Yields could continue to rise, but it may be time to think longer term.

By David Enna, Tipswatch.com

In the last week, I got calls from CNBC and Bloomberg reporters asking to talk about the rise in demand for short-term Treasurys, triggered by the recent surge in yield on a 26-week T-bill to 5+%.

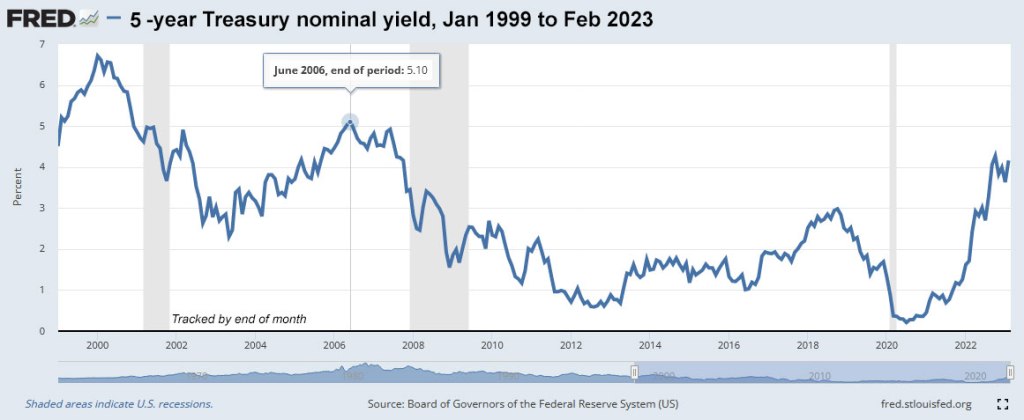

Why is that a big deal? Well, take a look at this amazing chart:

Last week, the 26-week Treasury bill crossed the 5% barrier for the first time since July 2007 — nearly 16 years ago. And for much of those 16 years, nominal yields on this ultra-safe investment were hugging very close to zero. Getting a no-risk, short-term return of 5% on your money is highly appealing, even if U.S. inflation continues to run at an annual rate of 6.4%.

Last July, I wrote an article detailing a strategy for staggering purchases of 13-week and 26-week Treasury bills, spacing out purchases and then rolling them over to capture rising interest rates, while also preserving easy access to your money. At the time, the 13-week was yielding 1.73%; today it is at 4.68%. The 26-week was yielding 2.62%; today it is 5.05%.

That strategy worked very well: It got money working immediately while also capturing future increases in interest rates. But at some point, possibly in the next six months, the Federal Reserve is going to call a halt to rate increases and move into “hold” mode. The rollover strategy would still work, but there will be no short-term rate increases to capture.

What’s the next move?

As interest rates near a peak — and I don’t claim to know when that will be — wouldn’t it be smart to begin allocating some funds to longer terms of U.S. Treasurys? Eventually, maybe sometime in 2024, short-term rates will begin moving lower (I think). At that point,the rollover strategy won’t be attractive.

Just look at the 26-week yield chart again. Notice how each time the yield peaks it begins a rather quick move downward? And notice how the past peaks have been followed rather quickly by a recession? Is that where we are heading?

Also, consider that if you buy a 26-week Treasury this week (the next auction is Monday), it is going to mature in August, possibly right at the peak of the U.S. debt crisis. Will that really matter? Probably not, but things could get a little crazy between now and then. And could that craziness make the Fed more cautious?

Longer-duration Treasurys will generally do well in a recession because interest rates are likely to fall, resulting in a higher value for your investment. Nothing is certain, of course, but the market seems to be shifting its focus toward medium-term Treasurys.

Here are January vs. February auction results for Treasury issues of various terms:

The chart shows that the 26-week T-bill is now the “sweet spot” investment, with the highest nominal yield across the entire maturity spectrum. But … notice how yields have been rising faster for the longer-term Treasurys, with the yield on a 5-year Treasury note rising 58 basis points in a month, versus 24 basis points for the 26-week. The 10-year Treasury note is now trading around 3.95%.

These longer-term yields may continue to rise, but they are starting to get attractive, matching the highs of October 2022 and closing in on the highs of June 2006. Here are long-term views for the 2-, 5- and 10-year Treasury notes:

What’s the strategy?

