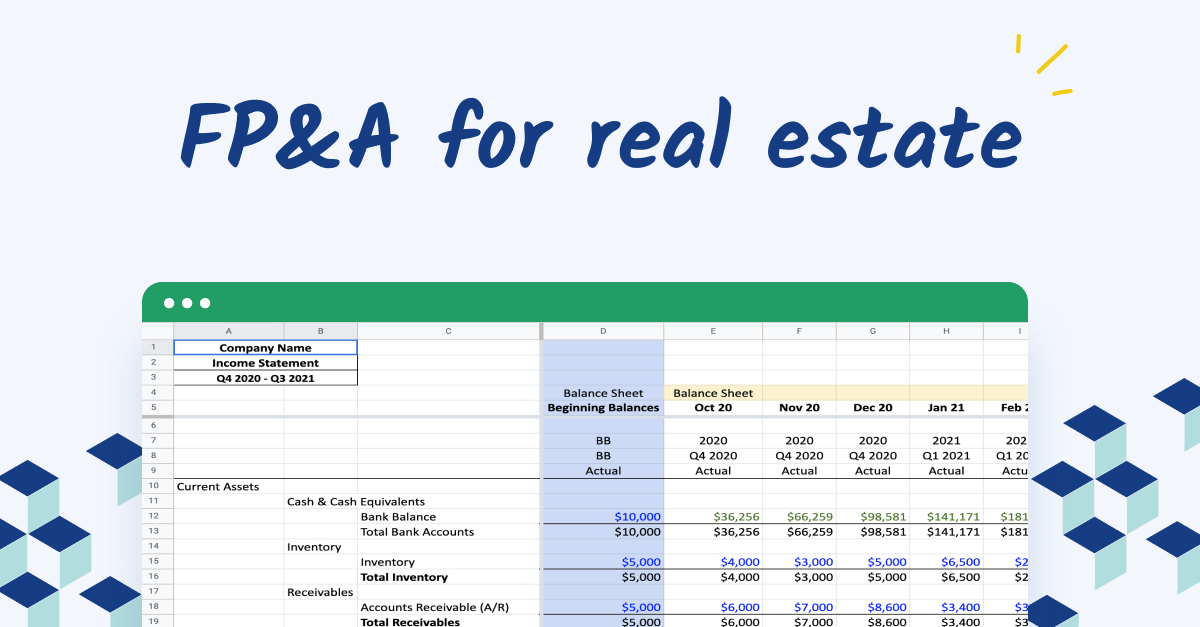

What does FP&A for real estate look like?

When it comes to the real estate sector, financial planning and analysis (FP&A) plays a crucial role in guiding strategic decisions. At its core, FP&A focuses on forecasting financial outcomes, budgeting, and providing actionable insights to support investment decisions. Given the dynamic nature of real estate markets, FP&A teams are responsible for creating financial models that can adapt to fluctuating property values, changing interest rates, and emerging economic trends.

Unlike other industries, real estate FP&A involves not only traditional financial analysis but also requires a deep understanding of regional market dynamics, property types, and investor expectations. Teams often analyze extensive data sets, from rental yields to property maintenance costs, to ensure accurate forecasting and optimize the allocation of capital across diverse portfolios.

Key stakeholders, including developers, investors, and property managers, rely on FP&A for clear financial guidance. Whether it's managing cash flow for new developments or evaluating the ROI of property upgrades, FP&A teams need to deliver comprehensive reports and dashboards that help decision-makers weigh risks and seize new opportunities.

Ultimately, successful FP&A in real estate requires a delicate balance between data-driven insights and market intuition. By aligning forecasts with strategic goals and market realities, finance leaders can ensure that their portfolios not only withstand market changes but also thrive in them.

What is strategic forecasting and budgeting?

