as a “rollover” with savings bonds. There is only purchases and redemptions. That you want to purchase an equal amount immediately following a redemption is irrelevant.

Replace I bonds you sold? If you sell 10k in I bonds you can buy 20k that year 10k new plus 10k to replace what you sold?

No. Selling i Bonds has no effect on the purchase cap.

Another consideration is that income taxes on the earned interest are deferred until redemption.

And they are also exempt from state income tax as well. Yet another benefit. The I bond is the gift that keeps on giving!

* they are exempt from state AND LOCAL taxes, furthering the “keeps on giving” thought.

If you use the funds to pay for higher education for a direct family member the earnings are also exempt from federal taxes. My children are done with college but there seems to be a loophole that would allow you to pass the funds along to grandchildren or beyond and still avoid federal taxes. It seems that you can set up a 529 plan for your children and fund it with I bond proceeds. A 529 contribution qualifies as a higher education expense. Then, down the road, you can change the beneficiary of the 529 to a grandchild. It could be years later. I’ve looked at this superficially and it seems to be acceptable. Has anyone else looked closely at this?

I have not, but I know there are income and other limits that apply so it’s is not even absolute that you qualify. This article explains most of the issue quite well:

https://thefinancebuff.com/cash-out-i-bonds-tax-free-college-529-plan.html