What Are APIs and Why Are They Important to the Banking Industry?

Financial Application Programming Interfaces (Financial APIs) are the key to securely and efficiently exchanging consumer-permissioned data and are a catalyst for new innovations, revenue opportunities and integrations in the financial services industry.

Table of Contents

- What are Financial APIs?

- The 3 Types of APIs

- How Financial APIs work

- How APIs are changing the banking industry

- Open Banking and APIs

- APIs Are a Catalyst for New Revenue

- Examples of APIs in the Financial Industry

- APIs and Platform Banking

- APIs and Innovation

- APIs for Connectivity & Integration

- Why It's Important to Develop an API Strategy

- What's Slowing Down Digital Transformation at Banks?

- Breaking Barriers with APIs

- Setting the Standard

- API Quality

- Build, Buy, or Integrate

What are Financial APIs?

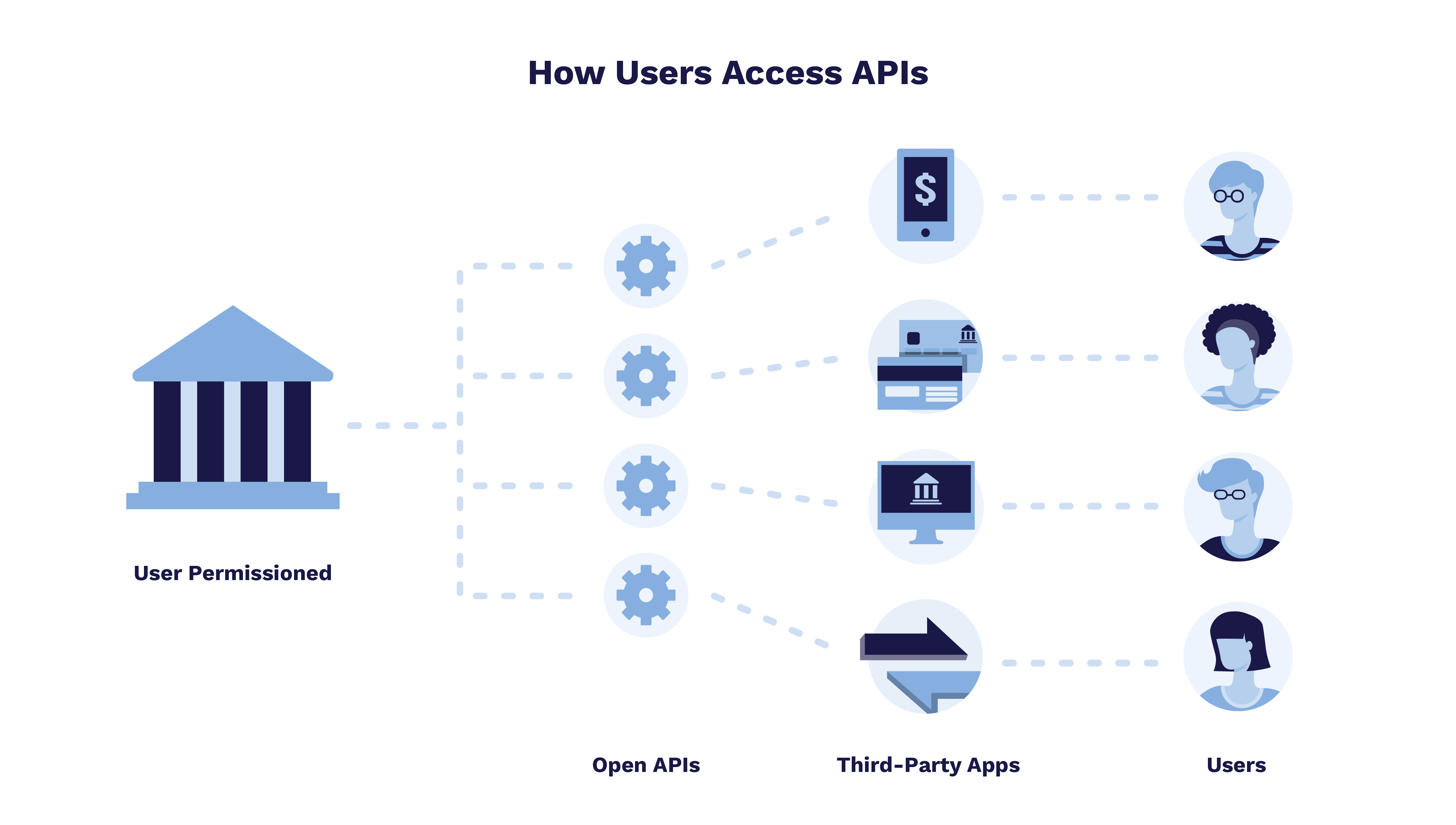

Revolutionizing consumer banking experiences, Financial Application Programming Interfaces (Financial APIs) are the key to securely and efficiently exchanging consumer-permissioned data. As a software application, APIs use a set of protocols and codes to enable communication between application software, essentially acting as an intermediary between financial institutions and third party software.

The 3 Types of APIs

There are three types of defined APIs: open, private, and partner.

- Open APIs: Open, or “Public” APIs are those in which access is granted to any third party, such as developers or external businesses. Any external party can connect to this API. Open APIs are the key to Open Banking and enable partnership between FIs and FinTechs.

- Partner APIs: Partner APIs are authorized for select business partners and external parties, such as developers or API consumers selected by the financial institution.

- Private APIs: Private APIs reflect a bank’s highest priorities and are only available within the organization. In focusing on internal departments, Private APIs enhance internal operations.

In using APIs, financial institutions can seamlessly connect their platforms to various products and services. Ultimately, APIs are the bridge between financial institutions holding data and FinTech services - they are the key to improved customer experiences. Through financial APIs, consumers can elect to share their financial data with third parties, such as FinTechs. In turn, financial APIs improve the user’s banking experience through increased visibility and control.

