Obviously, you cannot simply make business debt disappear. (Wouldn’t that be nice?!) But what you can do is make it more manageable, so it is easier to pay off.

Obviously, you cannot simply make business debt disappear. (Wouldn’t that be nice?!) But what you can do is make it more manageable, so it is easier to pay off.

Debt restructuring and debt consolidation are two debt management strategies that companies can use when they need help getting out from under their debt. There is a lot of confusion around these two financial debt management tools, which is why we have decided to put together a quick resource to help business owners and CEOs understand their options.

However, it is important to note that each business has its own nuanced needs and circumstances that should be considered before moving forward with either approach. You should always rely on the advice of a trusted business advisor when making these types of financial decisions – either your own CFO or a CFO consultant who can analyze your business position and evaluate your available options.

Let’s take a look at what debt restructuring and debt consolidation are, how they differ, and evaluate which one might be right for your business.

What is Debt Restructuring?

Debt restructuring is when a debtor (the borrower) and creditor (the lending institution) agree on an amount of outstanding debt to be paid back. A new contract is not created, instead the existing contract is altered to make the terms more favorable by excusing some of the debt. Typically, the amount of debt that will need to be paid back after negotiating will be expressed as a percentage of the overall amount owed, like “60% of the full debt amount.” Whether debt restructuring works is contingent upon how much the company can afford to pay back and how much the creditor is willing to forgive.

When a company enters into debt restructuring discussions it is typically because it is in a dire position. Debt restructuring is basically a last ditch effort to turn things around before a company goes under. Creditors are often willing to do debt restructuring because doing so means that they will be paid back at least a portion of what they are owed, which is likely more than what they will receive otherwise if/when the business fails. Additionally, if debt restructuring gets the company back on track so they can avoid going under, they get to forgo the high cost of engaging in bankruptcy proceedings.

What is Debt Consolidation?

Debt consolidation is a special kind of debt refinancing strategy that can be used when a company’s position is not as dire. It involves allowing debtors to roll multiple smaller loans into a single loan.

During the consolidation process, smaller higher interest loans are turned into one loan with a lower interest rate to make it easier for a company to pay of their debt. These lower interest rates create a more advantageous cash position for debtors because they can use the cash that was previously paying for high interest rates to pay off their loan principal instead. Once loans have been consolidated businesses can then choose to make smaller loan payments each month or pay off the loans faster, depending on their cash follow position and financial goals.

Debt consolidation requires signing a new contract to establish borrowing terms for the new loan, which means that business owners will need to provide all the same paperwork they needed when getting their loans initially (tax returns, financial statements, sales projections, etc.). Consolidation loans can come from banks, credit unions, government programs (like through the SBA), or alternative lenders. However, the goal remains the same regardless of who the lender is: to improve cash flow and increase the convenience of paying off debt.

Debt Restructuring vs Debt Consolidation

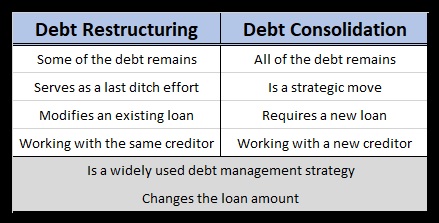

This chart illustrates the difference between debt restructuring and debt consolidation:

As you can see, debt restructuring and debt consolidation share some similarities but have a lot of differences when it comes to how they assist companies with managing their business debt.

So, which one should you choose?

Which one is Right for You?

There are a lot of things to take into consideration when deciding how to manage your business debt, including the amount and type of debt. Your business industry, size, and revenue numbers can also influence which strategy is best for your particular needs. Leaning on your CFO is crucial in determining which debt strategy is best because they will have a comprehensive view of your financial position as well as understand which options are available to move the company forward.

To complicate matters, lending institutions will have their own restrictions to contend with as well. Typically, if your business is not in significant trouble, debt restructuring is not going to be your best bet. In fact, creditors may not consider restructuring your debt if your business position is not dire enough to necessitate this kind of negotiation. However, if you are trying to consolidate your debt, creditors may not approve you for a new loan if your business is too new or if you do not have good credit to assure them of your ability to pay back the loan. And even with good credit your business debt may be too high to consolidate it into a single loan because you do not qualify for a loan of that size.

If your company is in a desperate position, trust in your CFO to guide your debt management efforts. If you do not have a CFO, you can hire a fractional CFO (also known as a CFO consultant) to advise you.

What Next?

Figure out what your goals are and then start the conversation with your financial leadership and your creditors to figure out what your options are to get out from under your debt. But remember, for companies that are losing money debt strategies are like band aids. They are just a short-term fix because without effective financial guidance, debt management will just prolong the inevitable without any real hope for change. Turning a company around requires having the right long-term strategic framework in place to improve revenue generation while managing your debt.

Looking for a financial assessment to understand your financial position? We offer financial assessment services to companies looking for an evaluation of their bookkeeping responsibilities, internal and external reporting, projections and modeling, financial systems and tools, personnel and senior management, internal controls, and operational focus. If you already have a good sense of how your company’s financial operations are doing and just need a CFO consultant to manage your company’s finances, we can help in that area as well. Contact us today to learn more about how we can help your organization!