By David Enna, Tipswatch.com

I’ve been pondering recently whether the Treasury will raise the I Bond’s fixed rate above 0.0% at the November 1 reset, and one side of my brain says, “Well, it should” while the other side says, “No, it won’t.” But that is a topic for another day; I need more time to ponder.

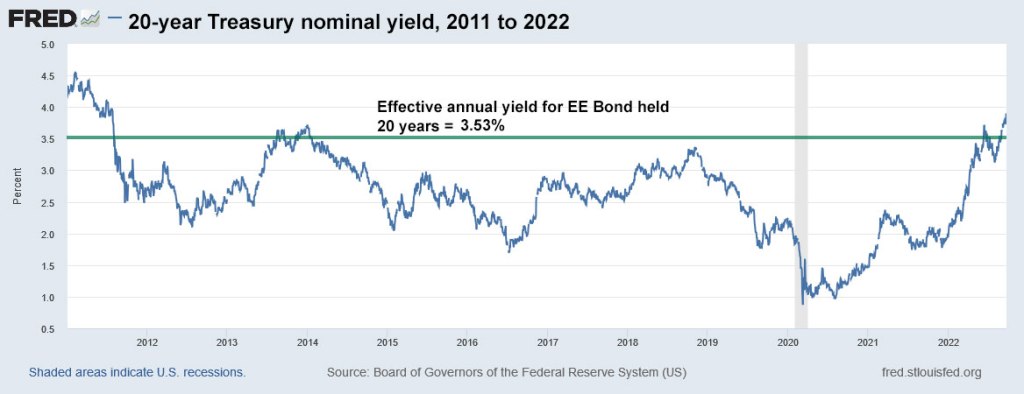

What has caught my eye this week is the fact that the Series EE Savings Bond has suddenly lost its long-held yield advantage over a 20-year Treasury bond. While I Bonds are now the sexy starlet of the financial scene, EE Bonds are the aging actor making a cameo role — pretty much ignored.

But … throughout the last 11 years of interest-rate repression, EE Bonds have maintained an attractive yield advantage over other long-term, very safe investments. EE Bonds currently offer a permanent fixed rate of 0.1%, ridiculous and irrelevant. What makes EE Bonds interesting are these terms:

All Series EE bonds issued since May 2005 earn a fixed rate in the first 20 years after issue. At 20 years, the bonds will be worth at least two times their purchase price. The bonds will continue to earn interest at their original fixed rate for an additional 10 years unless new terms and conditions are announced before the final 10-year period begins.

What this means is that an investment in EE Bonds held 20 years immediately doubles in value, creating an effective annual rate of return of 3.53%. That rate has surpassed the yield on a 20-year Treasury for more than eight consecutive years. Here is the comparison going back to 2011, the year the Federal Reserve began aggressive manipulation of the bond market:

What this means

As long as the 20-year Treasury yield remains higher than 3.53% (it closed yesterday at 4.01%) EE Bonds are no longer so attractive. If you are looking for a very safe 20-year nominal investment, buy the 20-year Treasury bond instead, either on the secondary market or at auction. There is a reopening auction coming up Oct. 19.

EE Bonds do have the advantage of earning tax-deferred interest and proceeds may be able to be used tax-free for education purposes. If this education goal applies to you, EE Bonds are still attractive.

What if you are holding EE Bonds?

Terms for EE Bonds have changed many times over the years, so it is important to consider when you purchased them and their actual terms. This page on TreasuryDirect links to the main categories. Some older EE Bonds might be worth retaining.

But if you bought them anytime after November 2015, they are paying a permanent fixed rate of 0.1%. Since the 20-year doubling is still years away, you could consider redeeming those EE Bonds and investing the money elsewhere. EE Bonds can’t be sold until you hold them 12 months, and if redeemed within 5 years, you lose three months of interest. Since the fixed rate is 0.1%, that is essentially zero. I’d feel comfortable redeeming any EE Bond held less than five years, if there is an attractive alternative (for example, I Bonds purchased now or in January 2023).

