Inflation outruns forecasts, prompting market bets on fewer Fed rate cuts

CFO Dive

APRIL 10, 2024

Futures traders cut from 56% to 17% the odds that the Fed will conclude 2024 having trimmed the main rate by more than a half percentage point.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

CFO Dive

APRIL 10, 2024

Futures traders cut from 56% to 17% the odds that the Fed will conclude 2024 having trimmed the main rate by more than a half percentage point.

CFO Dive

APRIL 1, 2024

Investor enthusiasm for artificial intelligence may spur companies to go public in coming months, EY said.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Barry Ritholtz

DECEMBER 1, 2023

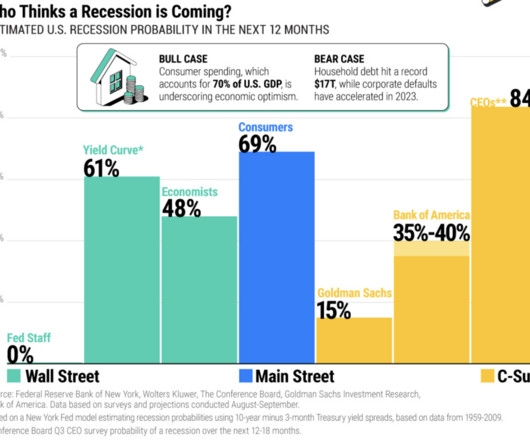

The chart above shows that 84% of CEOs are forecasting a recession over the next 12 months, 69% of Consumers saying the same thing, with the yield curve predicting a 61% chance of a contraction. The problem is those sets of forecasts is already 2 months old, dated October 3, 2023. Previously : Slowing U.S.

Centage

JUNE 28, 2023

When it comes to automation, what’s particularly beneficial is the way technology can automate how financial data flows through models and forecasts, freeing financial teams from the manual labor of attempting to create forecasts via spreadsheets. Fortunately, automation allows for increased agility.

Jedox Finance

MARCH 17, 2022

Although it is nearly impossible to predict the future, forecasting future market development and customer needs is an essential component of corporate strategy and planning. Predictive forecasting can help guide a company in growing more profitably and respond quickly to changes. What is Predictive Forecasting?

CFO Dive

FEBRUARY 26, 2024

Data on the job market, and consumer and producer prices, suggest the Fed may need to keep the main interest rate at a 40-year high longer than markets anticipated.

CFO Dive

JANUARY 17, 2024

Robust retail sales defy predictions that trends such as declining savings and a cooling labor market will inhibit consumer spending.

CFO News Room

FEBRUARY 5, 2022

The grid operator, as of Thursday evening, was forecasting demand on Friday morning to peak at roughly 73 gigawatts as temperatures drop. The silver lining here is that ERCOT’s forecast seems to bake in a lot of caution. The low forecast for Dallas Friday morning called for around 17 degrees, for example.

The Finance Weekly

JANUARY 8, 2024

While company leaders can't control everything, such as market fluctuations and economic changes, they can influence expenses. This is why expense forecasting is valuable for CEOs, CFOs, and other executives when predicting a company's future financial performance. What Is an Expense Forecast?

Centage

FEBRUARY 2, 2023

However, one of the most important planning tools for a business of any size is cash flow forecasting – and it’s especially important in times of uncertainty. Knowing the timing, amount and predictability of future cash flows with cash flow forecasting should be an essential component of the budgeting and planning process.

Future CFO

SEPTEMBER 7, 2023

Atradius has recently upgraded its global GDP growth forecast for 2023 to 2.4%, which is a slowdown from 2022 but a significant improvement on earlier predictions. In addition, the firm posted a global GDP growth forecast of 2.0% Emerging market economies (EMEs) will fare better, with forecast growth of 3.9% for 2024. “We

CFO Share

DECEMBER 9, 2023

In the whirlwind of being a small business owner, you may feel too overwhelmed to take time for forecasting, but building a financial forecast is not just an advantage—it’s a necessity for survival and growth. What is financial forecasting? However, hedging comes with its own costs.

