Projecting the COLA is a fool’s game. But I’ll try anyway …

By David Enna, Tipswatch.com

With the release of the June inflation report on July 12, we now have a “pretty good” idea of where the Social Security cost-of-living adjustment will be heading for payments in 2024, beginning with benefits received in January.

I say pretty good because after years of trying to make this projection, I have realized it’s almost impossible to nail it. Why? Because inflation in the summer months is notoriously finicky, and the COLA will be based the average of inflation indexes for July to September.

Last year, I predicted an increase of “about 10%” for 2023 payments. The correct answer was 8.7%.

But I actually got a little lucky last year. In June, I was interviewed by the AARP Bulletin for my thoughts on the COLA increase. After I listed all the iffy issues, the reporter asked, “What if nothing else happens, what would the COLA be?” I answered “about 9%” instead of my 10% prediction. That was very close to the 8.7% result and I somehow looked brilliant when the Bulletin was published in October.

- In 2021, I predicted 6.0% looked “likely.” Correct answer: 5.9%.

- In 2020, I predicted “a number very close to zero.” Correct answer: 1.3%.

- In 2019, I predicted “a range of 1.6% to 1.8%.” Correct answer: 1.6%.

- In 2018, I predicted a range of “3.1% to 3.2%.” Correct answer: 2.8%.

- In 2017, I predicted a COLA “less than 2.2%.” Correct answer: 2.0%.

So, to skip right to the good stuff, I am projecting a COLA increase of 3.0% to 3.2% for payments beginning in 2024. And here is how I got there ..

The Index

Annual U.S. inflation (measured by CPI-U) is running at 3.0% as of June, but the Social Security Administration doesn’t use CPI-U. Instead, it uses the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). For that index, the June annual increase was lower, at 2.3%.

CPI-W includes data only from households with at least 50% of income coming from clerical or wage-paying jobs. I’ve noted in the past that CPI-W generally lags slightly behind CPI-U, which means the Social Security COLA also generally lags behind the standard measure of U.S. inflation. However, in 2021 and 2022 CPI-W ran higher than official inflation.

CPI-W isn’t widely tracked or reported, but the Bureau of Labor Statistics updates the index each month in its overall inflation report. Right now, you could say, “Well, CPI-W is running at an annual rate of 2.3%, so that will likely be the COLA increase for 2023.” But that’s not true. In fact, the June number isn’t necessarily an accurate indicator. It just sets a baseline for future data. Then we come to …

The Formula

The SSA doesn’t look at a full year’s data to determine the COLA. Instead it uses the average CPI-W index for the third quarter — July, August and September. Here is the definition from the SSA site, in typical crystal-clear language of government bureaucrats:

A COLA effective for December of the current year is equal to the percentage increase (if any) in the average CPI-W for the third quarter of the current year over the average for the third quarter of the last year in which a COLA became effective. If there is an increase, it must be rounded to the nearest tenth of one percent. If there is no increase, or if the rounded increase is zero, there is no COLA.

The translation: This wording means the SSA eliminates years where inflation was zero or negative, and so there isn’t a “bounce-up” effect on benefits after a year of deflation. Instead, it goes back to the last year where there was an increase in benefits. But that won’t matter in this calculation for 2024, because the COLA rose 8.7% for payments in January 2023.

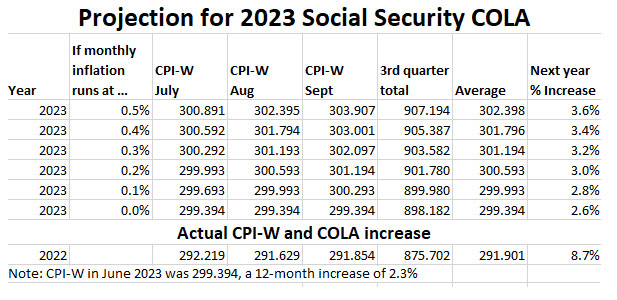

So, although 12-month CPI-W was up 2.3% in June, that number is irrelevant. The only inflation numbers that will matter are for the third quarter: July, August and September. Last year, the CPI-W index averaged 291.901 in the third quarter. The June 2023 index was set at 299.394, which is 2.6% higher than the 3rd quarter average in 2022. So if we have zero inflation in July, August and September, the Social Security COLA will be set at 2.6%.

