Goodwill impairment valuations: a secret treasure trove

CFO Dive

NOVEMBER 7, 2022

With the recent decision by US regulators to abandon plans to scrap mandatory goodwill impairment valuations, goodwill assessments are here to stay.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

CFO Dive

NOVEMBER 7, 2022

With the recent decision by US regulators to abandon plans to scrap mandatory goodwill impairment valuations, goodwill assessments are here to stay.

CFO News Room

JANUARY 15, 2023

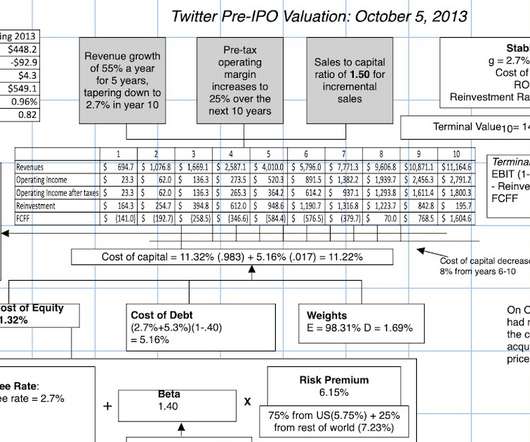

billion I estimated in 2021 (year 8 in my IPO valuation) as revenues in my IPO valuation of the company in November 2013, and its operating margin, even with generous assumptions on R&D, was 19.02% in 2021, still below my estimate of 19.76% in that year. . billion, well below the $9.6

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

VCFO

SEPTEMBER 21, 2023

Owner’s opinions of their business value can be influenced by inherent biases, flawed valuation methodologies, and factors lurking beyond their control. Owners often seek valuations from CPAs or similar entities for purposes such as insurance, estate planning, or internal events.

Nerd's Eye View

MARCH 6, 2024

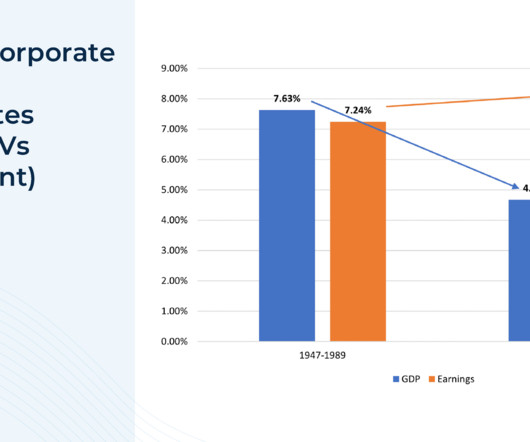

Financial advisors often discuss how futile it is to try and predict what will happen in the stock market, and yet the reality is that a core component of creating a financial plan involves making a prediction for how markets will behave, at least in the long run.

VCFO

NOVEMBER 7, 2023

How Quality of Earnings Reports Impact Valuation Securing a Quality of Earnings (QoE) report is often a routine step in the due diligence process for acquisitions. The post Quality of Earnings Reports Impact Valuation appeared first on vcfo. EBITDA is not a complete indication of financial performance for a business.

CFO News

OCTOBER 2, 2023

The IPO plans come after the company raised ₹1,000 crore in August to fund its ongoing capex plans in a round led by ValueQuest. It had previously raised ₹1,000 crore in October 2022.

CFO News

APRIL 12, 2024

Quantum Mutual Fund objects to ICICI Bank's delisting plan for ICICI Securities, citing non-compliance and flawed valuation. Allegations of fraudulent means in achieving majority vote raise concerns about the scheme's integrity.

Nerd's Eye View

APRIL 18, 2024

For over a decade, the financial advice industry has been bracing for an "any-minute-now" tsunami of advisor retirements and concomitant sales of financial planning practices. The primary risks when selling an advisory firm are that the deal may fall through, and existing clients may choose to leave the firm.

CFO News

MAY 25, 2023

The Securities and Exchange Board of India (Sebi) said SpiceJet's proposed preferential share issue to aircraft lessors as part of its plan to restructure its outstanding lease liabilities need not have independent valuation.

Musings on Markets

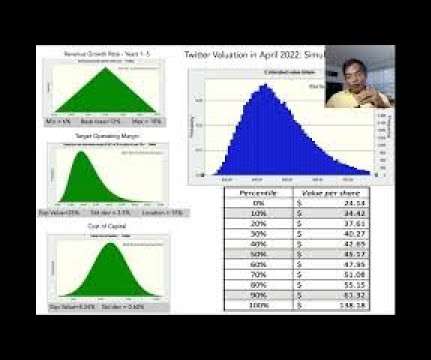

APRIL 21, 2022

billion I estimated in 2021 (year 8 in my IPO valuation) as revenues in my IPO valuation of the company in November 2013, and its operating margin, even with generous assumptions on R&D, was 19.02% in 2021, still below my estimate of 19.76% in that year. billion, well below the $9.6

Nerd's Eye View

MAY 16, 2023

Jim is the Co-Founder and CEO of Dew Wealth Management, an independent RIA based in Scottsdale, AZ, that provides virtual-family-office-style financial planning on a monthly retainer basis for 150 small-business owner entrepreneurs.