If you’ve already held the EE Bond five or more years, you may want to keep it until maturity. Here is how that math works out, ignoring the 0.1% fixed rate, which becomes irrelevant when the bond doubles:

- After 5 years, the EE Bond would double in 15 years, creating an effective annual return of about 4.8% for the final 15 years..

- After 10 years, the EE Bond would double in 10 years, creating an effective annual return of about 7.18% for the final 10 years.

- After 15 years, the EE Bond would double in 5 years, creating an effective annual return of about 14.9% for the final 5 years.

So I’d recommend holding on to any EE Bond that is approaching its doubling term, which has changed several times over the years. After it doubles, redeem it.

- Back in 1992, EE bonds paid 6% a year and were guaranteed to double in 12 years. After 12 years, they reverted to paying 4% a year to maturity.

- In March 1993, the doubling term was adjusted to 18 years.

- In May 1995, it was adjusted tp 17 years.

- In June 2003, it was brought to 20 years, where it has remained.

What the Treasury needs to do

Obviously, that ridiculous fixed rate of 0.1% needs to go higher — much higher — at the November 1 reset. Here are some examples of higher fixed rate resets in the last 12 years, showing that the Treasury was willing to set the fixed rate above 1% when longer-term Treasury yields were about as high as they are today:

Realistically, to make EE Bonds a stellar investment, the Treasury would need to reduce the doubling period, as it did in 1995, when it dropped from 18 years to 17 years. That would bring EE Bonds back to a favorable status versus a nominal 20-year Treasury. But I don’t think that will happen … this year. Maybe next year if rates continue at high levels.

The Treasury will probably make a cautious move in the November reset, knowing that interest rates are in a volatile phase. But I would expect the EE Bond’s fixed rate to rise above the current 0.1%.

* * *

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. The investments he discusses can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

I hold a $1000- 1993-30 year EE bond that matured in Sept. It’s current MA value is much less than the $1000-30 yr EE bond that matured in Jan 2023. How can that be?

I found you while searching for help with Treasury Direct E

Bond Calculator. I have tried repeatedly to remove bonds that I have cashed in and cannot. I also can’t seem to add bonds I omitted when I first set up my inventory on the old calculator. Any thoughts on how to accomplish these two actions? I’ve attempted the steps you suggested in an older article about the calculator.

Additionally, I have an inventory of bonds that have issue dates from 1993-1998. According to the calculator they have not doubled in value. Am I crazy or just lazy to keep them until they reach final maturity?

1) Go to your saved Savings Bond list and click on it. It should be an *.html file and open up in a browser window.

2) When the file opens, click on “Return to Savings Bond Calculator” in the upper left corner. This takes you to the actual calculator.

3) Now you should see your listing and each item should have the word “remove” on the right-hand side. Click on remove to cut matured bonds from the list. (If you aren’t seeing all the bonds, click on “View All” under the list.

4) To see updated balances, click on the green “update” box above the listing.

5) To add holdings, use the box above the listing to add items.

Thank you for your quick response. I was able to accomplish what I needed. I was a little thrown off when adding a bond because the new bond goes to the top of the list rather than in the proper chronological order!

Have a few 2o year old ee bonds to cash out….does the interest earned get added to the bond value monthly or every 6 months..? thx

If I purchased a 20-year Treasury (say at 4%), my understanding is that interest is paid every 6 months into a bank account. Wouldn’t I need to reinvest those amounts elsewhere over 20 years to beat out the EE bond?

That’s correct. You would need to reinvest the interest paid out and you might get a higher rate, you might get a lower rate. The EE Bond is a unique investment, earning 0.1% for 20 years, and then suddenly doubling the original purchase value.

My understanding is that you would need to buy STRIPS from a brokerage in order to emulate the EE bond characteristic of all interest being paid at maturity (or when redeemed).

I purchased some in 2020, 2021, and 2022 for a “roll your own” pension but am also going to cash out, although I will have to keep the 2022 until 2023. The long term TIPS look interesting if the rates can sustain that level, and I need some funds to buy January 2023’s I Bonds anyway.

