Weekend Reading For Financial Planners (June 14–15)

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

CFO Plans

OCTOBER 29, 2024

Innovations such as blockchain for secure transactions, AI for predictive analytics, and machine learning for process automation are redefining how businesses manage their finances. Staying abreast of these developments ensures that companies remain competitive and equipped to handle the challenges of tomorrow.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

AI In Accounting: A Practical Roadmap For Smarter AP

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Precision in Motion: Why Process Optimization Is the Future of Manufacturing

Stop Budget Burnout: A Better Way to Grow Your Nonprofit in 2026

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Nerd's Eye View

DECEMBER 27, 2024

Also in industry news this week: According to a recent survey, advisors are putting an increasing share of client assets into model portfolios, allowing for customization and time savings that advisors appear to be using to provide more comprehensive planning services RIA M&A deal volume saw an annual record in 2024 as a lower cost of capital, (..)

AI In Accounting: A Practical Roadmap For Smarter AP

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Precision in Motion: Why Process Optimization Is the Future of Manufacturing

Stop Budget Burnout: A Better Way to Grow Your Nonprofit in 2026

Your Accounting Expertise Will Only Get You So Far: What Really Matters

CFO Talks

MAY 20, 2025

Playing the Global Tax Game Without Getting Burnt: What Every South African CFO Must Get Right Its no longer enough to know your way around a balance sheet. Todays CFO is the nerve centre of every strategic decision, from pricing to expansion, and increasingly, international tax planning. Get it right, and you unlock value.

E78 Partners

MARCH 3, 2025

Public company reporting requirements are significantly more demanding than those for private firms, with the Securities and Exchange Commission (SEC) imposing strict financial disclosure standards. Develop Comprehensive Tax Strategies: Optimize tax planning, transfer pricing, and international tax considerations.

CFO Talks

NOVEMBER 11, 2024

Employment Taxes Pay-As-You-Earn (PAYE) : Collected on employees’ income, PAYE is an employer’s responsibility to remit to SARS. Unemployment Insurance Fund (UIF) : This social security tax supports unemployed workers. Both employers and employees contribute, typically 1% of earnings each.

Nerd's Eye View

APRIL 8, 2025

Seth is the founder of Heartwood Financial Planning, an advisory firm affiliated with PlanMember Securities Corporation that is based in Fresno, California, and oversees approximately $100 million in assets under management for 850 client households. Welcome to the 432nd episode of the Financial Advisor Success Podcast!

The Big Picture

JULY 16, 2025

They’ll be exclusively dependent on social security, but there’s also a. So I would urge planners and individuals pursuing their own retirement plans to think about building in some of those lifetime, uh, giving, uh, aspirations. And you’re also doing a little bit of tax planning as well.

CFO Plans

JANUARY 20, 2025

This guide aims to equip you with essential tools and insights to simplify tax filing, ensuring you’re not only compliant but also maximizing potential savings. Strategic Tax Planning for Entrepreneurs The foundation of effective tax management begins with strategic planning.

Global Finance

OCTOBER 31, 2024

Further highlighting its ability to cultivate partnerships is a recent upgrade of Ping An’s family office business, which now provides wealth and health management, generational development, charitable planning, and legal and tax-planning services. CMB’s custody portfolio ranks first in the domestic market, at ¥22 trillion.