My idea is to add some medium- or even longer-term nominal Treasurys if I can find attractive rates, as a hedge against future recession and eventual declines in interest rates.

Keep in mind that 4-week to 26-week Treasury bills will remain the ideal investment for your short-term cash needs. Another sensible option for cash is a top-of-class money market fund, such as Vanguard’s Treasury Money Market Fund (VUSXX), with a 7-day SEC yield of 4.55%.

Are bank CDs an option? Sure. Online banks often offer promotional rates to lure your investment. You can probably find a 6-month CD paying 4.75% or a one-year at 5%. Those rates are competitive. Also, you can find 5-year CDs paying around 4.65%, also competitive. But do you really want to open another new account at an unknown bank? Plus, interest from these accounts face state income taxes, while Treasurys are free of state taxation.

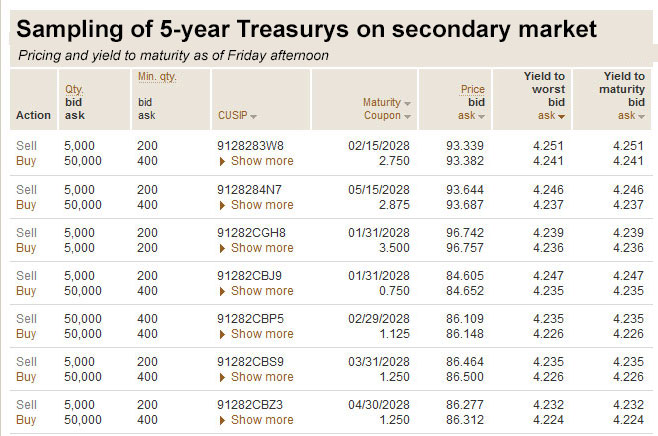

So this week I decided to hunt through the secondary Treasury market to see if I could find a 5-year Treasury yielding close to 5%, or a 10-year at 4%. (I’d prefer to see the 10-year at 5%, but I decided to be realistic.) My plan was to nibble into these nominal investments as a backstop to my ladder of TIPS investments.

As of Friday afternoon, my search failed but the market is getting close, at least for the 10-year:

Market conditions right now remind me a lot of late September and October 2022, when nominal and real yields were peaking. At that time, I bought a 5-year Treasury note at auction with a yield of 4.22%, very close to today’s market. But by early November, yields began falling in reaction to a series of weak inflation reports.

I doubt that yields will plummet in the near term, and the Federal Reserve seems strongly committed to raising short-term interest rates another 50 to 75 basis points before summer. So let’s be realistic, I’ll admit I have no strategy. I just want to hedge my inflation bets with some reasonable nominal yields.

After hunting around Friday, I ended up making a “nibble” investment in CUSIP 91282CAE1, which matures Aug. 15, 2030. It has a coupon rate of 0.625%. The price was 78.453, resulting in a yield to maturity of 3.99%. This is how it would work if I had invested $10,000:

- Cost of investment: $7,845.30

- Future interest: about $471

- Paid at maturity: $10,000

- Total return about $10,471.

Not spectacular, I admit. I think we may see better opportunities in coming weeks.

Conclusion. As the Federal Reserve nears the end of its rate-hiking cycle, it could be wise to look at stretching out the term of your Treasury investments, at least a bit. If recession strikes, interest rates are likely to fall, boosting the value of a nominal Treasury.

However, “this time could be different,” especially if inflation continues at high levels. Then the Federal Reserve would have to continue pushing rates higher. Nothing is certain.

* * *

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear.Please stay on topic and avoid political tirades.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. I Bonds and TIPS are not “get rich” investments; they are best used for capital preservation and inflation protection. They can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

brokerage listed secondary treasury/government securities are almost all callable. do u think the government will be able to call back those agency/treasury securities if rates crash down the road?

Most (if not all) Treasury bonds and notes are non-callable.

David, As I look across the curve zero coupons trail nominal treasuries slightly in yield, except when you get to the ten and twenty years. This morning Schwab is showing the ten-year treasury at 3.97% ytm while the ten-year zero is at 4.17%. The twenty-year treasury is at 4.14% but the twenty-year zero is at 5.97%. Is there something I am missing as to why the yields would diverge so much at that time window?

