By David Enna, Tipswatch.com

Even though I am now in beautiful but very windy Split, Croatia, this morning, I couldn’t resist the temptation to check in on Treasury Inflation-Protected Securities after an incredibly volatile week.

Over the last year, I have been recommending investing in TIPS with a sense of urgency, because we couldn’t be sure how long these attractive real yields would last. In 2019, the last time the Federal Reserve ended a tightening cycle, real yields declined quickly. And then came the Covid pandemic, leading to aggressive Fed stimulus and real yields falling deeply negative to inflation.

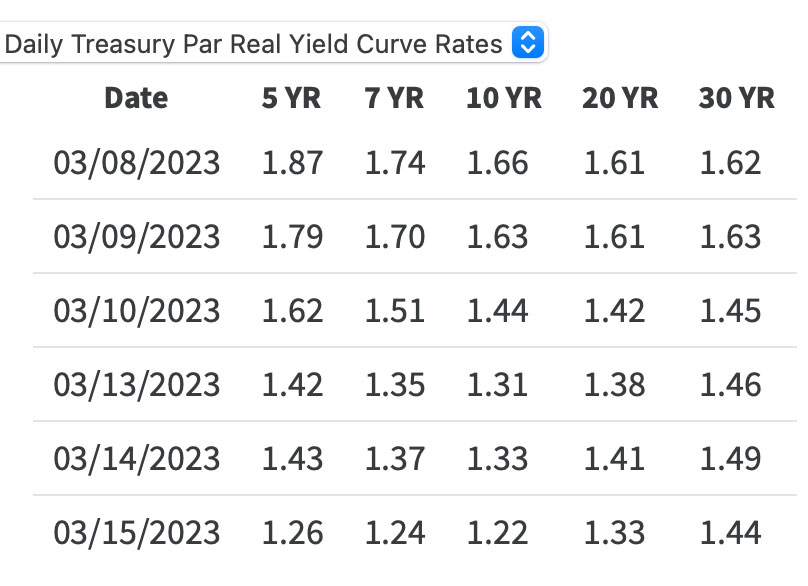

At this point of 2023, we are still seeing real yields at “fairly” attractive levels, but well below recent 2023 highs reached just last week. Here is the trend since March 8:

In this amazing week we saw: First a financial crisis caused by banks taking unneeded risks on long-term Treasurys for a minimal gain in yield, and second, a Federal Reserve bailout of depositors who were taking unneeded risks by concentrating deposits in a single “friendly” bank.

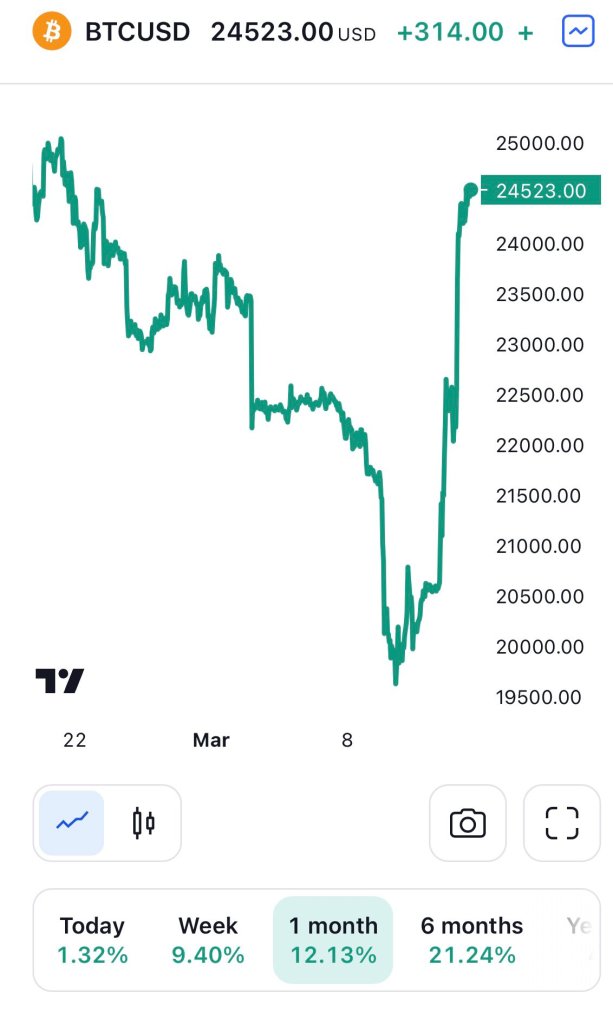

The moral of this story is that if you are big enough, there is apparently no risk in risk. And the markets heard this, loud and clear. The result was exactly opposite of what the Federal Reserve wants: Unfettered demand for highly risky assets like bitcoin, which has soared in the last week.

