Are you Researching ERP for 2023?

Navigator SAP

DECEMBER 23, 2022

Article Highlights :

CFO Dive

DECEMBER 7, 2022

Investing in data analytics that can reveal key opportunities can aid CFOs looking to better balance growth and profitability.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Finance Weekly

DECEMBER 22, 2022

First things first: despite any misguided "Excel is dead" stories you may encounter in the upcoming weeks, Excel won't disappear in 2023. The humble spreadsheet remains an essential, if not critical, component of many financial operations. Therefore, while we won't pay attention to what is or isn't happening to Excel (or Google Sheets), we can predict some CFO tech trends in 2023.

CFO Dive

DECEMBER 1, 2022

An expanding scope of responsibilities — which require finance chiefs to have cross-disciplinary expertise — is slowing decision making, according to an Accenture study.

Advertiser: Paycor

HR doesn’t exist in a vacuum. This work impacts everyone: from the C-Suite to your newest hire. It also drives results. Learn how to make it all happen in Paycor’s latest guide.

Barry Ritholtz

DECEMBER 5, 2022

I was working on a longer piece about which economic strata the Fed has the greatest impact on (its more complicated than you might think) when Invictus DM’d me this amazing FRED chart. We looked at this idea earlier this year , but it’s worth revisiting. Using data from the Federal Reserve, FRED analyzed 5 categories: Top 0.1%, the rest of the top 1%, the rest of the top 10%, the rest of the top 50%, and the bottom half.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

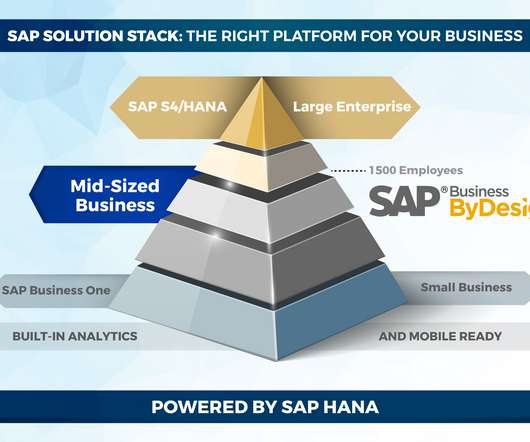

Navigator SAP

DECEMBER 16, 2022

There are typically three phases of a startup’s financial management journey.

CFO Leadership

DECEMBER 12, 2022

CFOs have positioned themselves as key contributors to the enterprises’ strategy and in C-suite and boardroom discussions. Now, as these leaders shift more attention toward preparing for the future, they need to continue to drive business forward with data-driven insights. Here are resources from Robert Half and Protiviti to help you prepare your finance function for the road ahead. 2022 Global Finance Trends Survey.

The Reformed Broker

DECEMBER 1, 2022

LET’S GIVE A ROUND OF APPLAUSE TO SAM BANKMAN-FRIED pic.twitter.com/HIVB3nTX2V — The_Real_Fly (@The_Real_Fly) November 30, 2022 Last night’s interview between the New York Times’ Andrew Ross Sorkin and Sam Bankman-Fried ended with the host thanking the accused criminal mastermind for coming, despite the protestations of his lawyers. The audience applauded as the screen went black.

CFO Dive

DECEMBER 9, 2022

FTX’s collapse underscores the highly-centralized crypto market’s risks and blockchain’s importance as a defense against bad actors, Metallicus' CFO argues.

Speaker: James Kahler, COO of Full Course

Ever wondered where to splurge and where to safely conserve when it comes to operating and growing your restaurant? 🤔 Join James Kahler, COO of Full Course and industry visionary, in this new webinar where he'll talk all about best practices to invest in your restaurant's success! Whether you're a new business or an established restaurant, a seasoned pro or a rookie, you'll learn the keys to sustainable success in this competitive industry.

CFO News

DECEMBER 4, 2022

Most finance heads vouch for the India growth story and say prospects in the medium to long term are intact. However, they are worried about inflation and recession.

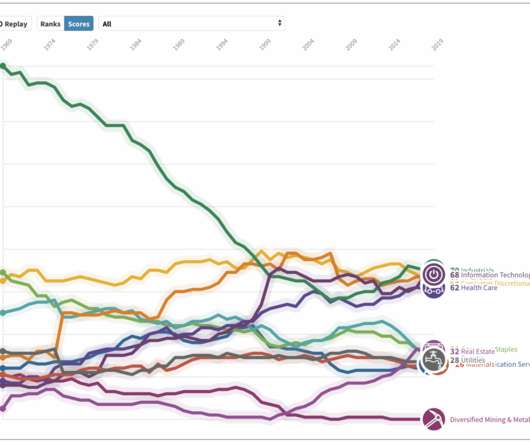

Barry Ritholtz

DECEMBER 30, 2022

Source: QAD Blog. A perfect way to end the 2022 annus horriblis is to remind readers that not just individual stocks, but entire sectors fall in and out of favor. It iss extremely challenging to select the right sector at the right time (and for the right reasons). Almost nobody does this well consistently over time. Here is QAD from 2019: In business, change is inevitable , and those that fail to adapt and innovate are often doomed to failure.