I don’t track the zero coupons and so I have no idea. That 20-year certainly looks attractive, if that is your investing timeframe.

Even if it’s not you should be able to get a good yield for ten years and then a gain.

20 year zero is at 5.97%?

Of course that’s impossible. The arbitrage of buying the zero and selling the “regular” 20 year would be enormously profitable under almost any interest rate assumptions

The arb produces a big credit up front which you can invest to offset the price of the 40 coupon payments. At maturity the redemption value of both securities is the same. I’ve got to run out now, but I may come back later after figuring out various internal rate of return calculations.

Seat of the pants, my guess is that the worst case is interest rates go to zero, in which case the upfront credit of about 70 is not enough to pay off 20 years of coupons (82.8). I’ll look for the internal rate of return where the break even occurs.

You and I can’t do this, but Wall Street houses would be all over this. They could easily and profitably hedge away the risk involved in the arb.

Yes Schwab shows it at 5,97%, but “none is available”

Look at the markets, at Schwab and Fidelity.

Fidelity has it 4.435 Yield bid, 4.372 Yield offered

Bad analysis

Correct arb is sell only as much regular 20 year Treasuries yielding 4.14% as it takes to fund the purchase of 20 year Zero Coupon Treasuries at 5.97%

So according to Schwab pricing, you need to sell $30.933 of regular Treasuries to fund the purchase of $100 worth of zero coupon

This chart:

Shows the results at different assumed interest rates throughout the period (obviously, in the real world interest rates will vary over 20 years, think of this as ” geometric average” of interest rates over the period)

Maximum profit occurs at the boundary zero interest rate, where you have to pay all the coupons during 20 years at 4.14% on 30.933 dollars worth of standard 20 year Treasury (= 30.933 * (0.0414) * 20 = 25.61), with zero cost to borrow the money to pay the coupons, and when both Treasuries mature, you collect the difference in the initial costs, since they both mature at par (= 100 – 30.933 = 69.067)

Difference then is $43.457 in profit, as in the chart

The trade is a winner practically all the way to 10%, i.e. reflecting the fact since you have to borrow money to pay the coupons until payday at maturity, the higher extant interest rates, the more expensive it is to borrow to pay the coupons.

TL;DR

Unless you think interest rates are going to average 10% over the next 20 years, you definitely prefer the zero coupon 20 years, given these two rates

And don’t worry about being stuck for 20 years, the value of the zero coupon will be increasing during the entire 20 years, you’re certain to be able to exit more profitably from the zero coupon than the standard 20 year Treasury, unless interest rates stay over 10%

Any idea how much potential loss if you want to sell a 13 or 26 week t bill early? We’re looking at selling our house in the next few months and putting a potentially large amount ($800k) in short term savings as we look for a new place to buy, likely later this year. I’m liking leaning towards 4 week t bills, reinvested each month but since it’s a large amount of money trying to figure out the optimal method.

On the secondary market, you could make money or lose money by selling early. If you want quick access to your money, why not just look at Vanguard’s Treasury Money Market (VUSXX) which is currently yielding 4.56%, pretty close to the 4-week Treasury at about 4.75%.

Thank you so much for all your useful information.

I am confused about something and want to be sure I “stay the course” in investing. In BND, the SEC 7-day yield is 4.32%, whereas YTD performance is -.22% I understand the drop is due to rising interest rates. This means I am earning 4.32% on my holdings as long as I don’t sell, but should I decide to sell, I would incur a slight loss due to increasing interest rates.

I feel like this question is so basic, yet it is not solidified in my mind that what I am earning by holding, vs loss I will incur if selling.

Thank you!

You have discovered a basic fact of bond-fund investing: When yields rise, the yield you earn rises. But the underlying value of the bonds providing that yield declines. Yields have been rising in 2023, fairly dramatically, so that means BND’s yield is higher but its net asset value is lower. BND is one of my core bond holdings. It’s been a disaster the last 12 months, but at this point is offering an attractive yield.

That’s what I thought. As long as I am holding this asset indefinitely, there is no advantage to selling this asset and purchasing Treasuries with a comparable yield. I have already harvested my taxes losses this year in all

my taxable accounts. Is my logic correct?

