Markets react with a shrug, but what does it mean for the Federal Reserve?

By David Enna, Tipswatch.com

February’s inflation report, just released by the Bureau of Labor Statistics, provides further support to the Federal Reserve’s caution on launching into interest-rate cuts.

Once again, U.S. inflation ran a bit higher than expected, with all-items seasonally-adjusted prices rising 0.4% for the month and 3.2% year over year. Annual inflation actually ticked higher versus January’s 3.1%.

Core inflation, which removes food and energy, came in at 0.4% for the month and 3.8% year over year. Both of those numbers were higher than economist expectations. So the trend of stubbornly high core inflation continues.

One important factor in the all-items increase was the return of higher gasoline prices, which rose 3.8% in February, after falling for four consecutive months. But gas prices remain 3.9% lower over the last year. The BLS also pointed to the shelter index as a key contributor, rising 0.4% for the month and 5.7% year over year.

Food prices, however, reflected good news: The food-at-home index was unchanged from January and up only 0.1% year over year. Other news from the report:

- The index for dairy and related products decreased 0.6% in February, led by a 1.1% decline in the index for cheese and related products.

- The index for rent rose 0.5% over the month and 5.8% for the year.

- Costs of new vehicles fell 0.1% for the month and were up only 0.4% year over year.

- Prices for used cars and trucks rose 0.5% after falling 3.4% in January.

- Apparel prices rose 0.6% after falling 0.7% in January.

- Airline fares rose 3.6% in February, but are down 6.1% year over year.

- Costs of motor vehicle insurance rose 0.9% for the month and are up a mighty 20.6% over the last year.

Here is the 12-month trend in annual all-items and core inflation, showing that the battle against U.S. inflation has made little progress over the last seven months:

What this means for TIPS and I Bonds

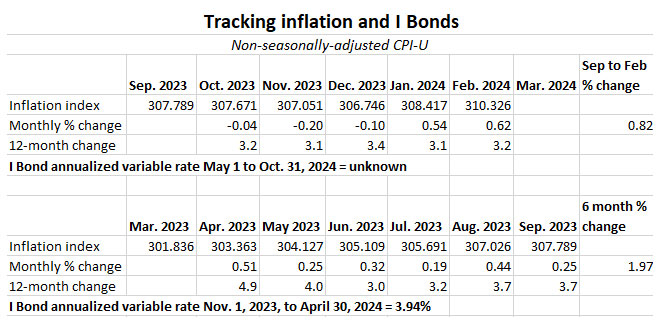

Investors in Treasury Inflation-Protected Securities and U.S. Series I Savings Bonds are also interested in non-seasonally adjusted inflation, which is used to adjust principal balances on TIPS and set future interest rates for I Bonds. For February, the BLS set the inflation index at 310.326, an increase of 0.62% over the January number.

For TIPS. The February inflation index means that principal balances for all TIPS will increase 0.62% in April, after rising 0.54% in January. While these might seem like outsized numbers, this result follows the typical trend at the beginning of each year, when non-seasonally adjusted numbers run higher than the “official” adjusted indexes. Here are the new April Index Ratios for all TIPS.

For I Bonds. The February inflation report is the fifth of a six-month string that will determine the I Bond’s new inflation-adjusted variable rate, to be reset May 1 and eventually roll into effect for all I Bonds. As of February, with one month to go, inflation has increased 0.82% over the five months. That would translate to a variable rate of 1.64%, much lower than the current variable rate of 3.94%.

One month remains, and it is likely we could see non-seasonal inflation in the range of 0.4% to 0.6% for March. That would boost the variable rate to somewhere in the range of 2.4% to 2.8%.

The new variable rate will be set in stone by the March inflation report, which will be issued at 8:30 a.m. EDT on April 10. Here are the data so far:

What this means for future interest rates

The February inflation report did come in higher than expectations, but it wasn’t a severe miss. At 9:20 a.m. both the S&P 500 and NASDAQ indexes were higher in pre-market trading, so investors seemed to be reacting with a shrug.

But the Wall Street Journal report this morning notes that February inflation brings “greater uncertainty over when the Federal Reserve will lower interest rates.”

