Fixed rate for Series EE Savings Bonds soars from 0.1% to 2.1%; doubling period remains at 20 years.

By David Enna, Tipswatch.com

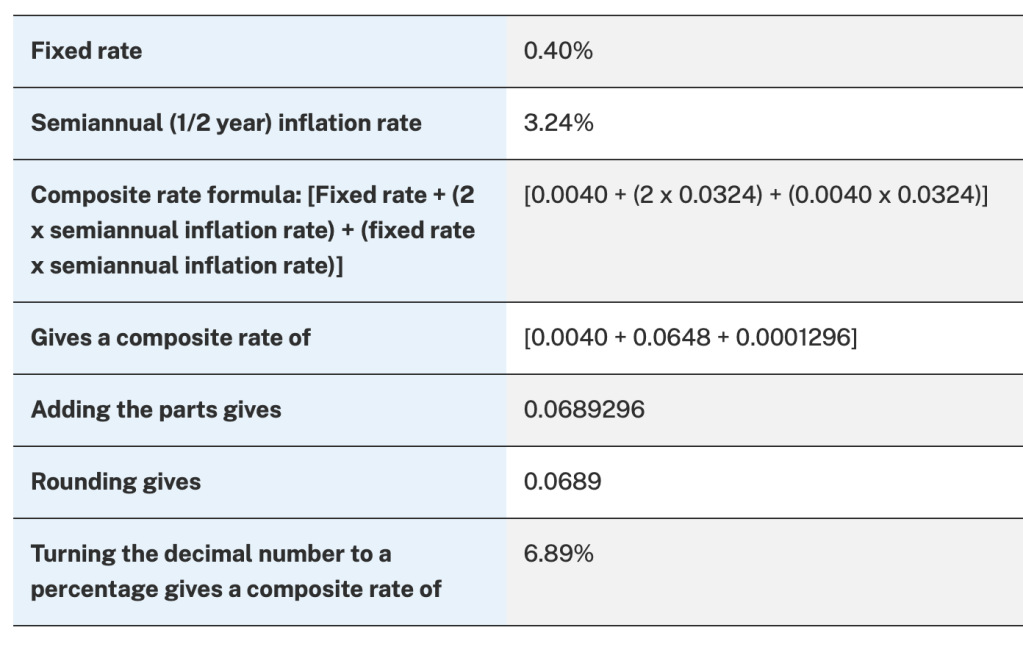

The U.S. Treasury announced this morning it is raising the fixed rate of the U.S Series I Savings Bond from 0.0% to 0.4% for I Bonds purchased from November 2022 through April 2023. This combines with the new inflation-adjusted variable rate of 6.48% to create a composite return of 6.89% for purchases from November to April.

Here is the announcement:

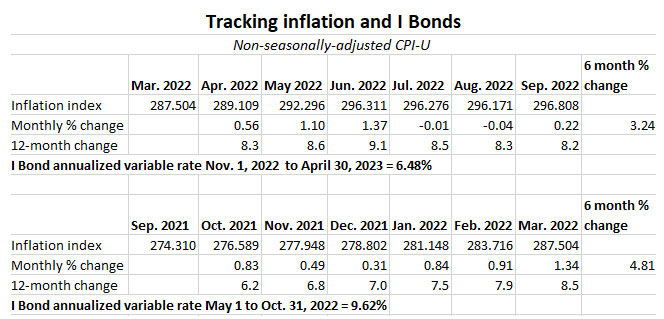

The composite rate for Series I Savings Bonds is a combination of a fixed rate, which applies for the 30-year life of the bond, and the semiannual inflation rate. The 6.89% composite rate for I bonds bought from November 2022 through April 2023 applies for the first six months after the issue date. The composite rate combines a 0.40% fixed rate of return with the 6.48% annualized rate of inflation as measured by the Consumer Price Index for all Urban Consumers (CPI-U). The CPI-U increased from 287.504 in March 2022 to 296.808 in September 2022, a six-month change of 3.24%.

And here is my translation:

- An I Bond earns interest based on combining a fixed rate and a semi-annual inflation rate. The fixed rate – which now rises to 0.4% – will never change. So I Bonds purchased from November 1, 2022, to April 30, 2023, will carry a fixed rate of 0.4% through the 30-year potential life of the bond.