Thanks to you, I have learned so much about Treasuries and TIPS. I have gotten out of high yield savings and CDs to take advantage of the current higher yields for my assets that I will need access to in the short term.

You just mentioned one reason I do not like bond funds. I don’t want my principal to drop when rates go up. Just buy your own bonds and hold to maturity. I like 4 month and 6 month Treasuries for now. Actually I do not like mutual funds at all. If I need a basket of stuff, I’d rather buy an ETF.

I agree with your thoughts about moving out longer term

According to CNBC pricing, there’s only 11 bps difference between the 5 year and 10 year TIPS

I think I’d prefer the 10 year TIPS over the 5s in that case, no?

http://www.bearforum.com/cgi-bin/rrr1.pl

BTW, I bought the same 5 year at auction for 4.22%

Everything is at highs, or close to it, tonight (see link above, useful for getting a snapshot of the entire Treasury spectrum including 5 and 10 year TIPS – click the security name to see charts, CNBC makes 1 year chart the default, but many other timeframes are available with a click)

Thank you very much for all your work, I recommend your site highly to everyone I know

I bought the most recent 10-year at auction with a real yield of 1.22%. It reopens at auction on March 23. So I will probably buy then or before on the secondary market if things keep on this trend. I am also interested in buying the new 5-year on April 20; my ladder is fairly weak for 2028 and I want to work on that.

My point was – if the coupon on the 5 year is almost the same as the coupon on the 10 year (and both were high enough to interest me as an investment), I’d be inclined to lock in my rate above inflation for 10 years rather than 5

On the close of Sept 30th of last year, the yield on the 5 year was 35 basis points higher than the yield on the 10 year (2.02 vs 1.67)

For a 35 basis point difference, I’d take the 5 year over the 10 year and **come out ahead if I were able to roll over the 5 year for anything better than a 35 basis point disadvantage to the current yield on a 10 year**

I don’t know if my analysis is going too far into the weeds, but I’ll be investing the balance of my Roth IRA into TIPS soon, and I’m trying to decide between them

If I have t-bills that mature on 3/9 that are going into my Zero-Percent C of I account, can I purchase t-bills with an issue date of 3/9 using the proceeds? Or do I need to wait for the next auction?

I do that all the time, no problem. Money from maturing securities is credited to the C of I before it is used toward new issues the same day.

If you haven’t elected rollover, can you place an order to purchase on the same day your existing bill matures, if you need that money to cover the purchase of the new bills?

(Assuming your bank makes the funds immediately available)

Example: if you have a $1000 investment in the 13 week bill maturing 3/9 with repayment going into your C of I, you could have an order in for a $1000 purchase of the 26 week bill that will be auctioned on 3/6 and issued on 3/9 sourced from the same repayment you are expecting to your C of I. Your source for funds debited for a single security can be your bank account or your Zero-Percent C of I but not both. One source, one security. Although you can add money to your C of I from your bank account under the BuyDirect tab, the limit is $1000 per transaction and the funds may not be available for purchase immediately. I plan ahead a couple business days to be sure. Also keep in mind that adding directly to your C of I puts a 5 business day hold on withdrawing from your C of I to your bank account. So if you will not already have the entire purchase amount needed in your C of I from newly maturing or past securities, better to source the new bill purchase from your bank. ACH withdrawals from my bank to cover a purchase show up at the bank very promptly.

I never use C of I

I fund Treasury Direct through my money market, currently paying 3.7%

I almost always have enough there to fund a rollover, I was just curious about Treasury Direct procedure, if they would realize they were making both a deposit and withdrawal to the same external account on the same day, would they prioritize the external deposit, or if they received a notice back of inadequate funds, would they retry knowing that they themselves were depositing funds that would make the withdrawal possible a little later

Thank you Paul for your response, because I wasn’t sure of the answer. I’ll add that if you are simply reinvesting in the same maturity, you can schedule a reinvestment by going to “ManageDirect” and clicking on “Schedule Reinvestments” in the Manage My Securities section.

Happy to help. The only situation I know of in which you might run into trouble is if your new issues total more than is available in your C of I at the time. For example, if your 13 week T-Bill maturing on 3/9 is repaying $1000 and you want to put $2000 into the new 26 week, make sure that the rest is available in the C of I prior to issue. If that means adding another $1000 from a bank account to cover, you want to start that process beforehand so that the C of I is credited with the deposit before it is needed.

