SaaS Multi-year Pricing Discounts

SaaS pricing can be a pretty complex subject. Mix multi-year contracts, discounts, and churn into your internal pricing discussion, and you need a degree in math to determine the optimal pricing for you and your customer.

Multi-year SaaS pricing discounts is a really interesting topic that does not receive enough financial thought. I have read a couple interesting posts that have lightly touched on the do’s and don’ts of discounting multi-year SaaS contracts.

Rules of thumb were offered on discounting, but I felt that there was not enough detail to trust the rule of thumb and implement in my sales contracting process.

In this post, I will explain the impact of churn, sales discounts, and SaaS contract length on your recurring revenue. I will start simple and then introduce variables to understand how every day sales decisions impact your recurring revenue.

Impact of SaaS Contract Length

With several variable inputs, this exercise can get quite confusing, so let’s start with an easy baseline. Then we can ease into changing the variables.

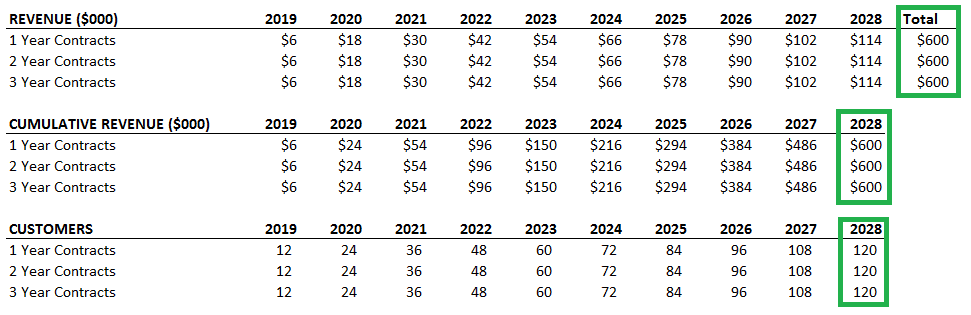

First, let’s assume no churn and no discounts to understand the impact of offering a one, two, or thee-year SaaS contract length to your customers.

You may have guessed the answer already. If churn is zero and there is no discounting based on contract length, your ending customer counts and revenue will be the same over time. This makes intuitive sense, but it is always helpful to see this in the picture below.

You can see from the picture above that the customer counts and revenue are the same. Again, SaaS contract length does not matter if you have no churn and offer no discounts to entice customers to purchase longer contracts.

Of course, everyone has churn and most every company offers sales discounts. The scenario above is not a realistic scenario, but I wanted to prove a point that contract length does not matter if you have no churn or discounts based on contract length.

Let’s Introduce Churn

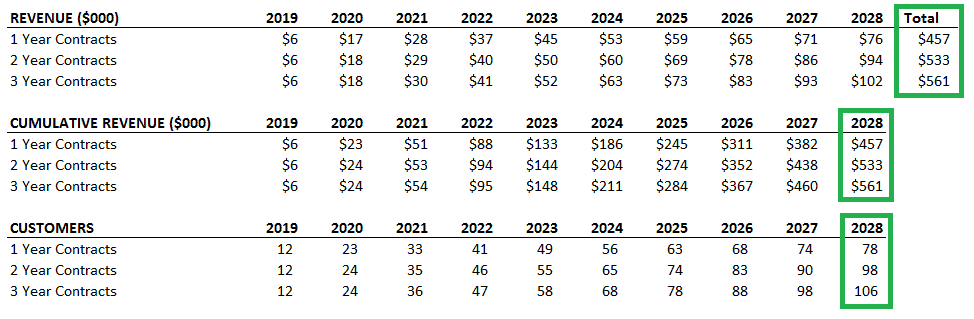

Let’s introduce churn on one, two, and thee-year contract terms. What contract length will have more revenue in the long run if the renewal rate is the same among one, two, and three-year contracts?

If my renewal rate is, say, 90% regardless of contract duration, it makes some sense that shorter contract terms offer customers more opportunity to churn, right? Each year they are given the opportunity to renew or churn.

On the other hand, multi-year SaaS contract customers have less opportunity to churn because they have to wait several years for that decision point.

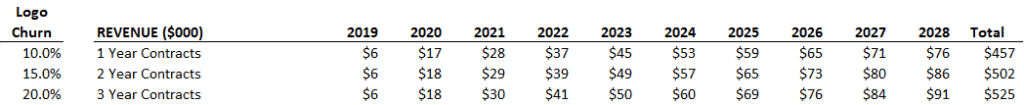

Therefore, longer contract lengths will earn more revenue over time at any level of churn and given equal churn among the scenarios. In the example below, I am using 10% churn at the time of contract renewal.

Would Churn be Different with Longer Contracts?

However, this begs the question. Would my churn rate be worse if I locked customers into longer contracts? I’d say, anecdotally, yes. However, it provides your customer success team more time to work with unhappy customers and bring them back to NPS happiness over the duration of a longer contract term.

BUT it introduces the important concept that you can accept higher churn on long-term contracts and still come out better than single year contracts with lower churn.

What churn rate can I accept for offering longer term contracts? I will address that next.