“A rate cut at the Fed policymakers’ meeting next week still looks to be off the table, with interest-rate futures implying that investors see next to no chance of one,” the Journal reported.

No one was truly expecting the Fed to cut interest rates this month. That decision is probably coming in May or June at the earliest, so the Fed will have more data to ponder in coming months.

From Bloomberg Economics’ Anna Wong:

The hot core CPI reading won’t build Fed confidence to cut rates imminently — but it also doesn’t rule out the chance of a mid-year rate cut. We still expect the Fed to gain enough confidence to cut rates as soon as May — our base case — as both inflation and the labor market cool further

Other economists interviewed by Bloomberg saw the first rate cut coming no earlier than June. Of course, no one can accurately predict future inflation or Fed actions. One final thought from Brian Coulton, chief economist at Fitch Ratings:

This is a sober reminder of the tendency for inflation to perpetuate itself. That is not the direction the Fed wants to see.

* * *

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear.Please stay on topic and avoid political tirades.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. I Bonds and TIPS are not “get rich” investments; they are best used for capital preservation and inflation protection. They can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

Hmmm… I’m confused with your Tracking inflation and I Bonds table. The January and February entries appear to show TIPS principal balance increases (0.54 & 0.62) instead of the monthly CPI increases (0.3 & 0.4 respectively). Additionally, the October-December increases were “adjusted” to 0.1, 0.2, and 0.2 respectively. Your table shows -0.04, -0.20 and -0.10. This would alter your listed Sep-Feb % change from 0.82 to 1.20. Is my perceived discrepancy due to the seasonal adjustment? I am sourcing the CPI increases from the latest BLS table:

https://www.bls.gov/news.release/cpi.nr0.htm

Yes, TIPS and I Bonds track non-seasonally adjusted inflation. The headline CPI you see listed elsewhere is seasonally adjusted.

Hello, this is my first posting. Any thoughts on the direction of the fixed rate portion for I savings bonds come May 1st? Higher or lower than the current 1.30%?

I wrote on this topic a few weeks ago: https://tipswatch.com/2024/02/26/lets-check-in-on-the-i-bonds-next-fixed-rate/

Slightly off topic, but for those who were waiting on a good time to buy the 1/15/34 TIPS, yields are pretty nice right now. https://www.cnbc.com/quotes/US10YTIP

TIPS are never off-topic on this site! Getting very close to 2.0% real yield, which is attractive. This will reopen at auction on March 21, but snagging 2.0% on the secondary market is a great alternative.

I had a hard limit of 2% but couldn’t wait. I got 1.977% at Vanguard this morning and after calculating the difference over 10 years I decided to be flexible 🙂

Hi David, for some reason I am suddenly unable to post my comment. I hope no one will see my duplicate posts because I tried it more than once.

I don’t see anything in the pending queue. But this comment worked, so give it a try again.

I just did and it tells me that I am posting a duplicate comment…hmm..never happened before. I even rebooted my Chrome…will try one more time.

I will try this way:

Thanks for your quick analysis and, more importantly, connecting it so well to TIPS and I Bond returns. As we know, the FED takes this data quite seriously, however, they also pay a lot of attention to the inflation expectations. NY Fed’s recent data on future inflation expectations is 3% for the next year and 2.7 to 2.9% for the next 2,3 – 5 years. What all this means for us income seeking investors is for us to maximize our risk free interest income, by focusing on the various parts of the US Treasuries yield curve as it evolves. We are in a way better situation than those days of near zero interest rates.

The endgame is tough because we pretty much have to predict changes in the tax law and inflation about two or three years ahead. Inflation is an important factor in my income because I am holding a lot of Treasury bills, six month and Iess. If we go to ZIRP or NIRP again, I will hold my 2001 I-bonds to maturity. If CPI stays around 3 or 4 percent or goes higher, I’ll have to cash out some portion before maturity. It is difficult to do the math when the values of important variables are unknown.

Looks like I’ll be getting 5.4 to 5.8 percent on my 3 percent fixed rate I-bonds for the next six months. Still an excellent yield on tax-deferred money. Curiously, I am getting 5.4 percent on my Treasury bills, which are fed taxable but state tax free. The average Fed funds rate over the last 50 years was about five percent. There Is something about “five percent” interest.