Market fluctuations, changing interest rates, and unpredictable global events can shake even the most well-planned investments. This is where strategic forecasting and budgeting come into play. Instead of relying on traditional, static budgets, forward-thinking finance teams are turning to more flexible models to stay ahead of market shifts. Here are a few key strategies to consider:

FP&A software

FP&A software is transforming how finance teams approach forecasting. By analyzing historical data and current market conditions, this technology can help you identify patterns and predict future trends with greater accuracy. For example, FP&A software might analyze past rental rates, economic indicators, and tenant behaviors to help teams anticipate shifts in property demand.

Consider investing in FP&A software that can identify emerging patterns and provide actionable insights into rental trends, economic indicators, and market conditions. This will allow you to fine-tune your long-term strategy.

Rolling forecasts

Traditional, static budgets lack flexibility and often struggle to keep up with market changes. Rolling forecasts, however, offer a more agile approach. You can update your projections frequently, usually every quarter or month, ensuring budgets stay relevant and aligned with the latest market conditions. This way, you can adjust your spending plans proactively.

Try establishing a rolling forecast process with regular updates so your team can refine projections and allocate resources based on the latest data. Schedule quarterly or monthly reviews to assess progress and make necessary adjustments.

External economic and market indicators

Accurate forecasting and budgeting require more than just internal data. External economic and market indicators, such as employment rates, consumer confidence, and local housing supply, provide crucial insights into the broader trends affecting real estate. Incorporating these data points into your planning process allows you to anticipate demand shifts and adjust your strategies accordingly.

That's why you should regularly review economic and market reports from government agencies, think tanks, and research firms to keep your forecasts aligned with broader trends. Use this information to refine your assumptions and ensure your financial models reflect the current economic landscape.

Effective portfolio management and optimization

In real estate, effective portfolio management ensures your investments generate the highest returns while minimizing risk. Market conditions can change quickly, and you must constantly refine your strategy to protect your investments and achieve your goals. But where should you begin?

Scenario analysis is a good place to start. It's a key tool for exploring different "what-if" market situations, like changes in interest rates or regional economic shifts. Creating a few plausible scenarios and analyzing their potential effects on your investments can uncover opportunities to maximize returns while planning how to navigate difficult conditions.

Next, allocating capital strategically across core and value-add properties can help you balance risk and return. Core properties provide steady cash flow through reliable tenants and established locations. Value-add properties, on the other hand, may require renovation or repositioning but offer the potential for higher growth once improvements are made. Balancing these two types can result in a resilient yet growth-oriented portfolio.

Lastly, diversification is essential for minimizing financial risk. By spreading investments across different property types—residential, commercial, or industrial—and various geographic regions, you can protect yourself from downturns in a specific market or sector. For example, if the office rental market struggles, industrial warehouses or multifamily properties might remain strong.

How to ensure data-driven decision-making

To keep up with today’s rapidly changing real estate market, finance teams need to make decisions that go beyond the limitations of traditional financial models. Here’s how you can refine your strategies:

1. Move beyond traditional financial models.

Traditional financial models often focus on historical data and apply broad assumptions that may not fully capture emerging trends or changing market dynamics. This backward-looking approach can lead to decisions that miss the mark when market conditions shift or when unexpected disruptions occur. As a result, finance teams relying solely on historical information can struggle to anticipate new opportunities or potential risks.

Predictive data models, on the other hand, combine historical trends with current data and advanced statistical techniques to provide more accurate and forward-looking forecasts. By incorporating real-time information, such as economic indicators, tenant behavior, and regional property market trends, predictive models can reveal how future demand, rental rates, and occupancy levels might change. This approach allows finance teams to create forecasts that better reflect what lies ahead, helping them make proactive decisions.

For example, a predictive data model can analyze patterns in tenant demographics and recent market fluctuations to forecast shifts in rental demand for specific property types or regions. Armed with this insight, finance teams can adjust their strategies to address emerging opportunities, such as developing new properties in high-demand areas or refining lease agreements to capture value in a competitive market.

