Rarely seen: High real yield, high coupon rate, discount to par value.

Update: New 5-year TIPS auctions with a real yield of 1.732%, highest in 15 years

By David Enna, Tipswatch.com

The U.S. Treasury on Thursday will offer $21 billion in a new 5-year Treasury Inflation-Protected Security, CUSIP 91282CFR7. This auction will be so unusual in so many ways — based on the last decade of TIPS auctions — that I am calling it a “unicorn,” rarely seen and rarely captured. But here it comes.

Just how unusual? Let’s take a look:

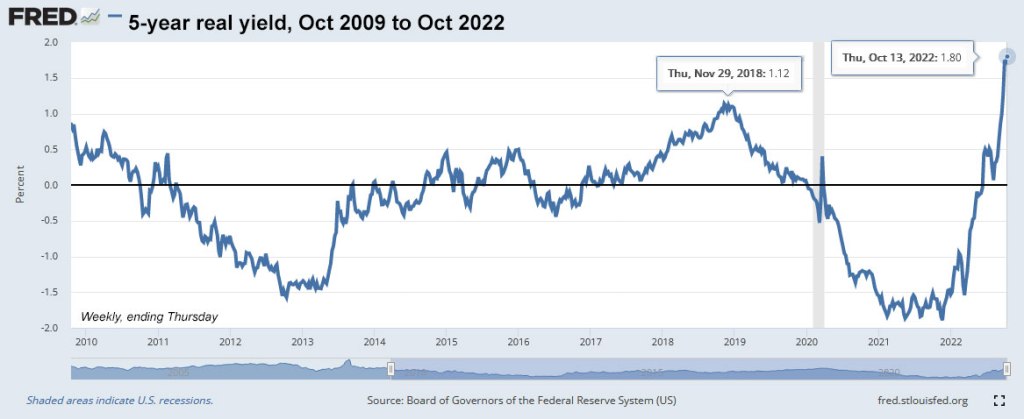

- This TIPS is likely to generate a real yield to maturity of about 1.80%, the highest for this term since October 2008, when a reopening auction got a real yield of 3.270% amid the depths of the U.S. financial crisis.

- One year ago — one year! — a new 5-year TIPS was auctioned with a real yield of -1.685%, the lowest in history for any TIPS of any term. That is an incredible 348 basis points lower than Thursday’s likely result.

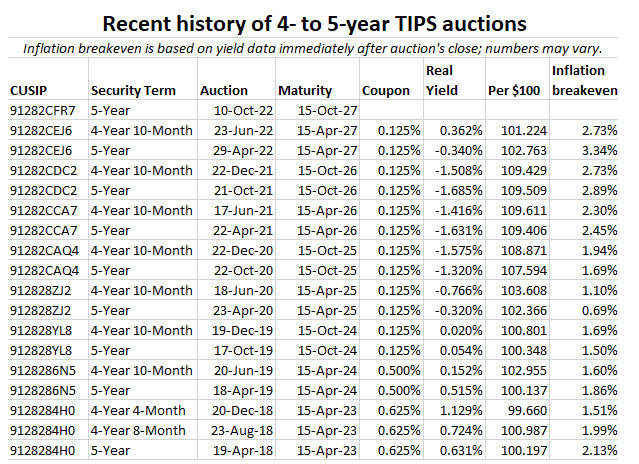

- The coupon rate could end up being 1.75%, which would be the highest for this term since April 2007. In fact, the last 12 new and reopening auctions of this term have had coupon rates of just 0.125%. No TIPS auction of any term has had a coupon rate at 1.75% or above since a 30-year auction in February 2011, more than 11 years ago.

- This new TIPS will have an inflation index of 0.99982 on the settlement date of Oct. 31, which means it is highly likely to have an adjusted price of less than or close to $100 par value. That hasn’t happened for a new issue of this term since April 2010.

