Weekend Reading For Financial Planners (December 23-24)

Nerd's Eye View

DECEMBER 22, 2023

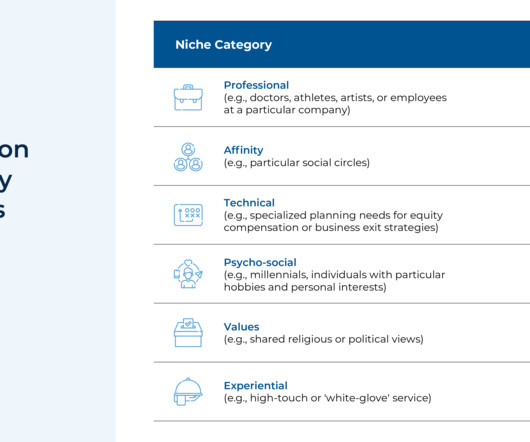

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that Envestnet has published research highlighting a number of key trends that they believe will shape the growth of the advisory industry in 2024 and beyond, which reflect at a high level advisors' ongoing shift towards providing (..)

Let's personalize your content