FISPAN and the Future of Data

How FISPAN sees the importance of data and how to grow beyond the point of data aggregation. How data will be delivered and received from FISPAN and the third-party partners we work with.

Financial institutions (FIs) are under pressure to drive innovation in financial data access for the commercial banking space. Banking customers are seeking more control over their banking data than ever before. According to a 2020 Deloitte study, 83% of respondents wanted the opportunity to opt out of sharing certain information, displaying their desire for more control over their data.

Data Feeds - Building Blocks

Beyond building highly controlled and integrated experiences, the industry has moved in a direction that allows data platforms to simplify the ERP and accounting system reconciliation process by delivering direct bank data feeds that deliver balance and transaction information straight into their respective reconciliation modules automatically. This data feed is the mechanism that securely exports valuable banking information and imports it into such modules automatically — saving finance teams many hours of manual work and reducing the amount of human error.

A powerful financial platform needs to enable third-parties the ability to leverage its underlying connectivity and help banks better serve their customers to provide enhanced financial experiences to the clients of these third-parties themselves (aka mutual clients). FISPAN’s continued explorations have led to a multitude of opportunities that support banks in scalably serving their clients, beyond just commercial institutions.

FISPAN manages the relationships with the various ERPs and partnerships needed to deliver the data feeds and conducts the due diligence, system design, and technical implementations for these projects. Data feeds eliminate a significant portion of users' frustration with their experience when accessing information reporting and conducting reconciliations for bank clients.

Data Quality

To support an up-to-date, high-quality user experience, FISPAN goes beyond data aggregation and data passthrough. FISPAN regularly syncs with its network of financial institutions to retrieve fresh and up-to-date data. From here, a complex and comprehensive transformation is applied to the raw data to ensure an easily digestible output is applied to reach a high degree of data quality and consistency.

The end result? A reliable and highly secure source of truth for bank balances and transaction information that has been enhanced to standardize the received information in such a way that the FISPAN output never changes, regardless of the raw data it ingests.

Data Privacy

Today, businesses are increasingly looking for deep banking integrations in their business systems and applications in order to drive productivity and lower costs. This opens new doors for FISPAN to explore (and continue to explore) new opportunities that further develop its partner ecosystem and build out the tools that allow FIs and businesses to have complete control over how, and where, their data is accessed.

As we look to the future, FISPAN’s next step is to explore a world where FinTechs like FISPAN are not just the architect behind the user experience, but can also act as the control center for banks and corporate users — which means the ability to provide access and permissions to unique integrations with a curated group of vetted partners.

About FISPAN

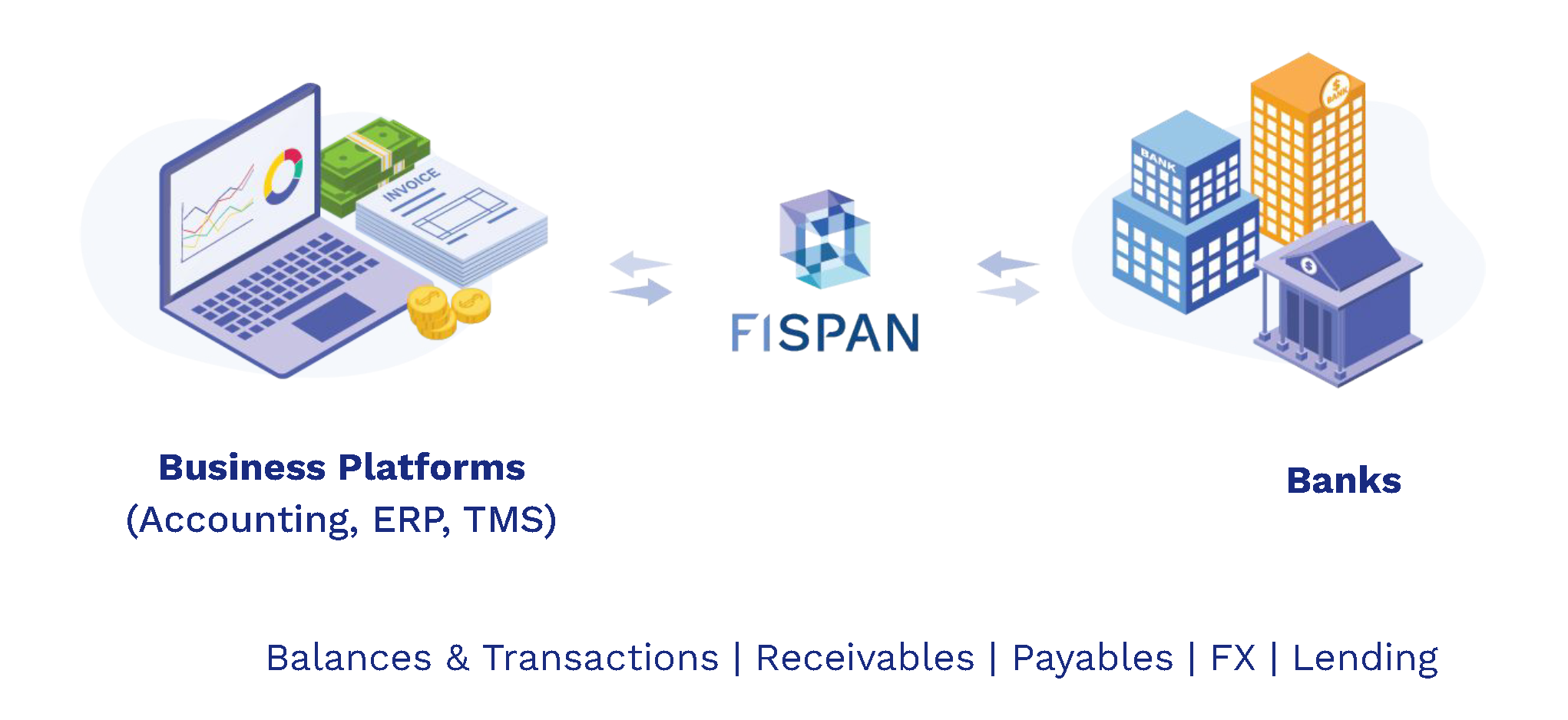

Since 2016, FISPAN has built and continued to expand the breadth and depth of a platform that securely houses both financial and business data. This centralized platform is designed to support direct, two-way connectivity between financial institutions (FIs), FISPAN, and business systems such as Enterprise Resource Planning (ERP) and accounting software. The two-way connectivity enables FISPAN’s market-leading embedded and contextual experiences to bring commercial banking services directly into the business systems that banking clients use every day.

With FISPAN, banks can expand their commercial banking offerings through a branded banking experience that is integrated within their client’s ERP and accounting software. Through integrations with partner ERP and accounting systems like Oracle NetSuite, Sage, Quickbooks, and more, FISPAN works with 10 of the top U.S. banks to embed their banking capabilities. As a result, banks can bring their services directly where clients operate their businesses with carefully designed user experiences that optimize workflows and efficiencies.

__

Set up a demo here to learn more about FISPAN's data feeds and what this can mean for your company and the future of business banking.