What is the Statement of Financial Position?

The Statement of Financial Position is the Balance Sheet of a nonprofit organization.

It gives you a snapshot of a nonprofit’s financial health at a point in time by displaying what the organization owns (assets), what it owes to others (liabilities), and its value (net assets).

The Statement of Financial Position can help you answer critical questions about your business. Like, “Do we have the cash available to pay our bills?” And “If we had to pay back all our debts tomorrow, could we do it?”

It is one of the essential financial statements that nonprofit founders need to know how to read. It’s vital for running your business effectively. And it’s a requirement for a nonprofit audit.

This article will show you what you’ll see on the Statement of Financial Position, what you can learn from it, and what your CPA will look for on your Balance Sheet to see just how healthy your business is.

PRO TIP: The Statement of Financial Position is the same report that a for-profit company calls the Balance Sheet. If your team or board are more familiar with the for-profit terminology, referring to the Statement of Financial Position as ‘Balance Sheet is fine.’ There are no hard-and-fast rules when it comes to internal reports.

What’s on the Statement of Financial Position?

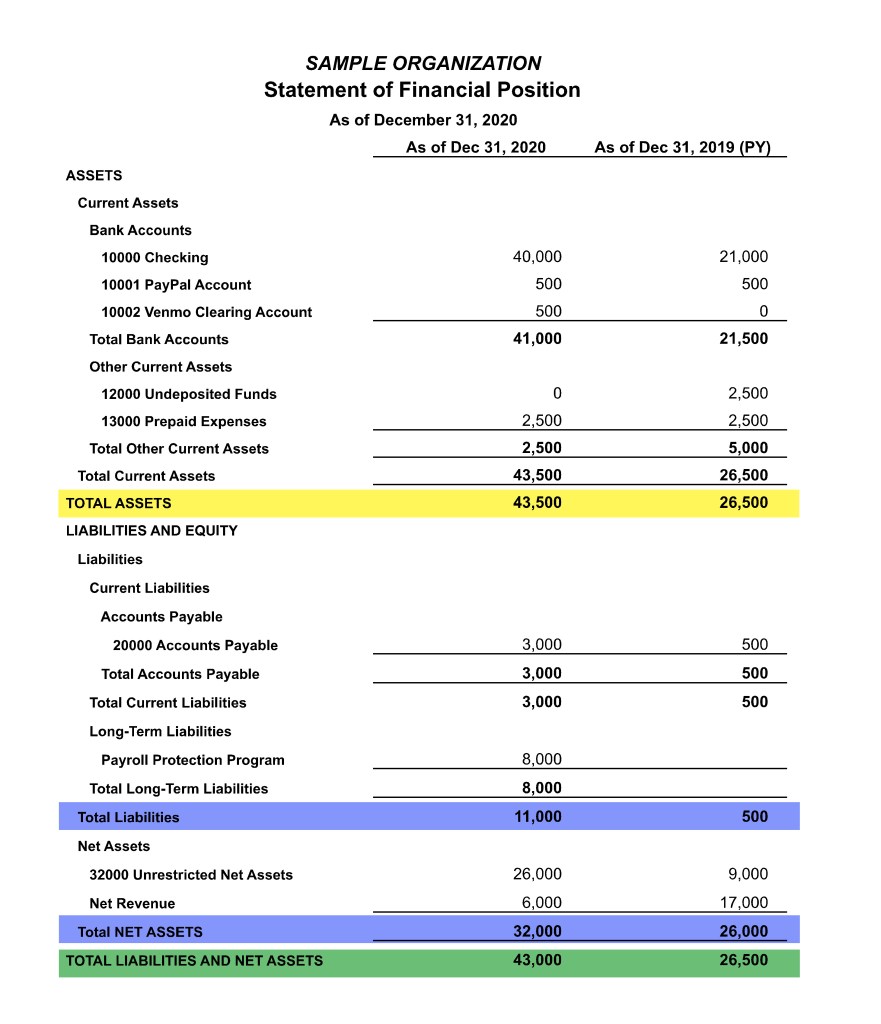

There are three sections on the Statement of Financial Position, and together they illustrate the nonprofit accounting equation:

Assets = Liability + Net Assets

To better understand what the equation means, let’s take a look at each of the three elements in the order that they appear on the report:

Assets: What do you own?

Assets are anything of value your organization possesses or is entitled to, such as cash, pledged donations, property, equipment, investments, etc.

On the Statement of Financial Position, your assets break down into current assets, fixed assets, and other assets.

Current assets are cash or assets you can reasonably expect to convert to currency within a year. Examples include bank balances, accounts receivable, pledged donations, investments, and prepaid expenses.

Fixed assets are long-term assets that are typically tangible items. Examples include buildings, furniture, vehicles, inventory, large equipment, and accumulated depreciation.

Non-current assets (or other current assets) are assets that you can’t convert into cash quickly. Examples include long-term investments, endowments, trademarks, and patents. Many small nonprofits won’t have any non-current assets on their books.

TIP: When organizing your cash assets, ask yourself: “Am I likely to receive this cash (or convert this asset into cash) within a year? If so, that’s a current asset. If not, it’s a non-current asset.

Liabilities: What do you owe?

Liabilities are anything your organization owes to someone else, like vendors, creditors, or employees.