Are the Fed, Treasury and FDIC now tacitly guaranteeing all deposits at all FDIC-insured banks, above the current limit of $250,000? It appears this is true for some period of time.

Bond investors, though, are ignoring the green light to risk and have been piling into the safety of TIPS and other U.S. Treasurys, resulting in the dramatic fall in real and nominal yields. Since March 8:

- 5-year real yields have fallen from 1.87% to 1.26%, a decline of 61 basis points.

- 10-year real yields have fallen from 1.66% to 1.22%, a drop of 44 basis points.

- 30-year real yields have fallen from 1.62% to 1.44%, a drop of 18 points.

The fact that 5-year real yields have fallen the most seems to indicate the market is expecting the Federal Reserve will now halt its increases in short-term interest rates, and that does look likely in the short term. But the Fed is walking a tightrope as it continues to battle U.S. inflation, which is still running at an annual rate of 6%.

There is a definite possibility that the Fed’s injection of money into the financial system could be inflationary. From a Bloomberg article today:

Market observers are on alert to find out just how much extra funding the Federal Reserve’s new bank backstop program will ultimately add into the system, with analysts at JPMorgan Chase & Co. positing that it could inject anywhere up to $2 trillion in liquidity.

Inflation analyst Michael Ashton notes that the February inflation report doesn’t leave the Fed with a lot of room for error:

A nice, soft inflation report would have allowed the Fed to gracefully turn to supporting markets and banks, and put the inflation fight on hold at least temporarily. But the water is still boiling and the pot needs to be attended. I think it would be difficult for the Fed to eschew any rate hike at all, given this context. However, I do believe they’ll stop QT – selling bonds will only make the mark-to-market of bank securities holdings worse.

Will the Fed opt to ease troubled financial conditions? Or will it opt to continue an aggressive fight against inflation? Investors at this point seem to think inflation is going to be set aside as the top priority. In this chart, note that the TIPS market, represented by the TIP ETF, has moved from under-performing the overall bond market in late February, to out-performing based on the last week’s surge.

This is good news for holders of TIP ETFs and mutual funds, which suffered severe losses in 2022. The overall TIPS market is doing well as investors see the possibility of stronger inflation ahead if the Fed changes course.

Are TIPS still attractive? I think they are. These current levels remain reasonable, in my opinion, even if they aren’t quite as attractive. It’s impossible to say if real yields will level off, continue falling, or potentially begin to rise again.

In early morning trading today, the most recent 10-year TIPS has a real yield of 1.17%, a bit below the yield of 1.22% at its originating auction on Jan. 19, 2023. That TIPS will reopen at auction on Thursday, March 23. I will be posting a preview of that auction on Sunday morning.

* * *

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear.Please stay on topic and avoid political tirades.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. I Bonds and TIPS are not “get rich” investments; they are best used for capital preservation and inflation protection. They can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

Interesting that CD rates are appealing once again. Someone check my memory on this, but weren’t CD rates 2 weeks ago ~0.6% lower?

If so, does this imply that the “spread” party is over for banks and that they’ll have to finally compete for deposits?

I noticed CD rates rose. I infer people are reluctant to invest in CDs – even those with FDIC coverage – due to the possibility of bank failure coupled with FDIC failure. While FDIC has never failed to repay a deposit under its limits, that doesn’t mean it could not happen. I understand FDIC has far less in its fund than the covered amounts across all US banks.

I would not worry at all about investing under the FDIC limit.

We agree FDIC failure is a remote risk. But it is insurance, not backed by the full faith and credit of the US like Treasuries are.

If the government just stepped in to guarantee $500,000,000 in Roku’s money above the FIDC limit (at SVB), you think they wouldn’t print as much money as it would take to bail out the whole nation UNDER the FDIC $250K limit?

No government would survive that

My understanding includes:

1) The reimbursement by FDIC above 250k was in an effort to prevent other runs. If many runs have already happened (in the future), that strategy would no longer make any sense.

2) The FDIC used their fund – not the big money printer they use for say deficit spending. Their fund hasn’t enough money to reimburse every deposit – I think it’s around 10% – similar to private insurance companies.

For me the bottom line is: now is a great time to spread cash across several strong banks at <250k per account type, and/or use treasuries or other securities to prevent loss.

