If you’re brand new to nonprofit accounting, the Chart of Accounts might be the best place to start. Because even if you only have one bank account, bill, investment, or expense, you’ll need one.

What is a Chart of Accounts?

It’s a list of the accounts you use in your organization to track your financial transactions. Specifically, it tracks your assets, liabilities, income, expense, and equity.

You don’t record any financial data in the chart itself. Instead, the Chart of Accounts provides an organizational map of your accounting structure.

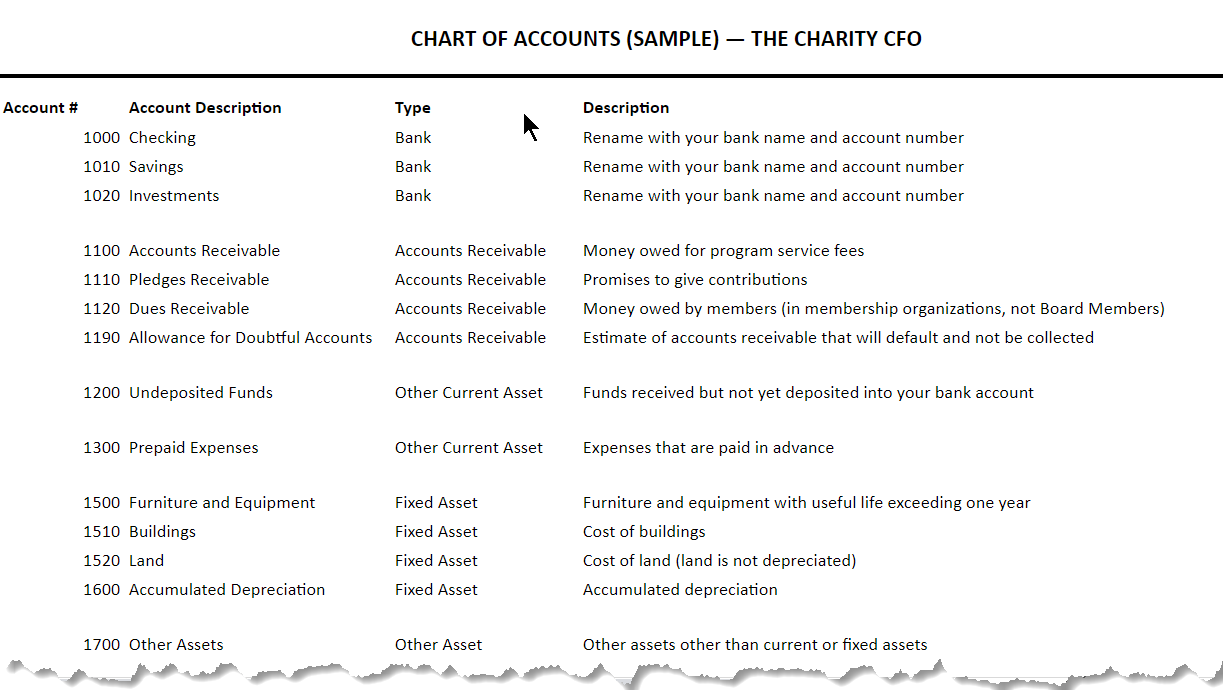

In a nonprofit’s Chart of Accounts, each account is identified in four ways: number, name, category type, and a short description. But the first two, number and name, determine the overall structure and organization of accounts and subaccounts.

How to Organize a Nonprofit Chart of Accounts

A Chart of Accounts organized properly helps people outside your organization (like your CPA or a bank) easily read your books.

For that reason, your account numbering, category names, and structure should follow standard guidelines and numbering conventions established by Generally Accepted Accounting Principles (GAAP).

Those number and name conventions are as follows:

Assets-1000s

Liabilities-2000s

Equity-3000s

Revenue-4000s

Expenses-5000s+

Pro-tip: Expenses are the only category that (typically) include more than one number range. Mid-size or larger organizations might use 5000s-9000s as expense categories.

When numbering accounts, keep things simple and group similar accounts together.