You’ll find your organization’s liabilities organized by current and non-current liabilities on the Statement of Financial Position.

Current liabilities are liabilities you must repay within one year. Examples include outstanding bills, accrued expenses, payroll and payroll tax liabilities, lines of credit, and short-term loans.

Non-Current liabilities are liabilities that will not become due within the next year. Common examples include mortgages and loans.

Net assets: What is your value?

If we rearrange the accounting formula a bit with some 7th-grade algebra, we’ll see that it looks like this:

Net Assets = Assets – Liability

In other words, the value of your organization is the difference between what you own and what you owe.

For-profit businesses call this difference Equity. Your personal financial advisor calls it your Net Worth. In nonprofit accounting, we refer to it as Net Assets.

It’s the accumulation of all the surpluses of revenue over expenses (profit) that you’ve seen on your Statement of Activities since the start of your organization.

And it’s the answer to the simple question–what is the financial value of my organization?

How is a Nonprofit’s Balance Sheet Different?

The name is the most significant difference between a Statement of Financial Position and a for-profit Balance sheet.

But there is one other major difference, and it’s the issue of restricted funds.

Nonprofits use a system of accounting called fund accounting to track sources of revenue that they can only use in specific ways. Fund accounting requires that organizations keep track of these funds and report them on their Statement of Financial Position.

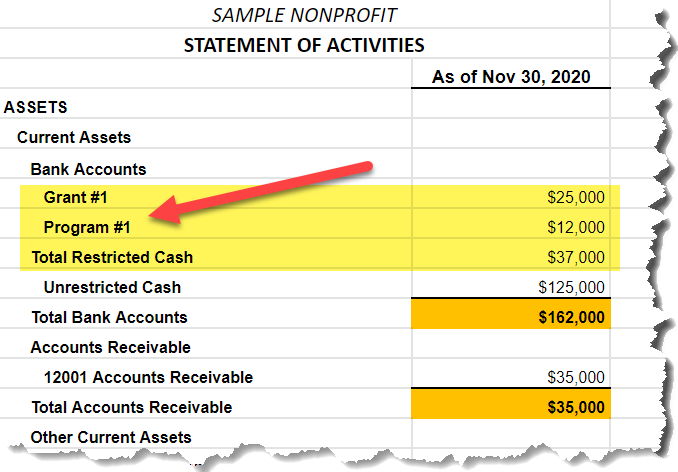

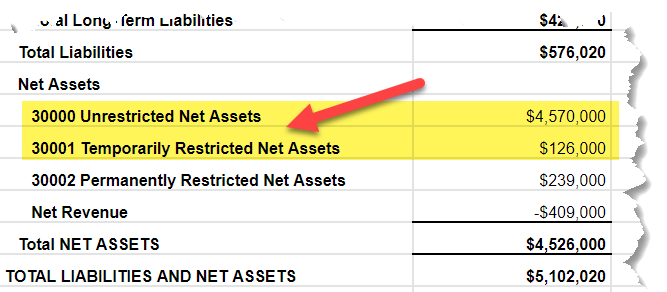

So, on a nonprofit Balance Sheet, you’ll see some extra lines detailing restricted assets, like this:

And you’ll also see them again in the Net Assets section:

Breaking out restricted funds on the Statement of Financial Position helps you answer a simple question:

Can I spend the money that I have to pay off my debts?

But that’s not the only question that your Statement of Financial Position can answer.

So, now let’s look at the questions a CPA or auditor will be asking themselves when reviewing your Balance Sheet…

What will your CPA look for on your Statement of Financial Position?

Your Statement of Financial Position is a snapshot of your business at a point in time. And it’s incredible how much a financial professional can learn about your business from it.

Here are some of the questions your CPA or nonprofit auditor will be asking when reviewing your Statement of Financial Position:

- Do you have enough cash to pay your bills? (More importantly, do you have enough unrestricted cash to pay your bills?)

- Are your accounts receivables increasing or decreasing over time?

- Are you paying down your liabilities or gaining new ones?

- Is your debt temporary or long-term?

But the biggest question they’ll be asking is this…

Do you have more assets than liabilities?

That’s the bottom line (literally) of your Statement of Financial Position and the easiest thing for you to take away from it at a glance.

Because if your Net Assets are increasing over time, you know you’re creating value and building a surplus you can use to achieve your future goals.

And if your Net Assets are decreasing, then something is wrong, and you’d better fix it or find yourself out of business.

Want to Put Your Accounting on Auto-Pilot?

When it comes to financial statements, reading them is the easy part!

It’s creating them that presents the more significant obstacle for time-challenged nonprofits.

Your team needs to spend countless hours entering receipts, invoicing clients, running payroll, and reconciling your books BEFORE you can get the reports you need to run your business the right way.

If you’re looking for an easier way to get accurate and on-time financial reports, consider outsourcing your nonprofit bookkeeping and accounting to The Charity CFO.

We’ll automate your bookkeeping processes to help you save a ton of time. And our expert accounting team will help you handle your trickiest tasks (like fund accounting and functional expense reporting) so that your books are always audit-ready!

Simplify Your Accounting

Do You Struggle to Make Sense of Your Financial Statements?

Get our FREE GUIDE to nonprofit financial reports, featuring illustrations, annotations, and insights to help you better understand your organization's finances.

Get the free guide!

0 Comments