What to Know About the Corporate Transparency Act

CFO Simplified

MARCH 7, 2024

Robert Garner, a partner in LP’s Corporate and Tax Planning Practice Groups , advises clients on tax planning in connection with a wide variety of transactions.

CFO Simplified

MARCH 7, 2024

Robert Garner, a partner in LP’s Corporate and Tax Planning Practice Groups , advises clients on tax planning in connection with a wide variety of transactions.

CFO Simplified

MARCH 7, 2024

Robert Garner, a partner in LP’s Corporate and Tax Planning Practice Groups , advises clients on tax planning in connection with a wide variety of transactions.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CFO News Room

NOVEMBER 8, 2022

And the four pillars are the financial plan, risk management, so just checking all their what-if scenarios that something…a husband dies, wife dies, long-term care, disability. And then we look at estate planning. And then in the fall, we look at tax planning. Cean: Yeah. We met at an insurance agency. Pause there.

Future CFO

MAY 24, 2020

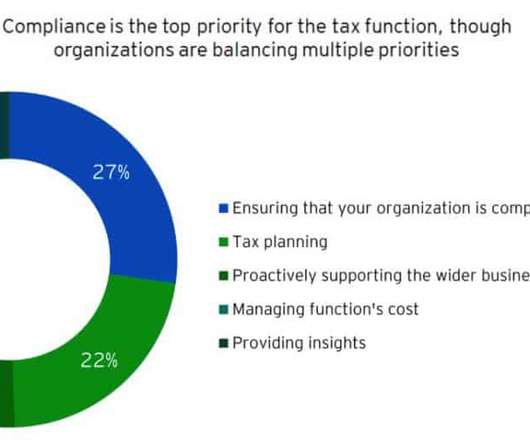

Particularly, compliance (27%) is the top priority for the tax function, even as they are balancing multiple priorities like tax planning (22%), proactively supporting the wider business and capital agenda (21%), managing the tax function’s cost (16%) and positioning the tax function to provide insights (13%).

Barry Ritholtz

OCTOBER 3, 2023

At the time, the Mexican, after the Mexican restructuring, they had, they had Mexican bonds with an oil option embedded in them. 01:19:23 [Speaker Changed] I i I think that we’ll say, Hey, this tax plan worked pretty well. Yeah, commodities and EmTech 00:20:15 [Speaker Changed] Made sense to us. Made sense.

Let's personalize your content