Projecting the 2024 COLA

U.S. inflation can be stubbornly finicky in the summer months, so predicting inflation from July to September is an impossible task. Hurricanes, gas shortages, food crop failures, stock market plunges, outbreaks of war, supply shortages, pandemic resurgence, etc., etc. It’s a guessing game, and nearly every summer brings some surprises.

In 2022, for example, CPI-W actually declined from July to September after surging earlier in the year. Let’s take a look at how differences in 3rd-quarter inflation would alter the COLA for 2024 payments:

Last year, several media reports in June predicted a 12%+ increase in the Social Security COLA, because those projections saw inflation continuing at the same high rate we saw in the first six months of 2022. But inflation softened dramatically and the COLA dropped to 8.7%, still the 4th largest increase in history.

In my projection, I am theorizing that inflation will not fall dormant this summer, but will continue in a range of 0.2% to 0.3% a month, leading to a COLA projection of 3.0% to 3.2%. But a single deflationary month or a sudden gas-price surge could derail that projection.

FYI, the Senior Citizens League, a nonprofit seniors group that generally makes accurate projections, is predicting a 3.0% COLA increase for 2024.

What this all means

The Senior Citizens League says the average monthly payment to Social Security beneficiaries is $1,787, so an increase of 3.0% would raise that benefit to about $1,841, beginning in January. If you are in the Social Security “limbo” period — older than 62 but not yet taking benefits — your future benefits would also climb by this percentage.

Of course, Social Security recipients won’t really know their bottom line until the 2024 Medicare Part B premiums are announced later this year. Part B premiums are automatically deducted from most beneficiaries’ Social Security benefits.

The actual COLA number won’t be known until 8:30 a.m. EDT on October 11, 2023, when the BLS releases the September inflation report and completes the data needed for the 3rd quarter average of CPI-W.

I will be tracking these numbers for July, August and September as each inflation report is issued. And I’ll keep a running total of the CPI-W changes on my Social Security COLA page.

* * *

Feel free to post comments or questions below. If it is your first-ever comment, it will have to wait for moderation. After that, your comments will automatically appear. Please stay on topic and avoid political tirades.

David Enna is a financial journalist, not a financial adviser. He is not selling or profiting from any investment discussed. I Bonds and TIPS are not “get rich” investments; they are best used for capital preservation and inflation protection. They can be purchased through the Treasury or other providers without fees, commissions or carrying charges. Please do your own research before investing.

It appears to me that the higher Fed rates and other tightening has had an effect on inflation rates. However, the OPEC continued cutting of oil production to raise the price will work towards maintaining some rate of inflation… of course I have little as any other in reliable stats to go on.

The Fed can’t control global inflation, clearly. It is have some dampening effect, though.

If possible, I would like to see a comparison between Floating Rate Notes and TIPs.

Somewhat off-topic, but I think of this every time the government announces, or is about to announce, a change in Social Security based on the CPI-W.

I have never understood why the Social Security COLA (unlike I Bonds and TIPS, which use the CPI-U) is based on the CPI-W, an index related to the expenses of (and actually named for) “Workers” when, by definition, the vast majority of people who are retired, at any age, and receiving Social Security, are not workers, or at least no longer full-time workers.

And meanwhile, if I understand correctly, the Bureau of Labor Statistics has been maintaining, like almost forever, a version of CPI tailored to the typical expense profile of the elderly, but it’s not used for Social Security.

It seems that, where Social Security is concerned, the government doth work in strange ways. 🙂

No, this is very on-topic. The COLA is set through a weird, outdated formula. I wrote about that in November 2017: https://tipswatch.com/2017/11/08/does-the-social-security-cola-shortchange-seniors/

I’d like to give a shout out to my man, Czar Vladdie I, who is doing his part to help raise this year’s COLA, by pushing worldwide grain and maritime insurance prices higher (canceling the Ukrainian grain export deal and threatening neutral shipping that calls at Ukrainian ports) and also pushing for higher worldwide energy prices (saying that the USSR — oops, I mean Russia — will join our good friends in Saudi Arabia in cutting oil production.) The rest of us lazy slugs should all be asking what WE can do to push reported inflation higher over the next 2-1/2 months!

Yes, impossible to predict with any accuracy. Based on current data it would be 3.5%, but it all depends on the July through Sept data. Ditto next year’s tax brackets, which are based on the previous 12-months’ data through September of Chained CPI, an even more arcane index.