So you can make that change after you’ve purchased the security after checking “no rollovers” at the time of purchase?

Cool, that answers my question perfectly

Any reason not to consider Short Term Treasury ETFs such as SGOV, XHLF or CLTL? All of their expense ratios are lower than Vanguards Treasury MM Fund. Are the safe for large amounts of money?

Vanguard’s Treasury Money Market VUSXX has an expense ratio of 0.09%, compared to 0.05% for SGOV, 0.03% for XHLF, and 0.08% for CLTL. So you would be fine on expense ratio. The very slight issue (positive or negative) is that these funds have very small interest rate risk, which VUSXX doesn’t have. Short-term rates are rising. VUSXX has a total return of 0.70% year to date, SGOB is at 0.68%, XHLF is at 0.53%, and CTTL is at 0.61%. Pretty meaningless differences, as long as you can buy and sell the ETFs without commission.

Good discussion David,

Starting to rotate some of the short term t-bills into longer term notes. Much of it depends on how close we are to peek rates, as you stated.

I have been looking at longer term notes(2,3,5,7,10 years) with higher yields. I did picked up the 10 year in Oct. 2022 with the 4.125% yield.

My rule right now is only notes with 4% and higher. The 2 and 3 year notes are around the 4.5% to 4.75% range, so rotating some of the short term T-bills into a little longer duration is making sense to me.

It helps me provide a little balance in my treasuries between I-bonds, Tips and T-bills. I also found the FRN very useful in capturing the increasing rates yields over the last year.

Thank You for all the great information on the site David.

Another great option besides short term treasuries and bank CDs is consider selling cash secured puts, option premiums are very juicy right now.

BBBY August 2023 50 cents Puts can be sold for 15 cents each, close to 60% return with very little BK risk.

Options aren’t my style, and buying anything involving Bed Bath and Beyond looks super risky to me. But if you enjoy gambling ..

BBBY already late on some interest payment and I am not sure why you think it has “very little” BK risk.

Just want to point out that if you sell 50 cents put your are risking $500 (in case it BK before August) to pocket $150

It might or might not BK but the risk is there unlike any Bond investment ( just want to make sure others understand)

I don’t know why you say there’s very little BK risk in the BBBY Aug 50 cent puts sold at 15 cents each

BK by August is likely, and you’d lose your 15 cents plus another 35 cents

David. Thank you for your effort and keeping all of us educated.

What are your thoughts on the 10 year reopening for the auction on 03/08 ?

I marked it on my calendar, but I generally don’t study the nominal issues carefully. If the yield appears likely to rise to maybe 4.2% or higher I’d probably be interested.

I also think starting to look longer term is appropriate over the next 6 months. What do you think about Bond ETFs like the 7-10 year treasury i shares IEF or the Schwab Tips ETF SCHP?

Both are good funds with low expense ratios. SCHP is my favorite all-maturities TIPS fund, but I no longer have any holding in it. The only TIPS fund I own now is VTIP, Vanguard’s 0-5 year TIPS fund.

Hello, is there a way to compare whether the 13 weeks bill is better than the 26 weeks bill? I have been buying the 26 weeks bill based on your last year laddering post when the 26 weeks bill rate was much higher than the 13 weeks bill. However, it looks like they are much closer now, so I was thinking if it would be better to switch to the 13 weeks bill.

Thank you.

My original strategy, which continues today, was to stagger both the 13-week and 26-week. Choose the 13 week if you will need the money in 13 weeks OR if you think interest rates will rise in the next 13 weeks. Choose the 26-week if you won’t need the money AND you think interest rates could start falling (or at least stay stable) in the next 13 weeks. (Of course, both of these are already pricing in at least a couple Fed rate increases, which look extremely likely.)

I bought the 52 week instead of the 26 this month. Yield was essentially the same, but locked in for a year. I won’t need the funds, so I am basically avoiding the uncertainty of the 26 week rate in 6 months..

I am a fan of the 52 week for the same reasons.

