The fundamentals of IFRS 16

Future CFO

MAY 22, 2022

Financial reporting specialist and lecturer Adam Deller explains the basic principles of IFRS 16, Leases. The post The fundamentals of IFRS 16 appeared first on FutureCFO.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Future CFO

MAY 22, 2022

Financial reporting specialist and lecturer Adam Deller explains the basic principles of IFRS 16, Leases. The post The fundamentals of IFRS 16 appeared first on FutureCFO.

Future CFO

NOVEMBER 27, 2023

The Financial Reporting Council (FRC) calls for IFRS 17 disclosures improvements in its recently published IFRS 17 'Insurance Contracts' thematic review. The IFRS 17 disclosures improvements that FR C expects include the following.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Planning Your Restaurant's Path to Profitability

How Automation is Driving Efficiency Through the Last Mile of Reporting

Future CFO

APRIL 17, 2022

Financial reporting specialist and lecturer Adam Deller explains the basic principles of IFRS 5, 'Non-Current Assets Held for Sale and Discontinued Operations'. The post The fundamentals of IFRS 5 appeared first on FutureCFO.

Future CFO

FEBRUARY 7, 2023

IFRS 17 will change insurers' reported earnings and equity as it alters their profit recognition patterns and measurement of liabilities, while not directly affecting insurers' creditworthiness, said Moody's recently. The new insurance reporting standard has been taken effect since January 2023.

Future CFO

JUNE 27, 2022

Financial reporting specialist and lecturer Adam Deller explains the basic principles of IFRS 8, Operating Segments. The post The fundamentals of IFRS 8 appeared first on FutureCFO.

Future CFO

AUGUST 15, 2021

Financial reporting specialist and lecturer Adam Deller explains the basic principles of IFRS 2, “Share-based Payment”, in this short video. The post The fundamentals of IFRS 2 appeared first on FutureCFO.

Future CFO

FEBRUARY 11, 2020

South Korea life insurance firm Kyobo Life has implemented a high-performance computing platform for IFRS 17 and K-ICS financial reporting compliance, said AON recently. The post IFRS 17: South Korean insurer implements a computing platform for compliance appeared first on FutureCFO.

Future CFO

JANUARY 21, 2020

At its October 2019 meeting, the IASB made progress in phase two of its project to amend IFRS in response to the financial reporting challenges posed by IBOR reform. The post Global IFRS IBOR reform: Phase 2 Classification and Measurement issues appeared first on FutureCFO.

Bramasol

SEPTEMBER 29, 2023

The first is the Financial Accounting Standards Board (FASB) in the United States. The other is the International Accounting Standards Board (IASB), whose rules for financial reporting are known as International Financial Reporting Standards (IFRS). More details on climate issues below.)

Bramasol

JULY 22, 2023

From a global perspective, the International Sustainability Standards Board (ISSB), which was established by the IFRS in November 2021 at COP26 in Glasgow, has issued its first two standards. IFRS S1 requires companies to communicate the sustainability risks and opportunities they face over the short, medium, and long term.

Future CFO

SEPTEMBER 19, 2023

The Taskforce on Nature-related Financial Disclosures on Sept. 18 released its final recommendations on nature-related risk management and disclosure, aligned with existing Global Reporting Initiative (GRI) and International Financial Reporting Standards (IFRS) and Kunming-Montreal Biodiversity Framework requirements.

Future CFO

FEBRUARY 1, 2024

Hasenoehrl adds that organisations must take the new International Financial Reporting Standards (IFRS) S1 and S2, which will be used in many countries as the accounting foundation for ESG reporting.

Future CFO

AUGUST 16, 2022

The ISSB, formed by the International Financial Reporting Standards ( IFRS ) Foundation after last year’s UN climate change conference, COP26, published two exposure drafts (EDs) in March 2022 for comment — one on general requirements and a second on climate disclosures. “We

Future CFO

APRIL 18, 2022

Click on the link to download to discover in detail a list of the benefits that IBM Cognos Controller provide for finance teams: Data collection and validation Reconciliations Workflow and tasks to improve the close cycle Currency conversion Minority interest calculations Inter-company eliminations Group closing adjustments Management adjustments Allocations (..)

CFO Leadership

OCTOBER 10, 2023

For instance, could financial statements generated by ChatGPT withstand audit scrutiny? Whether ChatGPT applications could pass a SOC-1 audit, a crucial certification for control over financial reporting, remains to be seen. SEC filings, GAAP documentation, FASB accounting standards, IFRS standards, PCAOB, FINRA, etc.),

Future CFO

MARCH 5, 2024

The path forward to action The report cites three critical actions that companies should consider taking to support the global climate agenda: Mindset shift from burden to action: In the best performing companies, disclosure data is used to drive action.

PYMNTS

JUNE 10, 2019

The CPAs’ request comes as the International Financial Reporting Standards Foundation (IFRS) Interpretations Committee prepares to meet this week in London to discuss standards in the cryptocurrency taxation space.

CFO Leadership

OCTOBER 18, 2023

For instance, could financial statements generated by ChatGPT withstand audit scrutiny? Whether ChatGPT applications could pass a SOC-1 audit, a crucial certification for control over financial reporting, remains to be seen. SEC filings, GAAP documentation, FASB accounting standards, IFRS standards, PCAOB, FINRA, etc.),

CFO Talks

JUNE 7, 2022

The Steward must ensure company compliance with financial reporting and control requirements. Accounting knowledge (IFRS and taxation). External financial and regulatory reporting knowledge. Information quality and control rationalisation are top-of-mind issues for the Steward.