- The reason the adjusted price could drift slightly above $100 is accrued interest, which has been negligible through all those auctions with 0.125% coupon rates. Investors will be purchasing 16 days of accrued interest on the settlement date of Oct. 31. If the coupon rate is 1.75%, accrued interest would be about 7 cents per $100, which could cause the adjusted price to rise slightly above $100. But this isn’t accrued principal or par value, and the interest will be returned to the investor at the first coupon payment on April 15, 2023.

- The auction size of $21 billion is the largest in history for a 5-year TIPS. In October 2019 the Treasury offered $17 billion in this term, which rose to $19 billion in 2021 and now $21 billion in 2022. That’s an increase of 24% in auction size in three years.

So, what’s not to like? Thursday’s auction of CUSIP 91282CFR7 is likely to generate a historically high yield, with a high coupon rate, at a lowish cost to par value. Meanwhile, the Treasury is pumping up the size of the offering, which should help keep the real yield high. (But I always note: Things can change.)

Definition: The “real yield” of a TIPS is its yield above official future U.S. inflation, over the term of the TIPS. So a real yield of 1.80% means an investment in this TIPS will exceed U.S. inflation by 1.80% for 5 years. If inflation averages 2.5%, you’d get a nominal return of 4.3%, pretty much on par with a nominal U.S. Treasury. But if inflation averages 4.5%, you’d get a nominal return of 6.3%.

Things can change by Thursday, but if the real yield holds at 1.80%, the coupon rate would be set at 1.75% and the unadjusted price would be somewhere around $99.75 for $100 of par value. But, because the inflation index is less than 1.0, the adjusted price will probably be something like $99.75 for $99.98 of accrued value (par value would remain at $100). All of this is a rough estimate, and that doesn’t include the accrued interest. The key is that investors at Thursday’s auction will be paying slightly less than par value.

For the buy-and-hold-to-maturity investor, this TIPS is a prize. The term is short. Sure, yields could continue rising higher, but you will have locked in a historically strong real yield over the next five years.

Here is the trend in 5-year real yields over the last 13 years, showing that the current real yield has surpassed the highest level of the Federal Reserve’s last tightening cycle, which peaked late in 2018. It’s a bit ominous, though, to see how quickly real yields declined in 2019 when the Fed changed course:

Inflation breakeven rate

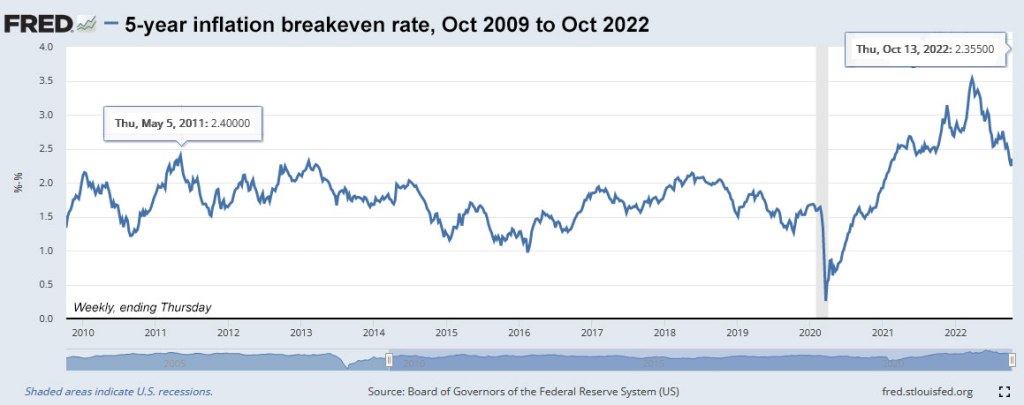

With a nominal 5-year Treasury note now yielding 4.25% (which I think is attractive, by the way) a 5-year TIPS currently would have an inflation breakeven rate of 2.45%, which seems reasonable at a time when U.S. inflation is running at 8.2%, and only inching lower over the last two months. Historically, though, that is a high number and would indicate that a 5-year TIPS is expensive versus a nominal Treasury. Here is the trend in the 5-year inflation breakeven rate over the last 13 years:

This trend-line chart ends on Thursday, Oct. 13, the last day Fred had data. But the breakeven rate popped 10 basis points higher on Friday, possibly influenced by the release of a University of Michigan report on consumer attitudes. That report found U.S. consumers expect inflation to run at 2.9% over the next 5 years, up from 2.7% last month.

