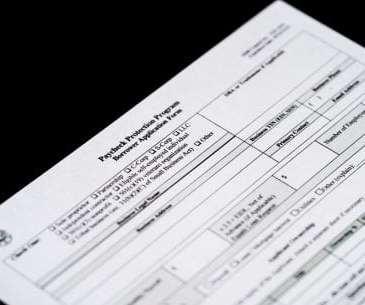

Texas Hotelier Nets $59M In PPP Loans

PYMNTS

APRIL 23, 2020

The biggest benefactor of the Paycheck Protection Program (PPP) is a Dallas, Texas-based hotelier named Monty Bennett, who has received $59 million from the program intended to help small or medium-sized businesses with the economic crisis. Bennett is the chair of Ashford Hospitality Trust , which manages a number of hotels including Atlanta’s Ritz Carlton and the Marriott Beverly Hills.

Let's personalize your content