Then you gentlemen should consider the 2 year note

If you’re looking to “lock in a good rate” there was only 15 basis points difference today between the 1 year bill and 2 year note

Readers: This article has generated great comments and opinions. There are a lot of investing viewpoints and many “correct” answers. I’ve appreciated reading through these opinions and seeing your commitment to inflation protection and secure investments. Keep it going.

It’s the difference between long term bonds vs short term but in miniature. You can have stability of principal or interest rate, but not both. Reinvestment risk = your 1 month T bill matures and the new rate has dropped. Interest rate risk = you buy a 6 month T bill but in 1 month the interest rate is higher so your 6 month T bill value drops (just a little, and only if you want to sell before maturity). Key principal — match to duration of the bill to when you might need to the money. If you might need it any time — 4 week bills, reinvested. If not, go longer.

Depends on how much you “might need”. If you have a million, you will likely need not more than $100,000 for an emergency. You could put that in a 4-week T-bill (4.59% last week), or maybe better in a completely liquid high yield money market fund (4.47% at SWVXX or 4.52% at VMFXX). You put the rest in 6-month T-bills (5.11% last week), laddering.

If I have an emergency I could sell some of my 6-months T-bills, possible at a slight loss to principal. But I like that extra 50 basis points at little risk (so far).

If the debt ceiling is left untouched until the last minute, there could be considerable turmoil in the Treasury market

I’m willing to give up a few basis points to be liquid for that possibility/opportunity

Good plan about giving up basis points to be liquid for turmoil in the Treasury market amidst the debt ceiling drama. I am storing the dry powder in Van settlement account and VUSXX: hopefully the Yellen “extraordinary measures” keep working to pay the monthly dividends in the meantime.

What happens to 4 week Tbills if the debt limit is not raised?

If the U.S. defaults on its debt, the entire world economy would go into a tailspin. Probably not recover. You would wish you were one of those “crazy” preppers.

Interesting question, and I don’t know the answer. I suspect that for a period of time, the US might not be able to issue new debt. Would it continuing paying off on maturing debt and interest on current debt? We better hope so.

I was listening to a financial radio show and the commenter stated that the federal government has sufficient cash flow from tax receipts to cover debt service for the foreseeable future. The commenter’s opinion that default on payments such as Social Security and Medicare would be more likely before defaulting on debt. But none of the scenarios are very good.

There’s no question tax receipts will always be enough to cover debt service. If debt service ever becomes greater than tax receipts, last one out please turn off the lights

I’d change the channel on any “financial program” where they considered that obvious fact to be something worth mentioning.

But a default on any obligation of the government is default, whether it’s debt service or an electric bill (much less a widely visible government obligation such as SS

I have been buying 6 month T-bills every week or so for the last seven months. During the November downturn in rates I locked in some 3 to 5 year CDs (non-callable of course) at around 5%. I have not seen any non-callable CD rates that high since. So my focus now is on T-bills, buy at auction, hold to maturity. T-bills are liquid, although I have not yet needed to cash out before maturity. I like 6-month T-bills because they pay the highest yield of all Treasuries, but mostly because they are relatively short-term.

I am completely uninterested in bond mutual funds. Principal can fluctuate a lot and you pay a fee, even with Vanguard. Also mutual funds can “gate” withdrawals, meaning they can prevent you from withdrawing (redeeming) your money whenever they want to and for any reason. Both BlackRock and Blackstone have just done this. Buying T-bills directly locks in your principal if you hold to maturity, they are liquid, and there are no fees for buying or selling. (Note: you can lose principal if you sell before maturity when rates fall below your purchase rate. I always hold to maturity.) I like I-bonds, but I can only buy $10,000 a year so I don’t think about them much.

As to the future, I will just keep doing what I am doing. When it looks like a recession is about to hit, I will start locking in longer term issues, likely Treasuries, but possibly also non-callable CDs. Right now, employment is buoyant, inflation is out of control. Ride the wave. When it looks like it is about to crest (head-fakes like last November are tricky), start moving to longer term. Watch core CPI MoM, core PCE MoM, and weekly jobless claims. I see it as a gradual process, like turning around an ocean liner, which is the best part about it. But I can move fast if I need to.

David: I love your site and I love your reports. Keep it up.