Navigator SAP

DECEMBER 9, 2022

The life science industry has to meet strict regulatory requirements in an extremely competitive environment burdened with financial pressures and unique market demands. Companies in this field can spend years in product development, conceptualizing, and running preliminary clinical trials before they can get approval from the FDA to manufacture and sell a product to consumers.

CFA Institute

DECEMBER 21, 2022

Investors can protect themselves from the next bubble by recognizing the trajectory that most follow.

Speaker: Jamie Eagan

As organizations strive for agility and efficiency, it's imperative for finance leaders to embrace innovative technologies and redefine traditional processes. Join us as we explore the pivotal role of digitalization and automation in reshaping what is commonly referred to as the “last mile of reporting”. We’ll deep-dive into why digitalization is no longer a choice, but a necessity for finance departments to stay competitive in a fast-paced environment touching on: 2024 trends for the Office of

The Reformed Broker

DECEMBER 8, 2022

Each Christmas season I do a webinar with my friends at YCharts where we take a look back at the most important charts of the year and discuss which of these trends will remain important going forward. It’s always a lot of fun and registration is free. This takes place tomorrow (Friday) December 9th at 12 noon ET (11am CT). This is a presentation for wealth management and asset management professionals, you can reg.

CFO Dive

DECEMBER 19, 2022

So long as the U.S. economy averts a deep recession, KPMG’s Greg Engel says financial executives can likely expect a steadier tax climate and no major new tax laws to 2023.

CFO News

DECEMBER 13, 2022

The value of the new deals could amount to nearly a fifth of the global IT services business valued at $800 billion, according to Ray Wang, founder of Silicon Valley-based Constellation Research.

Barry Ritholtz

DECEMBER 16, 2022

There seems to be a lot of confusion going on today with respect to inflation, interest rates, and ongoing Federal Reserve policy. A framework for exploring this has many parts: What the Fed (obviously) knows, how it express those views through police like FOMC rates, ZIRP, QE, QT, etc. There remains the question of what the Fed is actually wrong about. 1 .

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

Navigator SAP

DECEMBER 2, 2022

What if working remotely was exactly the same as working in the office?

Future CFO

DECEMBER 18, 2022

Growing economic volatility will continue to add uncertainty to an already challenging and unpredictable global business environment as we head into 2023. Business leaders will be expected to focus on strategic initiatives that will help them navigate through future headwinds and position their organisations for long-term growth and competitive success.

The Reformed Broker

DECEMBER 3, 2022

We’re having a live podcast taping to benefit one of our favorite charities, No Kid Hungry. It’s The Compound’s first ever Fan Appreciation Night and we’re joining forces with our friends at the On The Tape podcast to make it a great experience. Taping is December 16th at the Nasdaq Marketsite in Times Square. We’re reviewing the year that was and looking ahead to 2023.

CFO Dive

DECEMBER 1, 2022

Pricing pressures, labor costs and talent retention struggles are creating new forecasting challenges for financial and business leaders, the AICPA & CIMA survey found.

Advertisement

In this white paper, we explore the factors to consider in deciding whether the time is right for your Company to consider a new ERP or accounting software, the total cost of ownership and plans necessary to make the potential leap to these systems.

CFO News

DECEMBER 26, 2022

Trends like an increase in in-home consumption, Covid-19-induced premiumisation, and the power of brand recall for ordering home delivery are likely to continue, says Bittu Varghese.

Barry Ritholtz

DECEMBER 12, 2022

My back-to-work morning train WFH reads: • The sneaky economics of Ticketmaster : Ticketmaster’s maligned fees and customer service issues are again under the microscope. Will American music fans ever see anything better? ( The Hustle ). • What Is the Bond Market Saying About the Economy? The bond market is known for being much smarter than the stock market but we don’t have to go back very far to find a time when it was wrong.

Centage

DECEMBER 15, 2022

Why Accurate and Granular or Detailed Financial Reporting is Imperative During Times of Volatility. Business moves at a fast clip, whether during times of economic expansion or times of uncertainty like we are experiencing today. Often, CFOs and executive teams put together a plan that represents a snapshot of what they believe will happen, based on the best data they have available at the time.

Advertisement

Mastering data visualization in PowerPoint will help accelerate your career because it positions you as someone who can present data that drives business decisions forward. think-cell's PowerPoint Best Practices eBook was created specifically for professionals aiming to master the art and science of data-driven storytelling. What’s inside: Practical Insights: Uncover valuable tips for crafting engaging and persuasive presentations.

Let's personalize your content