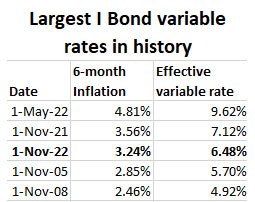

- The inflation-adjusted rate (also called the variable rate) changes every six months to reflect the running rate of non-seasonally adjusted inflation. That rate is now set at 6.48% annualized, down from the current 9.62%. It will update again on May 1, 2023, based on U.S. inflation from September 2022 to March 2023.

- The combination of the fixed rate and inflation-adjusted rate creates the I Bonds’ composite interest rate, which was 9.62% but now falls to 6.89%, still very attractive. An I Bond bought today will earn 6.89% (annualized) for six months and then get a new composite rate every six months for its 30-year term. The fixed rate will remain at 0.4% for the life of the I Bond.

Here is how the Treasury calculated the I Bond’s new composite rate:

It’s important to note, however, that all I Bonds — no matter when they were issued — will get that 6.48% inflation-adjusted rate for six months (annualized), on top of any existing fixed rate. So an I Bond purchased in October will receive 9.62% for six months, and then 6.48% for six months.

There has been a lot of news coverage lately noting that the I Bond’s variable rate was “falling off a cliff,” but that 6.48% rate is highly attractive and is the third-highest inflation-adjusted rate in I Bond history.

Here are the inflation numbers used to determine the new inflation-adjusted variable rate:

Obviously, I Bonds remain a very attractive investment. A higher fixed rate is always preferable, since it remains with the I Bond for the entire potential term of 30 years. The composite rate of 6.89% is much better than any other very safe investment, and this one comes with future inflation protection.

I advise using I Bonds as a long-term investment, building up a large store of inflation-protected cash. And I’d absolutely advise against selling any I Bonds you currently own until three months beyond the time when both the 9.62% and 6.48% variable rates are complete. (If you haven’t owned the I Bond for 5 years, you will lose the latest three months of interest.)

The month that triggers the new 6.48% variable rate depends on the month that you originally bought the I Bond.

| Issue month of your bond | New rates take effect |

|---|---|

| January | January 1 and July 1 |

| February | February 1 and August 1 |

| March | March 1 and September 1 |

| April | April 1 and October 1 |

| May | May 1 and November 1 |

| June | June 1 and December 1 |

| July | July 1 and January 1 |

| August | August 1 and February 1 |

| September | September 1 and March 1 |

| October | October 1 and April 1 |

| November | November 1 and May 1 |

| December | December 1 and June 1 |

The fixed rate of an I Bond is equivalent to the “real yield” of a Treasury Inflation-Protected Security. It tells you how much the I Bond will yield above the official U.S. inflation rate. So, for these new I Bonds issued from November to April, the investment will earn 0.4% above official U.S. inflation for up to 30 years. A higher fixed rate is a very good reason to hold the I Bond long term.

And remember: The I Bond’s purchase cap of $10,000 per person per year will reset on January 1, so everyone will have access to this 0.4% fixed rate in 2023.

EE Bond gets higher fixed rate

Here is the Treasury’s announcement:

Series EE bonds issued from November 2022 through April 2023 earn today’s announced rate of 2.10%. All Series EE bonds issued since May 2005 earn a fixed rate in the first 20 years after issue. At 20 years, the bonds will be worth at least two times their purchase price. The bonds will continue to earn interest at their original fixed rate for an additional 10 years unless new terms and conditions are announced before the final 10-year period begins.

And here is my translation:

- The EE Bonds’ fixed rate soars from a paltry 0.1% (where it has been since November 2015) to a more competitive 2.1%. This is a huge upgrade for EE Bond investors, but keep in mind …

- An EE Bond held for 20 years immediately doubles in value, creating an investment with a compounded return of 3.53%, tax-deferred. So, if you invest $10,000 at age 40, you can collect $20,000 at age 60, with $10,000 of that total becoming taxable.

- After the doubling in value at 20 years, the EE Bond will revert to earning 2.1 % for another 10 years.

This change to the fixed rate is a big deal because under the old fixed rate of 0.1%, it made no sense to invest in an EE Bonds unless you could absolutely hold it for 20 years. Now it makes sense to hold for 20 years, but it isn’t an absolute necessity.

