Why Inflation Has Been Falling…

Barry Ritholtz

JANUARY 13, 2023

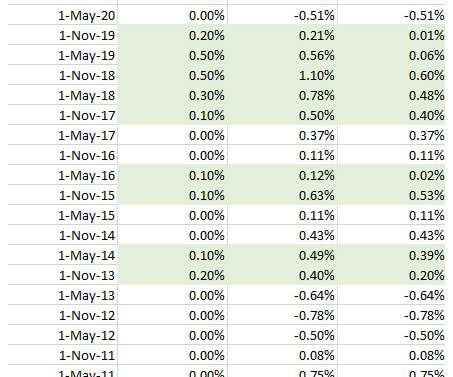

It may surprise you to learn that during this cycle of falling inflation, there seems to be little correlation with rising Fed Rates. This is very counter-intuitive but it makes sense when you consider what an aberrational and unusual cycle this has been. Despite zero rates for a decade plus inflation was quite benign. it was only the combination of the global pandemic and lockdown, a massive fiscal stimulus, and a surge in demand for goods that have driven the 2020 to 2022 inflation.

Let's personalize your content