As the chart shows, however, market expectations of 5-year inflation have fallen fairly dramatically from a high of 3.59% on March 25, 2022. In span of 2009 through the post-pandemic surge higher in March 2020, the previous high was 2.45% on April 19, 2011, matching today’s number. Back in April 2011, U.S. inflation was running at 3.2%, versus 8.2% today.

Yes, I think a nominal 5-year Treasury yielding 4.25% is attractive, but I would still rather invest a 5-year TIPS with potential for a decent return, along with insurance against unexpectedly high inflation in the future. (Unexpected inflation is what we are experiencing today.)

Final thoughts

Unless market conditions change dramatically in the next few days, CUSIP 91282CFR7 is going to be an attractive purchase. If the real yield to maturity holds at around 1.80%, it has a 180-basis-point yield advantage over the U.S. Series I Savings Bond, if both are held for five years. But the TIPS lacks the I Bond’s sexy 9.62% annualized return for six months — I Bonds get that advantage because they track trailing inflation numbers. Nevertheless, over the next 5 years, this TIPS is likely to out-perform an I Bond with a fixed rate of 0.0%.

If you are considering investing in this TIPS, remember that things can change. You can track the Treasury’s estimate of the real yield of a full-term 5-year TIPS on its Real Yields Curve page, which updates after the market close each weekday. Non-competitive bids at TreasuryDirect must be placed by noon Thursday. If you are putting an order in through a brokerage, make sure to place your order Wednesday or very early Thursday, because brokers cut off auction orders before the noon deadline. I’ll be posting the results soon after the auction closes at 1 p.m. EDT.

Thursday’s auction will be the first of four consecutive monthly auctions that are likely to be very attractive:

- Oct. 20, new 5-year TIPS

- Nov. 17, 10-year TIPS reopening

- Dec. 22, 5-year TIPS reopening

- Jan. 19, new 10-year TIPS

And of course, on January 1, you can again purchase I Bonds up to the $10,000 per person limit.

Here is a history of recent 4- to 5-year TIPS auctions, showing the long string of recent auctions with a coupon rate of 0.125%. Thursday’s result should be much higher:

* * *

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. The investments he discusses can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

Pingback: Despite volatility, this week’s 5-year TIPS reopening remains appealing | Treasury Inflation-Protected Securities

Well that auction didn’t go well for those who placed orders. 1.732% yield versus yesterday’s close of 1.89%.

Thanks Carlos for the update on the real yield being 1.732%. As another commenter (Ed) had mentioned, if the auction was very popular, that may have caused the rate to drop. Still good to exceed inflation (albeit before taxes) by a bit.

About 15 minutes before the close of the auction the yield suddenly started to drop. Very suspicious.

Of course, now the yield is back up again….

What existing TIPS are people comparing to, because there is not an existing secondary that matures October 2027. Thanks.

The comparable TIPS is CUSIP 91282CEJ6, which matures in April 2027.

Thanks. Currently, on Fidelity at the TIPS asking price, the July 2027 yield below the April 2027, and they yield below the January 2027.

And, the July 2027 are at 1.811.

So for October 2027 to come in below that, seems like a continuation of the lower yields.

Good luck everyone.

Thursday update, 11:02 am: It does look like 5-year yields are drifting lower, with the most recent 5-year TIPS now trading at 1.84%. The TIP ETF is slightly higher, also indicating slightly lower yields. The auction will be a strange one, though, impossible to predict precisely.

