IFRS 17 cost estimated at US$15B to US$20B for insurers

Future CFO

JUNE 14, 2021

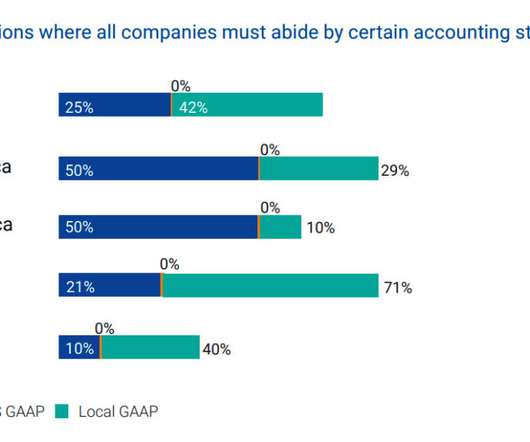

The total IFRS cost faced by the global insurance sector to implement the standard is estimated to hit the range of US$15 billion - US$20 billion, said Willis Towers Watson recently. Estimated IFRS costs vary significantly by insurer size, according to a Willis Towers Watson study which polled 312 insurers from 50 countries.

Let's personalize your content