- News

- 3 min read

RBI may opt to roll over $5-b forex swap

The Reserve Bank of India (RBI) is considering rolling over a $5 billion foreign exchange swap set to mature next week in order to prioritize liquidity management over bolstering forex reserves. Some investors believe that allowing the swap to mature could lead to an inflow of around ₹40,000 crore in the banking system, but others argue that the RBI should focus on battling inflation. The RBI's decision may also be influenced by its desire to augment reserves as it collects $5 billion back from banks.

The Reserve Bank of India (RBI) could consider rolling over a $5-billion foreign exchange swap set to mature next week as the central bank, which has repeatedly flagged inflationary risks stemming from excess funds with banks, prioritises liquidity management over bolstering forex reserves.

Some investors believe that a current deficit in headline liquidity prints and expected currency leakage during the festive season make a case for the RBI to let the swap mature on October 23, potentially leading to an inflow of around ₹40,000 crore in the banking system.

However, others pointed out that with core liquidity remaining at a large surplus, the RBI is likely to accord more importance to the battle against inflation, given the central bank's worries about excess cash with banks fuelling consumer price pressures.

Core liquidity accounts for the government's cash balances, which cyclically flow in and out of the banking system.

"With the government running down its surplus cash position in the coming months, headline liquidity would get a boost. In this backdrop, to avoid any premature rate easing expectation, the RBI could consider rolling over the FX swap maturity of approximately ₹400 billion on Oct 23rd so as to defer its liquidity augmentation impact in the near-term," Kumar said.

SWAP MECHANISM

On April 28, 2022, the RBI concluded a sell-buy foreign exchange swap under which banks bought US dollars from the central bank and simultaneously agreed to sell the same amount of dollars at the end of the swap period.

The central bank had said at the time that the step was taken to elongate the maturity profile of its forward book and smoothen receivables related to forward assets. In April 2022, headline liquidity in the banking system was at a massive surplus of around ₹5 trillion as the RBI had infused large amounts of cash in order to keep borrowing costs low amid the COVID crisis.

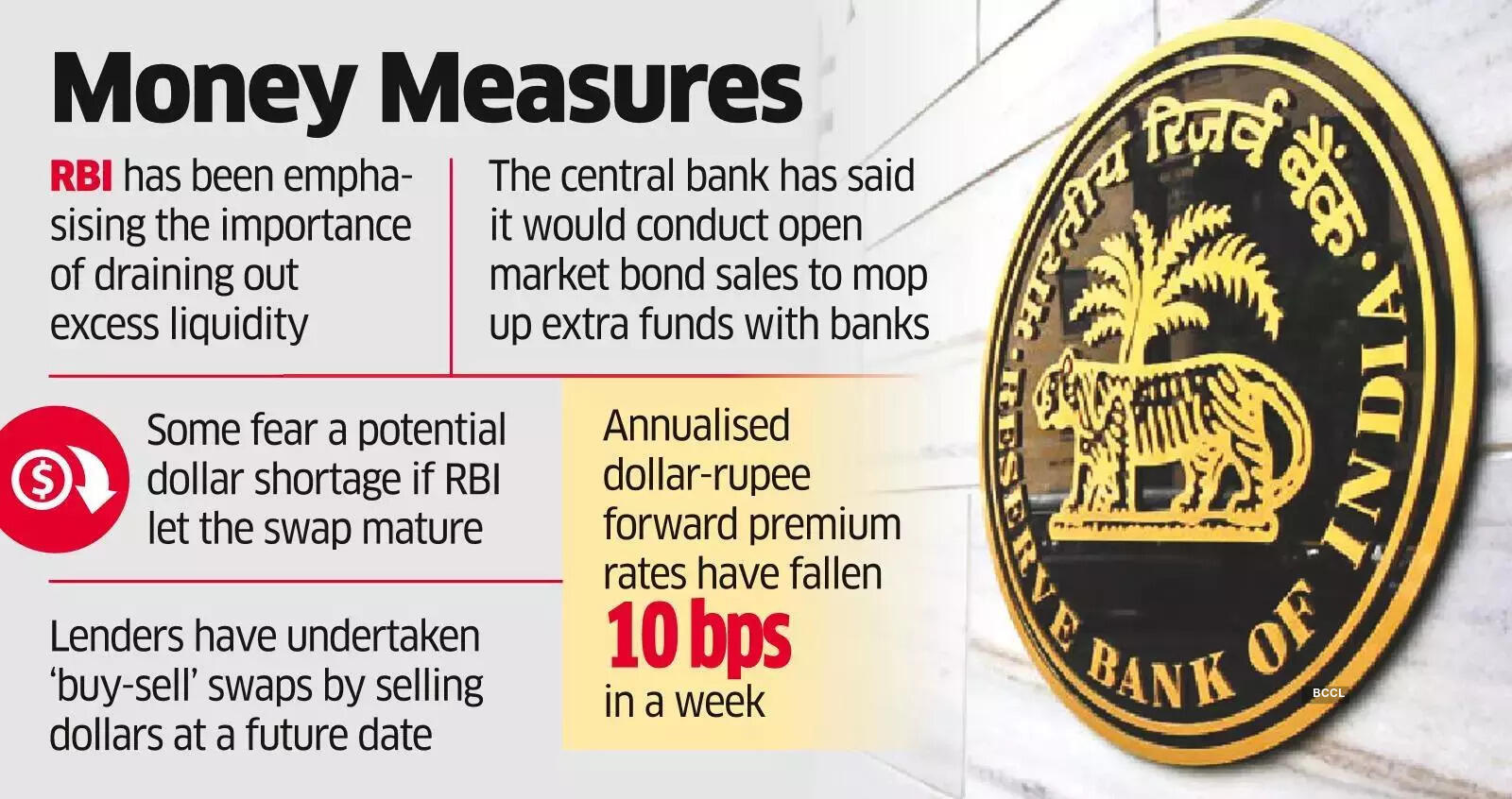

However, with inflation remaining volatile and far above the RBI's target of 4%, the central bank has been emphasising the importance of draining out excess liquidity. Earlier this month, the RBI said that it would conduct open market bond sales, a measure which durably mops up extra funds with banks and drives up sovereign debt yields.

RESERVES DILEMMA

According to a foreign bank trader, a factor that may prompt the RBI to let the FX swap mature is its desire to augment its reserves as it collects $5 billion back from banks.

From August 24 to October 6, the RBI's headline foreign exchange reserves have dropped $10.12 billion to $584.74 billion due to a combination of revaluation in the face of a strong US dollar and the central bank's dollar sales aimed at shielding the rupee.

With some banks fearing a potential dollar shortage if the RBI were to let the swap mature, annualised dollar-rupee forward premium rates have fallen 10 bps over the past week as lenders have undertaken 'buy-sell' swaps, which entail selling dollars at a future date.

COMMENTS

All Comments

By commenting, you agree to the Prohibited Content Policy

PostBy commenting, you agree to the Prohibited Content Policy

PostFind this Comment Offensive?

Choose your reason below and click on the submit button. This will alert our moderators to take actions