I think the yield moved slight up again, if I can believe the chart posted by CNBC. The low was set at 10:30 AM…

The lowest I saw today was 1.82%.

It’s back-up to 1.87% right now.

With 20 minutes to go on the competitive bids.

5 year TIPS is ticking downwards this morning.

1.89%, then 1.87%, then 1.85%

One more advantage to TIPS is that they insulate you against the risk that the Federal Reserve increases its inflation target from 2% to something higher. That would make nominal bonds reprice higher in yield causing losses to holders of nominal bonds but it would have less of an effect on holders of TIPS.

David per your comment:

“But, because the inflation index is less than 1.0, the adjusted price will probably be something like $99.75 for $99.98 of accrued value (par value would remain at $100). All of this is a rough estimate, and that doesn’t include the accrued interest. The key is that investors at Thursday’s auction will be paying slightly less than par value”.

Nothing has apparently changed to this point so this still holds true so if I purchased 30 TIPS but only have $31K available in my Settlement account it should be more than an adequate amount to cover the purchase price even given the potential unknowns that can occur at the auction?

Thanks yet again,

deeMatrix

I’d say “probably.” But this is a question for a financial adviser who knows your situation and I am not a financial adviser.

As long as the price is less than 103, you’d be good, and AFAIK that is all but certain.

More to the point, though, the auction is tomorrow, and settlement is the 31st, so whatever the numbers are, you’d have a week to make sure your money is where it needs to be.

Daily Treasury Par Real Yield Rate now up to 1.89%! I quickly placed an order via Treasury Direct.

I am very curious what the fixed rate on I-bonds will be…

My gut feeling on the fixed rate keeps pointing to … an increase above 0.0%. We’ll see.

I assume that if the auction is wildly oversubscribed, the real yield will drop (a lot) from the last data point?

That could happen, but I am suspecting that it won’t. The Treasury market seems to be begging for buyers suddenly.

David, in one of your comments above you stated, “Vanguard’s total bond fund (BND) which has a total return of -15.8% this year. But its current SEC yield is 4.2% … getting there.”

I’d appreciate it if you’d discuss the difference between SEC yield and distribution yield. For example, here is the Vanguard page for VBTLX, Vanguard Total Bond Fund (Admiral shares). If you search the page for yield you see that SEC yield is 4.28%. However, if you continue you see that the “distribution yield” in October was 2.59%.

https://investor.vanguard.com/investment-products/mutual-funds/profile/vbtlx

I follow two online investing forums – Bogleheads and early-retirement.org. Here are discussions of this issue on the two sites:

https://www.early-retirement.org/forums/f44/maybe-time-to-buy-bonds-back-114704.html?utm_source=newsletter&utm_medium=email

https://www.bogleheads.org/forum/viewtopic.php?t=382848

I quote from the early-retirement link above:

“The SEC yield or Yield to Maturity that bond funds use (in this case 4%) is yet another scam to lure unsuspecting investors. That yield assumes that the fund hold every issue to maturity which just won’t happen. Make no mistake, this fund and others like it are in a buy high sell low mode with fun holders suffering losses.”

I’d appreciate your observations on this issue.

SEC yield is the current yield given the bond composition of the fund. Returns are historical and in this case reflect past market yield changes.

In the case of TIPS funds, the SEC yield can be wildly misleading, since Vanguard quotes real yield (very conservative) and others quote a 30-day payout yield (can be misleading). But I am not too worried about BND, the total bond market ETF. The expenses are very low, so expenses aren’t much of a factor. And trading shouldn’t be a factor in this index fund. As one poster noted:

“Distribution yield is averaged over the preceding 12 months. SEC yield is a averaged over the preceding 30 days for a bond fund and over the preceding 7 days for a money market fund.”