For example, you don’t need separate accounts for different types of office supplies (pens, paper, markers). But, you might want to have breakroom supplies or office equipment listed next after office supplies.

Your financial reports (such as a Statement of Cash Flows, for example) will be organized according to the accounts in your Chart of Accounts. So it will be much easier to make sense of them if you list accounts in a logical order.

What goes on the Chart of Accounts?

Every Chart of Accounts operates similarly, with the same five categories, in this order: Assets (1000s), Liabilities (2000s), Equity (3000s), Income (4000s), and Expenses (5000s+).

Here’s how that works for each account category.

1000: Assets

Assets are anything your organization owns, like cash in your bank account, accounts receivable, inventory, or fixed assets.

You’ll need to create a separate account for each individual checking or savings account.

Here’s how this would look on your Chart of Accounts:

| Account # | Account Description | Type | Description |

| 1000 | Checking Acct #1 | Bank | Rename with your bank account and account number |

| 1001 | Checking Acct #2 | Bank | Rename with your bank account and account number |

| 1010 | Savings Acct #1 | Bank | Rename with your bank account and account number |

| 1100 | Accounts Receivable | Accounts Receivable | Money owed for program service fees |

| 1110 | Pledges Receivable | Accounts Receivable | Promises made by donors to give contributions |

| 1500 | Furniture and Equipment ‘ | Fixed Assets | Furniture and equipment with useful life exceeding one year |

2000: Liabilities

A liability is anything you owe to other people or companies, including accounts payable, credit cards, and short-term or long-term debt. Your Chart of Accounts will be unique to your organization, but here’s an example of what it might look like:

| Account # | Account Description | Type | Description |

| 2000 | Accounts Payable | Accounts Payable | For normal bills due to others |

| 2100 | Credit Card | Credit Card | Rename with your Credit Card bank name and account number |

| 2310 | Accrued PTO | Other Current Liabilities | Unpaid paid time off including sick leave and vacation |

| 2700 | Notes or Mortgage Payable | Long-Term Liability | Long-term notes, mortgages, or capital leases |

3000: Equity / Net Assets

Equity is referred to as Net Assets in the nonprofit world. But no matter which name you use, it’s the accumulation of any surpluses (profit) that your organization has built up over time.

You calculate your equity by subtracting your liabilities from your assets. This calculation is called “the accounting equation,” and it’s the central principle behind all double-entry accounting systems.

Following GAAP rules regarding fund accounting, your nonprofit organization will need separate accounts for donor-restricted and unrestricted net assets.

Here’s how the Equity section might look on your Chart of Accounts:

| Account # | Account Description | Type | Description |

| 3000 | Opening Balance | Equity | |

| 3100 | Unrestricted Net Assets | Equity | Accumulated surplus that is not restricted for any purpose |

| 3200 | Temporarily Unrestricted Net Assets | Equity | Accumulated surplus that is held for a purpose or time |

| 3300 | Permanently Restricted Net Assets | Equity | Accumulated surplus held in permanently |

4000: Income / Revenue

Revenue (or income) is all money coming into your organization, including contributions, pledges, grants, and revenue. You should separate contributions by source (individual, federated funds, corporate gifts, government grants). And also, create separate accounts for program service fees, in-kind, special event revenue, and other miscellaneous income.

The Revenue section of a Nonprofit Chart of Accounts may look like this example below. Feel free to add any additional accounts or sub-accounts you may need to keep track of your various sources of revenue.

| Account # | Account Description | Type | Description |

| 4000 | Individual Contributions | Income | Cash donations from individuals |

| 4200 | Federated Contributions | Income | Contributions from federated campaigns (like United Way) |

| 4300 | In-Kind Services and Goods | Income | Value of donated goods and services |

| 4500 | Special Event Revenue | Income | Revenue generated at special events |

| 4700 | Membership Revenue | Income | Earned revenue from sales of annual memberships |

5000-9000: Expenses

Expenses are the money you spend, including operational expenses like salaries and rent and everyday expenses like office supplies and postage.

