-2.png?width=1200&height=627&name=Blog%20Hero%20(1)-2.png)

It's not earth-shattering news to say accounting and finance haven't exactly been vanguards of innovation in the past. And that’s a bit of a head-scratcher given the typical finance organization's reliance on data, all of which leads us to an unfortunate but undeniable fact:

Finance hasn't consistently provided the accurate, timely data leadership needs for sound decision-making in a dynamic marketplace.

But times change, thankfully, so with the advent of specific technologies – automation, data analytics, and data dashboards, to name a few – board members and executives no longer have to sit around a handsome conference table staring at stale management reports, inaccurate ratios, or outdated key performance indicators (KPIs). In fact, thanks to the flexibility and nuanced insights provided by a well-constructed dashboard, leaders can now analyze genuine business intelligence rather than 90-day-old metrics.

Manual Reporting Breeds Stale Board Reports

Think about the twisted and tangled business environment from the last few years. A global pandemic, supply chain implosion, and labor shortages, not to mention bankruptcies, impairment, and other assorted disruptions – it's been a real doozy.

Now imagine a chief financial officer sitting in a board meeting, discussing how all of these variables and variances are occurring at once, and continue to evolve at a rapid pace. Unless those board reports use relevant benchmarks and immediate data – or something close to it – that CFO is going to struggle illustrating what it all means to the company.

And yet, despite similar scenarios playing out across the globe, many finance leaders still rely on manually generated data, often weeks or even months old, in their reports. With companies continually dealing with such a constant flurry of curveballs, those weeks or months might as well be years or decades.

Mind you, we're not talking about your balance sheet, income statement, and cash flow because the old stalwart financial statements and annual reports will always have prime seats at that handsome conference table. No, we’re going well-beyond line items for receivables, liabilities, and your standard profit and loss statement. Instead, we're referring to the reports and analyses still relying on Excel and PowerPoint to present financial results and your current financial position with the board. And that leaves us with a big ol’ obvious question:

Why do so many finance leaders continue using outdated data and manual processes with the executive director, finance committee, and other heavy hitters?

Well, old habits die hard. And by old habits, we really mean MS Office and the never-ending parade of spreadsheets that spring from it. Sure, Excel workbooks will always have a role in a finance organization. However, that role shouldn’t be financial reporting or propelling the sort of forward-looking, far-reaching business intelligence that separates the winners from the also-rans. And that’s where financial data dashboards provide so much value.

Your Board of Directors Wants Relevant Financial Information

It's not just stale reporting that creates such an issue, however. It's also the inefficiencies that stem from it. Going back to our beleaguered CFO, let’s say they’re speaking to the board about a worrisome, very recent market dynamic. As you might guess, by discussing such a recent development without timely supporting data, board members will inevitably want a more relevant, up-to-date type of report that slices and dices financial performance and relevant factors as insightfully as possible.

Since our CFO wants to stay on the board’s good side, they immediately agree and task a finance manager and small squadron of analysts to reinvent the data wheel and generate said reports, further taxing an already stretched team. See where we're going with this?

Without the flexibility that near real-time data and reporting provide, CFOs will never catch up, basically relegating themselves to the financial reporting equivalent of Groundhog Day. Fortunately, data dashboarding is the feel-good ending CFOs so desperately need to stop that stressful, self-perpetuating narrative.

Data Dashboarding: Exactly What Your Board Needs From Reporting

Now let's revisit our previous scenario, only after implementing dashboard reporting. That same troubling dynamic appears in the market just a few days before the board meeting. However, since our CFO now relies on streamlined information systems and dashboards for reports, they’re able to present data to the board that's only a day old – maybe even hours – rather than weeks or months.

We won't do a deep dive into dashboard reporting right now since we've already discussed the topic in the past. However, it's safe to say that dashboards provide the flexible, relevant, timely information that business leaders – both management and your board – deserve and demand in this ever-evolving climate.

Also, since you can drill down into your financial data during a board meeting – not to mention correlating, synthesizing, and connecting your financial data to operational and sales data in a single spot – the board members won't be requesting a cavalcade of further reports. Obviously, this makes life easier for a CFO, finance manager, and analysts who can now focus on value-add tasks rather than manually re-creating reports with fresher data.

Financial Dashboards Drive Business Intelligence

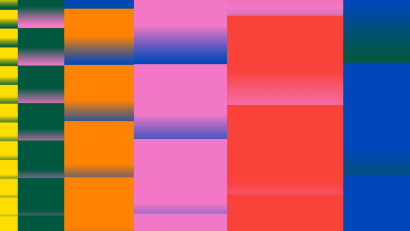

Ultimately, efficient data systems, advanced analytics, and dashboard reporting propel the type of business intelligence (BI) that distinguishes an organization from the competition. As you go, your FP&A forecasting and modeling become more sophisticated and prescient, allowing you to be more predictive in your analysis rather than descriptive or diagnostic.

Put another way, as our graph demonstrates, your BI capabilities mature as you implement initiatives focused on tools like dashboards and their analytic brethren. Granted, this isn't just a benefit to your board or even C-suite, but helps everyone in the organization, from the bottom on up.

To avoid getting too far over our skies with this discussion, though, let's wrap up by saying BI is something you build toward, because it's not going to just fall out of the sky and into your lap. And what is one of the most critical steps in developing true BI? You guessed it – data dashboards.

In the end, dashboards breathe new life into your board meetings and performance reports. They're accessible from anywhere and at any time, allow the user to instantly drill down into deeper insights, and can integrate almost immediate data into your reporting. Plus, they make any CFO look like a superhero in front of the board. So let's get you up and running, shall we?