But even with the higher fixed rate, EE Bonds in November 2022 aren’t particularly attractive, since you can get 4.66% right now on a 1-year Treasury bill, or 4.44% on a 20-year bond.

The EE Bond will outperform an I Bond with a fixed rate of 0.4% if inflation averages less than about 3.1% a year over the next 20 years. I think that is a possibility (but who knows, given current inflation trends).

• Confused by I Bonds? Read my Q&A on I Bonds

• Let’s ‘try’ to clarify how an I Bond’s interest is calculated

• Inflation and I Bonds: Track the variable rate changes

• I Bond Manifesto: How this investment can work as an emergency fund

* * *

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. The investments he discusses can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

Pingback: 2022 in review: Scary year for inflation, better year for inflation protection | Treasury Inflation-Protected Securities

Very appreciative of the information in your blog David! I have lot’s to learn. I use Schwab for a broker. As I compare different issues on the secondary market why can’t I make the assumption that my return will be exactly the same for all of the offered issues if I return adjust for the difference in YTM at purchase? Obviously, I’m assuming identical terms and ignoring the impact of unlikely deflation. I guess what I’m suggesting is that the issue offered with the highest YTM is the better buy and I don’t have to be concerned with any other factors. Am I correct or incorrect in my analysis?

I’d say that you do need to look at the term of the investment and realize that TIPS of different maturities will have different sets of expected real yields. Normally, the longer the term, the higher the real yield, but that is not true today with the flat or slightly inverted yield curve. The amount of accrued principal you are purchasing is also a factor, because it appears investors will want a higher real yield when the accrued principal is higher. In general, though, YTM is the most important factor and the one to focus on.

Hello, David, and thank you for this hugely useful website.

For someone who tries to buy I Bonds to the annual limit (mostly because I have a robust emergency fund and am transitioning it to I Bonds for inflation protection), do you have any advice about buying in January versus waiting until May or November? E.g. should I take advantage of that 0.4% fixed rate in the fear that it may revert to 0.0%, or hold off in the hope that it may rise higher? Or hedge my bets by splitting my purchases between Jan-Apr and May-Oct (and Nov-Dec)? Or wait until April so that I will know what new variable rate will go into effect in May?

Two clear advantages of just buying in January are that I will get that many more months of earning interest at I Bond rates rather than bank rates, and I will be that many months closer to liquidity and to being able to cash out without an interest forfeiture. But I don’t know how to balance that against the other considerations. Another advantage of buying in Jan-April is that if the recent inflationary trend proves to be transient, I will have maximized the upside. So I guess maybe I’m leaning towards January? But then if the fixed rate goes up in May I’ll kick myself about not being able to take advantage of it …

I will write about this in early January, but your thinking looks solid. If you are creating an emergency fund and trying to get to 5 years as quickly as possible, buying in January makes sense, if you have the money available. Waiting until mid-April means you can scope out current conditions (including the new variable rate) and still get the same return as in January, just delayed.

I’m curious about thoughts on EE bonds. I began purchasing them in Aug 2020. At the time I found them competitive with annuities. Buy 10k a year, cash after 20 yrs, having achieved age 82. This plan compared favorably with an annuity beginning in 20 yrs. Of course, rates are higher now.

I purchased 10k each time in Aug 2020, Jan 2021 and Jan of 2022. I’m considering cashing the 2022 batch, taking the piddling interest and possibly buying the new ones at 2.1%. I would retain the first two batches since I have only an 18 yr holding period to double value.

I will buy 10k of I bonds in any event.

You do need to hold the EE Bonds one year before you can cash them. Back in August 2020, your strategy made perfect sense, because the 20-year Treasury was yielding just 1% at that time, versus 3.53% for the EE Bond held 20 years. One good thing about redeeming now is that you will owe very little tax. You could also look at other Treasury alternatives, such as a 10-year note or 20-year bond, but those will be subject to market fluctuations.

Hi David and all readers,

What do you all think/opinion about 2, 3 and 5 years Note?

Thanks

All of these look like strong options right now. Rates could continue to climb, but these are solid yields. I’d love to see the 5-year hit 5%.

Thanks David. I always love to read your articles about financing/saving such as I-bond and TIPS. I bought my first TIPS last month after learning from your article. I definitely buy 5 years note if it hits 5%.