David, if the 5 year TIPS yield remains near 2%, do you expect to bump up higher than your normal allocation? Looking forward to your IBond post. Thanks.

They sank to 1.54% this morning. That’s giving-up almost a half point in the course of a couple of days.

Just shows that you have to buy them when there’s panic in the streets.

On Friday it was flirting with 2% at the market close. Should have nibbled for some more on that day.

But the way things were going, I figured that it would break 2% on Monday morning.

Jokes on me.

And now the stock market is roaring higher, which for obvious reasons, the Fed is not going to like. Just another example of the wild market swings of recent weeks. The markets seem to think the Fed is going to “crack.”

Could you explain further on how Treasury sets fixed rate for ibond? I was under the impression it’s influenced by treasury yields, so fixed rate should be around 3.5%-4% if prices are flat (I know wild assumption). Even on lower end, could they justify going below 3% (the current fed funds rate)?

The Treasury does not give any guidance on how it sets the I Bond’s fixed rate and there is no set formula. I’d say the federal funds rate isn’t a factor; what seems more likely is that as real yields rise, especially the 10-year real yield, the Treasury is more likely to raise the I Bond’s fixed rate. Right now the 10-year real yield stands at 1.39%, which justifies an increase above 0.0%, possibly as high as 0.5%. But the Treasury may believe it can stand pat because demand for I Bonds remains extremely high. I plan to write about this topic, possibly over the weekend.

Well, I used to look at the pre-Great Recession FRED charts with a sense of nostalgia. Back in the 2003-2007 time frame, both the 5 and 10 year TIPS were floating around 2%. The 5 year was mostly between 1% and 2%. The 10 year was mostly between 2% and 3%. Yesterday, both the 5 and 10 year yields were above 1.5%. I never thought that I’d see TIPS with yields like this again. There was even a 9 year TIPS available with an inflation adjusted price of under par ($96.06). Because of the par floor feature, that means that even if there was deflation for the entire 9 years, they’d post a net gain of $3.94. As long as the inflation adjusted price is under par, even purchasing them on the secondary market doesn’t carry any risk of losing principal. Since I’m in my 70’s now, that’s pretty much the name of the game for me.

Please let me know how to change Beneficiary’s on Bonds directions are to hard to follow! You would need to be a computer programmer to follow these directions! HELP

For electronic Savings Bonds held at TreasuryDirect, you need to log in to your account, go to current holdings and open your list of bonds, then select the bond you wish to change. That screen will show the current registration. If you want to change it, click on the “edit” button, answer the security question and from the next screen click “Add New Registration.” You should be able to complete the process there. After that, you will need to change the registration for every bond you own.

This thoughtful comment came from a reader who wishes to remain anonymous, so I am posting it for that person:

1. Since EE bonds do not have coupons, the appropriate comparison to Treasurys is 20-year zero coupon Treasury bonds, not coupon-paying bonds. Right now, 20 year coupon bonds are yielding 4.19% to maturity and their zero coupon cousins are yielding 4.31%; that’s a substantial difference. Both outpace EE bond yields so substantially that it is hard to justify purchasing EE bonds right now. And for people worried about mark-to-market values of Treasurys prior to maturity, it would help to remind them that if they were willing to hold EE bonds for 20 years, they should think of the same holding period to maturity in Treasurys and not even pay attention to mark-to-market losses or gains prior to maturity.

2. Because taxes are normally deferred until maturity on EE bonds, their effective yield to the 20 year doubling is higher than 3.53% — it’s more like 3.6% to 3.8%, depending on assumptions about how much the money that would have been paid each year on taxes (if not deferred) is earning. You can check this out with a financial calculator.

