- Strategy & Operations

- 2 min read

Jindal India throws its hat in the ring for Future Enterprises by submitting debt resolution plan

Jindal (India) has submitted a debt resolution plan for Future Enterprises under the Insolvency and Bankruptcy Code (IBC) process. The company will be against Reliance Retail, which has sought time till October 30 to decide if it wants to bid for Future Enterprises.

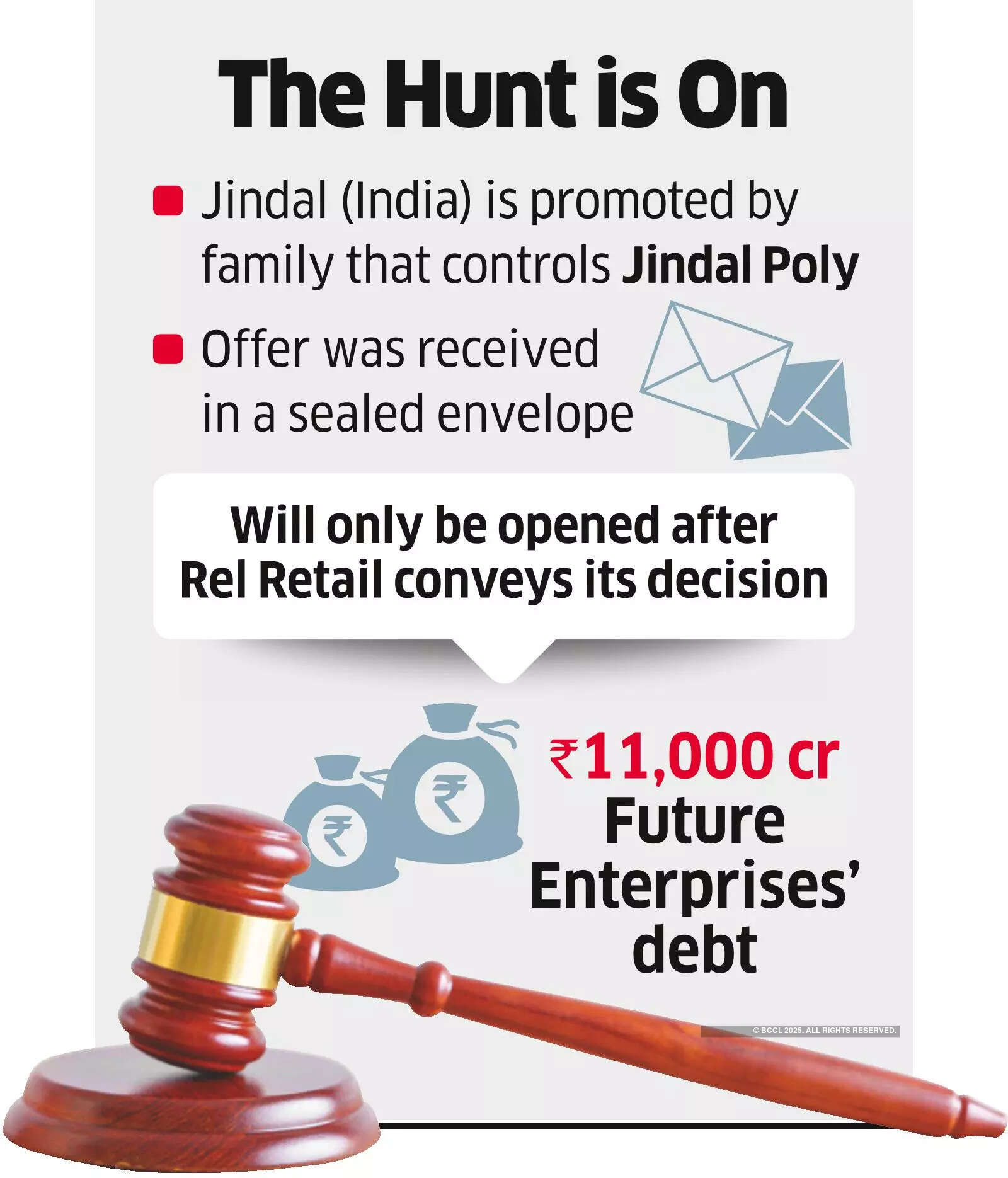

Jindal (India), promoted by the family that controls Jindal Poly Films, has submitted a debt resolution plan for debt-laden Future Enterprises under the Insolvency and Bankruptcy Code (IBC) process, said people briefed on the matter.

This could pit the company against Mukesh Ambani-controlled Reliance Retail, which has sought time till October 30 to decide if it wants to bid for Future Enterprises, the people cited above said.

Details of the bid placed by Jindal couldn't be ascertained as it was submitted in a sealed envelope as is common practice for confidential financial bids submitted under the IBC.

The offer will be opened only after Reliance Retail conveys its decision to Future Enterprises' creditors about its intent to either continue or walk out of the bidding process.

Future Enterprises has Rs 11,000 crore of debt. It was admitted for insolvency proceedings on February 27 by the National Company Law Tribunal in response to a petition filed by a creditor claiming the company had defaulted on payments.

Unlike its sister concern Future Retail, which received bids from only scrap dealers, creditors are hoping for a better outcome from the insolvency process of Future Enterprises, which owns stakes in life and general insurance joint ventures that Future Group promoter Kishore Biyani had struck with Italy's Generali group in 2006.

Jindal (India), Reliance Retail and Future Enterprises' resolution professional Avil Menezes did not respond to ET's emailed queries till press time.

Future Retail's creditors are faced with huge write-offs on their loans. Data sourced from the website of the Insolvency and Bankruptcy Board of India showed the company's financial creditors, such as banks, are owed Rs 20,000 crore. The best debt resolution offer received for the company was Rs 550 crore from a Gurugram-based online scrap dealer.

Assuming Future Enterprises' insolvency process results in a better debt resolution acceptable to all creditors, the winning bidder could become the rightful owner of a 25.5% stake in Future Generali's general insurance company and receive a nearly 9% stake in Future Generali's life insurance company.

The general insurance company was valued at Rs 5,000 crore in May last year when Generali raised its stake in the company from 49% to 74%. It paid Rs 1,267 crore to purchase the additional stake to take advantage of liberalised foreign direct investment guidelines (FDI) in the insurance sector.

COMMENTS

All Comments

By commenting, you agree to the Prohibited Content Policy

PostBy commenting, you agree to the Prohibited Content Policy

PostFind this Comment Offensive?

Choose your reason below and click on the submit button. This will alert our moderators to take actions