How Can a CFO Impact Your Customer Acquisition Cost and Lifetime Value?

Author: Larry Chester, President

We all understand that customer acquisition cost (CAC) and lifetime value (LTV) are all about data. It’s about information—and a CFO lives and breathes the data that’s involved in running your company. So, let’s talk about how a CFO can impact your customer acquisition cost and the lifetime value of that customer.

Better yet, we have Larry Chester, President of CFO Simplified on camera to answer the question: “How can a CFO impact your customer acquisition cost and lifetime value?”

Calculating Your Customer Acquisition Cost

Let’s look at customer acquisition first.

As a business owner, you need to understand what your total cost of marketing and sales is. This might include the amount you’re spending on:

- Digital marketing

- Brochures

- Advertising

- Marketing salaries and bonuses (which depend on whether you’re marketing is outsourced or in-house)

- Base salaries and commissions for your sales team

- Administrative staff salaries (supporting your sales department)

In addition, you must look at what your specific targeted marketing costs are. For example, are there specific programs that you’ve put together to draw customers in? Do you have a special program that you’re providing a promotion for? Special discounts? An additional product that you’re giving away as an incentive? Money that you’re spending to go to trade shows? Discounts you’re providing?

All of these expenses are part of your general marketing costs.

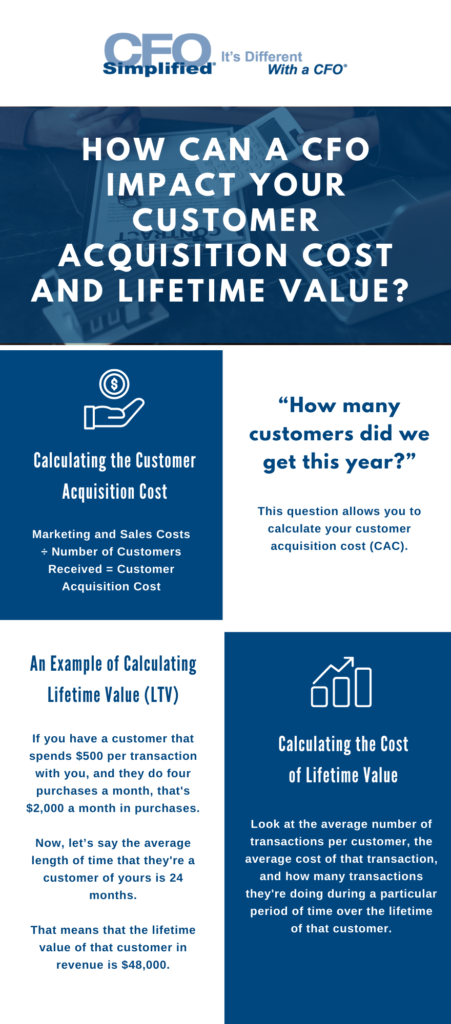

Now, you can do the math when you add all of this together, sit down and ask, “How many customers did we get this year?”

Divide the total amount of marketing and sales support dollars by the number of customers that you’ve received—this will tell you what your customer acquisition cost is.

Marketing and Sales Costs ÷ Number of Customers Received = Customer Acquisition Cost

Calculating the Lifetime Value of Your Customer

There’s another piece to this that’s even more important, and that is what is the lifetime value of your customer?

The fact that you get a customer isn’t as important as how much revenue or actually how much net income is being generated by that customer.

Take a look at the average number of transactions per customer, what the average cost of that transaction is, and how many transactions they’re doing during a particular period of time. Let’s consider this over the lifetime that the customer is on board with you.

These three elements are going to tell you what your lifetime value of that customer is.

An Example of Calculating Lifetime Value

For example, if you have a customer that spends $500 per transaction with you, and they do four purchases a month with you, that’s $2,000 a month in purchases.

$500 per transaction x 4 transactions per month = $2,000 a month in revenue

Now, let’s say the average length of time that they’re a customer of yours is 24 months or two years.

That means that the lifetime value of that customer in revenue is $48,000.

$2,000 a month x 24 months = $48,000 in revenue over two years

Now, that certainly doesn’t mean that you could spend $48,000 to get that customer and break even.

However, that’s the total revenue that you’re going to be receiving while they’re a customer.

How Can a CFO Impact Your CAC and LTV?

Certainly, given the previous example, the amount you spend to acquire a customer and the net income from that customer is going to be a factor you want to consider in your customer acquisition cost.

A CFO can directly impact the cost of your customer acquisition and lifetime value considering that these individuals are up to their knees in customer acquisition cost and lifetime value data on a daily basis. A CFO can help steer your business in the right direction by properly measuring and understanding these metrics.

Interested in learning more? Read on to find out if your business is ready for a part-time CFO.

Related Posts

Cash Flow Solutions –

Twelve Things To Do If You’re Cash Short

Every business ends up short of cash from time to time. But there’s short of cash, and then there’s SHORT

Protecting Your Law Firm

As we’ve worked increasingly with law firms over the past few years, there are a number of commonalities that we’ve

Get Clarity On Your

Company’s Performance

Our people are unique CFOs. They are all operationally

based financial executives.