Nerd's Eye View

APRIL 30, 2025

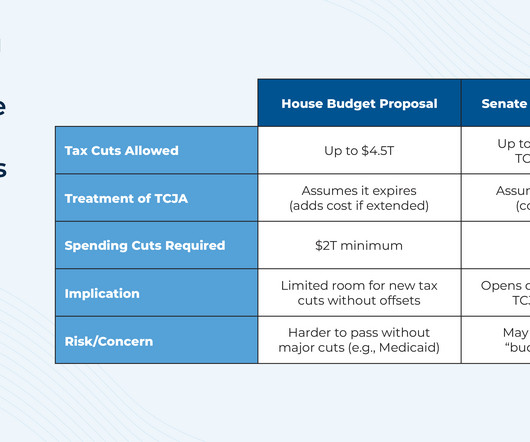

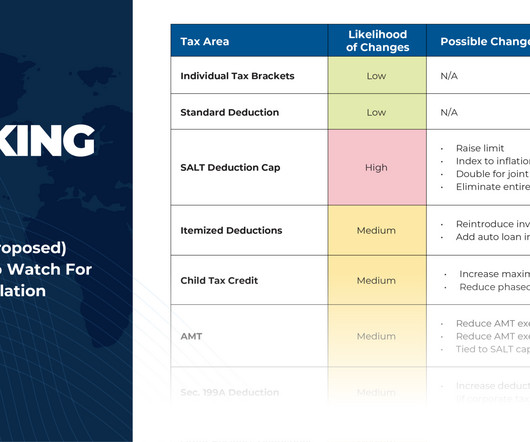

And even though negotiations may continue to drag out the process of drafting and passing a final bill, it still makes sense for advisors and their clients to take a "wait and see" approach to tax planning (while being reasonably confident that there will at least be a tax bill passed by the end of the year!). Read More.

Nerd's Eye View

NOVEMBER 13, 2024

With Republicans appearing to have secured a sweep of the White House and both chambers of Congress, the most immediate question for many financial advisors and their clients is what impact the election results will have on the scheduled expiration of the Tax Cuts & Jobs Act (TCJA) at the end of 2025. Read More.

CFO Dive

JUNE 23, 2025

That environment can easily lead to paralysis, with business leaders waiting for more information before undertaking planning actions. However, proactive planning can be a crucial tool that helps businesses to find stability within a challenging environment. What can a business do to plan for continually shifting tax rules?

Nerd's Eye View

SEPTEMBER 25, 2024

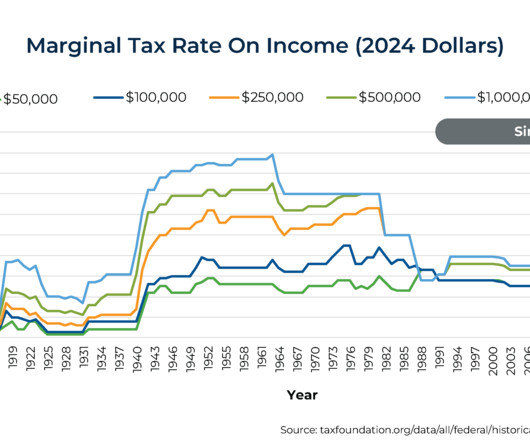

Because not only were very few households actually subject to the 1950s-era top tax rates (which were triggered at the equivalent of over $2 million of income in today's dollars), but the long decline in nominal tax rates has also come with the elimination of many loopholes and deductions that have resulted in more income being subject to tax.

Nerd's Eye View

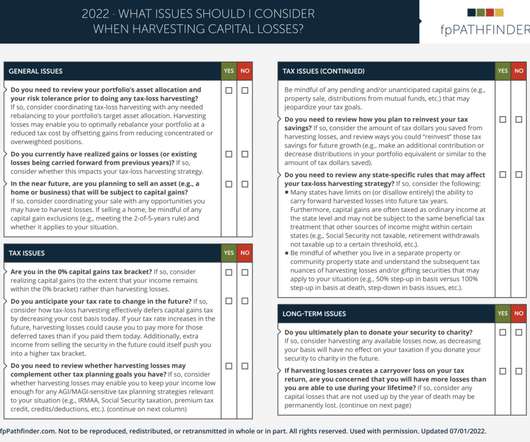

OCTOBER 14, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that the Cost Of Living Adjustment (COLA) for Social Security beneficiaries will be 8.7% for 2023, the largest COLA since 1981.

Nerd's Eye View

SEPTEMBER 29, 2022

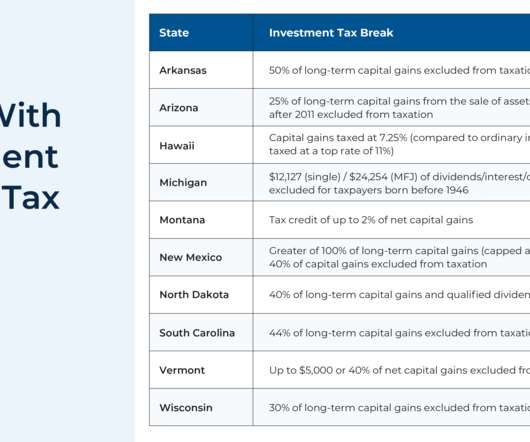

As a result, the list of states where a typical (or even higher-income) retiree would pay very little or even zero tax might be much larger than what might be assumed based on the top marginal rates alone. Every state in the U.S.,