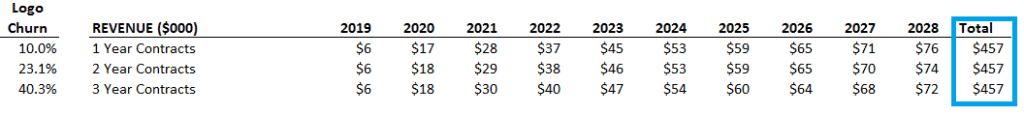

How Much Churn Can I Accept with Multi-year SaaS Contracts?

When customers are locked into longer contracts, they have less opportunity to churn. Therefore, you can accept higher churn than shorter contracts and still come out with the same revenue.

In the example below, I am testing a ten-year period. Over that time frame, you reach the same amount of total revenue (blue box) but with different customer churn rates. Single year contracts churn at only 10%, but you can absorb up to 40.3% churn rates with three-year contracts. And still come out with the same revenue over ten years.

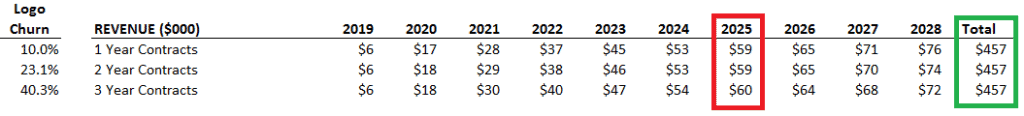

Hold on…Not so Fast

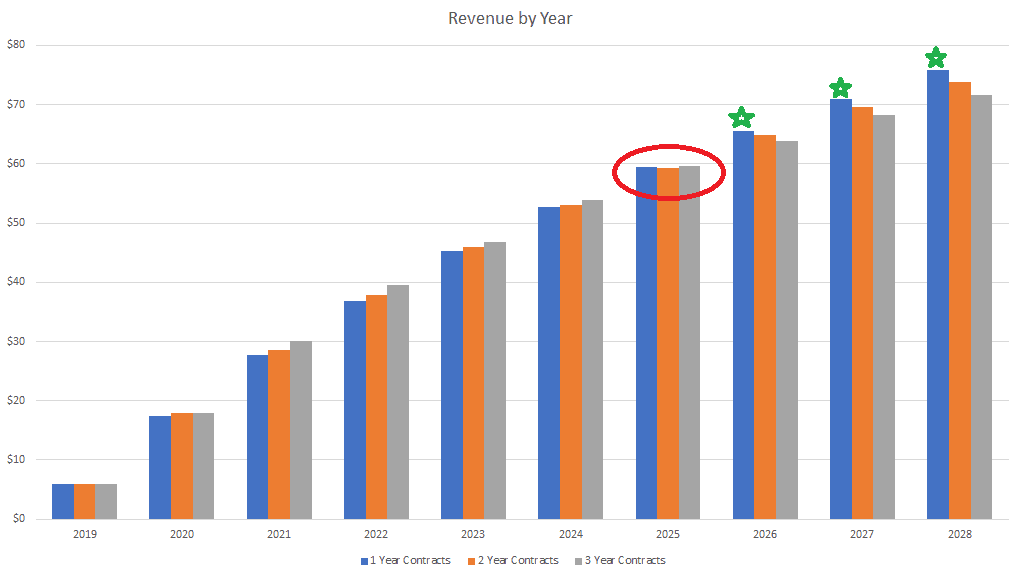

That is a lot of churn, but…there is an inflection point in year seven (2025) of the revenue forecast (red box below). In 2025, your annual revenue is almost equivalent. After 2025, the single year contract with 10% customer churn wins with the most annual revenue. The three-year contract with high customer churn begins to trail off and lag shorter term contracts.

The important point here is that you can accept higher churn with longer term contracts but only up to a point. Therefore, it is important to download the pricing calculator below and run scenarios specific to your company.

The Impact of Discounts on Multi-year Contracts

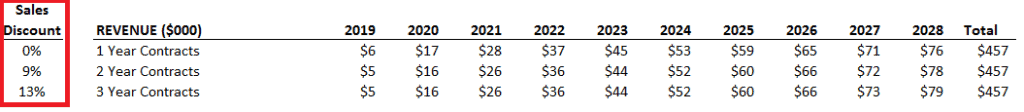

Ok, this is the last variable but one of the most important variables to consider in your sales process. Let’s say we experience the renewal rates below based on contract length. Discounting is still set to zero.

How much of a discount can we offer on a two or three-year contact and still come out ahead of single year contract?

Based on the churn rates in the picture above, we can accept up to a 9% and a 13% sales discount for a two-year and three-year contract, respectively. And still come out even with a single year contract.

Of course, there are many variables in the example, so I suggest that you download the pricing calculator below and run scenarios specific to your situation.

The big point here is that you cannot randomly throw out nice, round discount percentages to lock prospects into multi-year contracts, because it looks good on paper.

You must consider your current churn rate, discounts, and what contract lengths you would like to offer.

Action Item

Download my SaaS multi-year pricing calculator below. Find your following data points:

• Renewal rates by contract length

• Average customer ARR

• Average subscription sales discount by contract length

Plug those data points into the calculator and see how your revenue compares by contract length. That’s your baseline.

Then adjust the sales discount input and see what discount you can offer before your long-term contract revenues drop below single-year contract revenues. It’s like a break even point.

You’ll have a better feel for how far you can push the discount on multi-year contracts.

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 8+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.

The article was informative and I liked how this article explained about Churn.

Thanks for a good post Ben – this is in my experience a much overlooked issue that is often splitting finance and sales with good arguments on “both sides”.