CFO Network

SEPTEMBER 2, 2021

But did you know that business valuation can give you more insight into your business than just the economic value? Keep reading to learn more about why business valuation is such an important process for every business. Business valuation is the best way to get proof of how well your business is doing year to year.

PYMNTS

JANUARY 7, 2021

The deal raises the valuation of Mambu and its software banking platform to more than €1.7 The Berlin-based firm said it plans to use the money to speed up its expansion and “deepen its footprint” in the 50 countries where it currently operates, with a special focus on the United States, Japan and Brazil.

PYMNTS

JUNE 16, 2020

bank Monzo , fresh off a round of layoffs, has taken a major hit from the coronavirus pandemic, as shown by a funding valuation that is 40 percent lower than its valuation last year. billion valuation a year ago, as reported by PYMNTS , while talks were in progress. Online U.K. billion, down from its $2.5

CFO News

JUNE 5, 2023

CaratLane had been in a strategic vendor relationship with Tanishq, Titan’s jewellery brand, since 2010. Between 2016 and 2019, Titan bought into the company in tranches, spending a cumulative Rs 440-450 crore, primarily via a secondary purchase of shares from Tiger Global, an early stage backer.

PYMNTS

AUGUST 21, 2020

As it aims for an approximately $225 billion valuation, Ant Group intends to seek dual listings in Shanghai and Hong Kong in the weeks to come, Bloomberg reported, citing unnamed sources. A dual listing of $30 billion would come out ahead of the $29.4 billion take of Saudi Aramco per Bloomberg data.

PYMNTS

NOVEMBER 24, 2020

According to people familiar with the discussions, the new valuation could hit as much as $70 billion or maybe as much as $100 billion, Bloomberg said. clients and making plans to acquire a startup from Nigeria to further African expansion.

PYMNTS

JANUARY 11, 2021

The Silicon Valley startup is planning to offer 24.6 At $44 per share price, Affirm would have a valuation in excess of $10 billion, Reuters reported. The startup had originally said it would go public before the end of 2020 but postponed plans. Affirm intends to list on the Nasdaq under the ticker AFRM.

PYMNTS

NOVEMBER 30, 2020

Airbnb and DoorDash are expected to release higher-than-expected valuation ranges for their upcoming initial public offerings (IPOs), which shows strength for the market, The Wall Street Journal (WSJ) reports. exchanges, with soaring valuations catching the attention of numerous companies to join the public market. billion.

PYMNTS

NOVEMBER 12, 2020

The reports followed the closing of a funding round that raised $200 million and brought the company’s valuation to $17.7 percent of consumers who have shifted to grocery shopping online plan to maintain at least some and possibly all of their new digital shopping habits.”.

PYMNTS

JANUARY 20, 2019

Lime and Bird , the two electric scooter startups that raised hundreds of millions of dollars in funding in 2018, are aiming to raise more but at a lower valuation. That is under the $3 billion or higher valuations they were fetching in years past. But with the lower valuations, it appears that business is starting to fray.

CFO News

MARCH 11, 2024

Madhabi Puri Buch, Sebi chairperson, expresses concerns over stretched valuations of small- and mid-cap stocks favored by retail investors. Sebi plans to bring in more disclosures on risk factors and allow T+ 0 trade settlement. AMFI directs mutual funds to provide additional disclosures.

PYMNTS

DECEMBER 5, 2019

Silicon Valley-based Chime has raised $500 million in a Series E funding round that sent its valuation soaring to $5.8 The anonymous source told CNBC that Chime’s CEO and Co-founder Chris Britt is planning to earmark the funds for product development and new hires. billion, CNBC reported on Thursday (Dec. 5), citing sources.

PYMNTS

JULY 23, 2019

The Series D funding round tips Bird’s valuation above the $2.3 billion where it was pegged last year, double the startup’s previous valuation, three people with knowledge of the deal told reporters on Monday (July 22). Regardless, Bird continues growing and is planning launches in over 50 new cities.

PYMNTS

NOVEMBER 14, 2018

billion valuation, the publication said. Last month, it was revealed that Instacart raised $600 million, giving it a valuation of $7.6 At that time, the company had a valuation of $4.35 He continued, “In our house, sometimes the ritual of going to the grocery store is inspiring and helps us meal-plan for the week.

PYMNTS

DECEMBER 12, 2019

12) indicated that the company was looking to raise $299 million at a valuation of $3.6 The company is expecting to sell 26 million shares for $9 to $10 each , instead of the originally planned 36 million for $12 to $14, according to the filing. billion valuation last year, according to filings by PingAn.

PYMNTS

SEPTEMBER 26, 2018

Stripe, the payments startup, has raised $245 million in a new round of venture funding, giving the company a valuation of $20 billion. According to the report, the company plans to use the funding to hire more employees for its global engineering team. “We Strong businesses do not always tend to be dependent on outside funding.”.