Nerd's Eye View

OCTOBER 5, 2022

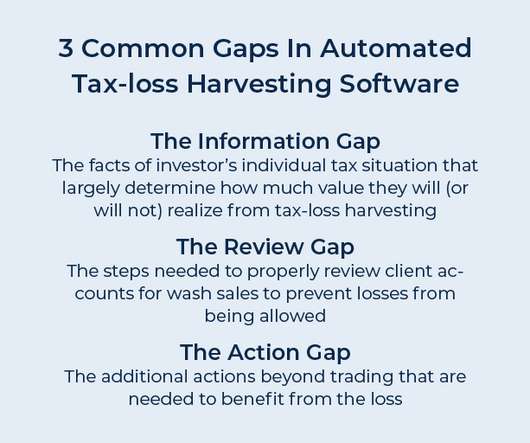

The 1%+ added value of automated tax-loss harvesting may be achievable in some ‘ideal’ cases, such as an investor who frequently contributes to their portfolio, has short-term losses to offset, and/or has many individual security holdings. Read More.

Nerd's Eye View

SEPTEMBER 6, 2022

Read More.

Nerd's Eye View

SEPTEMBER 20, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that the North American Securities Administrators Association (NASAA) released the latest edition its annual survey outlining the state of state-registered RIAs, showing that the number of state-registered firms and their assets (..)

Nerd's Eye View

DECEMBER 25, 2023

We start with several articles on retirement planning: Data showing where American retirees currently stand, from their average net worth to how they spend each hour of the day How, according to a recent study, delaying Social Security benefits typically leads to greater lifetime wealth than claiming benefits early in order to reduce portfolio withdrawals (..)

Nerd's Eye View

SEPTEMBER 7, 2022

Finally, many software tools for trading and rebalancing may incorporate tools for tax-loss harvesting, such as checking for potential wash sale violations and allowing the advisor to designate replacement securities. With these three tools (i.e., With these three tools (i.e.,

CFO Plans

OCTOBER 9, 2024

Learn How CFO Plans Can Boost Your Financial Health Corporate Tax Planning for Proactive Financial Management Corporate tax planning is a fundamental aspect of successful tax compliance. As a result, they were able to invest more in innovation, fueling further growth.

CFO Plans

AUGUST 9, 2024

Tip: Ensure your cloud accounting platform has robust security measures to protect sensitive financial information. Strategic Tax Planning and Preparation Services Effective tax planning is essential for minimizing liabilities and maximizing returns. Optimize your tax planning with expert services.

CSC Advisors

SEPTEMBER 27, 2024

5 Tips to Maximize Your SBA Loan Benefits This Tax Season Securing a Small Business Administration (SBA) loan can be a game-changer for your business, providing the necessary capital to invest in growth and operations. Maximize Interest Deductions The interest paid on your SBA loan is generally tax-deductible as a business expense.

CFO Plans

SEPTEMBER 24, 2024

Cloud-Based Accounting Services: Secure, Scalable, and Accessible Embrace the future of accounting with cloud-based accounting services. These services offer unparalleled security and scalability, providing real-time access to your financial data. From tax planning to filing, advisors are here to make tax season a breeze.

CFO Plans

AUGUST 23, 2024

Strategic Financial Planning and Tax Savings Tax Planning and Preparation Effective tax planning and preparation can significantly impact your business’s bottom line. A Fractional CFO leverages their in-depth knowledge of tax laws to ensure compliance and identify opportunities for tax savings.

Nerd's Eye View

FEBRUARY 19, 2024

Digital hygiene, encryption security, and good staff training can all be enormous factors in the overall safety of the company, as explained by Patrick Hennessy, Schwab's Director of Business Consulting.

CFO Plans

SEPTEMBER 24, 2024

Discover Digital Accounting Solutions Transition to Cloud-Based Accounting Services Cloud-based accounting services provide unparalleled flexibility and security. This accessibility ensures that business owners and financial advisors can collaborate seamlessly, leading to more effective financial planning and tax strategy formulation.

