- News

- 2 min read

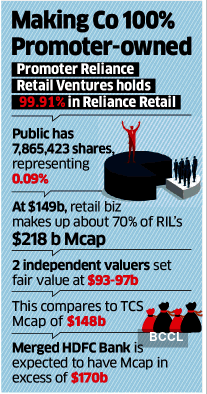

Reliance Retail set to cancel all public shares

Global investment firm Bernstein in a May report valued the holding company of Reliance Retail, called Reliance Retail Ventures (RRVL), at $131 billion (₹10.82 lakh crore). RIL owns 85% of RRVL, which in turn owns more than 99% of Reliance Retail.

Mumbai: Reliance Retail Friday said its board approved a proposal to cancel the equity shares held by public shareholders. The company will pay ₹1,362 per share for the cancelled unlisted stock, valuing Asia's richest man Mukesh Ambani's retail business at $149 billion (₹12.31 lakh crore). At that price point per share, this is as much as 70% of parent Reliance Industries' (RIL's) $218-billion (₹18.01-lakh crore) market capitalisation.

Global investment firm Bernstein in a May report valued the holding company of Reliance Retail, called Reliance Retail Ventures (RRVL), at $131 billion (₹10.82 lakh crore). RIL owns 85% of RRVL, which in turn owns more than 99% of Reliance Retail.

The fair value of Reliance Retail, as determined by two independent valuers Ernst & Young Merchant Banking Services and BDO Valuation Advisory, is ₹884.03 and ₹849.08 a share, respectively. This would mean the firm is worth $93-$97 billion (₹7.68-8.01 lakh crore).

Promoter RRVL, a 100% subsidiary of RIL, holds a 99.91% stake in Reliance Retail, while the public holds 7,865,423 equity shares, representing 0.09%.

"The board of directors at its meeting held on July 4, 2023, approved a proposal to reduce the equity share capital to the extent held by shareholders other than its promoter and holding company, namely, RRVL," Reliance Retail said.

Shares Hit Record High Last Year

According to Narottam Dharawat of Mumbai-based Dharawat Securities, Reliance Retail shares are currently traded privately at Rs 2,700-2,800 apiece. He added that the stock hit a record high of Rs 4,300 last year. According to brokers, about a quarter of a million shares of Reliance Retail were traded in June 2023.

In December 2019, when the Reliance Retail stock was trading at around Rs 900 apiece, RIL announced a scheme of arrangement where Reliance Retail shareholders were offered one share of RIL in exchange for four shares of Reliance Retail. This scheme valued the shares of Reliance Retail at about Rs 380 per share.

However, later in January 2020, in an extraordinary general meeting (EGM), Reliance made the share-swap scheme for shareholders in the retail venture optional as against mandatory earlier.

Reliance Retail is a step-down subsidiary of RIL.

In 2020, RRVL raised nearly Rs 47,265 crore from global private equity funds for 10.09%, valuing the company at Rs 4.2 lakh crore, or north of $50 billion at current exchange rates.

Reliance Retail reported a year-on-year net profit growth of 30% in FY23 to Rs 9,181 crore. Its revenues also expanded 30% in FY23 to Rs 2.6 lakh crore.

COMMENTS

All Comments

By commenting, you agree to the Prohibited Content Policy

PostBy commenting, you agree to the Prohibited Content Policy

PostFind this Comment Offensive?

Choose your reason below and click on the submit button. This will alert our moderators to take actions