I’m generally not a fan of using the SEC yield to make investing decisions, but it is an indicator. In more normal times, I’d look at the 12-month trailing yield. For BND I think that is about 2.7%, which underestimates its current yield because of much lower bond prices.

David, I respectfully disagree. I always use the SEC yield over the distribution yield whenever I can. It reflects the most current estimate of true investment yield, which as you suggest, is especially critical in volatile markets.

Wednesday morning update: At the close Tuesday, the Treasury estimated the 5-year real yield at 1.79%. But yields appear to be moving higher this morning, by a few basis points. Vanguard’s order page is showing an indicative yield of 1.875%, and Fidelity predicts the coupon at 1.875%. Don’t assume those numbers are correct. It could very well be true, but don’t assume anything. It’s impossible to predict the auction result, but these are indicators.

I’m new to this. How does one decide if this is appropriate? It sounds attractive, but I’m not grasping how this works compared to Tbills. How would $10,000 invested in each of these differ?

T-bills and TIPS are very different investments. T-bills are great for money you will possibly need in the next year, or two years. TIPS are more about capital preservation, pushing money into the future, protected from unexpected inflation.

Thank you. Thinking about $20-40k for a wedding fund (multiple daughters) to use in 10-15 years. If folks have any suggestions, I’m open to them!

That might cover 1/2 of one daughter 🙂

1st time poster,

Since auction announcement, Fidelity is showing coupon at 1.875% versus you’re expecting 1.75%. And as of today, they show Yield to Worst at 1.780%. See screen shotshots below. Their info doesn’t quite match up with the way you previously described the auction process and coupon determination as well as in current post. Any ideas on what’s going on? I’m looking forward to see how it plays out, already have my order in!

Thanks for the great education in TIPS at your site!

Details

CUSIP 91282CFR7

Pay Frequency SEMI-ANNUALLY

Coupon 1.875

Maturity Date 10/15/2027

Moody’s Rating —

S&P Rating —

Issuer Events NO

Bond Type TIPS

Blue Sky States NO

Interest Accrual Date 10/15/2022

Basic Analytics

Price (Bid) N/A

Price (Ask) N/A

Depth of Book —

Ask Yield to Worst 1.780%

Ask Yield to Maturity N/A

Current Yield —

Inflation Factor 0.99982

Inflation Adjusted Price N/A

Third Party Price N/A

Inflation Adjusted Third party Price N/A

Spread to Treasuries N/A

Treasury Benchmark N/A

1) These numbers change every day, almost by the minute, so as I wrote on Sunday “things can change.” 2) If Fidelity is estimating the coupon rate at 1.875% and a real yield at 1.780% that is an error. The coupon rate will be below the auctioned real yield, to the nearest 1/8th of a percent. So if the real yield is 1.78%, the coupon rate will be 1.75%. 3) The Treasury’s real yield estimate closed today at 1.79%, up from 1.76% on Monday. That is a good estimate, but no one can predict the auctioned yield, even hours before the auction closes at 1 p.m. EDT Thursday.

Hello, is the 1.8% return over inflation a yearly number ?… So in other words, would the TIPS return 1.8% more per year than inflation ? If held to maturity or course…

That’s correct, whatever the real yield turns out to be, it is the yield over annual inflation.

Yes.

The yield is paid, like a regular treasury.

Principal is adjusted based on monthly inflation.

The principal adjustment also adjusts the interest dollar amount, because the interest rate is applied to the adjusted principal.

David – You are indeed correct, as I expected, since your explanation made total sense. But I am disappointed in Fidelity’s incorrect listing of information since I thought they were also a bond broker of significant size and would have a correct and proper way of displaying the bond information. Fidelity corrected the bond information after today’s auction. Thanks for everything you provide!

The 5 year TIPS yields are 1.78% today. A tad under last week’s 1.83%, but still good enough. The 5 year nominals are at 4.22%. So, the break-even inflation rate as of today is a reasonable 2.44%. Just placed my order today.

