Finance Teams: Stop Wasting Time on Manual Account Reconciliation & Automate

The Finance Weekly

NOVEMBER 3, 2021

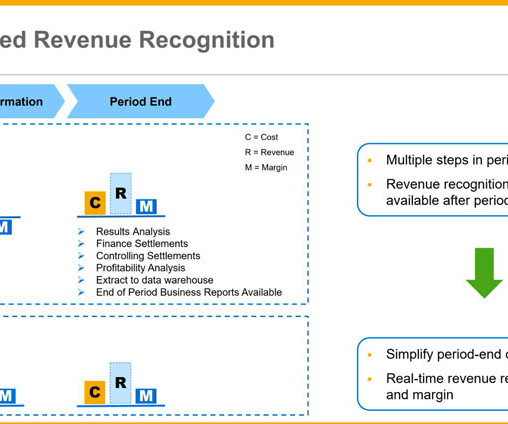

Account reconciliation is the matching and validating of balances in the general ledger (GL) to internal and external sources or other independent calculations to accurately close month-ends and year-ends. For both internal and external sources, each balance has to match the corresponding account in the general ledger.

Let's personalize your content