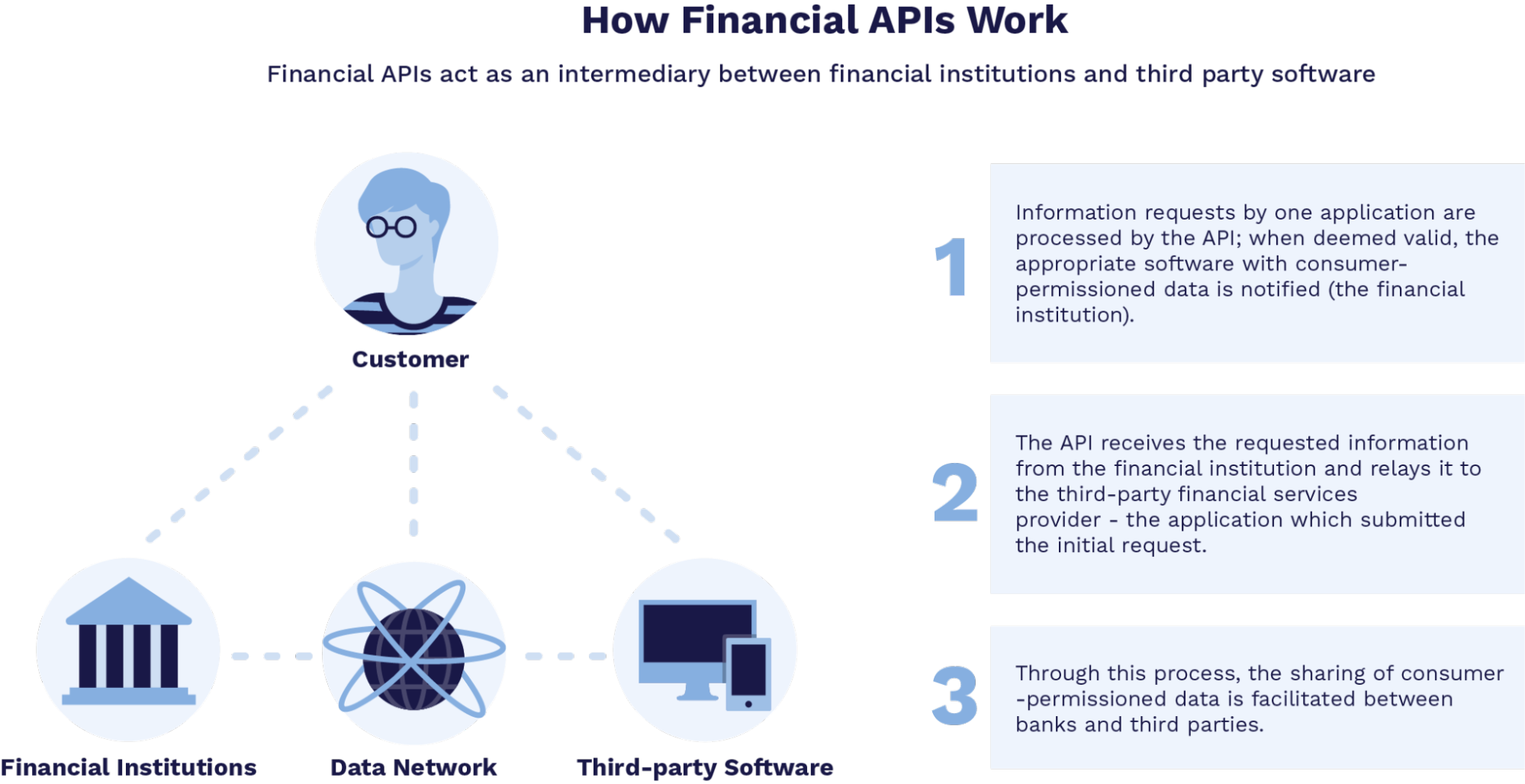

How Financial APIs Work

Financial APIs act as an intermediary between financial institutions and third party software. First, information requests by one application are processed by the API; when deemed valid, the financial institution holding consumer-permissioned data is notified. From there, the API receives the requested information and relays it to the third-party financial services provider - the application which submitted the initial request. Through this process, the sharing of consumer-permissioned data is facilitated between banks and third parties.

How Financial APIs Are Changing the Industry

Financial APIs are also referred to as ‘banking APIs’ or ‘open banking APIs’ and help customers connect their personal or business bank accounts to various financial services applications and products. Financial APIs are essential for financial institutions (FIs) to create the required digital products and experiences that reach their customers, quickly accelerating expectations. Not only are they essential to the customer experience, but they are also completely reshaping the financial services ecosystem, eliminating barriers to entry and creating more opportunities for innovation.

The big push for players in the financial sector to adapt an API strategy and to start using financial APIs has largely been driven by the rise of Open Banking. Open banking is built upon the idea of securely sharing access to consumer financial data. How exactly is this done? Through APIs.

Open Banking and APIs

Open Banking is an emerging banking practice which enables financial institutions to grant third party financial service providers access to consumer-permissioned data. As the key tool to share data across financial institutions and third parties, financial APIs enable the realization of Open Banking. APIs are the common denominator that create the foundation of technological developments in the banking space. As financial institutions continue to adopt Open Banking strategies, APIs will enable them to keep up and maintain a first-mover advantage.  