Finally, a TIPS bond market that’s approaching somewhat normal yields. We’ll see how long this lasts after the FED’s November meeting. Anything under 0.75% will be an indication that the FED is getting weak in the knees.

If this is a new issue, why is their accrued interest? Also, wouldn’t it be better to buy this issue on the secondary market so we are not guessing as to what the real yield is.

Bid-ask spread is a killer. These are relatively illiquid instruments. I’m buying from Treasury Direct.

So they don’t trade every day? Are you suggesting the lack of liquidity means you will need to hold them for the entire 5 yrs even if you need the money or other fixed income investments look more attractive.

Yes. You should plan to hold to maturity. TIPS are not as flexible as I-Bonds.

The shorter-term TIPS are a lot more liquid and should be easy to move, although I always hold TIPS to maturity. Bid/ask spreads become an issue for buyers in the secondary market trying to make smallish purchases; you probably won’t get the yield you expected. Another issue: I’ve been looking for TIPS that mature in 13 to 18 years, and I haven’t seen any on Fidelity or Vanguard.

When you say shorter-term TIPS, what terms are you referring to. Less than 5 years?

On Vanguard’s platform right now, you can find 46 issues offered (reasonable, since there aren’t that many TIPS currently on the secondary market). Twenty of those mature in 2027 or before. Then there are 9 that mature from 2028 to 2030, and 5 that mature from 2031 to 2032, but zero from 2033 to 2039. So at least on the buy side, it is lot easier to find TIPS with shorter maturities.

I’ll admit that I rarely consider buying TIPS on the secondary market, and never sell them before maturity. Possibly other readers can give helpful advice.

TIPS trade all day every day the bond market is open. The spreads can be under a dime for short maturity, currently up to 50 cents for 30 years. And most brokers charge zero commission for Treasuries.

https://www.wsj.com/market-data/bonds/tips

The issue date of this TIPS is October 15, but the settlement date is Oct. 31. So when your purchase settles, you will have earned 16 days of interest at whatever the coupon rate is, and you have to pre-pay for that. But when the first coupon payment is issued on April 15, you get the money back.

So when do I need to have the money ready for payment? Is it the settlement date? Thanks

Yes, on the settlement date.

Another noobie question David. I’ve been looking at my TIPS holdings and notice every day the inflation factor seems to decrease ever so slightly from the day before.

Is that because the past 2 months prior to this past CPI report there was a slight decrease in inflation? Shouldn’t this inflation index number start going up at some point with this past month increase or am I not understanding this?

Thanks once again in advance.

deeMatrix

October’s inflation indexes were set by August non-seasonally adjusted inflation, which was down -0.04%. November’s indexes were set by September inflation, which was up 0.22%. So the accruals will begin rising in November.

David, can you provide a link to a TIPS primer. I’m interested to know how the TIPS principal amount is adjusted. You mentioned that I-bonds use lagged trailing 6 months of CPI-U data annualized for interest calculations. Does the TIPS principal amount adjust based on the most recent monthly CPI-U print? I’ve seen “daily adjustments” referenced online. How does that work if CPI-U is published monthly? Thx!

I have a TIPS Q&A here: https://tipswatch.com/why-tips/

TreasuryDirect has one here: https://www.treasurydirect.gov/marketable-securities/tips/ (with other helpful links)

The principal balance of a TIPS adjusts (up or down) every day based on non-seasonally adjusted inflation two months earlier. So right now, October indexes were set by August non-seasonal inflation, which was down 0.04%. CPI-U is published monthly, and the BLS sets the non-seasonally adjusted monthly inflation index. That is used to set the daily accruals for TIPS two months in the future. Here are the November indexes, which were set by September inflation, up 0.22%: https://www.treasurydirect.gov/instit/annceresult/tipscpi/2022/CPI_20221013.pdf

David, One more thing that is very unusual is that the “yield curve” has inverted. I’ve never seen the 5-yr TIPS with a higher rate than the 10-yr TIPS. There is lots written about the yield curve inverting for regular treasuries; any idea what it may mean when TIPS invert?

