My mid-week morning train WFH reads:

• All Markets Are Uncertain: The Forecasters’ Hall of Fame Has Zero Members: In any given year, someone, simply due volume of forecasts, is “right”. I have yet to see anyone who can repeatedly, accurately forecast market outcomes. What we can say, with all certainty, looking backward, is that the S and P (and virtually every other market) has inexorably risen. I find it interesting that there is no Forecasters’ Hall of Fame. There is no one to induct. (The Uncertainty of It All)

• The Chatbots Are Coming for Google: ChatGPT and a handful of startups founded by Google alumni are aiming to reimagine search for the AI age. (Businessweek) see also ChatGPT Sparked an AI Craze. Investors Need a Long-Term Plan. Artificial intelligence has sparked new competition in internet search—for the first time in decades. Here’s how to build an AI portfolio. (Barron’s)

• Stan the Man: How one man came to exert immense influence over an entire generation of central bankers — and still does: Stanley Fischer is the pocket-sized colossus of modern central banking. Although Fischer himself is long retired, it now looks like yet another of his disciples is to pick up the reins of major central. (Financial Times)

• The Little Research Firm That Took On India’s Richest Man: Nate Anderson’s Hindenburg, named for the exploding airship, is locked in a battle with Gautam Adani, whose conglomerate is a pillar of the nation’s economy. (Businessweek)

• PE Has Only Scratched the Surface of Sports Investing. These Firms Are Trying to Change: That. Generational, cultural, and legal shifts are making sports investing more attractive. Capital has yet to follow. (Institutional Investor)

• How Spotify’s podcast bet went wrong: Bill Simmons sent an email to her boss. Simmons had sold the sports and pop culture audio empire The Ringer to Spotify a year earlier for $200 million. Now he wrote Spotify CEO Daniel Ek to argue for keeping the Ringer’s mass audience on Apple and its advertising revenue, driven by the explosion of sports betting. (Semafor)

• Inside the Near-Collapse and Resurrection of the Redstone Media Empire: In the new book Unscripted, authors James Stewart and Rachel Abrams dissect the prolonged, tumultuous battle over the media behemoth that is now Paramount Global—and reveal how, against all odds, Shari Redstone emerged victorious. (Bloomberg)

• The Death of the Smart Shopper: Internet retail was supposed to supercharge the informed consumer. What happened? (The Atlantic)

• Influence Networks in Russia Misled European Users, TikTok Says: The covert and coordinated campaign was disclosed in a new report that also addressed misinformation, fake accounts and moderation struggles. (New York Times) see also Misinformation on Misinformation: Conceptual and Methodological Challenges. Alarmist narratives about online misinformation continue to gain traction despite evidence that its prevalence and impact are overstated. Drawing on research examining the use of big data in social science and reception studies, we identify six misconceptions about misinformation and highlight the conceptual and methodological challenges they raise. (Sage Journals)

• “You’re So Vain”: An Oral History of How to Lose a Guy in 10 Days. Kate Hudson, Matthew McConaughey, and more look back on 20 years of love ferns and that yellow dress. (Vanity Fair)

Be sure to check out our Masters in Business interview this weekend with Rick Rieder, Chief Investment Officer of Global Fixed Income at BlackRock, Head of the Global Allocation Investment Team, and Senior Managing Director. Rieder helps to manage $2.5 trillion in fixed-income assets as a member of BlackRock’s Global Operating Committee and is Chairman of the firm-wide BlackRock Investment Council.

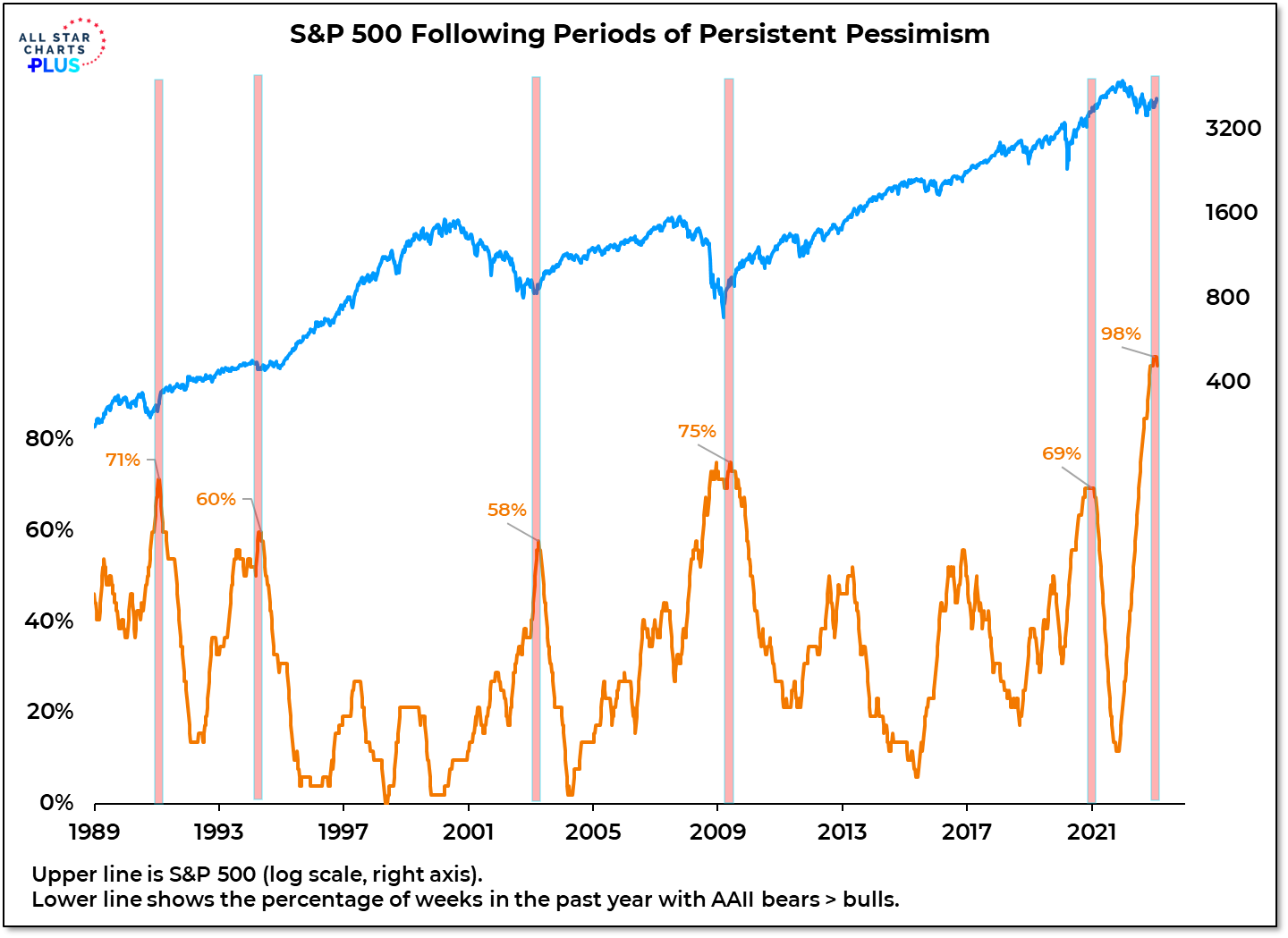

Stocks don’t usually suffer after persistent pessimism fades

Source: @WillieDelwiche

Sign up for our reads-only mailing list here.