That’s a great point about needing to make decisions two or three years ahead when important variables such as future tax laws and inflation are unknown. I don’t want to part with any of my 1998-2001 I-Bonds now, which will all be paying a combined rate of 7.0% to 7.6% next month, but maybe it will be a little less painful to begin redeeming a portion of them in December 2025. I’m hoping they pass a law that Social Security benefits will no longer taxable, then I would be able to redeem enough of my 1998-2001 I-Bonds 2-3 years early so that they would all fall into the 12% tax bracket.

Up to 85% of Social Security income is taxed for any income totals above $34,000 for single filers and $44,000 for joint filers. These thresholds have not changed since 1993. This is an abomination, and a stealth tax. The government adjusts almost everything for inflation, but not this one, which truly hurts many seniors. If you account for inflation those thresholds should be doubled by now, around $78,000 for single filers and around $88,000 for joint filers. This rule definitely needs to be changed.

I meant $68,000, not $78,000.

I will be starting my Social Security benefits when I turn 70 in August 2026. Hopefully your wishes will come to fruition by then ..I didn’t know this.. we do joint taxes…..thanks

Patrick, what is weird is that I think both parties support this “stealth” tax because the money raised does go to bolster the so-called Social Security lockbox. Because we do Roth conversions, my wife and I just factor in Social Security at 85% taxable for paying estimated taxes. Eventually … just my opinion, don’t go nuts … I think 100% of Social Security payments will need to be taxed at the federal level (with an exception for low-income people) to bolster the SS system.

David, the way it is now, it probably hurts lower income seniors more than anyone else. If they want to bolster Social Security, the government should make the annual social security tax apply to all income levels. It is currently capped at $168,000. Why should all income over $168,000 be free of social security tax? If anybody can afford it, the rich can. And why shouldn’t low income people pay a lower social security tax rate, just like federal income tax does?

Agree. But Democrats won’t agree for one reason. Republicans won’t agree for a different reason. And so it goes.

Have you ever read how the WEP SS tax works. These poor people who receive a government pension, think police officers, loose %50 of their SS up to the monthly limit of losing $587/month. For some reason the max loss is $587/month, which again means that the lowest earners get burned the most.

I am in this boat myself. I was laid off a state position at age 50 after and had to move to non government work. But I will never achieve the 30 yrs of SS earnings to wipe out the WEP offset. My retirement organization is always lobbying to change the WEP provision but it is unlikely to ever succeed because it only impacts about 12 states. I have just accepted the fact that this is how it is going to be and I have been trying to find other ways to compensate for the loss of that $587 / mo. 401ks, Roth, deferring Soc. Sec., I Bonds.

It isn’t a necessarily a 50% loss though. This is a common error that people make expressing it as a fixed percentage. It could be much lower % with enough social security earnings, deferring the age to start, etc.

Thanks for your great summary.

I’m always impressed by your quick analysis whenever a new CPI-U monthly index is announced. Thanks for keeping us informed and helping us to understand it! I am finally planning to take your good advice about redeeming some of my 1998-2001 era I-Bonds over the next few years in a lower tax bracket rather than holding them all until their 2028-2031 30-year maturities. I hate the idea of losing the 3.0% – 3.6% fixed rate on these any sooner than necessary, but the 10% difference between the 12% tax bracket and the 22% bracket (or maybe higher some day?) makes this a winning strategy. I will forego any Roth Conversions over the next three years to maximize the amount of these I-Bonds I’ll be able to redeem while staying in the 12% tax bracket. Thanks for planting this thought in my mind a few weeks ago!

Don’t you have any more recent Ibonds to cash (with a lower Fixed Rate)?

I cashed my 0% fixed rate (Feb 2022 & August 2021) and a few 1.2% fixed rate I-Bonds on November 2, 2023. If I don’t redeem any of my 3.0 to 3.6% I-Bonds early, I would be redeeming up to $150k per year (e.g., about $120k in interest on the $30k in I-Bonds I purchased in December 1998). Yes, this is a good problem to have!

William… you are lucky to have such a problem! I understand that the current tax brackets will end on December 31, 2025. I can’t imagine them going any lower or moving into a more favorable outlook. Of course, we’ll know by then what the political environment will be like… so there is that(?).