Because Treasury Direct does not act as custodian for IRA accounts, TIPs cannot be purchased directly from TD by an IRA account, so the IRA owner would need to use an outside party – presumably a broker – to act as IRA custodian. While brokers can of course purchase TIPs in the secondary market for IRA accounts, it appears that that they cannot purchase new TIPs issues from TD on behalf of IRAs. If that is true, then IRAs cannot own new TIPs issues under any circumstances – is that correct?

No, that is not correct. You can buy a new or reopened TIPS at auction in any major brokerage account, most often without any fees or commission. I do this all the time at Vanguard.

Fixed Rate Fanatics rejoice!!

Dear readers: Some of the comments on this article were getting off topic and divisive. Please stay on topic. Thank you.

What is the initial rate for a paper I Bond issued pursuant to IRS Form 8888 (allocation of tax refund)? Treasury Regulation? Treasury Reg Section 359.27 states that the issue date of a definitive Series I savings bond is the first day of the month in which the authorized issuing agent “received payment.” In the case of a tax refund, this date would be April 15 which is the due date for the return for the prior year, even though the tax return may not be processed until November. This is a major issue for many who filed Form 8888. The initial accrual rate has a big impact over 30 years.

Wouldn’t the date be the date the IRS finishes processing the return and issues the refund?

The date will be the month the paper I Bond is issued. So: Don’t wait until too late to file your return.

Due to the massive popularity of I-bonds, the lag time between filing and bond issuance is increasing. A few examples:

2021: e-filed 5/02, bonds issued 5/13

2021: e-filed 5/18, bonds issued 5/27

2022: e-filed 2/17, bonds issued 3/08

2022: e-filed 4/05, bonds issued 5/05 (ouch!)

paper filed 2/22, bond issued 7/17 with 7/1 date. double ouch

The composite rate was lower because the CPI component (the adjustable rate) was lower. The fixed rate is set separately from that.

In fact, the fixed rate is set whatever the Treasury Secretary feels like it should be. Bad mood: 0%. Decent mood: 0.4%.

Any hope for the maximum annual investment for I-bonds rising above the $10,000 per SS#? You mused about a potential executive order that could raise the cap to $100,000 earlier this year, but I think it was for illustrative purposes.

I invest the max for myself and my wife on January 1st every year, have been doing so since 2011, and really hope they raise the max! You hearing anything about a potential raise?

There was no mention of raising the cap today, and TreasuryDirect still lists it as $10,000 per person per year.

A key difference between TIPS and I Bonds: With TIPS you are investing in anticipated future inflation; With I Bonds you are investing in 6-11 months of past known inflation, then anticipated future inflation. That’s what has made I Bonds winners over the past 12 months.

True, but people who bought TIPS a year ago got a very similar inflation adjustment. The problem back then was negative real yields.

That’s exactly (as you have noted many times) why I Bonds make sense instead of TIPS when real yields are negative.

Do you know if the Treasury will issue paper I Bonds bought with tax refunds before May 1, 2023, or will they wait until after May 1 to issue them? Or is the issue date based more on how early you file?

Here is an article trashing I-bonds. https://www.forbes.com/sites/baldwin/2022/06/12/i-bonds-and-tips-compared-which-are-a-better-buy/?sh=646cd6004236

Your comments please.

What do you expect from Forbes?

The whole point of iBonds is low risk inflation protection.

Right now, TIPS have a better yield.

But iBonds give you more flexibilty.

I just use them as a tax deferred inflation protected rainy day fund.

After 5 years, there’s no interest penalty.

Before that it’s a 3 month interest penalty.

Try getting that on a 5 year CD.

There’s no doubt that the purchasing limit on I bonds, plus having to deal with the Treasury Direct site rather than a broker of your choice, is a huge negative. Not to mention adding another complication to your portfolio.

But I still like them, just about. For intelligent investors of modest wealth, they make sense. Liquidity after one year is a huge benefit, albeit with interest penalty.

The more money you have, the less sense they make, in all honesty. Unless you actually put alot of money into them over the years! In which case you are a bit of an outlier.

Seems to me that TIPs are still a better investment than I-Bonds, even with the higher fixed rate.