Pro tip: Notice that Expenses is the only category that uses multiple number categories. Leave plenty of room to add new expenses down the road. One way to do this is to use a new number range for each expense category, like Employee Wages and Benefits (5xxx), Operational Expenses (6xxx), etc.

The expenses portion of a Chart of Accounts might look something like this:

| Account # | Account Description | Type | Description |

| 5000 | Salaries and Wages | Expense | Cost of payroll including salary and wages |

| 5200 | Payroll Taxes | Expense | Employer portion of payroll taxes |

| 6100 | Professional Development | Expense | Training and development of staff and volunteers |

| 6300 | Printing and Postage | Expense | Printing and postage of correspondence, appeals, etc. |

| 6600 | Rent | Expense | Rent of office and equipment |

| 7100 | Insurance | Expense | Cost of liability, property, etc. insurance |

| 8100 | Interest | Expense | Interest expense incurred as a result of leases or debt |

| 8300 | Gain/Loss on Sale of Assets | Expense | Gain or loss resulting from the sale of property or equipment |

Download the Nonprofit Chart of Accounts Template!

Now, let’s put each of those 5 required categories together to get a full look at a nonprofit Chart of Accounts.

If you’re ready to create a Chart of Accounts for your nonprofit, you can start with this template, made for you to customize by The Charity CFO.

Use it as a guide. If you don’t need all of these accounts, you don’t need to create them today. And you may need to add others you don’t see here. But following this basic structure should give you a strong starting point for your organization.

Chart of Accounts and Nonprofit Financial Statements

Your Chart of Accounts can, and should be, the foundation for any accounting system. So the accounts on your Chart of Accounts will appear on your financial statements, like the Statement of Financial Position (balance sheet) and Statement of Activities (income statement).

But, not every section of the Chart of Accounts will be used on these statements.

The income statement uses the revenue (4000-4999) and expense (5000+) sections.

The Balance Sheet includes Assets (1000-1999), Liabilities (2000-2999), and Equity/Net Assets (3000-3999) accounts.

Get Started with Accounting for Nonprofits

There are 3 elements to set your accounting up for success; the overall accounting program, the accounting solution (or team), and the reports or documents.

- Accounting processes: A Chart of Accounts is best managed through a detailed accounting program. This program includes the organization’s accounting processes and accounting procedures. A detailed set of steps, due dates, tasks, and policies to be followed by your accounting solution or accounting team. (An example would be choosing and implementing an accounting software.)

- The accounting solution or team: As outlined in this resource, keeping track of governance and finances for nonprofits is more cumbersome than keeping your accounts clean. It often takes a dedicated provider or even an accounting team of individuals, depending on the size and scope of your organization. Hiring an in-house accounting staff or contracting a qualified solution are two examples of how many nonprofits handle their financial management.

- Accounting documents: The process and team dictate the documents and additional accounting reports necessary to show progress and maintain compliance with all laws and regulations regarding your nonprofit’s status.

A Trusted Partner in Nonprofit Accounting

You should now have a good starting point for understanding and creating a Chart of Accounts for your nonprofit.

But the Chart of Accounts is just the structure for organizing your accounting data. Now you’ll need to fill those accounts with all your financial data and keep them up to date week after week and month after month.

And use that data to create financial statements to share with donors and run your business effectively.

So if you’re ready to turn your chart of accounts into a living accounting system, we’d recommend you start with our free masterclass on nonprofit accounting and reporting.

It’s a great primer on nonprofit accounting, designed for non-accountants like exec directors, founders, board members, and volunteers.

The masterclass is 3 easy-to-understand video lessons you can watch in a single afternoon, so don’t miss it!

Click here to get free and immediate access.

Do You Struggle to Make Sense of Your Financial Statements?

Get our FREE GUIDE to nonprofit financial reports, featuring illustrations, annotations, and insights to help you better understand your organization’s finances.

Do You Struggle to Make Sense of Your Financial Statements?

Get our FREE GUIDE to nonprofit financial reports, featuring illustrations, annotations, and insights to help you better understand your organization's finances.

Get the free guide!

0 Comments