The Finance Weekly

MARCH 28, 2022

Continue reading to learn what ESG reporting is, what's new with ESG reporting standards, why Finance teams should care, and the five benefits of aligning ESG and financial reporting. But other considerations, however, are pushing increased CFO involvement in ESG reporting.

Future CFO

NOVEMBER 2, 2020

Many jurisdictions are moving towards international accounting standards such as International Financial Reporting Standards (IFRS) and US Generally Accepted Accounting Principles (GAAP).

PYMNTS

DECEMBER 16, 2016

A key part of business life is getting the books closed on time, with clean financial reporting that allows a high-level and granular view of what needs to be done next. This is especially true when multinationals must reconcile data across different accounting standards, such as GAAP and IFRS.

The Finance Weekly

JANUARY 31, 2022

Activity-based costing can be used to calculate the cost of each activity for budgeting and financial reporting, so it will be easy for the FP&A function to measure the performance of each business function against these activities as this will help the organization to streamline their operations.

Spreadym

AUGUST 10, 2023

When choosing the best financial reporting software solution, it's important to consider factors such as ease of use, scalability, integration with existing systems, compliance with accounting standards, cost, customer support, and any unique requirements your organization might have. What is financial reporting software?

Planful

JULY 27, 2016

Limited reporting and analysis capabilities, and too much manual effort. Not being compliant with US GAAP or IFRS. The next logical step is to replace the spreadsheet-based process with purpose-built enterprise performance management (EPM) applications designed to streamline budgeting, planning, and financial reporting.

Michigan CFO

MARCH 21, 2023

Having accurate and timely financial reports prepared before listing your business for sale is a sensible way to alleviate potential headaches once a deal closes. Financial consultants specializing in business sales can help prepare your financial records to maximize goodwill asset value.

Bramasol

JANUARY 27, 2023

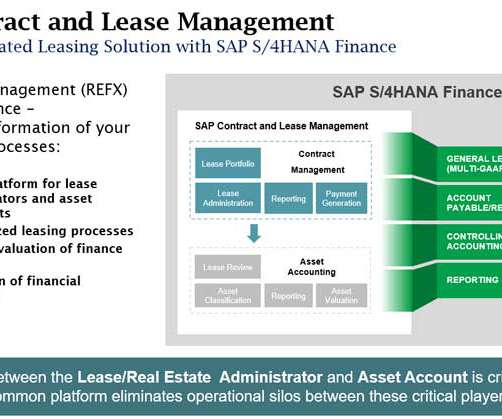

In 2018, the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) announced the release of new accounting standards, ASC 842 and IFRS 16, that redefined how organizations must account for leases.

Planful

SEPTEMBER 6, 2021

In an ideal world, financial reports should build shareholder trust by offering accurate data about the performance of the company. In reality, a company’s financial report can be more flimsy—involving estimates and judgment from leadership that’s far from the truth. at its peak to $0.26

Planful

SEPTEMBER 5, 2019

Periodic financial reporting is a great example. Most organizations put a great deal of manual effort into their periodic reporting. Our customers love to tell us how many inefficiencies they had in their reporting process before they started using the Planful Platform for financial reporting.

Musings on Markets

JULY 14, 2021

Almost in parallel, accounting as a profession found its footing and worked on creating rules that would apply to reporting, at least at publicly traded companies, with GAAP (Generally Accepted Accounting Principles) making its appearance in 1933.

Bramasol

MARCH 24, 2022

From a global perspective, the International Sustainability Standards Board (ISSB) is also working on developing uniform financial reporting rules. ISSB was established by the IFRS Foundation in response to the Glasgow COP 26 conference in November 2021.

The Charity CFO

JANUARY 19, 2023

There are ongoing efforts to establish International Financial Reporting Standards (IFRS) for nonprofits, which, if successful, could result in greater consistency and comparability of financial information across countries. Do You Struggle to Make Sense of Your Financial Statements? Get the free guide!

CFO Talks

DECEMBER 26, 2021

So it’s interesting that the focus isn’t only on climate change and reporting thereon and how to reduce emissions, but also on business efficiencies. So once we started to see this development, we then thought how do we give recognition to the accomplishments of these amazing people who we call CFOs.

Jedox Finance

JULY 11, 2023

In 2022, requirements related to several ESG issues accelerated with the European Financial Reporting Advisory Group (EFRAG) approving the European Sustainability Reporting Standards (ESRS). The standards are designed to bring sustainability reporting on par with financial reporting over time.

Planful

JUNE 22, 2017

Consolidating the data following specific financial accounting rules and guidelines, such as U.S. GAAP or International Financial Reporting Standards (IFRS). Reporting results to internal and external stakeholders.

Planful

AUGUST 1, 2017

According to a 2014 study by APQC benchmarking the financial close process, the bottom performers took 12 days or more to close and report their results to management. Then there’s additional time spent on external financial reporting and filings. Multi-GAAP reporting (i.e., US GAAP, Canadian GAAP, IFRS, etc.).

Onplan

NOVEMBER 30, 2022

Adaptive is one option companies use for modeling, budgeting, forecasting, and financial reporting. In addition to offering financial and sales planning solutions, Workday Adaptive also caters to workforce and operational planning needs. Automated reporting also enforces compliance with GAAP and IFRS standards.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content