PYMNTS

JANUARY 27, 2020

forecasts that its initial public offering (IPO) valuation will be far under the approximate $1 billion it had for its most recent funding. The IPO would provide the company with a valuation of $768 million and would bring in $182.4 eCommerce mattress merchant Casper Sleep Inc. Casper , for its part, was valued at $1.1

PYMNTS

AUGUST 13, 2020

This week, The Wall Street Journal reported despite a 40 percent decrease in its valuation in three years, Airbnb Inc. Airbnb is planning to file its initial public offering (IPO) later this month with the Securities and Exchange Commission, and Morgan Stanley and Goldman Sachs Group Inc.

CFO Simplified

AUGUST 7, 2023

Too often business owners are forced to make exit decisions without any advance planning based on factors that are largely out of their control including health, divorce, and owner disputes. According to the Estate Planning Institute, 80% of U.S. As stated by the Exit Planning Institute , exit planning is a smart business strategy.

CFO News

APRIL 26, 2023

HZL chief executive Arun Misra, in recent media interviews, said the company hadn't yet formally shelved the plan to acquire Vedanta's international zinc assets. In its communication to HZL on February 17, the mines ministry had asked the company to "explore other cashless methods of acquisition of these assets"

E78 Partners

AUGUST 21, 2023

Macro Investment Market Challenges a Headwind for Private Equity Valuations Private Equity Sponsors are facing their most challenging valuation market since the great recession of 2008-09. Heightened inflation and interest rates will continue to be valuation headwinds. But you cannot stop there.

CFO News Room

NOVEMBER 16, 2022

As someone who has spent the last four decades talking, teaching and doing valuation that we have lost our way in valuation. Even as data has become more accessible and our tools have become more powerful, it is my belief that the quality of valuations has degraded over time.

PYMNTS

SEPTEMBER 19, 2019

FinTech Stripe is raising $250 million in its latest funding round and has reached a pre-money valuation of $35 billion, according to a release on Thursday (Sept. The company recently launched in eight new countries: Estonia, Greece, Latvia, Lithuania, Poland, Portugal, Slovakia and Slovenia, with more planned in the coming months. .

PYMNTS

MARCH 5, 2019

now has a valuation of $1.5 The company also plans to double its size to more than 200 employees and expand its leadership team. billion valuation, with DST leading the round. Rivals Revolut and N26 recently raised hundreds of millions of dollars, but at higher valuations. billion valuation. billion valuation.

PYMNTS

SEPTEMBER 8, 2019

That figure is less than half of its $47 billion valuations following January’s fundraising round. An IPO roadshow could allow We Company to offer a better valuation to investors. A We Company valuation drop would be a major upset that would affect existing investors such as Japan’s SoftBank Group Corp. .

PYMNTS

APRIL 26, 2019

Uber , the ride-hailing startup gearing up to go public via an initial public offering (IPO), is reportedly seeking a valuation of between $80 billion and $90 billion and is getting a $500 million investment from PayPal. It is also closer to the $76 billion valuation it had after its latest round of funding.

PYMNTS

JANUARY 10, 2020

Chinese eCommerce and social media startup Xiaohongshu , also known as “Little Red Book,” wants to raise funds at a $6 billion valuation, according to Bloomberg. It’s teamed up with a financial plan adviser to identify possible investors. RED closed a $300 million series D round in 2018 and had a valuation of $3 billion.

PYMNTS

SEPTEMBER 26, 2019

billion valuation as it goes public, The Financial Times reported on Wednesday (Sept. billion valuation. billion valuation. The venture capital firm TCV led Peloton’s last fundraising round in August 2018 and is planning to buy $100 million shares that are separate from the 40 million shares being floated.

PYMNTS

OCTOBER 8, 2020

Instacart saw its valuation double to just over $17 billion, Kroger made its move on the prepared food market, Amazon brought its grocery business into the Prime Day fold while Whole Foods reports struggling to keep up with the post-pandemic boom town in grocery sales. Instacart's $200M Pick-Up and New $17.7B

PYMNTS

DECEMBER 7, 2018

The company, which is said to have enlisted the help of Morgan Stanley, is looking for a valuation north of $600 million, CNBC reported. UNTUCKit has 50 stores around the country and plans to add another 100 to its roster.

CFO News

APRIL 13, 2023

Initial talks on for around $100m transaction; SoftBank to sell small stake.

PYMNTS

DECEMBER 10, 2018

The Wall Street Journal , citing people familiar with the discussions, reported that Bird plans to take on more investors at a $2 billion valuation. In the past, the startup has told potential investors it wanted to raise hundreds of millions of dollars at a much higher valuation. That ended up being an underestimate.”

Focus CFO

APRIL 8, 2022

With the Exit Planning Institute. FocusCFO has contributed to the Exit Planning Institute’s latest white paper, ‘ Understanding Your Business Value.’ The five stages of value maturity, according to the Exit Planning Institute, are Identify, Protect, Build, Harvest, and Manage. Understanding Your Business Value.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content