Cube Software

MARCH 4, 2024

What to look for in revenue forecasting software Revenue forecasting software is a tool designed to help businesses predict future sales and income over a specific period. It leverages historical data, sales trends, and market analysis to provide an estimate of the revenue a company can expect to generate.

Strategic Treasurer

JULY 21, 2022

Preparing Your Cash Forecasting Strategy for Market Uncertainty. Description : Companies today are bracing for an era of increasing market uncertainty, interest rate and pricing fluctuations, and possible recession. In such times, forecasting needs to become a priority. September 22 | 2:00 PM EDT. Register Now.

CFO Share

JANUARY 12, 2024

Financial forecasting is an essential practice, but navigating the waters of financial planning can be daunting, especially when you’re considering bringing a fractional CFO on board for the first time. What is a Financial Forecast? Updating forecasts monthly is considered best practice. Final forecast review.

Barry Ritholtz

MAY 19, 2023

Only 5 stocks driving markets?! Equal-weighted Nasdaq100 up 17% since the June lows for the market because “it’s only 5 stocks”? How bad at math do you need to be to think that it’s only 5 stocks driving this market? But people have been forecasting an imminent recession for 18 months — and we still have yet to have one.

Barry Ritholtz

FEBRUARY 14, 2024

At the Money: Is War Good for Markets? February 14, 2024) What does history tell us about how war impacts the stock market? Can these patterns inform us of future bull market behavior? A 500% move in the stock market. Explain your dad’s thinking about how war plus inflation equals a stock bull market.

VCFO

MARCH 4, 2022

Financial Forecasting Best Practices – 7 Tips for Success. Financial forecasts are critically important planning tools. In creating the forecast, research into the profitability of current operations and areas of potential expansion are essential to success. Prepare multiple forecast views. Begin with the end in mind.

Spreadym

SEPTEMBER 19, 2023

Budgeting and forecasting in business are both financial planning tools used by businesses, but they serve different purposes and have distinct characteristics. Here's an overview of the key differences between budgeting and forecasting. Forecast: Forecasts can vary in terms of their time horizon.

Centage

OCTOBER 28, 2021

Dynamic market conditions may not be anything new but navigating the current business environment and its unprecedented unpredictability has shined a spotlight on just how critical cash flow forecasting is to an organization. Here are three best practices to improve your cash flow forecasting: #1.

Barry Ritholtz

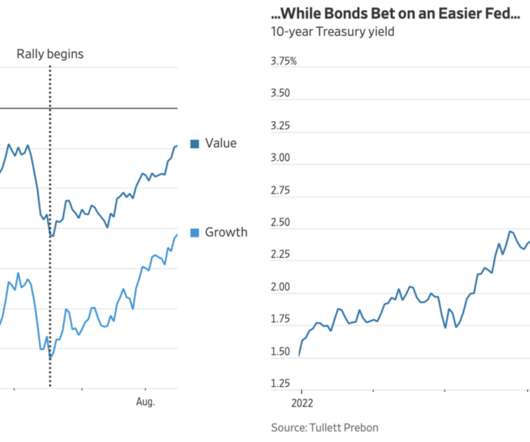

AUGUST 19, 2022

The link was to James Mackintosh’s column “ Five Not-Quite-Impossible Things the Market Believes.” But rational people can reasonably disagree on anything market-related — after all, someone has to be on the other side of your trade. As to what the market “knows:” Stop Anthropomorphizing Mr. Market.

Barry Ritholtz

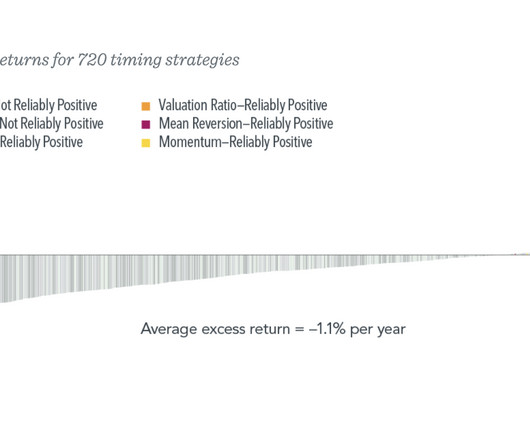

NOVEMBER 27, 2023

This weekend Jeff Sommer discussed a DFA research paper on market timing; both are well worth your time to read. The broad strokes are: Market timing is extremely difficult, very few people (if any) do it consistently well. Low Stakes : The most successful market timers are often those people who do not have actual assets at risk.