I am 69 and 1 to 2 years from retirement. We have enough money to last many years beyond our life expectancy. The only thing that could derail us is to lose what we have. So safety is our number one priority. If safety is at the top of the list, then TIPS seem like the only available investment that meets our needs. My problem with long term treasuries is that they are essentially a gamble that future unexpected inflation will not be large. However, as Sal so eloquently explained, the risk of high future inflation is not trivial. They may provide a higher return if inflation does not materialize, but for us that benefit does not seem worth the risk. For money not in TIPS, ST treasuries seem safer than LT treasuries because they should reprice pretty quickly to reflect inflation.

In my experience, trying to time any market, including the bond market, is a mistake. For every time it works, there is at least one time when it doesn’t. So I take a different approach. Over the long term, stocks usually out perform bonds. Stocks have outperformed bonds more than 8 out of every 10 rolling 10-year periods, and 9 out of every 10 rolling 20-year periods, going back more than 90 years of market history (from the blog “A Wealth of Common Sense” by Ben Carlson). The problem with stocks is that they periodically have nasty bear markets. Initially, I purchased bond funds as a hedge against stock bear markets, but that failed spectacularly in 2022. Individual nominal treasuries held to maturity will protect against bear markets, but they will not protect you against inflation. With the national debt spiraling out of control, along with memories of the 1970s and 80s, I definitely want protection against inflation. Individual TIPS purchased at auction (or close to par value) and held to maturity are the only investments I know of that will protect the buying power of your money against inflation, deflation, and bear markets. I will use them to make sure I have enough income to cover my essential living expenses during retirement. Money needed in less than 5 years could go into nominal treasuries. Everything else is invested in low cost, well diversified, stock funds.

I should have said: Individual nominal treasuries held to maturity will not protect your buying power against inflation that is higher than the nominal interest rate of the security.

We more or less agree. A lot of my asset allocation is in inflation protection, and I will plead “guilty” to trying to take advantage of strong real yields when I see them. Investors have the opportunity right now to build an entire ladder of TIPS with real yields above 1.5%. That was impossible over most of the last 12 years. Nominal Treasurys with attractive yields provide better returns in times of low inflation or deflation. So mixing a few nominals into the portfolio helps in those scenarios. Plus, of course, short-term Treasurys are excellent for cash holdings.

Agreed! I try to focus more on allocation than timing and usually make changes in allocation gradually over time (dollar cost averaging) rather than trying to time them. Moving assets from bond funds to individual TIPS didn’t seem like a change in allocation since they are in the same asset class and should move in the same direction. Also, I guess I should have said – if an investment makes sense and meets your investment goals now, then go for it and try not to worry too much about if you might have a better opportunity later on.

Hmmm…I’m wondering which is better:

A 5%, 26-Week T-Bill (2.5%) which is taxable (federal) in 2023 and then liquid in September and then rolled into another 26-Week T-Bill at the prevailing rate at the time;

OR…

A 6.89% I Bond (3.445%) which is tax deferred (federal) and optionally liquid in 2024 (with a 3 month interest penalty of unknown amount) but with a 0.4% Fixed rate over inflation for the second 6-month period.

Just a guess, but if you really, truly want a one-year investment, the 26-week Treasury, rolled over once, will probably be the winner. The I Bond probably won’t make up the ground lost by the 3-month interest penalty.

It is sobering to see the drop in interest rates in 26 week T Bills once recessions started and the historical consistency of the decline. What would you think about dollar cost averaging into aggregate bond funds/ETFs? I was thinking of Vanguard’s BND ETF. Thanks again for your insights!

BND is one of my core holdings in a traditional IRA. I am not adding to it, but I am also not selling out of it. It’s been a tough 14 months, but it now has a 7-day SEC yield of 4.24%, much higher than in recent years.

BND negative 13% performance in 2022. Worst ever since inception in 2007. Bought BND last week $72 in IRA (that means the price will go lower so next buy at $70). Too heavy in ISavings bonds/hedge against lower variable inflation rates.

Recently, I have been staying short-duration, and don’t think it’s time yet to purchase treasuries with longer than 2 year maturities. Not until the Fed signals that it’s done and will hold rates as is “until the job is done”.

My strategy (for taxable accounts) is to purchase treasuries with low coupons that mature in just over one year, for example Cusip #91282CBR1 which matures 3/15/24, and has coupon of 0.25%. One could purchase this on IBKR for $95.15, a ytm of 5.08%.