Across the world, countries are developing and implementing open banking regulations. For example, in the European Union (EU), PSD2 mandates financial institutions to provide third party access to consumer-authorized data. Banks have abided by this mandate through open APIs. What this has meant for the industry is more innovation, FinTech collaboration, and improved customer experiences.

Across the world, countries are developing and implementing open banking regulations. For example, in the European Union (EU), PSD2 mandates financial institutions to provide third party access to consumer-authorized data. Banks have abided by this mandate through open APIs. What this has meant for the industry is more innovation, FinTech collaboration, and improved customer experiences.

Similar to the benefits of open banking for customers, innovation through financial APIs promise’s more access to alternative payment methods, improved visibility into your financial transactions, increased opportunities for automated processes, more efficient information reporting (IR) and reconciliation and more convenient and faster payments. Banks, FinTech and other players are increasingly putting more focus on APIs and creating these opportunities for their customers.

APIs Are a Catalyst for New Revenue

From 2019 to 2021, the number of financial institutions, who either invested in or developed APIs, has skyrocketed from 35% to 47%, and another 25% plan to do the same in 2022. As banks continue to explore creative ways to serve their customers, APIs present an opportunity to leverage transparent data access that will help their firms strengthen core capabilities, co-innovate with partners, and fuel growth that open new revenue streams.