By moving beyond traditional models and embracing predictive data models, finance teams gain a clearer picture of what's coming. They can anticipate changes in tenant demand, rental rates, and investment opportunities with greater confidence, ensuring their financial strategies align with market realities.

2. Make use of advanced data visualization techniques.

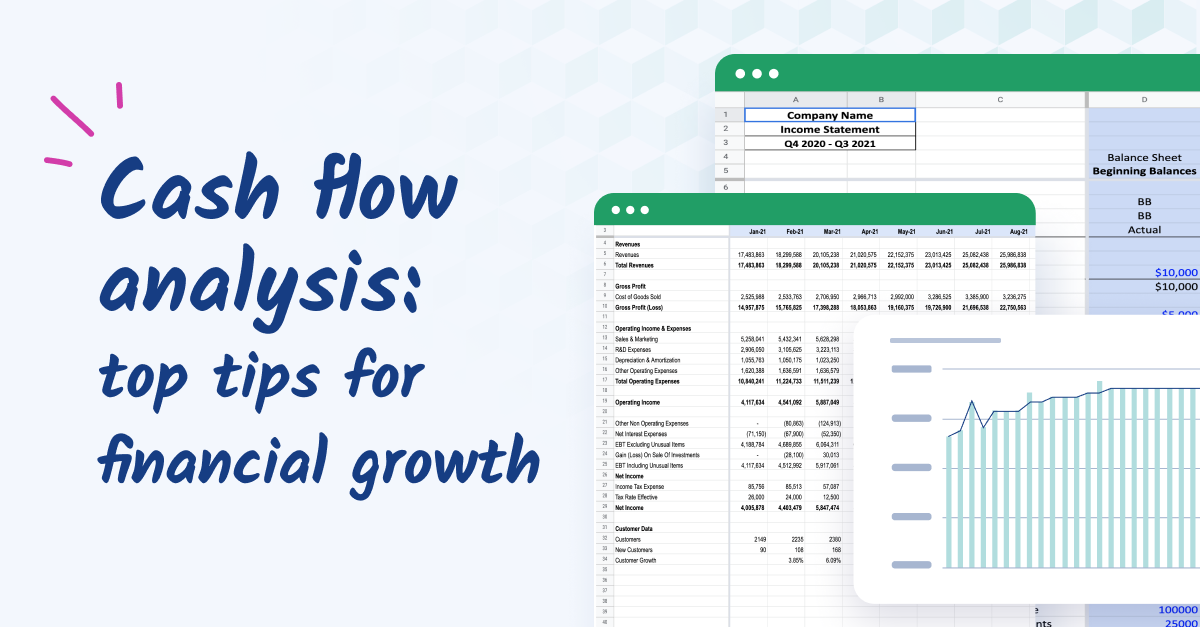

Data visualization tools offer finance teams the ability to interpret complex data sets quickly and efficiently. In the real estate industry, where financial patterns and market trends can change rapidly, having this immediate clarity is crucial. Dashboards, charts, and graphs translate raw data into easily digestible visuals, offering real-time insights that enable quicker and more informed decision-making.

With these intuitive tools, decision-makers can identify emerging opportunities or potential risks that might not be as evident in traditional spreadsheets. For instance, a well-designed dashboard can track metrics like occupancy rates, rental yields, and market growth to uncover trends that highlight areas for investment or signal potential declines. If rental yields start to fall in a specific region while other indicators remain stable, finance teams can investigate further to address potential issues proactively.

Additionally, advanced data visualization enables teams to customize insights based on stakeholder needs. For example, an executive report can include simplified visuals that clearly outline a property's performance, investment return, or potential growth opportunities. These visuals resonate more effectively with stakeholders, ensuring everyone understands the data's implications.

Data visualization tools often include interactive features, enabling finance teams to dig deeper into specific metrics or explore different scenarios. This flexibility allows them to analyze "what-if" scenarios, such as how occupancy rates could impact cash flow or how economic changes might influence market demand.