FDIC said they will use their “special assessment” option. This fee will be paid by banks to pay for any money needed by the FDIC. The banks will likely pay this fee by increasing all sorts of fees charged to customers, and lower already low interest rates (I doubt if CEOs are going to take a salary cut to pay for it). In other words, we, the public, have to bail out the wealthy politically connected depositors at Silicon Valley Bank.

As for brokered CDs, be sure they are non-callable. Brokered CDs do not compound interest, so CDs that pay every six months or annually are not as good as those that pay monthly. If you get your interest monthly, you can invest the interest in a money market fund monthly if you want. If you have to wait a year for your interest, you have to wait a year. Brokered CDs have a big advantage over bank issued CDs in that there are no early withdrawal penalties. But realize if you sell before maturity you may lose principal if rates are higher than when you bought. Also brokers will charge a commission if you sell the CD, although it is not very much.

I repeat – heads will roll if Roku got $500 million guaranteed in excess of the FDIC $250,000 limit, but retirees with $500,000 in deposits lose half their money.

Whichever party controls Congress at that time would get slaughtered at the next election

Even worse than threatening to cut SS

Patrick, you wrote:

“Brokered CDs do not compound interest, so CDs that pay every six months or annually are not as good as those that pay monthly. If you get your interest monthly, you can invest the interest in a money market fund monthly if you want.”

False. ALL CD rates are quoted on an APY basis. That doesn’t mean a “6% CD” that pays monthly pays 1/2% each month, that would result in an APY of 6.17%.

see this exact example at:

https://www.investopedia.com/terms/a/apy.asp

The formula for APY is (1 + r/n)^n – 1, where r is the nominal rate

You actually have it backwards. If CD APY rates are higher than money market rates, the FEWER times distributions are made, the better off you are. The FEWER the number of distributions, the less your reinvestment risk

Let’s make it simple by looking at an extreme example. Suppose you have a one year CD with payment at the end of the year, versus a one year CD with monthly distributions, and they both have an APY of 12%.

Again to make the point, assume money markets pay 0% (anything less than 12% APY on a money market gives the same result, but I’m trying to make this as obvious as possible).

On $1,000, the annual payout is $120 at the end of the year. APY = nominal rate

For the monthly payout, if APY is 12%, the nominal rate is 11.387% (see formula above). That means that each monthly payment is $94.89 each month, not $100, and you only collect a total of $113.87 over the course of the year.

It is YOUR problem to reinvest that each month to come out ahead of the $120 you would collect for a CD that only pays at the end of the year

I don’t think FDIC is going anywhere, but there is no obligation for the surviving or purchasing bank to maintain existing yields. They are free to break the CD and pay you interest to date, leaving you to invest elsewhere. This happened frequently in the 2008-10 banking crisis. Brokered CDs especially were often broken at par value, which could be an issue if you purchased them above par for a higher coupon rate.

I was going to make my first TIPS investment at the April at the 5 year auction, but AFTER the nosedive in interest rates this week, I was able to buy brokered 5 year CDs at 4.9% (not a typo 4.9% not 3.9%)

FDIC, non-called CD

I filled my dance card by Thursday afternoon, and the CD I invested in is no longer available, but I found a 4 yr CD at 4.95% still available this morning at my broker

I couldn’t miss the chance to go to the races with tomorrow’s newspaper and today’s race results tucked under my arm.

The Fed has broken at least one thing that we know about. That’s the known unknown. We still have to worry about the unknown unknowns.

On QT: I read on Grant’s Interest Rate Observer that last week’s rush of emergency lending to banks resulted in significant expansion of the balance sheet…

From everything I have read, this is true, possibly about $150 billion in one week.

That’s only 1.5 months worth of Fed runoff on their balance sheet ($60 billion Treasuries, $35 billion MBS each month)

As long as this isn’t repeated (more than once every 1.5 months) the Fed is still winding down their balance sheet.

I heard one Fed governor saying he wanted to continue the runoff until the balance sheet is cut in half, which will take 4 years since it started in earnest last September

It will be interesting to see how that plays out.

How many customer withdrawals are due to redistribution of funds between banks to stay within FDIC coverage limits?

If that accounts for a large percentage of banks’ access to the Fed’s discount window(s), most of the funds should be repaid to the Fed over the next few weeks or months.

Core CPI MoM came in at .5%, above consensus of .4%. Check out the trend, Nov Dec Jan Feb, .2%, .3%, .4%, .5% (note Nov Dec numbers were revised up to .3% and .4% by the authorities, but the trend is the same). We know the Fed only cares about the core CPI and probably only month to month data. I don’t care much of about core CPI data six to twelve months ago, which are of course included in annual data.