Today’s shift in digital banking has extended the bounds of competition beyond traditional institutions. This means banks will need to step outside of their comfort zone and differentiate in ways that stand out to consumers and drive firm value. However, “digitizing” is not just simply the removal of manual, paper processes. Banks need to fully immerse themselves in redefining the customer journey itself, using APIs to streamline B2B interactions that enhance the commercial banking experience overall. In order for banks to do this, they must meet their customers where they are, on the devices they use, and when they use them—the perfect use case for APIs.

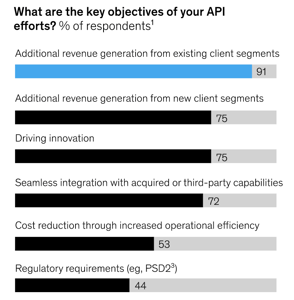

The value that APIs have brought to early adopters clearly cannot be understated. Once a one-off development challenge for technology-first firms, APIs have become a sustainable, competitive advantage that helps drive revenue for organizations across several different industries. Research has shown that over a four-year period, companies who invested in APIs saw 12.7% more growth in market capitalization than those who did not . McKinsey also reported that more than 90% of financial institutions use or plan to use APIs to generate additional revenue among existing customers, while three-quarters say they are seeking revenue streams from new client segments.

While these numbers emphasize the power that APIs can bring to the banking sector, it should be noted that we are not even close to the height of API innovation yet; this is just the tip of the iceberg. API functionality will only continue to evolve, growing the number of financial institutions who have formal API strategies along with it.

Examples of APIs in the Financial Industry

Open Banking through APIs is becoming more and more commonplace and astute Financial Institutions are taking the initiative. Making use of this innovative and expanding opportunity, Paul Margarites, head of U.S. commercial digital platforms and FinTech partnerships at TD Bank, in a recent interview, said that his team uses APIs to tie clients’ banking processes and services together.

“If I use TD [Bank] as a commercial client, I might use TD for my payments, I might use TD for my receivables, I might use TD for my trade, finance or lending,” Margarites said. “What we’ve done — and continue to do — is connect those experiences via APIs into a single experience through our commercial digital portal, so that the client gets the benefit of the various systems but in a single, unique experience.”

In a recent announcement, TD announced their new collaboration with FISPAN that enables TD to integrate their treasury management services into its clients’ enterprise resource planning (ERP) systems. Leveraging APIs, clients will be able to initiate payments, track payment status updates, and automate the corresponding journal entries; all from within their ERP system. They will also have access to account and transaction information within their ERP and will be able to streamline their reconciliation processes.

That single, unique experience is something all Banks and Financial Institutions want to bring to and provide for their commercial clients. There are numerous ways APIs can support that vision, whether it be for Platform Banking, Innovation, Integration or Connectivity.

APIs and Platform Banking

Banking-as-a-Service (BaaS) functionality, a key component of open banking, also relies on APIs. BaaS is the end-to-end process that connects third parties and FinTechs to banks’ systems directly through the use of APIs. These connections help banks allow third parties to offer customers financial products without needing to provide a full suite of banking services. This also enables them to increase their product and service offerings as they are built on top of the regulated infrastructure.

APIs and Innovation

APIs help accelerate innovation in the commercial banking sector, especially with co-innovation opportunities. With APIs, banks can seamlessly integrate new technologies as needed, required or demanded without having to go through the potentially costly expense of creating something net-new in house.

“The need for innovation and change, especially during these unprecedented times has accelerated corporate banks to move toward application programming interfaces (APIs), shortcuts that make it easier for software developers to build new applications and increase the productivity of teams. Innovative banks that are tapping into open APIs are becoming leaders in their market”, writes Clayton Weir, Co-Founder and CEO of FISPAN in a recent Toolbox.com byline.

APIs for Connectivity & Integration

The API integration controls what information is shared and allows information to be shared in real time. This is especially beneficial for commercial clients who may have multiple accounts requiring up to date information sharing between them.

Using APIs can help legacy systems communicate with newer systems by serving as a reliable translator between them and extending the lifespan of existing systems. Replacing legacy systems can be time consuming and cost prohibitive. By using APIs to support the integration, this allows banks to safely connect newer products and services like Enterprise Resource Planning (ERPs) to the specific banking data required to run those platforms. Another benefit? There’s no need to alter the legacy code and risk any errors in the process.