However, my plan now is to put $5K into I-Bond in January and then wait and see what inflation is going to do. If inflation keeps dropping, then I probably will no longer add to my I-Bond investments but move the TIPs and/or Treasury Notes instead. If inflation stays high, the I-Bonds could be the better deal.

I was also thinking of putting in $5k into an I bond in January, and then playing wait and see…perhaps putting cash into CD ladders instead if inflation heads downward (since I don’t understand TIPS and probably never will).

It’s hard to justify buying an EE Bond as a personal investment. To me, it continues to be more appropriate to buy as a gift for a child which can be stashed for their future. You can do better than 2.1% for a personal investment with a treasury bond and most dividend-yielding stocks.

An I Bond, on the other hand, continues to be an excellent personal investment for these historically high inflationary times. If you purchased an I Bond at the end of last year, you received 7.12% annualized for the first 6 months, 9.62% annualized for the next 6 months, and now 6.48% for the upcoming 6 months. That’s a guaranteed return that can’t be beat and the three highest rates ever for I Bonds.

If you buy an I Bond now through April, the 6.89% rate inclusive of the 0.4% fixed rate is still very attractive. With inflation expected to moderate due to the Fed actions, you can always redeem in 15 months and be ahead of the game if that’s indeed what happens.

EE Bonds have their appeal, especially now that the rate is 2.1%. Where else can you guaranty a 2% return (possibly 3.55% if held at least 20 years) with practically 0 risk of loss of principal and 0 interest rate risk?

Right now, a high yield savings account might be yielding a bit more than 2.1%, but this is not guaranteed for 30 years. In fact, I’m pretty confident that at some point over the next few years, the economy will tank and the Fed will drop rates back down to 0. When this happens, an EE bond paying 2.1% will look amazing.

You might say, well you can lock in a 30 year treasury with a 4% rate, which makes the EE bond’s 2.1% look pathetic. Fair enough, but when interest rates drop, the treasury bond will take a hit while the EE bond will not have lost a dime.

No one is getting rich off of EE bonds, but other than I bonds, I don’t see a superior investment if the goal is to have ultra safe investments.

Very good points

I should have said if interest rates go up, the treasury will tank while the EE bond will not lose value.

The best guess right now is that short-term rates will increase with Fed actions and long term rates will decrease because of exactly what you said. Therefore, a 20 or 30 year treasury seems to be the superior choice over an EE Bond.

Your comments about the EE having appeal are right on target because of the certainty. The terms are clear – the 2.1% fixed interest rate and the guarantee of a double after twenty years that locks in an annualized ~3.6% regardless of what the entire USA treasury yield curve (currently the highest since 2006).

I started buying the EE twenty+ years ago with no regrets.

As your general belief is lower interest rates and the goal is to be “ultra safe” your thought process is solid. Even if interest rates increase and stay elevated, your exit would be far less painful with the current 2.1% versus that .1% rate since 2015.

Main drawback of EE bonds is their tax treatment. You have to pay federal taxes when selling.

Thus, if you plan to hold until maturity, buying a note or bond in an IRA is the better deal right now than buying an EE bond.

Of course if you are at an age for the dreaded IRA RMDs taxes are still a consideration for TIPS – fed *and* state (CA for me, ugh). Puts a dent in the inflation “protection”, alas.

What are you talking about? Roth IRAs have no taxes on withdrawal.

He’s talking about traditional IRAs. Roth IRAs do not have RMDs.

As Diego pointed out the mention of RMDs should have been the clue that he was discussing traditional IRA and not Roth (which does not have RMDs).

RMDs can be a killer when tax time comes, so if you are holding in an account that has RMDs, it’s something you’ll need to consider in your tax planning.

But isn’t being in a high tax bracket when retired, fundamentally a rich person’s problem?

I expect my tax bracket to plummet in retirement.

Define rich.

A middle class worker can build up quite a large 401k next egg by the time they retire. RMDs on that nest egg can actually result in them having a higher tax bracket in retirement than they had while working (or at the very least not as low a bracket as they were expecting).

If, over your lifetime, you’ve saved a good amount into tax deferred accounts like 401ks and traditional IRAs. You just may discover that you too have a “rich persons problem” as your tax bracket might not be as low as you think it will be when RMDs start.

