My morning train WFH reads:

• The surprisingly chilled bear market: The equity sell-off has been weirdly tranquil. (Financial Times Alphaville)

• What’s the Inflation Rate? It’s a Surprisingly Hard Question to Answer: Microeconomic analysis suggests underlying inflation could be as low as 3%; macroeconomic analysis suggests it isn’t (Wall Street Journal) see also How the Fed Causes CPI to Increase: Rising mortgage rates has sent made apartment prices higher market. The result is as Federal Reserve attempts to fight inflation by raising interest rates, it leads to higher CPI inflation each month — even as prices of goods have come down. (TBP)

• Family Offices Get Opportunistic Amid Market Chaos: Distressed hospitality, digital assets, lithium, and even Ukrainian tech companies are commanding the attention of these allocators. (Institutional Investor)

• How the 60/40 Portfolio Makes A Comeback: If bonds don’t do well when starting yields are low, inflation is high, and rates are rising, then this implies that they do perform well when yields are high, inflation is low, and rates are stabilized or dropping. (Of Dollars And Data)

• Is Most Personal Finance Advice… “Wrong”? I can plot out the next five years of my life neatly in a spreadsheet, full of Future Value formulas, average returns, and estimates about income increases—but it’s mostly an illusion that provides a sense of control. But there’s a problem with “the plan”: The human psyche. We don’t live in Excel World. We live in the Real World. And in the real world, people behave irrationally. (Money with Katie)

• Elon Musk Seems to Answer to No One. Except for a Judge in Delaware. Kathaleen St. J. McCormick, the chief judge of Delaware’s Chancery Court, gave Mr. Musk until Friday to acquire Twitter. She is also the judge in at least one other case involving the billionaire. (New York Times)

• Why Daylight Saving Could Exacerbate Europe’s Energy Crisis: Ending the practice of turning back the clocks one hour would generate financial and environmental savings for Europe just when the continent needs it most, according to new research. (CityLab)

• There’s a morning-after pill to prevent sexually transmitted infections; Why aren’t more doctors prescribing it? Years after it was first proven to work, a new tool for preventing sexually transmitted infections (STIs) is on the brink of entering mainstream medicine. That tool is doxyPEP, an antibiotic that works like a morning-after pill — but instead of preventing pregnancy within hours of unprotected sex, it prevents STIs like chlamydia and syphilis. (Vox)

• Doug Mastriano: is the Trump-backed election denier too extreme to win? The far-right Republican, running for governor in Pennsylvania, has extremist views – and he hasn’t softened his positions one bit. (The Guardian)

• The One Where Matthew Perry Writes an Addiction Memoir: In “Friends, Lovers and the Big Terrible Thing,” the actor gets serious about sobriety, mortality, colostomy bags and pickleball. (New York Times)

Be sure to check out our Masters in Business interview this weekend with The Jeremies! Professor Jeremy Siegel of Wharton, and Jeremy Schwartz, Chief Investment Officer at the $75 billion Wisdom Tree Asset Management. Siegel is the author of Stocks For The Long Run; Schwartz is his research partner/editor. The two discuss the sixth edition of SFTLR, the latest and most widely expanded edition of the investment classic.

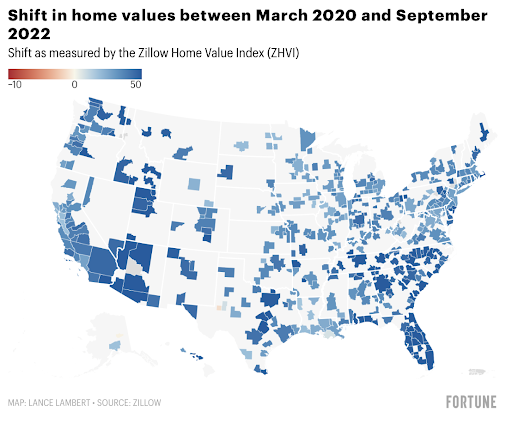

This is how fast home prices are shifting in regional housing markets

Source: @FortuneMagazine

Sign up for our reads-only mailing list here.