Future CFO

NOVEMBER 9, 2023

The fund raised its forecast for China’s economic growth after the country’s better-than-expected Q3 growth and Beijing’s move to approve a 1 trillion yuan (US$137 billion) sovereign bond issue and allow local governments to frontload part of their 2024 bond quotas. next year. "The

Centage

DECEMBER 19, 2023

Is your business set up to handle dynamic market conditions? Without it, you won’t know if you can make necessary capital expenditures to deal with unforeseen changes in the market, or have the funds to hire to ramp up production. What is a cash flow forecast? Do you have the resources to adapt?

Spreadym

JUNE 2, 2023

Rolling forecast is a financial planning and forecasting approach that involves continuously updating and extending the forecast based on the latest available data and information. As the current period elapses, the forecast is extended by adding a new period, maintaining the same forecast horizon.

Centage

JANUARY 3, 2024

As we ring in a new year and brace for all of the opportunities and challenges it will bring, one resolution should be near the top of the list for finance professionals: embracing flexible financial forecasting to future-proof your annual budget. Financial forecasting gives businesses the agility to adapt to changing conditions.

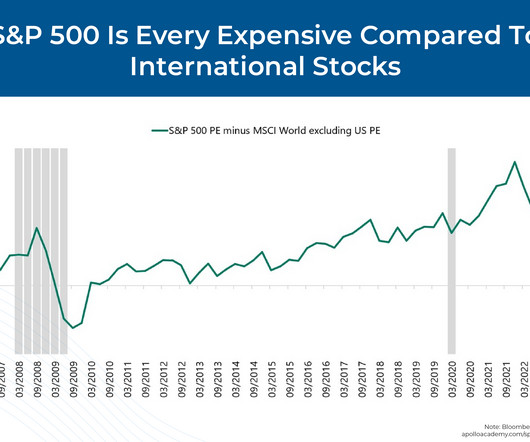

Nerd's Eye View

APRIL 3, 2024

The equity market is experiencing its own bifurcation, with a wide dispersion in (extremely elevated) valuations across the "Magnificent 7" and the rest of the market, which is much closer to historical averages. Given that corporate profits have historically tracked GDP growth, this inconsistency creates an interesting enigma.

Centage

DECEMBER 1, 2021

But times have changed – which is why financial forecasting is more important than your annual budget. More than half (57%) are producing P&L forecasts more often than monthly. What’s the Financial Forecast Look Like? Financial forecasting is especially important when it comes to cash flow. Watch Demo.

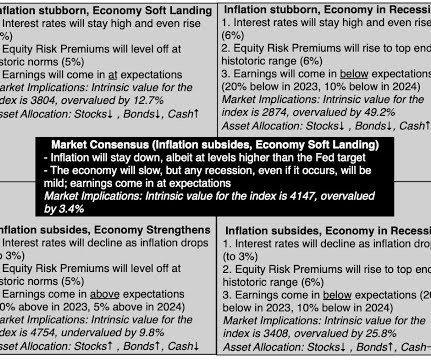

Musings on Markets

OCTOBER 4, 2023

That recovery notwithstanding, uncertainties about inflation and the economy remained unresolved, and those uncertainties became part of the market story in the third quarter of 2023. The Markets in the Third Quarter Coming off a year of rising rates in 2022, interest rates have continued to command center stage in 2023.

Centage

DECEMBER 14, 2023

Forecasting errors are an inevitable part of the budgeting process. Quickly identifying forecast errors in your budget is not a sign of failure, but an opportunity for improvement. Forecast error: Definition and Types In the simplest terms, forecast errors are the difference between predicted values and actual outcomes.