I doubt if most middle class workers are able to max out 401ks and Roths until they are least mid career if they are trying pay down mortgages, etc. when they are younger and are not at peak salary. I would say that anyone who can defer withdrawing from the 401k until 72 and the RMDs produce more cash than they need, then they are not in too much of a position to complain, when there are retirees trying to get by on $20,000 a year.

Well, of course. Anyone paying RMDs shouldn’t really complain because that money was never taxed. Still, it makes solid sense for someone to create a strategy to smartly reduce future RMDs by doing Roth conversions or withdrawals. One big issue with RMDs for non-rich people is that they can trigger higher Medicare costs, which can get pricey just by going $1 over any of the income limits.

If you have TIPS in your retirement fund you have to realize that the interest on TIPS will not be enough to cover your RMD.

So, you either have to ladder your TIPS bonds maturities, or have RMD funds available from some other retirement account.

“Well, of course. Anyone paying RMDs shouldn’t really complain because that money was never taxed.”

Except the unrealized capital gains in a taxable account is never taxed too. Unlike taxable accounts, where capital gains are not taxed until realized and never taxed if you die, in an IRA account is starts getting taxed at age 72 regardless if you realize capital gains. To me, this doesn’t make sense to allow this inequity between taxable and IRA accounts

It’s not a matter of complaining, it’s a matter of dealing with the tax consequences that RMDs can bring.

“Anyone paying RMDs shouldn’t really complain”

I know it wasn’t your choice of wording, but I don’t really think it’s fair to characterize the discussion of tax consequences of RMDs as “complaining”.

The thing to remember is that the money in deferred tax accounts (like 401ks), as you point out, was not taxed. That means the “high bracket” working years of those account holders was lower taxable income (and potentially an accompanying lower tax bracket) than they otherwise would have been, so it should not be much of a surprise that such an account holder may end up with higher taxable income (and potentially an accompanying higher tax bracket) in their retirement years than they were expecting.

The thing is (as you hinted at with Medicare costs) that higher income/tax bracket isn’t the whole story. In your retirement years, there’s all kinds of income dependent thresholds to benefits (up to 85% of your SS benefits can be taxable, IRMAA for Medicare, etc.) that come into play resulting in a bigger tax bite than one might think.

” in an IRA account is starts getting taxed at age 72 regardless if you realize capital gains”

Depends on how you take your RMD. If you are selling assets in the account in order to take the required distribution (as many deferred tax account holders do) you would, in effect, be realizing the gain.

Perhaps this has been answered before. I know that the rate on i-bonds can never go below 0%, even if we have deflation. But is that the composite rate that will be set at 0%? Or only the variable rate? For example, let’s say inflation runs at -1.0%, would an i-bond with a 0.4% fixed rate earn 0.0% or 0.4% (annualized) for that 6-month period?

The composite rate can never go below 0.0%, but if the variable rate is negative, it can wipe out any fixed rate on the I Bond for the next six months. So in your example. the composite rate would be 0.0%.

Thank you so much for taking the time to reply 🙂

The mention of October 2023 in reference to the I bond rate to be announced on May 1, 2023 is not correct. You probably mean March 2023.

This is fixed. Thanks for the heads up.

Thanks David. Great news about I-Bonds!

Still confused on EE Bonds. Their 20 year return (after doubling) was 3.5%. Does the new fixed rate mean it’s now 5.5%?

No. You earn 2.1% a year for 19 years, 11 months, and then the next month your original purchase doubles in value. After that, you continue earning 2.1%.

As David said, fir the first 19 years and 11 months, it’s 2.1%. as 20 years, if the bond is worth less than double your original purchase, it is automatically adjusted up to be double (thus effectively giving you a 3.5% annual return for those 20 years instead of the 2.1% return that it was).

One thing to note. The treasury may (for EE Bonds bought after 2005) change the interest rate or the way the bond earns interest for the last 10 years of the bond’s 30-year life (If they do that, they must announce that change before the bond is 20 years old.) So, it’s possible that last 10 years won’t be at the same 2.1% rate should the treasury choose to exercise that particular option.

Still disappointing news for EE bonds in my opinion.

Thought I was beyond being surprised by anything in the financial markets. Looking forward to David’s analysis of this rather bold move.