What I like about this strategy is that almost the entire return, if held to maturity, is in the form of long-term capital gain, in this example the appreciation from $95.15 to $100. Very little from the coupon, which is taxed as ordinary income on federal returns.

If/when the Fed is done, I will consider buying 5-10 year treasuries with the lowest coupons possible, hopefully at ytm’s of 5%+! Then, just hold to maturity.

Btw, I would also look to buy longer duration TIPs at that time, or longer term TIPs ETFs such as SCHP or TIP, for my tax-deferred accounts. Until then, I would stay shorter term in STIP or VTIP.

I believe the price return on a Treasury bought at a discount to par would be Original Issue Discount (OID), not long term capital gains.

Correct. It is reported on 1099-INT as interest.

As Adam C noted, with a T-bill, the difference between your original purchase and maturity amount is reported as interest income on 1099-INT. At least that is how TreasuryDirect does it. I am leaving all my short-term Treasury rollovers intact, but adding the longer-term nominals in “nibble” sizes for now. But I have been aggressively buying longish-term TIPS since fall 2022. We can lock in a real return of 1.5+% plus inflation, whatever that is. As I have noted in other articles, this is a good time to work on your TIPS ladder, while leaving some money on the sidelines just in case.

What about Treasury notes that mature in over a year that are purchased in the secondary market below $100 (due to higher interest rate environment since issuance) that are sold before they mature at or close to $100 for a gain? If held over a year before sale, wouldn’t the gain be a long term capital gain? This is the case with corporate bonds, and I am not aware that government bonds are any different. If I am wrong, my bad!

That sounds logical. It would not be considered interest, but I am not a tax expert.

Intuit states that a bond held to maturity does not generate a capital gain or loss. One sold before maturity for more than you paid for it typically does create a capital gain (or loss in the case of selling for less.) I have no first-hand experience to confirm this.

I should add that my relatively low investment level and low desire to micromanage my investments make it unlikely that I would sell a Treasury prior to maturity. Even meeting the minimums for a Treasury purchase on the secondary market through my brokerage is fairly rare.

Perhaps a better option is to buy Muni Bonds that mature in a year or two? Interest should be tax free and I think you might be able to get 5% as well.

The Vanguard Treasury MM is excellent. To my mind it comes very close to a short-term T-bill laddering strategy in performance without having to go into the T bill-market. I have used your T-bill laddering strategy at other

brokerages whose Gov’t MMs are not as attractive. While I note your qualifiers about waiting, I still think buying any kind of duration during an active hiking cycle is unwise. I’m also wondering about the promised ‘hold for longer’ period. How will that impact the rate curve? What’s more, I’m not so sure we can still count on rate cuts every time the wind blows. Especially if data continues to show upward I-pressure. Certainly not in ’23. Maybe in the following election year… Perhaps it’s not that “it’s different this time”, but rather that the last 15 years were “different that time” and we have a whole generation of market participants who are not used to anything else. After all; just look at the top left corners of your cited charts.

Ty David-another thoughtful and informative article.

Is there like an accounting significance of 13wk and 26wk? I always have to covert this to months for this to mean anything to me.

Probably just divisions of 52 weeks, so 4×13=52 and 2×26=52. But then you get to the 8 week and the 17 week and that doesn’t work. But I guess that 13 week is more accurate than “three months” and 17-week is more accurate than “four months.”

If you look at Treasury Direct’s official auction Competitive Results page, a .pdf file called “Treasury News” you will see on that page that they do not use months or weeks, rather they use days. T-bills in weeks of 4, 8, 13, 17, 26, and 52 are referred to as days 28, 56, 91, 119, 182, and 364. These are the weeks multiplied by exactly 7. Curiously the link to these useful pages is in weeks. They usually get the results out within about an hour after auction. Note: if you look on the Announcements page, they show both weeks and days.

https://www.treasurydirect.gov/auctions/announcements-data-results/announcement-results-press-releases/auction-results/

360 days, 364 days, 365: It all depends, but here is the calculation examples direct from Treasury Direct:

Click to access ofcalc6decbill.pdf

Interesting. If I was investing over $100 million, I would explore those calculations more thoroughly. Actually, I would hire somebody to do it.