- News

- 3 min read

Auto companies flag local value addition math under PLI

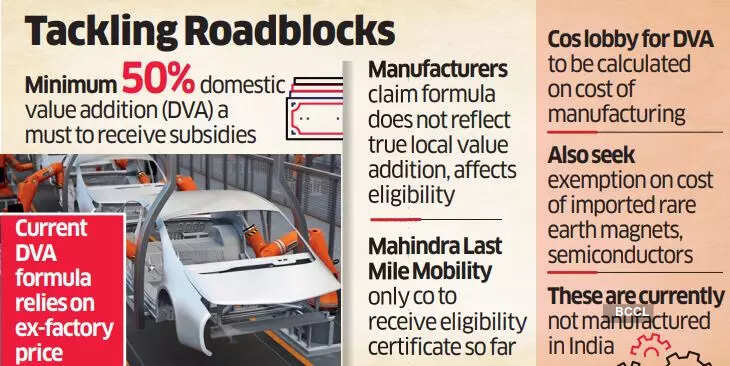

A minimum 50% domestic value addition (DVA) is a key condition for companies to qualify for subsidies under the scheme. The intention is to promote local manufacture of new technology products such as electric vehicles (EV) rather than subsidising imports.

Automakers that have qualified for the ₹25,938 crore production-linked incentive (PLI) scheme for the sector have flagged problems with the calculation of local value addition. That's making it difficult for them to get certificates of compliance for the scheme, said people aware of the matter.

A minimum 50% domestic value addition (DVA) is a key condition for companies to qualify for subsidies under the scheme. The intention is to promote local manufacture of new technology products such as electric vehicles (EV) rather than subsidising imports.

However, the formula for calculation of DVA relies on the ex-factory price of vehicles rather than the cost of making them. This, according to the automakers, is reducing the DVA score for companies selling vehicles at discounted prices, which are invariably below production cost, making it difficult to reach the 50% threshold.

The scheme has been operational since April 2022. Around 95 companies have been admitted to the scheme. Companies do not receive incentives until they get a certificate of compliance.

Auto companies have asked the government to implement a separate formula to calculate DVA based on the ex-factory cost in cases where vehicles are sold at a loss. This, they say, is a better reflection of local value addition and will aid them in meeting the 50% DVA requirement.

The problem arises because most EV makers are currently selling vehicles at a loss to remain competitive with conventional vehicle manufacturers and attract consumers.

The scheme has been operational since April 2022. Around 95 companies have been admitted to the scheme. Companies do not receive incentives until they get a certificate of compliance.

Auto companies have asked the government to implement a separate formula to calculate DVA based on the ex-factory cost in cases where vehicles are sold at a loss. This, they say, is a better reflection of local value addition and will aid them in meeting the 50% DVA requirement.

The problem arises because most EV makers are currently selling vehicles at a loss to remain competitive with conventional vehicle manufacturers and attract consumers.

While companies have made individual representations to the government on the subject, the Society of Indian Automotive Manufacturers (SIAM) had also written to the heavy industries secretary in May. ET has seen a copy of this letter.

"In the current context, where the costs of producing the vehicle are higher and more than the ex-factory price - EVs being still in innovation phase - the ex-factory cost is a more representative reflection of the true domestic value addition," the letter read.

The calculation of DVA based on the ex-factory price leads to an understatement of the real value added locally, SIAM said in its letter. "Hence, we propose that DVA% should be computed based on ex-factory cost in the event of a loss-making situation."

The ministry of heavy industries (MHI), which oversees this PLI scheme, did not comment.

"Industry would be much reprieved to see suitable changes being done in the DVA computation mechanism," said Saurabh Agarwal, partner, EY. "This shall go a long way in strengthening the localisation dynamics."

COMMENTS

All Comments

By commenting, you agree to the Prohibited Content Policy

PostBy commenting, you agree to the Prohibited Content Policy

PostFind this Comment Offensive?

Choose your reason below and click on the submit button. This will alert our moderators to take actions