It’s unusual, but predictable during a period of serious Fed tightening. It did happen in 2018, in November, with the 5-year at 1.30% and the 10-year at 1.09%, and it stayed inverted through the end of December. It’s significant that the Fed soon after paused the tightening as the stock market plummeted. (During that entire time, the 30-year real yield remained higher than the 5-year, and that isn’t true today.) The 5-year TIPS tends to be the most sensitive to Fed rate increases, and definitely most sensitive to short-term expectations for inflation.

Does anyone have a good broker they like for Tips on the secondary market? My accounts at Treasury direct are all taxable, but I would rather purchase Tips and hold them to maturity in a tax protected account. Any suggestions for someone in this situation? Thanks

I use Vanguard because that is where I have my traditional IRA. Their presentation is clunky and not as informative as Fidelity’s in my opinion. So I sometimes use Fidelity’s platform to double-check details of the offering.

Thanks for those suggestions! I am currently with Merrill and their minimum trade size for tips looks like ~$100k to me. Interestingly it is only $1000 for nominal treasuries. The tips minimum is too high to make it useful for me. Hopefully Vanguard and Fidelity have lower minimums.

I have very little experience and none with Merrill, but you may want to check this. I *think* how it works is that each seller’s lot is listed separately and they can choose their own minimum. On the long list of all available issues with different maturities, it may only show the cheapest offer and the minimum purchase size that goes with that price for each issue. But if you expand a single issue to show all the available lots, there are likely offers allowing for a smaller minimum, but you’ll pay a few pennies/dollars more.

It’s a weird market for those used to stocks where everything is fungible and orders are seamlessly forwarded to multiple exchanges. Here, it seems each broker has their own un-shared pool of bond orders. And within identical issuances, buy/sell lots are separated out and it’s a mostly manual process to match up individual buyers and sellers.

I don’t know if they are a good broker but I am with Etrade. I can buy Tips through them in my IRA. $1000 min. It is a bit hard to find the treasury auction page. If you go with them and need help finding it let me know.

I use TD Ameritrade, which has an excellent web site. It’s easy to trade stocks and Treasuries. The only complication is if you want to reinvest Treasuries that mature on the same day that the new Treasuries are purchased AND you don’t currently have sufficient cash. (You need to place the buy order before the auction date.) The web site won’t let you do it so you’ll need to call a TD Ameritrade on the phone to place the buy order — usually a 30+ minute wait time — which they will do because they can confirm that the cash will be available on the settlement date.

David, Thank you so much! I have learned so much from you in the last week since I found your site. I sure wish I had found it sooner – like all the years I’ve been trying to figure out where to place cash – particularly the start of this year – gave up, and put some in the market despite my misgivings. But you’ve taught me a lot that will help now, and I am grateful. Financial advisors have been no help at all on that score, so I guess it can be considered a good thing that inflation interacting with ibonds put more information sites where I could find them. 🙂

Do you have a rough percentage of how much of your portfolio you want to put into this “unicorn”, and how much you want to hold back for the upcoming possible unicorns?

My overall allocation percentage to inflation protection is less than 20%. I will be buying this TIPS, but within my allocation.

Adam Collins, who has posted in your blog, has argued that since future inflation is impossible to predict, the best strategy is to buy TIPS and nominal 5-year Treasuries in equal measure, 50/50. (If future inflation is more than expected then TIPS will outperform nominal Treasuries, and vice versa if inflation is less than expected.) Given what we think we know about the upcoming TIPS auction, what TIPS-to-Nominal ratio do you think is best?