ECB raised 50 bp today without batting an eyelash. According to the CME FedWatch Tool, the probability of the Fed raising 25 is today 83%, yesterday 55%, and one week ago 32%. Fed will likely do 25 bp, probably should do 50 bp. This assumes no Black Swan event. Higher for longer.

As for the Silicon Valley Bank debacle, the regulators have unleashed moral hazard on the banking industry. I am not sure if the $250,000 FDIC insurance limit applies any more. Since they changed the rules for one bank, does this rule change apply to all depositors at all banks? Or does it only apply to wealthy politically connected depositors at an ESG obsessed bank?

I’d agree that the big flow of bailout money, which is “created” from thin air, gives the Fed the ability to raise interest rates 25 basis points next week. That keeps the message on track while having zero effect on near-term inflation.

For better or worse, SVB was used as a conduit bank for many payment processors. Etsy, Plastiq, Avalara, Melio, Patriot Software, and other companies endured issues. For Patriot Software, they had $250,000 in passthrough insurance per company, but that is nothing for a payroll run for a moderately medium sized business. Patriot Software’s owners and users are the exact opposite of the people you mention in your question.

Incidentally, SVB is still advertising its 4.50% money market account (“startup account”) – https://www.svb.com/business-banking/business-checking – which they probably shouldn’t do.

Henry, of course, some companies using SVB were not “progressive or ESG”, but the vast majority were. In any case, leaving out politics, all depositors with over $250,000 were bailed out and that is the problem. My view is that a $200 billion bank failure does not pose a systemic risk to the $23 trillion banking industry. Furthermore, the regulators will force a special “assessment” on all banks to pay for the bail out. This, of course, will be passed on to customers in the form of higher fees and lower interest rates.

I sold about $90k in vanguard’s long term treasuries fund (VGLT) and bought individual secondary market tips maturing in 2029-2032. That exits my long term treasuries at a loss (bought 2021) but sold them on a day when they spiked up so even though I didn’t get the best price for tips that day I got a better price for VGLT than other days. These tips will mature in my 70s and I feel better about holding that position long term (to bond maturity) than VGLT.

Your site has been invaluable for TIPS education and I appreciate the great resource. Hopefully the good deals on TIPS last.

Sorry wrong years above (typo) correct individual tips I bought were maturing 2049-2052, swapping long term nominal for long term tips.

I have been using a similar strategy— selling out of Schwab’s SCHP to buy individual TIPS maturing in 5 – 20 years.

In my view, the Fed has to raise interest rates 25 basis points after indicating their intention to do so, otherwise they risk sending a signal of panic to the financial markets that the banking situation is really a crisis and not a result of specific bank mismanagement. They are taking other steps to reassure depositors that their money is safe.

Meanwhile, inflation has declined steadily for many months now and theFed will want to ensure the trend continues:

Jun: 9.2%

Jul: 8.5%

Aug: 8.3%

Sep: 8.2%

Oct: 7.7%

Nov: 7.1%

Dec: 6.5%

Jan: 6.4%

Feb: 6.0%

If you look at the last 8 months, inflation totals only 1.8%. Extrapolate that over 12 months and you get an annual inflation rate of 2.7%. Or extrapolate from February’s 0.4% over 12 months and you get 4.8%. Average those two ways of looking at it and you get a much more realistic 3.75%. And housing accounted for a large portion of inflation, which isn’t affecting most people in their daily lives. The inflation rate of I Bonds being cut in half over the previous 6 month period tells the story too. Any way you slice it, the Fed is succeeding in it s inflation fight more than the YOY numbers suggest. I think they see the light at the end of the tunnel and will finish the job.

Good analysis

David,

First, I want to thank you for sharing your knowledge of the TIPS/IBonds marketplace. Based upon this education, I have opened up a Treasury Direct account and have been regularly purchasing Ibonds for me and my wife.

However, I am still grasping for when to buy TIPS in my retirement accounts. It seems we are going to go into a period of lower or static rates yet, inflation consistently higher than the past two decades. If this equals stagflation, I understand that to be a good time for TIPs. Yet if the breakeven rates are lower, that’s not so good.

In the end, it is a decision whether you think future inflation will increase the value of your TIPs more than the lower fixed rate? If that’s the case, I would think the answer is buy as I have no faith the Fed will keep inflation at 2%

Thanks for all your help navigating this area of the market!

Joe

The question before the FED is actually very simple: do we want Hyperinflation or not?