This comment states that a 20 year coupon treasury bond is yielding 4.19% to maturity, and that it is outpacing EE bonds “substantially”. However, in a subsequent comment, you stated that a 20 year treasury paying 4% will not actually outpace an EE bond since the interest is paid semi-annually instead of compounding for 20 years. I’m not sure how to do the math, but if your comment is correct, a $10,000, 20 year coupon paying treasury bond with a 4% interest rate will pay substantially less than $10,000 in interest over the life of the bond (and we know that a $10k EE bond held for 20 years will pay $10,000 if held for at least 20 years). This being the case, isn’t it factually incorrect to say that a 20 year coupon bearing a 4.19% interest rate does not actually outpace an EE bond? Of course the semi annual interest payments could be re-invested and the interest from these new investments and the interest from the original 20 year treasury bond could potentially, in the aggregate, pay more than $10,000 over 20 years. However, aside from being a logistical nightmare, this assumes that interest rates would remain high so I don’t think this is a fair comparison.

Confused it says I bonds hold a 0.0%. Why is “everyone” saying 9.6 % ??

Why would anyone by anything if 0% ??

I Bonds pay an interest rate based on two factors: 1) the fixed rate, which is 0.0% and 2) the variable rate, which is currently annualized at 9.62% for six months. Because the fixed rate is 0.0%, we say that I Bonds purchased today have a “real yield” of 0.0%, meaning they will track future inflation, but not exceed it. The 9.62% rate is based on U.S. inflation from October 2021 to March 2022. The next variable rate will be reset on Nov. 1, based on inflation from April to September. It looks like that rate will be around 6.2% to 6.4%, annualized, for six months. Tracking future inflation offers insurance against surges in inflation, like we are seeing right now.

Hi David,

If I bought 10,000 of the 5 year tips auction in April of this year, and wanted to sell it tomorrow. What would a ballpark figure for the selling price likely be? If the tips are held at Treasury direct, would they have to be transferred to my brokerage Schwab, to be sold? If so, is that easy to do?

Thanks!

That is CUSIP 91282CEJ6, which as of today has an inflation index of 1.04935. It is currently trading at a deep discount, about $92.30 for $100 of value. So 10,000 x 1.04935 = $10,493.50 x .9230 = $9,685 current value, approximately. Rough estimate. Yes, to sell this you need to move it from TreasuryDirect to your brokerage, then sell it. Instructions: https://www.treasurydirect.gov/indiv/research/indepth/tips/res_tips_sell.htm

Unless I don’t understand it completely, another advantage to EE Bonds, important to me, is that you can cash in an EE Bond at any time, whereas with a 20 year treasury you are stuck with it for 20 years. There might be some opportunity losses by cashing in the EE Bond, but at least you can get the principal back and whatever measly interest there is.

But thank you for the information about the yield differential. That is interesting and pertinent.

If you buy a 20-year Treasury bond in a brokerage account, you can easily sell it at any time at the current market price. You might make money, you might lose money. With an EE Bond, you can redeem it anytime after a year and get back your full principal (plus the 0.1% fixed rate). If you redeem before five years, you lose three months of 0.1% interest, which is so small it is not worth considering. If you think you will need to sell early, the 20-year Treasury is a more risky investment, but you could actually gain from the market fluctuations.

Long-term treasuries are dangerous for individual investors, particularly when the coupon yield is stingy. When I started investing in the late 1960’s I remember reading an article in Barron’s where long-term bonds were described to as “certificates of guaranteed confiscation”.

From 1/1/2022 through yesterday, Admiral Shares in the Vanguard Long-Term Treasury Index Fund (duration 23.4 years) had a ytd return of -27.93%. By contrast, a relatively conservative stock fund, Admiral Shares in the Vanguard HIgh Dividend Yield Index Fund had a much less punishing ytd return of -12.19%, less than half as bad as the long-term Treasuries.

Long-term bonds of any kind are highly volatile. In the case of an EE Bond, however, it could never lose a cent of value, but it would have to be held 20 years to reap the 3.53% return. The value of a 20-year Treasury bond would be highly volatile, but acceptable if the investor is certain to hold to maturity.

Thanks. This is now on my list of things to do. I am thinking of selling them, and rolling them into a defined maturity ETF and a Treasury note.