Centage

JANUARY 31, 2022

Is your business set up to handle these dynamic market conditions? Cash flow forecasting provides that much needed insight and is the most effective way to start future-proofing your business for the year ahead. Transform how you budget, forecast, analyze and report. Do you have the resources to adapt? Learn More.

Spreadym

MAY 23, 2023

Cash forecasting refers to the methods and approaches used by businesses to predict and estimate their future cash flows. To forecast cash flows, companies can use a variety of tools that can include simple models in Excel spreadsheets and special business software that contain tools and features for cash forecasting.

CFO News Room

FEBRUARY 4, 2022

The share-price decline would wipe more than $175 billion from the tech giant’s market capitalization once markets open Thursday and could spell its worst daily performance since it started trading in 2012, according to FactSet. Eli Lilly reported quarterly profit and revenue that beat forecasts. ConocoPhillips reported a $2.6

Future CFO

MAY 31, 2022

Global growth forecasts for 2022 and 2023 are lower as Russia's invasion of Ukraine and pandemic lockdowns in China add to supply shocks and stoke inflation, said Moody’s recently. in 2022 and emerging market countries will grow 3.8%, down from March forecasts of 3.2% Advanced economies will expand 2.6%

Jedox Finance

OCTOBER 24, 2019

A high-quality business forecast delivers far more than just numbers. Finance professionals regularly try to look in their crystal ball with forecasts and enable the company to have seamless, solid planning. For this to succeed, your forecast must be of high quality. A forecast should be prepared and adjusted on a regular basis.

Future CFO

SEPTEMBER 21, 2023

Financial Forecasting and Planning The CTO and CFO collaboration serves as a bridge between technology and finance, enabling comprehensive financial forecasting and operations. Time-To-Market: Rapid delivery of technology solutions is crucial for staying competitive.

Spreadym

JUNE 6, 2023

Financial forecasting refers to the process of estimating or predicting future financial outcomes and performance based on historical data, trends, and assumptions. Financial forecasting is a critical aspect of financial planning and decision-making for businesses, organizations, and individuals.

CFO News Room

FEBRUARY 5, 2022

lakh crore from the market, while net borrowing will be at Rs 11.2 Bond yields touched a 30-month high on Tuesday after the government announced a higher-than-expected gross market borrowing of Rs 14.95 lakh crore from the market, while net borrowing will be at Rs 11.2 The government will borrow Rs 14.95 By Manish M Suvarna.

CFO Share

AUGUST 5, 2021

Your strategic business forecasting must include proper considerations for section 280E – this is essential to planning cash flow and avoiding catastrophic tax bills at year-end. Whether you are growing, extracting, or retailing; none of the following expenses are ever permitted to be tax deductible: Marketing and advertising expense.

Spreadym

JUNE 8, 2023

Planning, budgeting and forecasting for a business are three distinct financial management tools used in business, each serving a different purpose. Key differences between planning, budgeting and forecasting for a business Here are key difference between planning, budgeting and forecasting for a business.

Centage

JULY 26, 2022

The goal is to gather the necessary information to forecast your cash flow quickly, correctly, and frequently. A crucial business document, the cash flow forecast estimates the amount of money that will move into and out of your business in a given period of time.

Collectiv

AUGUST 18, 2022

To succeed in a highly competitive business landscape, enterprises need a robust financial planning and forecasting strategy. Why Planning and Forecasting are Critical for Enterprises. Financial planning and forecasting go far beyond just day-to-day budgeting. Why Planning and Forecasting are Crucial for Power BI Users.

CFO News

DECEMBER 6, 2022

Fitch on Tuesday retained India's economic growth forecast at 7 per cent for the current fiscal, saying India could be one of the fastest-growing emerging markets this year.

E78 Partners

JULY 19, 2023

As we approach the planning cycle for 2024, organizations are recognizing the immense value of harnessing the power of forecasting, planning, and analytics (FP&A). Effective FP&A allows organizations to anticipate market trends, optimize resource allocation, and align their strategies with dynamic market conditions.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content