Contingency Planning: The Role of a CFO

Author: Larry Chester, President

More than anything, the last two years have taught us that it’s not always possible to ‘expect the unexpected.’ This, however, does not necessarily mean that strategic planning is off the table.

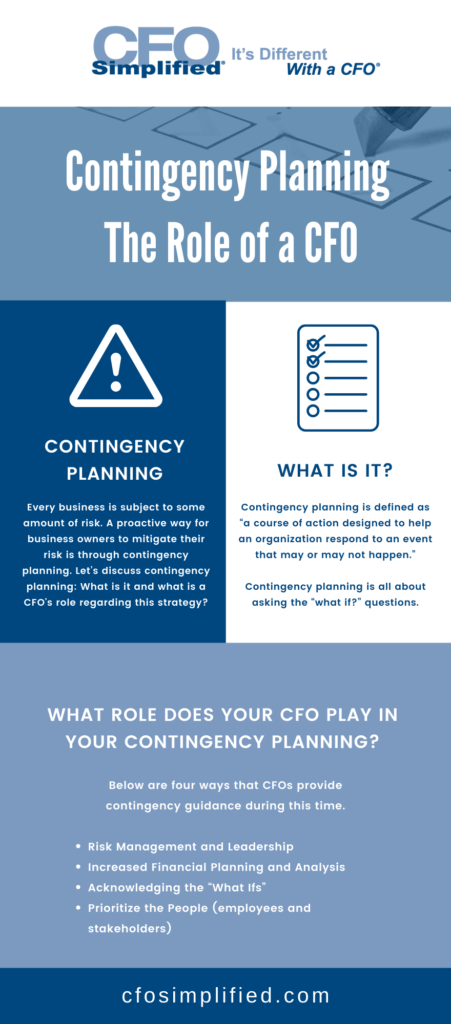

The fact of the matter is that every business is subject to some amount of risk. A proactive way for business owners to mitigate their risk is through contingency planning. So, what is contingency planning, and what is a CFO’s role in creating this strategy?

What is Contingency Planning?

Contingency planning is defined as “a course of action designed to help an organization respond to an event that may or may not happen.”

Contingency planning is all about asking the “what if?” questions. For example, what if your business doesn’t receive the funding you were counting on. What expenses will be cut in that case? What alternatives are available?

When it comes to contingency planning, a company starts by identifying potential risk factors and delays (i.e. not receiving funding when expected) and then factoring them into the business’ budget. In this sense, contingency planning can be thought of as your business’ ‘Plan B.’

The benefit? This type of strategic approach helps your business hit its targets and continuously recheck its priorities.

What Role Does Your CFO Play in Contingency Planning?

A business’ finance and accounting departments look up to the CFO for guidance—especially now, in light of the unexpected nature of the past two years’ fluctuations. This considered, the role of CFOs in contingency planning and crisis management is indispensable.

Below are four ways that CFOs provide contingency guidance during this time.

1. Risk Management and Leadership

A CFO knows a business’ financials better than anyone. They have the knowledge and skills to assess a crisis and mitigate risk.

2. Increased Financial Planning and Analysis

CFOs make decisions based on data. A CFO can help your business by ensuring its financial data and reporting are in tip-top shape. Additionally, this will help any other C-level executives on board with data-driven decision-making.

3. Acknowledging the “What Ifs”

The ‘what ifs’ are a crucial part of contingency planning. Addressing these questions will help your CFO prepare for the worst by brainstorming alternative strategies as well as ensuring liquid assets are available in the event of a crisis.

4. Prioritize the People

Last but certainly not least, when it comes to contingency planning, a CFO can help ensure employee and stakeholder safety and welfare is the top priority.

As it’s written by D&V Philippines, “CFOs must be able to determine how stakeholders, including employees, are affected by a crisis and what are the steps a company must take in order to protect them.”

How Does Your Contingency Planning Measure Up?

The CFOs at CFO Simplified excel at the strategic management necessary to mitigate risk through contingency planning. They are equipped to advise management on what steps to take to protect your business, its employees, and stakeholders. If your business does not have a full-time CFO, let’s talk about how CFO Simplified can provide access to the c-suite guidance a CFO brings to the table without the cost of hiring a highly experienced stakeholder full-time.

Read on to learn more about the value a CFO adds to your business.

Related Posts

Your Inventory Value Report

If you're like most business owners, you probably don't give much thought to your inventory value report. After all, what's

Reconcile That Account! (Not Just Your Checking Account…)

As a business owner, you must understand the importance of reconciling your accounts—and no, not just your checking accounts! Do

Get Clarity On Your

Company’s Performance

Our people are unique CFOs. They are all operationally

based financial executives.