This seems reasonable. If you lock up longish-term Treasurys with good yields, you will do very well if deflation sets in. TIPS will lose some value during extended deflation. My core bond fund (and largest bond holding) is Vanguard’s total bond fund (BND) which has a total return of -15.8% this year. But its current SEC yield is 4.2% … getting there. I generally buy TIPS to hold to maturity and back that up with CDs, short-term Treasurys and just recently, a 5-year Treasury note yielding 4.2%.

David I really appreciate all the time and effort you put into bringing this information to us. Before I found your web site I wasn’t able to find any other site that had such comprehensive and useful information about treasuries especially TIPS.

“…because the inflation index is less than zero, the adjusted price will…”

Do you mean 1, instead of 0?

Yes, I did. This is fixed and thanks for the heads up.

Greetings – this is my first reply here. Great site, just became aware of it.

My question is how to evaluate “indicative yield” on Vanguard’s web page (here: https://personal.vanguard.com/us/FixedIncomeHome).

For example, the indicative yield for the tips discussed above is 1.832. How does Vanguard arrive at this number – where do they draw it from an how reliable is it?

Note that they are also showing an upcoming six month treasury with an indicative yield of 4.331.

Do these numbers change from day to day, as we get closer to the auction date? Is there any rule of thumb about how close the final yield usually is to the indicative yield?

Thanks in advance.

The Treasury’s estimate at the market close Friday was 1.81%, but the bond market continues trading and possibly the yield on the 5-year term was rising. The most recent 5-year TIPS trading on the secondary market closed with a real yield of 1.83%, so maybe that’s where Vanguard draws the number. The Treasury’s estimate on the 26-month T-bill was 4.31%, also very close to that Vanguard number. Just realize that these are estimates and the predicted yields will change right up to the hour of the auction. Auctions results can be fairly unpredictable.

Understood – but bottom line is that when you buy at auction you have to put up with some measure of uncertainty, or so it seems

This is true. The benefit of the auction purchase is that all non-competitive bidders get the “high yield” while competitive bidders often get a lower yield. So at the auction you do get the highest yield needed to complete the issue. But you can’t lock in a yield like you can if you bid on the secondary market, which is subject to bid/ask spreads and sometimes minimum purchase levels for the best yield.

The good news is that there is no scheduled FED press conference for the rest of October. In the past, Powell’s had a tendency to make pronouncements that have sunk potentially decent yields immediately prior to several previous auctions. I started feeling like Charlie Brown trying to kick a football only to have “Lucy” Powell move it away at the last moment.

Hopefully, nothing happens on the international scene to upset the apple cart this time around.

This does sounds attractive to me if the yield holds up. Here is my question: if inflation begins falling, is it possible that the current CD rates and treasury notes will still continue to rise? Those rates are essentially following the Fed aren’t they? which is out ahead of a falling inflation rate….. or are they more a product of the actual inflation rate? I have been thinking 5-6% cd rates may not be far off. That would be something I would try to lock into. Just not sure we will get there.

Shorter-term interest rates definitely follow the Fed’s actions. Longer-term rates are influenced by economic conditions. I agree that 5% nominals are worth grabbing, if we see them.

I must be misunderstanding something. Instead of buying a 5 year TIP, why not but a 52 week T-Bill at a coupon rate of 4.49% now with a secure principal. And then at maturity, I purchase the “sweet spot” at subsequent T-Bill auctions. Indeed, if inflation subsides, returns will go down for both T-Bills and TIPS. What am I missing?

I have no problem with buying a 52-week T-bill, and I am currently rolling over 13- and 26-week T-bills. If you buy a TIPS yielding 1.8% over inflation, and inflation is 5% over the next year — definitely possible — you’d get a nominal return of 6.8%. But as you say, “if inflation subsides” … we don’t know. TIPS are inflation protection. T-bills are a source of short-term income.

I stagger purchases of the 13-week and 26-week, and then reinvest automatically when they mature. I wrote about this in July: https://tipswatch.com/2022/07/04/looking-to-put-cash-to-work-consider-short-term-treasury-bills/

Do both! 🙂