3. Take advantage of Big Data.

Big Data is a term used to describe the process of collecting, analyzing, and making sense of massive sets of information that are too complex for traditional data-processing methods. For real estate finance teams, this involves sourcing vast amounts of data from multiple channels, including tenant demographics, local economic trends, and internal property performance metrics. By systematically analyzing these data sets, teams can identify patterns and trends that inform smarter, more strategic investment decisions.

For instance, understanding tenant demographics can provide insights into what types of properties will be in demand. By analyzing trends like age, income level, and employment status, finance teams can forecast changes in rental demand and tailor their strategies accordingly. If younger tenants are increasingly moving to certain neighborhoods, properties catering to their preferences can be prioritized for development or acquisition.

Local economic indicators, such as employment rates and consumer spending, also play a crucial role in uncovering growth markets. An area with rising employment figures and significant infrastructure development might signal an emerging hotspot for real estate investments. Conversely, declining job numbers or falling consumer confidence could indicate a market where demand is expected to dip, prompting teams to reassess their investment approach.

Analyzing internal property performance metrics, such as occupancy rates, maintenance costs, and tenant turnover, can reveal areas for operational improvement. If a particular property consistently has a high tenant turnover, finance teams can investigate whether issues like rental rates, amenities, or management practices are impacting tenant satisfaction. Addressing these problems can improve the property's stability and increase its long-term value.

By integrating these diverse data sources and applying advanced analytical methods, finance teams can refine their strategies to maximize returns while reducing risks. Big Data analysis allows them to identify promising new markets, spot early signs of emerging trends, and make data-driven decisions that align with long-term growth objectives.

Common pitfalls (and how to avoid them)

While effective FP&A practices can significantly enhance decision-making and drive growth, certain pitfalls can undermine even the most well-intentioned efforts. Here are some common pitfalls to be aware of:

-

Over-reliance on historical data: While historical data provides valuable insights, it shouldn't be the sole foundation of your financial models. Market conditions change rapidly, and relying too heavily on past trends can lead to outdated projections. Always incorporate current data and external economic indicators to ensure forecasts remain relevant.

-

Ignoring regional market differences: Real estate markets vary greatly by region due to factors like local regulations, economic conditions, and demographics. Applying a one-size-fits-all approach across regions may result in missed opportunities or underestimated risks. Customize your financial models to reflect specific regional market dynamics.

-

Inadequate scenario planning: Focusing solely on optimistic projections or failing to consider worst-case scenarios can lead to significant setbacks. Incorporate comprehensive scenario analyses to explore various market conditions, interest rate changes, and economic fluctuations, and use these insights to strengthen your risk management strategies.

-

Lack of stakeholder alignment: When FP&A teams don't align their strategies with the goals and expectations of stakeholders like investors, developers, and property managers, it can create friction and lead to misguided decisions. Establish clear communication channels and tailor reports to stakeholder needs for better collaboration and alignment.

-

Neglecting portfolio diversification: Concentrating investments in a single property type or region exposes the portfolio to higher risk. An unexpected downturn in one sector can significantly impact overall returns. Diversify across property types and geographies to mitigate these risks.

-

Overlooking operational costs: Focusing solely on acquisition costs and expected returns may lead to underestimating the long-term operational expenses of a property, such as maintenance, tenant turnover, or property management fees. Accurately project and monitor these costs to ensure profitable investments.

-

Inconsistent data quality: Poor data quality or inconsistent data entry practices can lead to inaccurate projections and flawed decision-making. Implement data governance policies and regularly audit data sources to maintain accuracy and consistency across financial models.

Conclusion: achieving sustainable growth

Ultimately, successful FP&A balances data analysis with market intuition. By embracing these strategies, finance leaders can confidently guide their portfolios through challenges and seize opportunities for sustainable growth.

Want to learn how a solution like Cube can simplify this process? Request a free demo today.

.png)