Why It’s Important to Develop an API Strategy

One Stop is Not Enough: In It For The Long Run

To realize long-term success in the new digital age, FIs must implement and establish a strong API strategy; a one step solution is not enough. Coined the “digital glue holding modern banks together” by Accenture, a solid base of APIs are critical for FIs to reach a higher level of digital innovation. The need for a long-term focus on data sharing - ultimately, a comprehensive API strategy, was echoed in Cornerstone Advisor’s Report. FIs must uphold the features and customer experiences enabled by APIs in order to maintain differentiated and value-added customer experiences.

By establishing a strong overarching API strategy, banks are better positioned to meet evolving consumer needs and respond to technological advancements. As evidenced by the intense digital transformation throughout the COVID-19 pandemic, rapid development can occur within the financial services industry over the next decade. In a survey conducted by McKinsey, banks considered enabling agility and driving innovation to be the second and fifth most important objectives they follow when implementing APIs, respectively. The collaborative model enabled by an API strategy will help banks keep up with the banking industry’s changing landscape.

What’s Slowing Down Digital Transformation at Banks?

There are many roadblocks for banks when it comes to updating their technology and systems internally, on top of offering new digital products and services to their customers. In addition, not every bank suffers from the same obstacles, but the one thing that is common across the board are legacy systems.

Legacy systems are outdated platforms that are the foundation of a bank’s back end operations, including across key functions and products like transaction processing, making deposits and account set-up. Cognizant observed that “due to legacy technology, proprietary data models, and limited ability to interface with other systems, legacy systems can restrict a bank’s ability to rapidly deliver new experiences, products, and services.” Investing in new systems to replace legacy systems should be a strategic priority for financial institutions as they move forward into the digital age.

Transitioning from legacy infrastructure while securing the newly implemented technologies infrastructure has put banks in a very challenging position. Keeping resources up to date with the latest trends and technologies in payment security is difficult. Shifting away from legacy systems would require a significant investment in tools, custom processes, training, integrations, ensuring security and recurring maintenance. It makes it extremely difficult for FI’s to meet customer demand, get products out to market and ensure the quality of this new technology without outsourcing.

“FI’s can certainly develop their own API in house to serve a specific purpose or service, but then they would have to update and individually integrate every FinTech to their legacy systems. Integrating to a cloud based platform is by far the better solution for an FI and they would benefit from access to multiple FinTech providers and services.” - FISPAN CEO, Clayton Weir

Banking APIs enable legacy systems to communicate with newer ones by creating a bridge between old and new. This benefits FIs by extending the usable lifespan of existing legacy systems all without having to make changes to the legacy code and possibly risk errors in the process. In the digital age, legacy software is one of the most significant barriers for modernization in the financial services sector.

FISPAN’s Head of Cybersecurity, Maryam Hamidirad wrote in Security Boulevard, “By leveraging APIs, not only can banks provide innovative solutions to their customers at a faster pace, but they can offload the heavy-lifting of building solutions to trusted third parties—saving them time and money. Furthermore, as more of the financial world shifts to open banking, having secure APIs in place will help banks more easily adjust to this new way of doing business.”

Through API’s, banks, FinTech and other players in the ecosystem can grow and innovate at a much faster pace. Utilizing the tools around you, not just internally, but understanding when to outsource, collaborate, partner, acquire or build is key to diversifying the financial services sector.

Breaking Barriers with APIs

APIs are nothing new, but the race to embrace digital transformation as a result of the pandemic has accelerated its widespread use globally, not just in tech. According to a 2020 State of API Report, more than half (55%) of API practitioners have only started to develop APIs in the last five years. But despite the transformation many businesses have come to rely on, some companies who have turned to APIs are noticing slower-than-expected development.

Why might this be the case? Although there are still several key challenges for APIs to overcome, three main issues need to be addressed first:

- The lack of standardization

- The risk of poor API quality

- The debate between buy versus build

Setting the Standard

APIs are dramatically changing the way businesses operate and share information- specifically, between financial institutions (FIs) and third-party providers like FinTechs. The National Automated Clearing House Association (NACHA) says that consumers' needs for “digital experiences extend beyond the traditional boundaries of the bank franchise and it is through APIs that leading institutions are reaching new customers, delivering new services and doing so with lower incremental expense.” Yet, the capacity to which businesses can fully benefit from APIs is still to be discovered—that’s where standardization comes in.

