My Two-for-Tuesday morning train WFH reads:

• Are Declining Interest Rates Responsible for Stock Growth? While declining interest rates have been responsible for stock growth (at least at the extremes), interest rate changes don’t always determine our investment destiny. What does though? Fundamentals:. (Of Dollars And Data) see also The Long-Term Wins: These periods do seem arbitrary but the changing of the calendar from one year to the next offers a good chance for market nerds like myself to update some long-term market data. (A Wealth of Common Sense)

• Tight Money Will Pressure Startups to Sell in 2023: Startups holding out for an IPO or Figma-scale acquisition are likely to be disappointed (Businessweek)

• Commodities have largely erased last year’s spike: Commodity prices got heaps of attention on the way up, but their drop hasn’t generated anywhere near as many headlines. That suggests to us that there is a lot of room for sentiment to catch up to reality on this front, boosting stocks along the way. (Fisher Investments) but see also Mapping the Death of NYC’s Cheap Slice: Inflation is ratcheting up the price of pizza in New York City. One man tracked more than 450 purchases over eight years to quantify the troubling trend. (CityLab)

• The Crypto Collapse and the End of the Magical Thinking That Infected Capitalism: Dogecoin. WeWork. The Metaverse. It was an era of illusory and ridiculous promises. (New York Times)

• EVs Made Up 10% of All New Cars Sold Last Year: Worldwide, sales of electric vehicles in 2022 passed 10% market share for the first time; 11% of total car sales in Europe (Plug-in hybrid vehicles were another >9%), EVs were 19% in China, and 5.8% in U.S. (up from 3.2% in 2021). (Wall Street Journal) see also 5 unintended consequences of the EV revolution: EVs are going to change our cars — and how we drive. (Vox)

• The joy of sets: Why won’t our artistic-literary establishment recognise that there’s mystery, beauty and humanity in maths? (Prospect)

• Microsoft Bets Big on the Creator of ChatGPT in Race to Dominate A.I. As a new chatbot wows the world with its conversational talents, a resurgent tech giant is poised to reap the benefits while doubling down on a relationship with the start-up OpenAI. (New York Times) see also What Meta employees really think about their company’s brutal year: Recode obtained a recording of a Mark Zuckerberg Q&A and internal survey results that show how Meta’s struggles are impacting staff. (Vox)

• Two research teams reverse signs of aging in mice: But doubts remain about whether cell reprogramming technique could one day help humans. (Science)

• ‘That Girl is Going to Get Herself Killed’ There is risk in the wilderness — even in mild adventures — and yet we still seek to reason with it, to assign order to it, to control it, and to tempt it. (Longreads) see also An Analysis of Deaths in U.S. National Parks (Panish Shea Boyle Ravipudi)

• Marcel Duchamp painted this explosive nude masterpiece. Then he quit. Modern art’s most influential trickster was hatched from the controversy surrounding “Nude Descending a Staircase (No. 2). (Washington Post)

Be sure to check out our Masters in Business interview this weekend with Jennifer Grancio, CEO of Engine No. 1, where she guides the firm’s strategic vision. She previously was a founding member of BlackRock’s iShares business, where she led European, US, and global distribution, driving the growth of iShares and the global ETF industry.

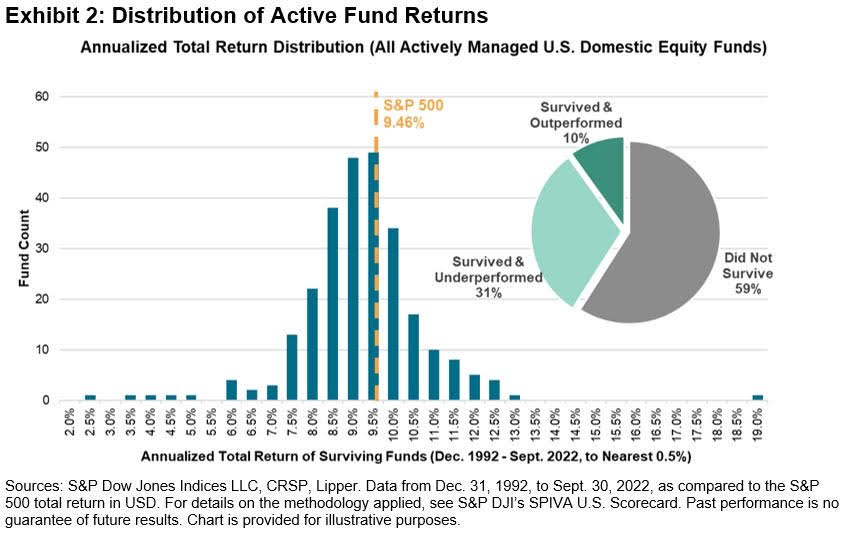

Only 2% of funds survived and outperformed the SP 500 since 1992

Source: @PeterMallouk