Spreadym

APRIL 27, 2023

Tax planning: Some financial analysis and planning software includes tax planning tools that help users forecast and minimize tax liabilities and maximize tax deductions. Read here how API can help manage planning and budgeting process in your business. Visit the link to learn more about it.

CFO Plans

AUGUST 2, 2024

This evolution allows accounting professionals to focus on strategic activities such as business tax planning and CFO consulting for tech startups, rather than getting bogged down with routine tasks. These platforms offer real-time access to financial data, robust security features, and the flexibility to work from anywhere.

Nerd's Eye View

JULY 12, 2024

Which suggests that while firms might be tempted to zero in on compensation when it comes to retaining advisors, focusing on these other factors (which do not necessarily involve hard dollar expenses) could pay off in the form of increased advisor (and client) retention over time.

CFO News Room

DECEMBER 30, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” – this week’s edition kicks off with the news that the passage of “SECURE Act 2.0” has brought a wide range of changes to the world of retirement planning. In fact, while no single change in SECURE 2.0 In fact, while no single change in SECURE 2.0

CFO Plans

SEPTEMBER 24, 2024

Get Customizable Accounting Packages Tax Optimization Strategies Maximize Savings Effective tax planning can significantly impact your bottom line. Tax Optimization Strategies help small businesses minimize their tax liabilities and maximize savings.

CFO Simplified

MARCH 7, 2024

The CTA and the disclosure obligations it imposes upon reporting companies is designed to help safeguard national security and provide US law enforcement agencies with an additional tool to fight financial crimes, such as money laundering, trafficking, tax fraud, and other illicit activities.

CFO Plans

JUNE 14, 2024

Cloud-based accounting software offers a seamless, efficient, and secure way to manage your finances. These services include cash flow analysis, tax planning, and risk management, ensuring that your real estate portfolio remains profitable and sustainable.

CFO Plans

SEPTEMBER 6, 2024

Fractional CFOs usually have a network of professionals providing outsourced tax preparation services, business tax planning services, and accounting and finance consulting. Explore comprehensive financial support with CFO Plans. They help present your financials effectively to attract investors and secure funding.

CFO Plans

SEPTEMBER 24, 2024

These services offer personalized guidance on a range of financial issues, from tax planning to investment strategies. These services offer startups the financial expertise they need to navigate the early stages of growth, from securing funding to managing cash flow.

CFO Simplified

MARCH 7, 2024

The CTA and the disclosure obligations it imposes upon reporting companies is designed to help safeguard national security and provide US law enforcement agencies with an additional tool to fight financial crimes, such as money laundering, trafficking, tax fraud, and other illicit activities.

CFO Thought Leader

OCTOBER 6, 2024

It’s more about data, and because it’s more about data, there’s more security risk everywhere. But, recently, we have found that the CFO and the CIO now recognize that they need to work more closely together to drive greater investment in the modernization of financial systems. Things have changed.

CFO Plans

MAY 30, 2024

Consider the case of a growing tech startup that utilized fractional CFO services to develop a robust financial plan, which helped secure additional funding and scale operations efficiently. Expert accounting consultants can also assist with tax planning and compliance, ensuring your real estate investments remain profitable.

CFO Share

MARCH 9, 2021

Talk to your payroll provider, accountant, or check out the IRS guidance on how to apply for this tax credit. Plan for repayment of deferred social security taxes. The CARES act allowed employers to defer social security employment taxes until December 2020.

CFO Plans

OCTOBER 21, 2024

A manufacturing firm successfully renegotiated their loan to secure a lower interest rate. Aligning with expert partners like CFO Plans can make all the difference, ensuring your business remains resilient and growth-oriented amidst financial challenges.

CFO News Room

NOVEMBER 30, 2022

And the consequences for incorrect tax advice can include legal and financial penalties if a client were to be harmed by the wrong advice – which is often not covered by the firm’s E&O insurance –creating an expensive liability when tax advice goes wrong. Might be a source of tax-free income ( unless the IRS says otherwise )!

CFO News Room

NOVEMBER 29, 2022

So, we do look at clients from the complexity of what type of planning they have. Now, everybody, at the end of the day, still needs the same same type of planning in the sense of estate planning, tax planning, financial planning. Or how do we work around a concentrated stock position, right? ” Right?

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content