Today, many banks lack the advanced infrastructure needed to keep up with the pace of the industry, especially when you take into account the growing number of neo-banks who threaten the traditional nature of financial services. Tied down by strict regulation and highly bureaucratic organization structures, commercial FIs become stuck in their ways with multiple legacy systems that require hundreds upon hundreds of customized processes and APIs. It’s no wonder that API standardization is the top challenge for 58% of these organizations.

Without standardization, developers must make modifications to each and every application that is used to interact with a bank when changes or updates are needed. However, with standardization, a developer can create a single platform that serves a multitude of different functions for several banks at once. A standardized approach can also help FIs better leverage their technology for innovation, implement and deliver new capabilities more quickly, reduce fraud and risk through transparent transactions and increased speed of communications, as well as meet evolving client needs while maintaining security . Ultimately, having API standards not only improves the consistency, compatibility, and sustainability of the developer experience and organization as a whole, but it will also contribute to the ease of API consumption on behalf of the user.

API Quality

Another challenge with the deployment of APIs is its quality—is it resilient, robust, secure, discoverable, and consistent? The highest quality APIs are the ones that are going to attract and retain a business’ most important clients in the long-run. However, investing the time and resources into ensuring such quality is not always at the top of the list; 52% of developers say the biggest obstacle to ensuring API quality is a lack of time due to workload. When quality is not prioritized, companies are forced to assume risk in several other areas that may result in additional loss: loss of time and resources spent troubleshooting, and a loss of customers whose expectations are not being fulfilled.

Build, Buy or Integrate

Once a business has committed to investing in APIs, the next decision becomes a matter of whether it is best to build the technology in-house or to buy a third-party, ready-made solution.

While many companies may be keen to kickstart their own API development, you’d be surprised to find out how many large IT projects at enterprise banking and financial services firms get delayed, overrun, and fail to deliver on the business value that was initially promised. The truth is, internal API development is often coupled with over-budgets and missed delivery deadlines. With nearly half (48%) of financial institutions noting that their legacy systems aren’t sufficient to respond to the evolving needs of both their commercial and noncommercial customers, partnerships with FinTechs are integral to stay ahead of the changing payments landscape.

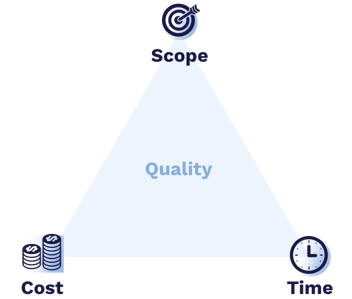

The reason why buying an API portal is ultimately better than building one comes down to the iron triangle (or triple constraint) of project management.

Any new project requires an investment of time, cost, and scope, all of which are balanced by a certain standard of quality. But when developing your own APIs become much too time-intensive, cost-driving, and out of scope, the ability to achieve this desired quality moves further out of reach.

Think of it this way: you can either choose to compromise API quality as you attempt to strike a balance between deadlines, budgets, and product features, or you can buy an off-the-shelf product from a company who has dedicated their entire business to developing APIs.

Through partnerships with FinTechs, financial institutions are better poised to offer Embedded Banking, real-time data exchange, real-time payments, and capitalize on the rise of Open Banking. These collaborations enable banks to extend beyond simple monetization of APIs and into more revenue-achieving activities.

By integrating with partners to develop their APIs, financial institutions can implement and fast-track their API strategies. Our blog post, “FinTechs Are Friends, Not Foes,” details the benefits of partnering with third parties like FinTechs (and FISPAN). By partnering with third parties, financial institutions can better focus on their core competencies and on their evolving consumer needs, without worrying about the speed to market and upkeep which accompanies the development of in-house APIs.

At the end of the day, APIs are no longer the nascent technology that allowed commercial banks to justify their traditional ways of banking. APIs are now a necessary part of an increasingly digital world that is changing how customers access financial services altogether.